Tag Archive: newslettersent

Quick Look at Why the September Jobs Data will Likely Be Strong

There are several economic data points that suggest a healthy gain in jobs in September. College educated unemployment is 2.5% with high school graduate unemployment at 5.5%. The jobs report we expect is consistent with a Fed hike in December.

Read More »

Read More »

Great Graphic: Growth in Premiums of Employer-Sponsored Health Insurance

Upward pressure on US consumer prices is stemming from two elements. Rents and medical services. Due to the differences the composition of the basket of goods and services that are used, the core personal consumption deflator, which the Fed targets, typically lags behind core CPI.

Read More »

Read More »

You Want to Fix the Economy? Then First Fix Healthcare

We don't just deserve an affordable, sustainable healthcare system--we're doomed to bankruptcy without one. What is blindingly obvious to employers but apparently invisible to the average zero-business-experience mainstream pundit is this: if you want to fix the economy, you must first fix healthcare.

Read More »

Read More »

Donald’s Electoral Struggle

Wicked and Terrible After touting her pro-labor union record, the Wicked Witch of Chappaqua rhetorically asked, “why am I not 50 points ahead?” Her chief rival bluntly responded: “because you’re terrible.”* No truer words have been uttered by any of the candidates about one of their opponents since the start of this extraordinary presidential campaign!

Read More »

Read More »

Switzerland, UBS Consumption Indicator August

The UBS Consumption Indicator rose to 1.53 points in August from 1.45. This development was fueled by resurging tourism and above-average car sales for the month. However, the situation on the labor market casts a shadow on this rise.

Read More »

Read More »

FX Daily, September 28: Dollar Mostly Firmer, but Going Nowhere Quickly

The US dollar is enjoying a firmer bias today, but it remains narrowly mixed on the week. It is within well-worn ranges. Of the several themes that investors are focused on, there have not significant fresh developments. In terms of monetary policy, both Draghi and Yellen speak today. The former is behind closed doors with a Germany parliamentary committee.

Read More »

Read More »

Switzerland stays most competitive nation as WEF warns on trade

The World Economic Forum named Switzerland the most competitive nation for an eighth straight year as it warned less open trade was threatening economic growth globally. Switzerland was ahead of Singapore and the U.S. in the annual rankings of 138 countries, with Netherlands overtaking Germany to take the fourth spot.

Read More »

Read More »

Great Graphic: Stocks and Bonds

The relationship between the change in Us 10-year yields and the change in the S&P 500 has broken down. The 60-day correlation is negative for the first time since late Q2 2015. It is only the third such period of inverse correlation since the start of 2015.

Read More »

Read More »

Are The ‘Invisible Americans’ the Key Players in This Election?

For the bottom 90% of American households, the "prosperity" of the "recovery" since 2009 is a bright shining lie. The phrase is from a history of the Vietnam War, A Bright Shining Lie: John Paul Vann and America in Vietnam. Just as the Vietnam War was built on lies, propaganda, PR and rigged statistics(the infamous body counts--civilians killed as "collateral damage" counted as "enemy combatants"), so too is the "recovery" nothing but a pathetic...

Read More »

Read More »

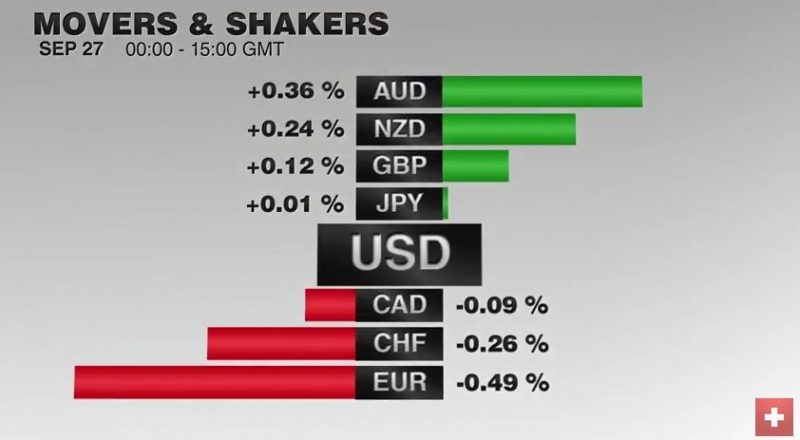

FX Daily, September 27: US Debate Lifts Peso, but Leaves the Dollar Non-Plussed

Since the monetary assessment meeting, the EUR/CHF is trending downwards. Sight deposits indicate that the SNB is intervening 0.9 bn per week. We emphasized that the preferred intervention corridor is between 1.08 and 1.0850. The first US Presidential debate may not sway many voters but has lifted the Mexican peso. The peso, which has fallen by about 1.3% over the past two sessions, has stormed by 1.5% today as the seemingly biggest winner of the...

Read More »

Read More »

The Undemocratic Nature of TTIP

Mounting Resistance Thousands of people recently demonstrated in Brussels against free trade deals negotiated by the EU. This happened just days before a meeting of EU trade ministers in Bratislava last Friday, which was considered the last push to salvage the Transatlantic Trade and Investment Partnership (TTIP) between the EU and the United States.

Read More »

Read More »

Trump, Trade and Taxes

Donald Trump has made trade agreements a central issue in this presidential election, declaring trade treaties such as the North American Free Trade Agreement (NAFTA) as unfair and subject to cancellation or renegotiation. Setting aside the issue of whether presidents can cancel trade treaties via executive orders, let's look at the underlying issue: the erosion of manufacturing and entry-level job opportunities that lead to middle-class security...

Read More »

Read More »

A Different Candidate?

French for Trump OUZILLY, France – There are two ways you can destroy a country: pull down its money or build up its military. Usually, they go hand in hand – one hand ruining the economic body, the other attacking the soul.

Read More »

Read More »

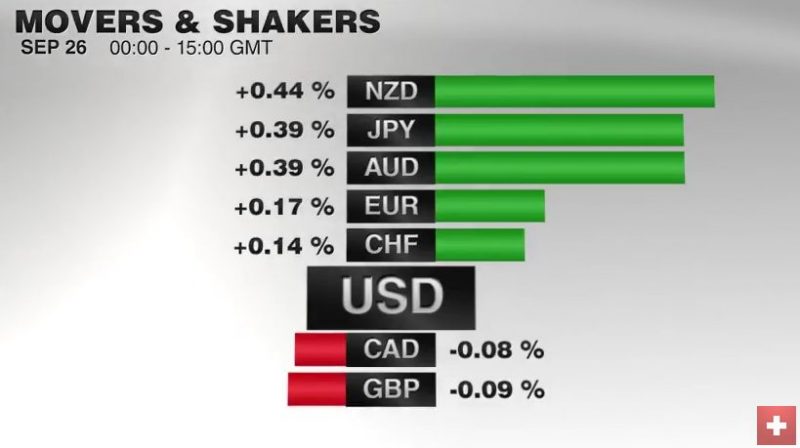

FX Daily, September 26: Dollar Mixed while Stocks Slide to Begin Last Week of Q3

The US dollar is narrowly mixed. The euro, yen and Swiss franc are higher, while the dollar-bloc and sterling are softer. The moving element here is not so much the greenback, which serving more as a fulcrum, but idiosyncratic, country-level developments.

Read More »

Read More »

Japan’s Planners Ratchet up Monetary Experimentation

It was widely expected that the BoJ would announce something this week after it promised to perform a comprehensive review of its monetary policy. It certainly did deliver a major tweak to its inflationary program, but its implications were seemingly not entirely clear to everybody (probably not even to the BoJ).

Read More »

Read More »

Negativzinsen: Unsere Schweiz als Versuchskaninchen

In der gestrigen Ausgabe der NZZ am Sonntag wird Nobelpreisträger Paul Krugman zitiert, wie er den Mindestkurs der SNB und deren Negativzinsen lobt. Die Negativzinsen seien ein „wertvolles Experiment“ meint er und „bedankt“ sich dafür sogar bei der SNB. „Die Schweiz eruiert neues Territorium. Aus akademischer Sicht liebe ich das.“

Read More »

Read More »

Great Graphic: Nearly Five-Month Uptrend in the Dollar Index Set to be Tested

DXY has been holding an uptrend since early May. It looks set to be tested near-term and technical indicators suggest it may not hold. Here are the two scenarios of penetration.

Read More »

Read More »

Why the Deep State Is Dumping Hillary

Join me in offering solutions by becoming a $1/month patron of this wild and crazy site via patreon.com.

Read More »

Read More »

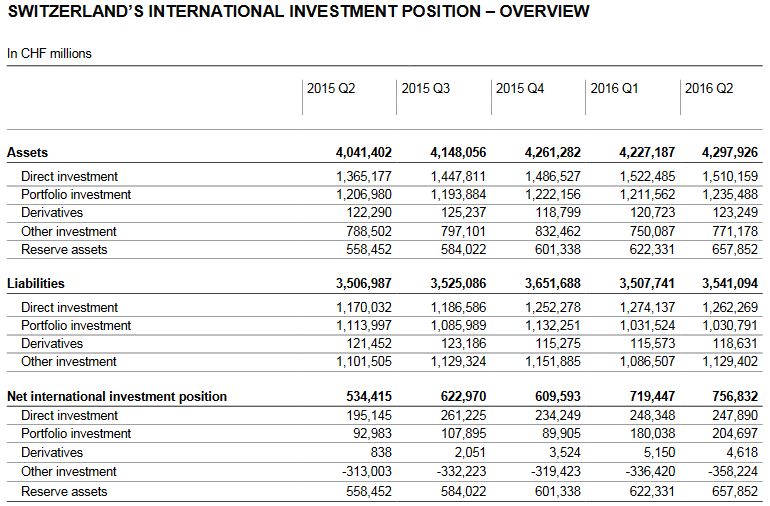

Swiss balance of payments and international investment position: Q2 2016

In the second quarter of 2016, the current account surplus amounted to CHF 17 billion. This was CHF 3 billion less than in the year-back quarter, mainly due to a decline in the receipts surplus in primary income (labour and investment income).

Read More »

Read More »