Tag Archive: newslettersent

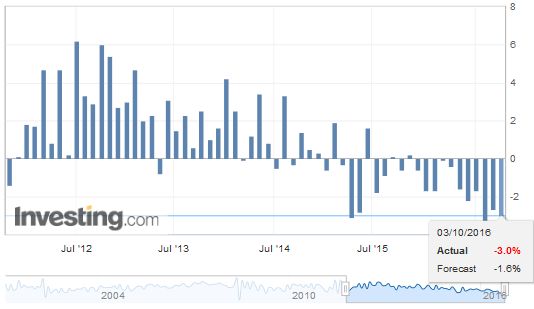

Swiss Retail Sales -2.9 percent nominal (YoY) and -3.0 percent real (YoY)

Turnover in the retail sector fell by 2.9% in nominal terms in August 2016 compared with the previous year. This decline has been ongoing since January 2015. Seasonally adjusted, nominal turnover fell by 0.3% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Read More »

Read More »

Is The US Dollar Set To Soar?

Hating the U.S. dollar offers the same rewards as hating a dominant sports team: it feels righteous to root for the underdogs, but it's generally unwise to let that enthusiasm become the basis of one's bets. Personally, I favor the emergence of non-state reserve currencies, for example, blockchain crypto-currencies or precious-metal-backed private currencies--currencies which can't be devalued by self-serving central banks or the private elites...

Read More »

Read More »

Credit Crisis in Waiting

Clowns in the Coliseum DUBLIN – The presidential debate began long after our bedtime, here in Ireland. So we got up this morning, rubbed our eyes, and watched the highlights. “Lowlights” is perhaps a better way to describe it:

Read More »

Read More »

Fun with Fake Statistics: The 5 percent “Increase” in Median Household Income Is Pure Illusion

Supporters of the status quo nearly wet their pants with joy when the Census Bureau reported that real (adjusted for inflation) median household income rose 5.2% between 2014 and 2015. Too bad it was completely bogus: the supposed increase in everyone's income is pure statistical trickery.

Read More »

Read More »

Secret Swiss Military Bunkers Filled With Gold: Alternatives To Bank Deposits

For decades, Switzerland had a reputation for bank secrecy that made it the most sought after tax haven for billionaires from around the globe. But, after more than 80 years of secrecy, a series of bilateral agreements with countries around the world, including America’s Foreign Account Tax Compliance Act (FATCA), have forced the private-banking industry in Switzerland to embrace an entirely new era of transparency that requires a full exchange of...

Read More »

Read More »

The Fed and the Everything Bubble

John Hussman on Recent Developments We always look forward to John Hussman’s weekly missive on the markets. Some people say that he is a “permabear”, but we don’t think that is a fair characterization. He is rightly wary of the stock market’s historically extremely high valuation and the loose monetary policy driving the surge in asset prices.

Read More »

Read More »

Politics and Violence

Elizabeth received a strange letter from her congressman. “We have to be on guard against our enemies… and not be afraid to name them.” A brave, forthright stand? But wait, he didn’t name the enemies. That left us wondering: Who are our enemies? Muslims, Jews, Arabs… Russians, Iranians, North Koreans… capitalists, the Deep State, Yankees… liberals, conservatives?

Read More »

Read More »

FX Weekly Preview: Next Week’s Two Bookends

The start of next week will likely be driven by Deutsche Bank's travails and dollar funding pressures, which may or may not be related. The end of the week features the US monthly jobs report. Despite being a noisy, high frequency time series subject to significant revisions, this report like none other can drive expectations of Fed policy.

Read More »

Read More »

Vancouver tops list of cities at risk of housing bubble. Zurich 9, Geneva 11.

Vancouver, London and Stockholm rank as the cities most at risk of a housing bubble after a surge in prices in the past five years, according to a UBS Group AG analysis of 18 financial centers. Sydney, Munich and Hong Kong are also facing stretched valuations, UBS said in its 2016 Global Real Estate Bubble Index report, released Tuesday. San Francisco ranked as the most overvalued housing market in the U.S., while not yet at bubble risk.

Read More »

Read More »

Secret Alpine gold vaults are the new Swiss bank accounts

Deep in the Swiss Alps, next to an old airstrip suitable for landing Gulfstream and Falcon jets, is a vast bunker that holds what may be one of the world’s largest stashes of gold. The entrance, protected by a guard in a bulletproof vest, is a small metal door set into a granite mountain face at the end of a narrow country lane. Behind two farther doors sits a 3.5-ton metal portal that opens only after a code is entered and an iris scan and a...

Read More »

Read More »

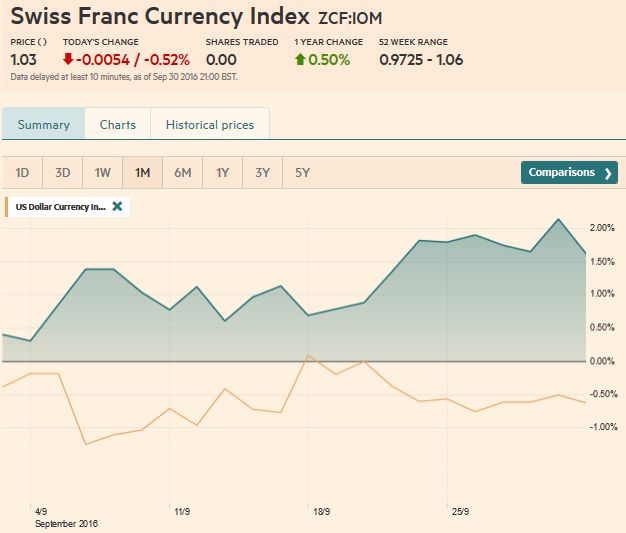

FX Weekly Review, September 26-30: Dollar vulnerable at the Start of Q4, CHF collapses at Quarter End

The US dollar fell against most of the major currencies in Q3. The Norwegian krone was the best performer, gaining 4.4% against the greenback, followed by Aussie and Kiwi. The Swiss Franc collapsed on Friday at quarter end.

Read More »

Read More »

Switzerland’s best paid bosses

The Ethos Foundation recently published a list of Switzerland’s highest paid employees in 2015. The figures are striking and may leave some wondering what someone would do with such large sums. Ethos looks at the pay of the managers of the 204 largest companies listed on the Swiss stock exchange.

Read More »

Read More »

Weekly Speculative Positions: Speculators Closing their CHF Longs

Marc Chandler speaks of the volatility of the CHF speculative positioning. For us this was window dressing by the SNB that wants to improve the quarterly results. Traders react to the strong market movement caused by the SNB and they close their long CHF positions. If it was really the SNB, we will see on Monday

Read More »

Read More »

The Italian Dilemma

The sudden panic about a potentially imminent Italian banking sector collapse back in July has somewhat subsided for now, but sooner or later the issue will inevitably rear its ugly head again.

Read More »

Read More »

Renzi and the Italian Referendum: Disruption Potential Minimized

Italian Prime Minister has set the date for the constitutional referendum as late as practically possibly. It will be held on December 4. The issue is the perfect bicameralism that gives as much power to the Senate as the Chamber of Deputies. Renzi's argument is that the political reform is necessary to make Italy governable. Italy has had 63 governments since the end of WWII. In order to address the economic challenges the country faces, political...

Read More »

Read More »

FX Daily, September 30: SNB Intervenes to Polish Q3 Results

True to its recent habit, the US dollar is finishing the week on a firm note. On the month, though, the greenback has fallen against most of the majors, but sterling, the Canadian dollar, and the Swedish krona. Global equities are trading heavily, and investors' angst is lending support to bond markets.

Read More »

Read More »

Divergence: Norway and Sweden

Sweden has one of the weakest of the major currencies this year. Norway has one of the strongest of the major currencies this year. The key driver is divergence of monetary policy and that divergence is likely continue into next year.

Read More »

Read More »

Swiss stocks slump on Deutsche Bank trouble

The Swiss Market Index is set to finish the week notably lower, underperforming global stocks, as financial sector stocks sell off on questions over Deutsche Bank’s solvency.

Read More »

Read More »

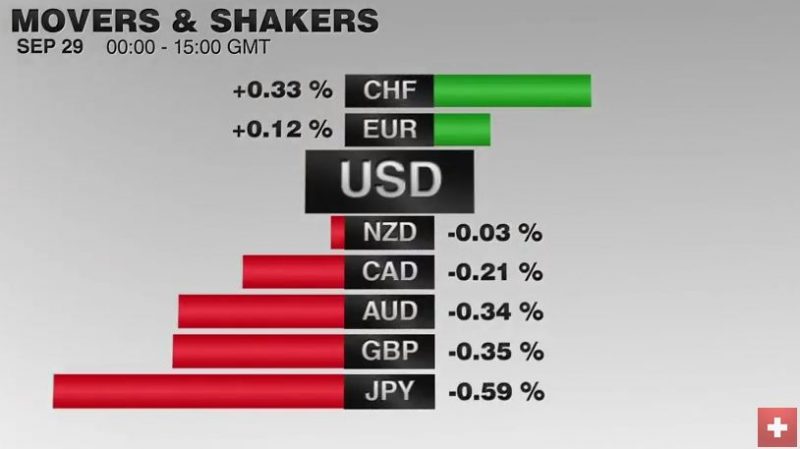

FX Daily, September 29: Dollar Quietly Bid, while Market is Skeptical of OPEC Deal

The US dollar has firmer against most major and emerging market currencies. It remains well within its well-worn ranges, which continue to be narrow. A notable exception today is the yen's weakness. While the majors are mostly off marginally and now more than 0.3%, the yen is 0.75% lower. That puts the greenback at a six-day high (~JPY101.75) at its best.

Read More »

Read More »