Tag Archive: newslettersent

Is It Safe To Travel To Europe?

In recent months, more and more of our clients and friends from overseas are asking us whether it is safe to travel to Europe. These fears are understandable, given the media coverage of the tragic events that occurred this year. The press painted a sinister and truly graphic picture of Europe as a war zone, as a target of global terrorism.

Read More »

Read More »

Weekly Speculative Positions: More Bearish Euros and CHF, Less Bullish the Yen

Speculators turned more bearish the euro and Swiss Franc and less bullish the Japanese yen in the Commitment of Traders week ending October 11.

Read More »

Read More »

FX Weekly Review, October 10-14: Rates Still Key to Dollar’s Outlook

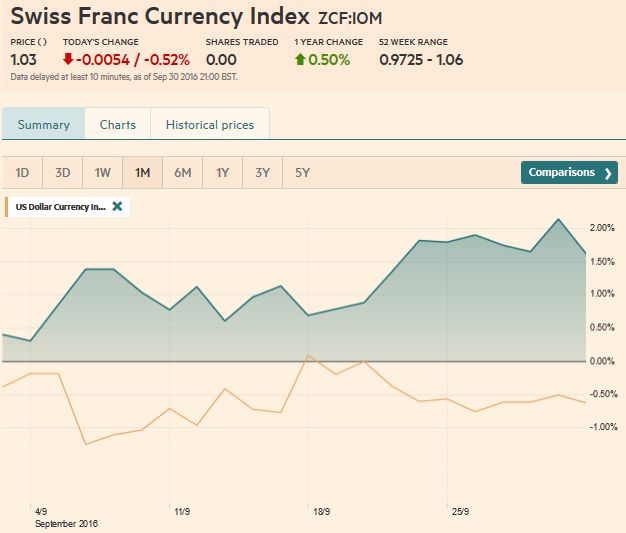

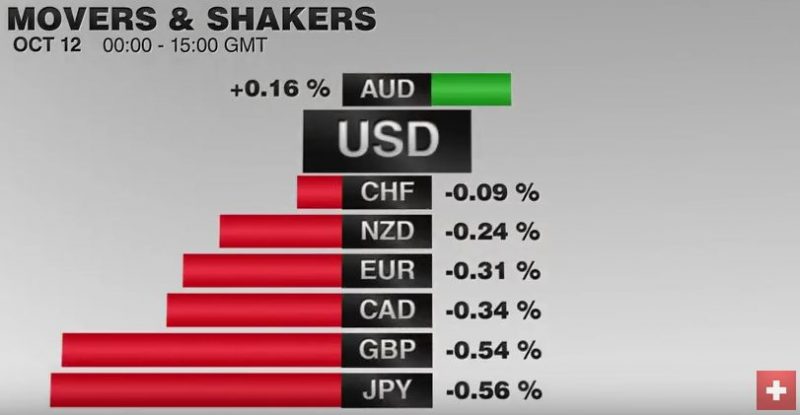

The Swiss Franc index had once again a bad stance against the dollar index. The CHF index was down 1%. The dollar index, however, improved. The US dollar rose against the major currencies last week, except the Australian and Canadian dollars.

Read More »

Read More »

Where Will All the Money Go When All Three Market Bubbles Pop?

Since the stock, bond and real estate markets are all correlated, it's a question with no easy answer. Everyone who's not paid to be in denial knows stocks, bonds and real estate are in bubbles of one sort or another. Real estate is either an echo bubble or a bubble that exceeds the previous bubble, depending on how attractive the market is to hot-money investors.

Read More »

Read More »

Swiss cross-border shopping declines

Residents of German-speaking Switzerland appear to doing less shopping across the border, something that has also been observed in Geneva. According to the newspaper the Handelszeitung, Swiss cross-border shopping peaked in 2015 and local customs posts have seen a decline in VAT and duty collected since March.

Read More »

Read More »

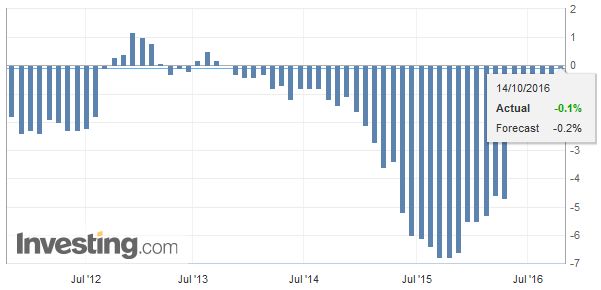

Swiss Producer and Import Price Index, September 2016: +0.3 percent MoM, -0.1 percent YoY

The Producer and Import Price Index rose in September 2016 by 0.3% compared with the previous month, reaching 99.7 points (base December 2015 = 100). The rise is due in particular to higher prices for petroleum products. Compared with September 2015, the price level of the whole range of domestic and imported products fell by 0.1%.

Read More »

Read More »

FX Daily, October 14: Firm Dollar Consolidating, Awaiting US Retail Sales

The US dollar is firm against most of the major currencies, but within yesterday's ranges, which seems somewhat fitting amid the light new stream. The high-yielding Australian and New Zealand dollars are resisting the stronger greenback, while on the week the Aussie and the Canadian dollar are the only majors to gain.

Read More »

Read More »

Great Graphic: China’s PPI and Commodities

China's PPI rose for the first time in four years. It is related to the rise in commodities. Yet there are good reasons there is not a perfect fit between China's PPI and commodity prices. US and UK CPI to be reported next week, risk is on the upside.

Read More »

Read More »

Global stocks at lowest levels since July

The Swiss Market Index is set to finish the week lower, but outperforming global stocks, thanks to a strong week of luxury good stocks. Global stocks fell to their lowest levels since July on Thursday as investors rushed to the safety of government bonds, yen and gold after renewed concerns over weakness in the Chinese economy and as the Federal Reserve considers raising interest rates.

Read More »

Read More »

Ending a Taking Economy and Creating a Giving Economy (Part 1)

The world can no longer afford a taking economy, where “make a killing” is the motto. Together we need to create a giving and sharing economy that helps us all “make a living.” This essay will unveil the present unjust and unworkable economic system that punishes responsibility and rewards fraud.

Read More »

Read More »

FX Daily, October 13: Dollar Edges Higher, though US Rates Soften

The EUR/CHF remains in the range of 1.0815 to 1.0980. The SNB usually intervenes below 1.0850. I am expecting that speculators are reducing their CHF short positions. More tomorrow.

Read More »

Read More »

IMF’s Reserve Data: Dollar Share Little Changed, Yen Share Jumps, Helped By Valuation

The increase in the yen's share of reserves was flattered by the yen's 9% appreciation. The dollar and euro's share of reserves were stable. Chinese integration has seen the share of unallocated reserves fall. Starting with Q3 data, (available end of March 2017) will break out the yuan's share of reserves.

Read More »

Read More »

More Swiss visas for non-Europeans in 2017

Visa quotas for non-EU workers will rise next year. The increased quotas will include 3,000 B-permits and 4,500 L-permits, 1,000 more than this year. These limits are still lower than in 2014, when Swiss politics turned against the free movement of workers from the EU.

Read More »

Read More »

This Is How Quiet Fascism Works

So my little-visited Wikipedia entry was minding its own business, not bothering anyone, until I dared to criticize the Clinton Foundation. The next day, my Wikipedia entry was taken out and shot by a mysterious "editor." It was just coincidence, right, that my Wikipedia entry had been available for years without offending anyone, and then suddenly it's deleted the day after I dared to criticize the Clinton Foundation.

Read More »

Read More »

High Court Hears UK Constitutional Challenge

Regardless of outcome early next week, the High Court's decision will likely be appealed. The issue is the role of parliament. The greater the role, the greater the risk of a delay, but also a better chance to minimize a hard Brexit.

Read More »

Read More »

FX Daily, October 12: May Concedes to Parliament, Sterling Rises after Pounding

News that UK Prime Minister May has accepted that Parliament should vote on her plan for exiting the EU stopped sterling's headlong slide. Sterling had been pounded for roughly 8.5 cents since the start of the month including the last four sessions. The idea that parliament, where the Conservatives enjoy a slim majority, is less enthusiastic about Brexit may mean a less acrimonious divorce.

Read More »

Read More »

Forget ‘Great, Again’; Make America Switzerland?

talked to a Swiss local yesterday about American politics. He says everyone in Switzerland is following the race closely. He favors Trump because he thinks Trump would be better for the global economy. I asked if anyone he knows in Switzerland is worried about Trump’s “temperament” and having his finger on the nukes.

Read More »

Read More »

Sterling: Has the Breaking Point been Reached?

Sterling's decline is not longer coinciding with lower rates. Sterling's decline is boosting inflation expectations. If the inflation expectations are realized (Sept CPI next week), it will quickly erode what ever competitive gains there may have been.

Read More »

Read More »

Interview with Doug Casey

Our friend Natalie Vein recently had the opportunity to conduct an extensive interview with Doug Casey for BFI, the parent company of Global Gold. Based on his decades-long experience in investing and his many travels, he shares his views on the state of the world economy, his outlook on critical political developments in the US and in Europe, as well as his investment insights and his approach to gold, as part of a viable strategy for value...

Read More »

Read More »

Evacuate or Die…

BALTIMORE – Last week, we got a peek at the End of the World. As Hurricane Matthew approached the coast of Florida, a panic set in. Gas stations ran out of fuel. Stores ran out of food. Banks ran out of cash.

Read More »

Read More »