Tag Archive: newslettersent

FX Daily, October 27: Rising Yields Continue to be the Main Driver

The euro remains pinned near the seven-month low it recorded two days ago near $1.0850. It approached $1.0950 yesterday and has been confined to about a 15-tick range on either side of $1.0905 today. Against the yen, the dollar remains near the three-month high (~JPY104.85) also seen two days ago. New dollar buying emerged yesterday near JPY104.

Read More »

Read More »

Great Graphic: CRB Index Revisited

Interest rates and 10-year break-evens are rising. Some think the CRB Index is tracing out a head and shoulders bottom. We look for inflation in non-tradable goods' prices (think services).

Read More »

Read More »

Syngenta slumps on concern of protracted ChemChina EU review

Syngenta AG shares tumbled on concern that China National Chemical Corp.’s $43 billion takeover of the Swiss herbicide and pesticide maker risks regulatory delays in the European Union. ChemChina didn’t submit so-called remedies in the EU’s early-stage review of the deal by the Oct. 21 deadline, the European Commission’s press office said by phone on Monday.

Read More »

Read More »

Central Bank Austria Claims To Have Audited Gold at BOE. Refuses To Release Audit Report

After years of gradually securing its official gold reserves (unwinding leases) the central bank of Austria claims to have completed the audits of its 224 tonnes of gold stored at the BOE. However, it refuses to publish the audit reports and the gold bar list. What could possibly be so sensitive to hide from public eyes?

Read More »

Read More »

Switzerland UBS Consumption Indicator September: Confidence despite weakness in retail

The UBS consumption indicator rose from 1.53 to 1.59 points in September. The positive trend continues and points to further growth in private consumption for the fourth quarter. The driving forces are new vehicle registrations, which are at a record level, and the upsurge in domestic tourism in August.

Read More »

Read More »

Cashless Society – Is The War On Cash Set To Benefit Gold?

Cash is the new “barbarous relic” according to many central banks, regulators, and some economists and there is a strong, concerted push for the ‘cashless society’. Developments in recent days and weeks have highlighted the risks posed by the war on cash and the cashless society.

Read More »

Read More »

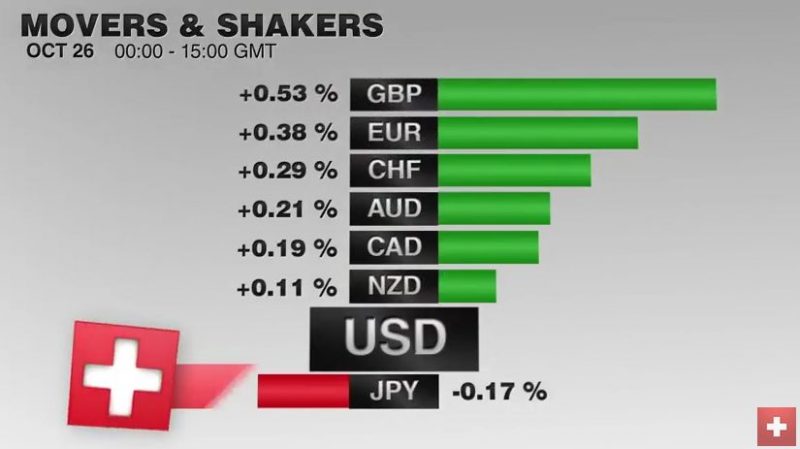

FX Daily, October 26: Euro and Yen Extend Recovery

After touching 1.08, which apparently the "new floor", the SNB moved the EUR/CHF upwards yesterday and Monday. Today's EUR recovery against USD, let also the EUR/CHF rise. The US dollar's upside momentum reversed in North America yesterday and has been sold in Asia and Europe. This seems like mostly position adjustments ahead of next week's FOMC, BOE and RBA meetings, in an otherwise subdued news period. The euro has at three-day highs. It has...

Read More »

Read More »

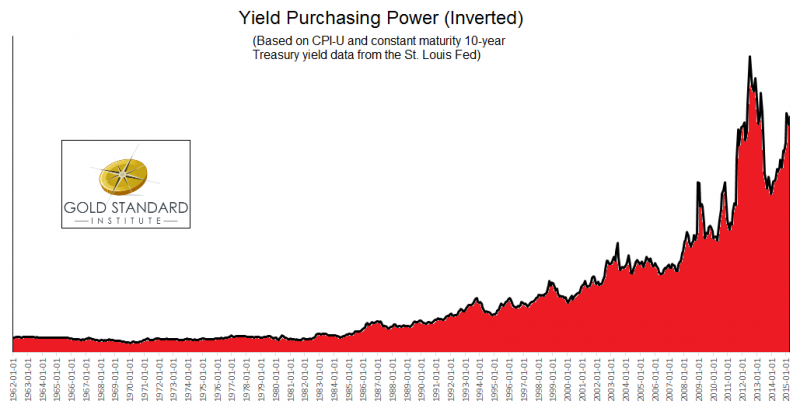

End Of The Bond Bull – Better Hope Not

It’s been really busy as of late to cover all of the topics I have wanted to address. One topic, in particular, is the bond market and the ongoing concerns of a “bond bubble” due to historically low interest rates in the U.S. and, by direct consequence, historically high bond prices.

Read More »

Read More »

Introducing Yield Purchasing Power, the Video

I gave a 45-minute presentation on Yield Purchasing Power at American Institute for Economic Research in Great Barrington, MA on October 14, 2016. I am grateful to the Institute for recording video of my presentation plus extended Q&A.

Read More »

Read More »

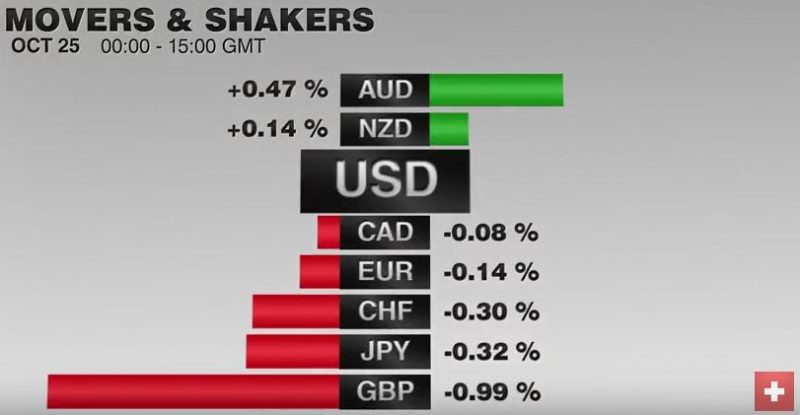

FX Daily, October 25: Germany IFO, Dollar Going Nowhere

The US dollar has been confined to extremely narrow ranges against the euro, yen, and sterling. To the extent that there is much action in the foreign exchange market, it is with the dollar-bloc and emerging market currencies.The Canadian dollar was whipsawed by comments from the Bank of Canada.

Read More »

Read More »

Seven Things I Learned while Looking for Other Things

Mainland demand for HK shares has dried up this month. EMU growth may accelerate in Q4, while the collective deficit continues to fall. German fertility rate increased last year.

Read More »

Read More »

Governments Will Lose Their War on the Markets

DELRAY BEACH, Florida – The markets continue to dawdle. Not much conviction in either direction. We’ve already looked at the War on Poverty, the War on Drugs and the War on Terror. So let’s move on – using our new lens to look at another of the feds’ fake wars. No war was ever officially declared against the markets.

Read More »

Read More »

The Secrets of Self-Employment: Overhead and Capital Accumulation

There are still opportunities to not just earn a wage, but the overhead, profit and capital skimmed by global corporations. So how can someone earning $15 an hour as an employee get ahead? The short answer is: they can't. One worker earning $15/hour will struggle to get ahead, which I define as building capital that generates an income stream.

Read More »

Read More »

Yuan Not

There were two dogs that did not bark this year. There are the Japanese yen, which despite negative interest rates and an unprecedented expansion of the central bank's balance sheet, the yen has strengthened 15% against the dollar. The yen has been the strongest major currency, and the third strongest currency in the world behind the high-yielding Brazilian real, recovering from last year's drop, and the Russian rouble, aided by a rebound in oil.

Read More »

Read More »

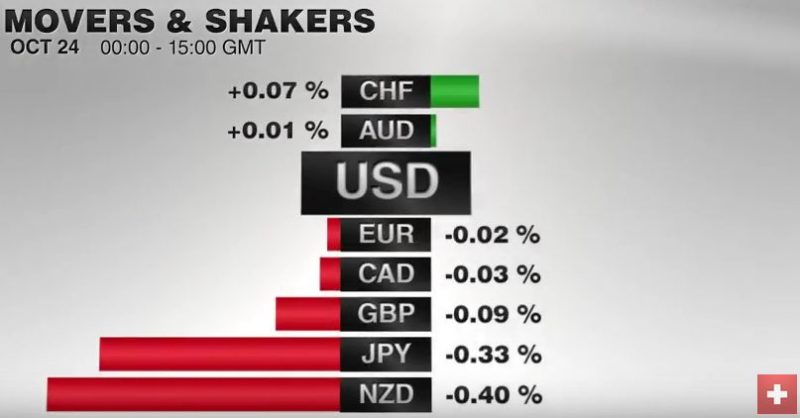

FX Daily, October 24: Dollar Begins Mostly Slightly Lower, and Risk is On to Start the Week

Sterling vs the Swiss Franc has remained close to its lowest level in history caused by the aftermath of the Brexit vote back in June and more recently the announcement that Article 50 will be triggered by March 2017. Confidence in Sterling exchange rates has plummeted recently and until we get some form of assurances as to how the talks may go with the European Union we could see Sterling fall even further against the Swiss Franc than its current...

Read More »

Read More »

Two Sets of Solutions as the Status Quo Crumbles

Two charts illustrate Why Our Status Quo Failed and Is Beyond Reform: this chart of the S-Curve of financialization, leverage, debt, central planning, regulatory capture and globalization--that is, the engines of modern "growth"--depicts the inevitable stagnation and decline of these dynamics as overcapacity, debt saturation and diminishing returns take hold.

Read More »

Read More »

FX Weekly Preview: Forces of Movement in the Week Ahead

Fitch cut Italy's rating outlook to negative from stable, while DBRS left Portugal's rating and outlook unchanged. Europe and Canada's free trade negotiations broke down, but many seem to be making exaggerating the significance of the drama. Japan and Australia report inflation figures, and both are exceptions to the generalization that price pressures are rising in (most) high income countries.

Read More »

Read More »