Tag Archive: newslettersent

FX Daily, November 29: Dollar Comes Back Mostly Firmer, but Focus is Elsewhere

The US dollar correctly lowered yesterday, but most of the selling was over by the end of the Asian session, and the greenback steadied in Europe and North America. The dollar is firm against the euro and yen but within yesterday's broad trading ranges. The Australian and Canadian dollar's gains from yesterday are being pared.

Read More »

Read More »

Great Graphic: Yen and Yuan Connection

The US dollar has rallied against both the Japanese yen and Chinese yuan since the end of September. Through today, the yen has fallen 9.8% and the yuan has fallen by 3.5%. What they have in common is the rise in US interest rates relative to their own. Since September 30, the US 10-year yield has from below 1.60% to above 2.40% at the end of last week. Japan's 10-year yield has risen from minus nine basis points at the end of September to five...

Read More »

Read More »

Weekly Sight Deposits: Investors hedge with Swiss Franc again for the coming inflation cycle.

We explained the Trump reflation trade, where the Swiss Franc acts as the usual inflation hedge against the obviously inflationary policies of Trumpeconomics. Trump is about tax cuts – i.e. a fiscal deficit up to 10%, and about protectionism. Trump would restrict global trade and push up U.S. wages.

Read More »

Read More »

FX Daily, November 28: Corrective Forces Seen in Asia, Subside in Europe

As soon as markets opened in Asia, the greenback was sold, and corrective forces that had been nipping below the surface took hold. The euro, which had finished last week below $1.0590, rallied nearly a cent. Before the weekend, the greenback had pushed to almost JPY114, an eight-month high, before closed near JPY113.20. It was sold to almost JPY111.35 in early Asia. Sterling extended last week's gains and briefly poked through $1.2530, to reach...

Read More »

Read More »

Swiss banks taking more risks to compensate for record-low interest rates

Swiss banks focused on property lending are taking more risks to compensate for the impact of record-low interest rates, increasing the threat of a real-estate bubble, Swiss National Bank Vice President Fritz Zurbruegg said.

Read More »

Read More »

FX Weekly Preview: Shifting Portfolio Preferences Continue to Drive Capital Markets

Forces emanating from the US and Europe are driving the capital markets. The moves may be stretched technically, but the market adjustment has further to run as not even two Fed hikes are discounted for next year. European political concerns and an ECB expected to continue its asset purchases have driven German 2-year yields to new record lows.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM ended last week on a somewhat firmer note, though we note divergences remain in place. For the week, ZAR and KRW performed the best while TRY and BRL were the worst. US jobs data Friday will draw some attention, though a December Fed rate hike is pretty much fully priced in.

Read More »

Read More »

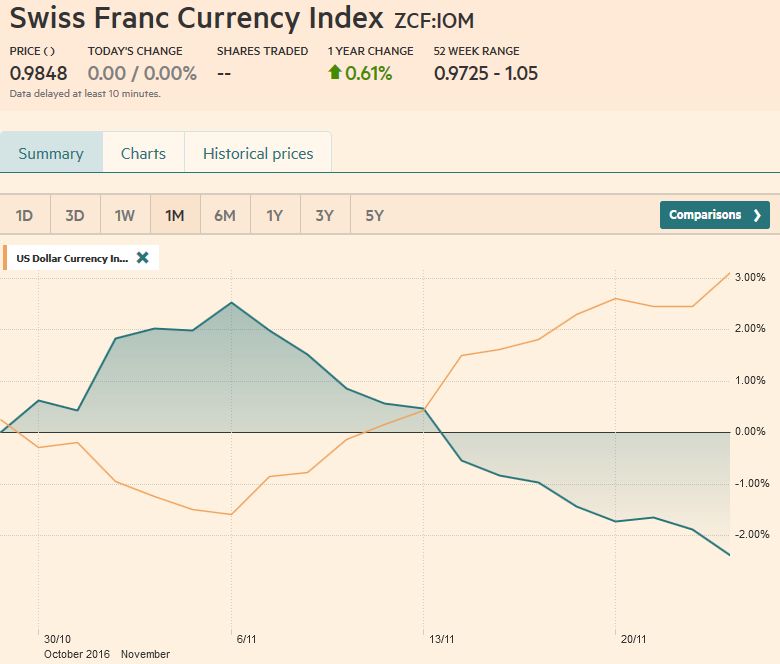

FX Weekly Review, November 21 – November 25: Dollar Strength Losing Steam

After a three-week rally, the dollar bulls finally showed signs of tiring ahead of the weekend. At least against the Swiss Franc index, the dollar index could further advance. We had observed SNB interventions in the previous week that kept the euro mostly above 1.07.

Read More »

Read More »

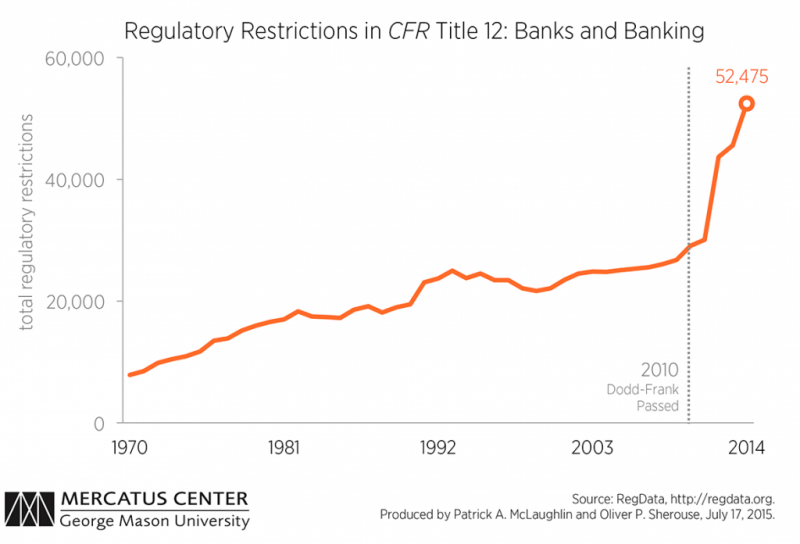

Celebrating this Land of Absurdity

“Myths and legends die hard in America,” remarked Hunter S. Thompson in The Great Shark Hunt, nearly 40-years ago. These great myths and legends of America died long ago. Freedom. Liberty. Independence. Limited representative government. Sound money. Private property rights. All getting more and more replaced by regulation.

Read More »

Read More »

Gold Price Skyrockets in India after Currency Ban – Part III

In part-I of the dispatch we talked about what happened during the first two days after Indian Prime Minister, Narendra Modi banned Rs 500 and Rs 1000 banknotes, comprising of 88% of the monetary value of cash in circulation. In part-II, we talked about the scenes, chaos, desperation, and massive loss of productive capacity that this ban had led to over the next few days.

Read More »

Read More »

The Problem with Corporate Debt

There are actually two problems with corporate debt. One is that there is too much of it… the other is that a lot of it appears to be going sour. As a brief report at Marketwatch last week (widely ignored as far as we are aware) informs us.

Read More »

Read More »

Why Is the US Dollar Rising?

Note the apparent breakout above 100 and the constructive similarities to the 2014 breakout that was followed by a 20% increase in the purchasing power of the USD relative to other currencies.

Read More »

Read More »

The New Nobility Uses Political Correctness to Fragment the Precariats

Combine identity politics with political correctness, and the New Nobility/Oligarchy can laugh their way to the bank while their pawn-serfs fight over how many politically correct angels can dance on the head of a pin.

Read More »

Read More »

How Do We Create Value When Knowledge Is Almost Free?

Credentials are increasingly in over-supply; problem-solving skills are scarce. How do we create value in an economy that is increasingly dependent on knowledge? The answer is complicated by the reality that knowledge is increasingly digital and "unownable" and therefore almost free. Financialization as a substitute for creating value has run its course.

Read More »

Read More »

Emerging Markets: What has Changed

Philippine President Duterte will reportedly ask central bank. Governor Tetangco to stay on for a third term. South Africa’s government has proposed a national minimum wage. Fitch moved the outlook on South Africa’s BBB- from stable to negative. Turkey’s central bank surprised markets with a 50 bp hike in its benchmark repo rate to 8.0%. Political risk in Brazil is rising as President Temer’s top aide was implicated in an influence peddling...

Read More »

Read More »

L’Allemagne est le patron-sponsor de l’Eurosystem.

Lors des échanges commerciaux et interbancaires, il y a des banques émettrices de monnaie et vis-à-vis une banque réceptrice. Normalement, à la fin de la journée, tout cela devrait être ramené à l’équilibre. Ceci n’est plus le cas depuis la crise américaine de 2007 (subprimes) comme nous le voyons sur le graphique ci-dessous de quelques pays de la zone euro.

Read More »

Read More »

We Should Take Our Cues From Markets – Not Politicians

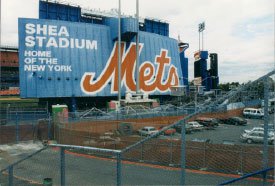

I grew up a block away from the 7-train, where I’d take a short ride from the 90th Street station to the Willets Point–Shea Stadium station to watch my favorite team, the New York Mets. Sitting in the stands as a young child, I learned quickly that there were a number of ways to obtain and interpret information. I could watch the umpire and immediately have known whether Al Leiter threw a strike or a ball. Another option was to watch the scoreboard...

Read More »

Read More »