Tag Archive: newslettersent

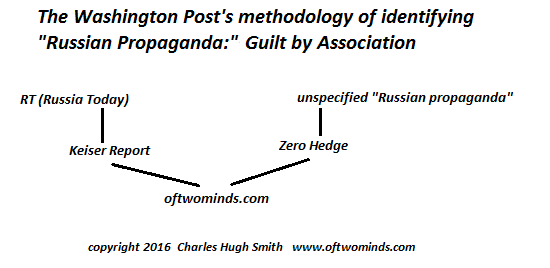

Charles Hugh Smith a Russian Propaganda Site?

We highly appreciate the site of Charles Hugh Smith because it integrates good economic graph with critical political comments.

A couple of days ago, it appeared on a list of "Russian Propaganda Sites" that got cited by mainstream media.

Read More »

Read More »

Pension payments could become compulsory for self-employed in Switzerland

Switzerland’s Federal Council is looking at a proposal to make pension payments compulsory for self-employed workers in the same way that they are for salaried workers.

Read More »

Read More »

Adoption Of The Euro Has Been ‘Unequivocally Bad’ For Southern European Economies

Some say that the common currency prevents less productive economies from cheating by weakening their national currencies and forces them to become more efficient and competitive. Industrial production data shows that it is not the case. Italy, France, Greece and Portugal have not only stopped producing more; they are producing now less than in 1990! The decay started immediately after the introduction of the euro in 2002!

Read More »

Read More »

Emerging Markets: What has Changed

Hong Kong Chief Executive Leung Chun-ying said he won’t seek a second term. Korea’s parliament voted 234-56 to impeach President Park. Czech National Bank raised the possibility of negative rates to help manage the currency. A Brazilian Supreme Court justice removed Senate chief Renan Calheiros from his post, but was later overturned by the full court. Brazil central bank signaled a possibly quicker easing cycle.

Read More »

Read More »

Global Warm-Ongering: What Happens If Trump Takes US Out Of Paris Agreement?

For all the shock, horror, and aghast of global warm-ongers, comes a startling revelation: It’s Irrelevant if US Pulls Out of Paris Accord. Donald Trump has sent his clearest message yet about his plans for reshaping US policy on global warming by choosing a chief environmental regulator who has questioned the science of climate change.

Read More »

Read More »

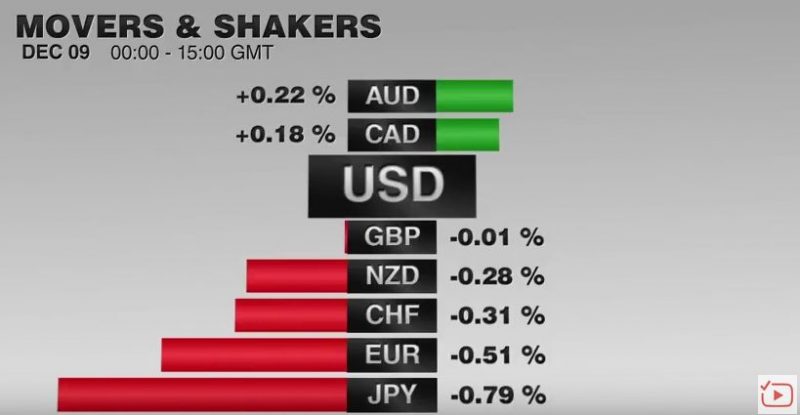

FX Daily, December 09: Euro Chopped Lower before Stabilizing

The euro has stabilized after extending yesterday's ECB-driven losses. The euro's drop yesterday was the largest since the UK referendum to leave the EU. Ahead of the weekend, there may be some room for additional corrective upticks, but they will likely be limited, with the $1.0650 area offering initial resistance. In the larger picture, this week's range, roughly $1.05 to $1.0850 likely will confine the price action for the remainder of the...

Read More »

Read More »

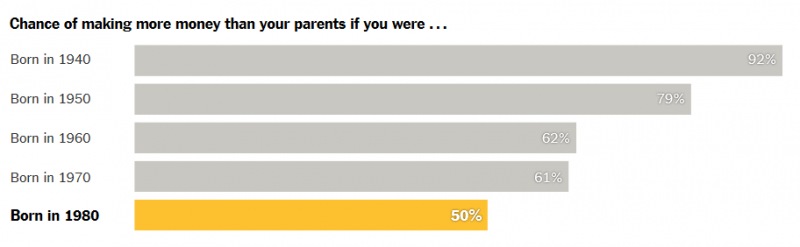

Great Graphic: Another Look at the Reproduction Problem

In order for a society to be sustained social relations have to be reproduced. Yet now neither the middle class nor capital are able to reproduce themselves. This may be the single greatest challenge our society faces.

Read More »

Read More »

Uncertainty prevails everywhere, says Draghi, but apparently investors don’t mind

According to European Central Bank President Mario Draghi “uncertainty prevails everywhere” but apparently investors don’t mind. Market participants shrugged off last weekends “no” to constitutional reform in Italy and the subsequent resignation of Prime Minister Matteo Renzi to push European indices to 12 month highs this week.

Read More »

Read More »

Swiss EU immigration – unfortunately there is no plan B, says president in interview

Switzerland’s plan to solve an immigration dilemma with the European Union could avoid being held up by another referendum if it gets strong support in parliament next week, according to Swiss President Johann Schneider-Ammann. A clear result in a final vote on Dec. 16 with the Swiss People’s Party, or SVP, in the minority could make it “delicate” for the group to push for another plebiscite, he said in an interview with Bloomberg Television’s Guy...

Read More »

Read More »

How Trump Can Bring Outside-the-Box Thinking to Bear on the Fed

President-elect Donald Trump will soon have the opportunity to put his stamp on the Federal Reserve. And that is making the elite body of central bankers nervous. On the campaign trail, Trump harangued Fed chair Janet Yellen for pumping up financial markets with cheap money – accusing the Obama appointee of being politically motivated. Trump also called for the Federal Reserve to be audited.

Read More »

Read More »

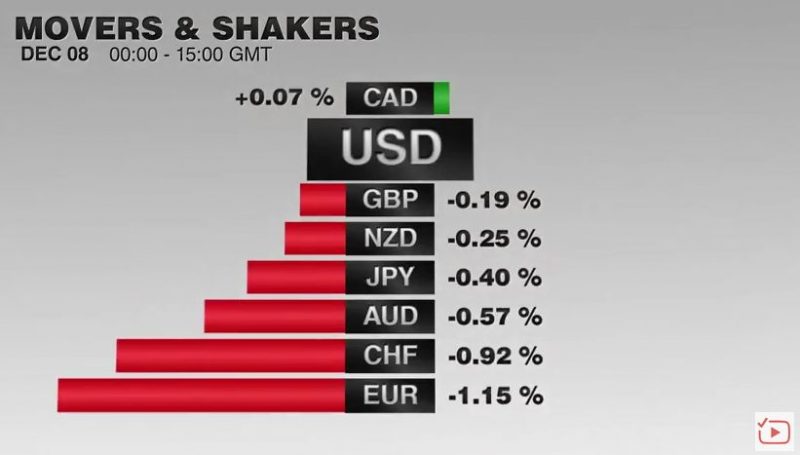

FX Daily, December 08: Dollar Heavy into ECB

The ECB prolonged its bond purchases, which came unexpected for markets. Consequently the EUR/CHF lost nearly half of its big gains that it registered in the beginning of the week. The ECB expects lower inflation for longer, which makes the life for the SNB harder for longer.

Read More »

Read More »

ECB: Dovish Taper or Hawkish Ease?

Purchases increased for longer but at a lower level; overall, more purchases than anticipated. Euro spiked higher on the announcement, but has subsequently dropped 2 cents. Lower inflation forecast for 2019 shows scope for a further extension.

Read More »

Read More »

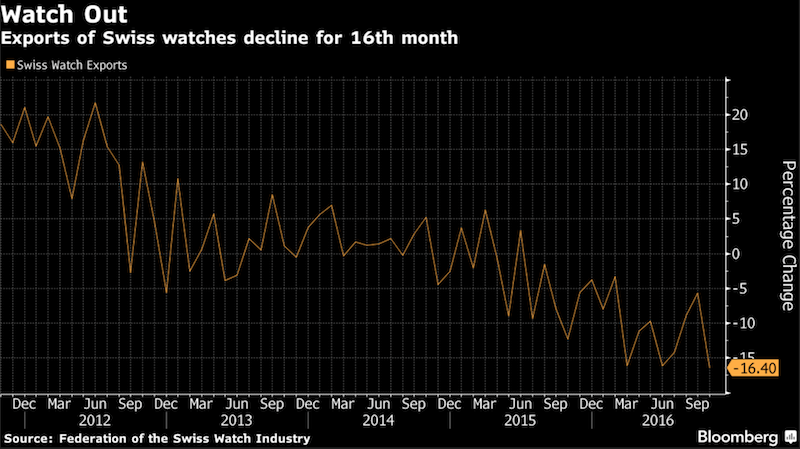

Richemont cuts send shockwaves from Geneva to mountain valleys

Richemont’s plan to slash 210 watchmaking jobs in Switzerland is sending shockwaves from Geneva to some of the country’s remote mountain villages, the cradle of high-end watch manufacturing. In Le Sentier, a town perched in the middle of the Jura mountain range, straddling the border between France and Switzerland, some 400 people protested Thursday against plans to cut the workforce of Vacheron Constantin and Piaget.

Read More »

Read More »

Cool Video: Discussing the ECB on Bloomberg TV

Tired of reading what analysts are saying? Here is a 4.3 minute video clip of my discussion earlier today on Bloomberg TV about the outlook for tomorrow's ECB meeting. The discussion covers various aspects of the ECB's decision.

Read More »

Read More »

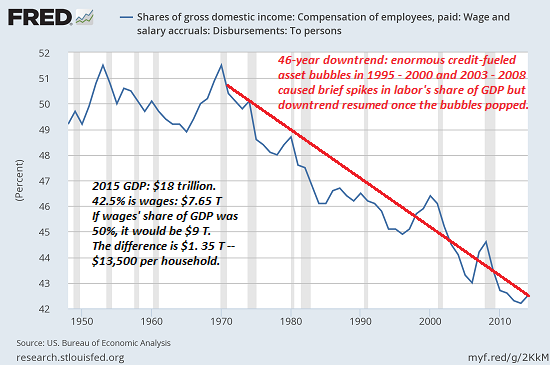

Populism in America: “Follow the Money”

If you want to understand today's populism, don't look to the mainstream media's comically buffoonish propaganda blaming the Russians: look at the four issues listed below. One of the most disturbing failures of the mainstream media in this election cycle was its complete lack of historical context for Trump's brand of populism.If you consumed the mainstream media's coverage of the campaign and election, you noted their obsession with speech acts...

Read More »

Read More »

ECB and the Future of QE

ECB will likely extend asset purchases in full. It may modify the rules by which it buys securities. It may adjust the rules of engagement for its securities lending program.

Read More »

Read More »

FX Daily, December 07: Greenback is Broadly Steady While Sterling Slides

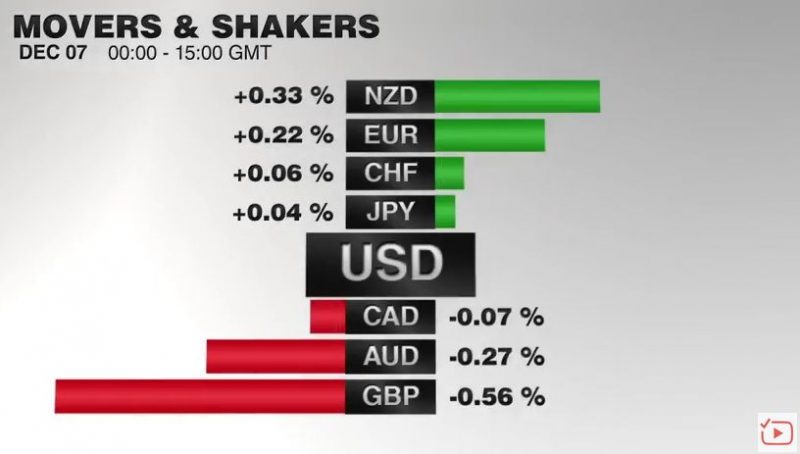

The US dollar is little changed against most of the major currencies. Sterling is the notable exception, losing about 0.75% to trade at three-day lows. It was on the defensive in early European turnover but got the run pulled from beneath by the unexpectedly poor data. UK industrial output fell by 1.3% in October. The median forecast was for a small increase.

Read More »

Read More »

Wie die SNB durch Kapitalsteuern die Schweizer Wirtschaft belastet

Vor dem Hintergrund eines angeblich „schwachen Wirtschaftswachstums“ rechtfertigte SNB-Chef Thomas Jordan neulich in einem Interview in der Tagespresse die SNB-Negativzinsen und bezeichnete diese als „expansiv“. Nur: Sind Negativzinsen wirklich „expansiv“? Sind diese nicht viel eher „restriktiv“ und bremsen unsere Wirtschaft – bewirken also genau das Gegenteil von dem, was die SNB behauptet?

Read More »

Read More »

Over 4,000 studios for rent. Standing room only. Telephone included.

The contractural requirement for Swisscom to provide every commune with a telephone box comes to an end at the end of next year. Late last week, the Federal Council adopted a new plan that will come into force in 2018. Internet subscriptions without a fixed phone contract should also be part of the new plan.

Read More »

Read More »