Tag Archive: newslettersent

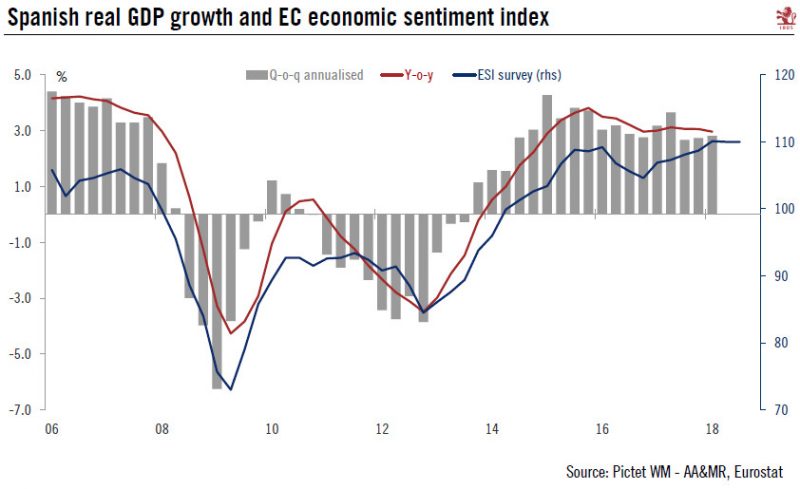

Europe chart of the week – Spanish growth

This week saw the final release of Spanish GDP growth for Q1. The economy again managed to post robust growth, the highest among the four largest euro area economies (+0.7% q-o-q versus 0.4% q-o-q for the euro area). The breakdown of figures showed that domestic demand was once again the main growth driver.

Read More »

Read More »

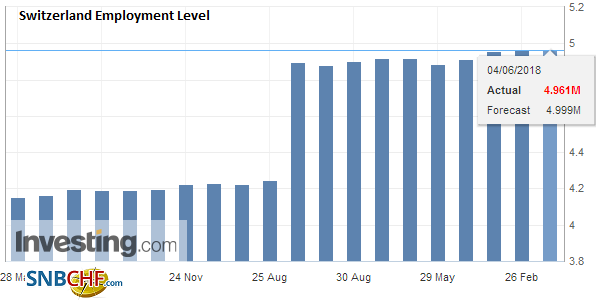

Slowdown in Middle Eastern tourists to Switzerland

After almost tripling in the last decade, the number of tourists to Switzerland from the Middle East is slowing down, with the slowdown expected to be particularly marked this summer. The growth rate of tourists from the Gulf will be zero this summer, according to forecasts by Oxford Economics and the Swiss tourist board.

Read More »

Read More »

FX Daily, June 5: Sterling Jumps Ahead, While US Equities Have Small Coattails

The British pound is benefiting from the stronger than expected service and composite PMI readings, which among other things are serving as a distraction from the government's seemingly tortured approach to Brexit and the sales of part of its stake in RBS for a GBP2 bln loss. Financials are a drag on the FTSE 100 today (~-0.5% while other major bourses are higher).

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX put in a mixed performance Friday, and capped off an overall mixed week. Over that week, the best performers were IDR, TRY, and INR while the worst were BRL, MXN, and ARS. US yields are recovering and likely to put renewed pressure on EM FX.

Read More »

Read More »

Vollgeld – Eine umfassende Analyse

Am 10. Juni stimmen wir in der Schweiz auf nationaler Ebene über die Vollgeld-Initiative ab. Diese widmet sich einer der wohl komplexesten und zugleich wesentlichsten Thematiken unserer Gesellschaft: unserem Finanzsystem. Die Idee des Vollgeldes geht weit über die Initiative in der Schweiz hinaus und ist heute in erster Linie Bestandteil der «Modern Monetary Theory». Ihren Ursprung lässt sich in das 19. Jahrhundert zurückverfolgen. Auf der Webseite...

Read More »

Read More »

House Prices Down in Verbier but Up in Some other Swiss resorts

A recent report published by UBS shows real estate price changes in european mountain resorts. Over the last year, Verbier (-3.2%) and Crans Montana (-3.0%) experienced the largest price declines, while Saas Fee (+14.3%) and St. Moritz (+7.4%) climbed the most.

Read More »

Read More »

FX Weekly Preview: Macro Matters Now, Just Not the Data

The main concerns of investors do not arise from the high-frequency data that are due in the coming days. Last week, the somewhat firmer than expected preliminary May CPI for the EMU failed to bolster the euro. The stronger than expected US jobs data, even if tipped by the President of the United States, and the pendulum of market sentiment swinging back in favor of two more Fed rate hikes this year did not trigger new dollar gains.

Read More »

Read More »

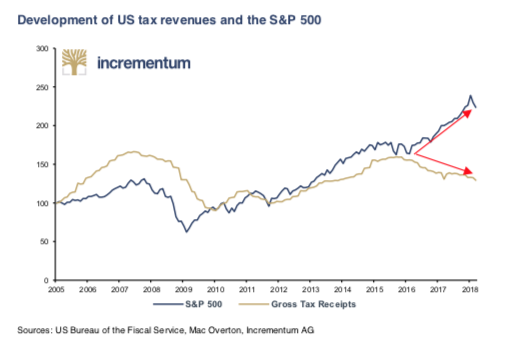

Get “Positioned In Gold” Now As “You Will Not Have Time To Get Positioned” Later

Get “Positioned In Gold” Now As “You Will Not Have Time To Get Positioned” In Physical Later. Guest post by Dominic Frisby of Money Week. This year’s “gold standard” of gold-related research has just come out. Conveniently enough – given gold’s “safe haven” reputation – it’s arrived just in time for another major financial market scare, this time in the form of Italy. Below, I consider some of the most pertinent points…

Read More »

Read More »

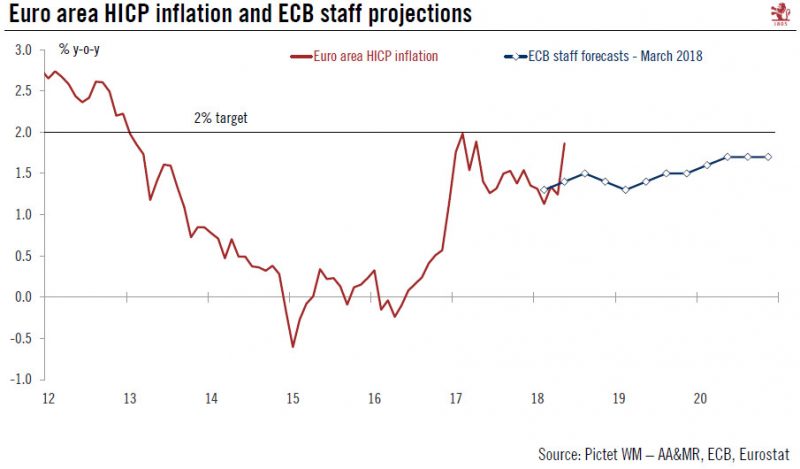

Euro area inflation close to ECB target in May

Today’s release of euro area flash HICP surprised to the upside both in terms of headline inflation (which surged from 1.2% to 1.9% y-o-y in May, above consensus expectations of 1.6%) and, crucially, in terms of core inflation (HICP excluding energy, food, alcohol and tobacco rose from 0.7% to 1.1%).

Read More »

Read More »

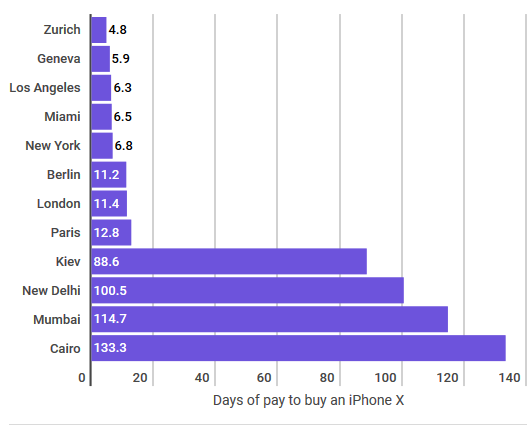

Pay in Zurich and Geneva highest in the world

A survey of the cost of living in 77 cities, by UBS, ranks Zurich (1st) and Geneva (2nd) as the most expensive. But while these cities are the most expensive, their workers are also the highest paid. In Zurich, less than five days pay affords an iPhone X. In Geneva, the same device requires less than six days of labour.

Read More »

Read More »

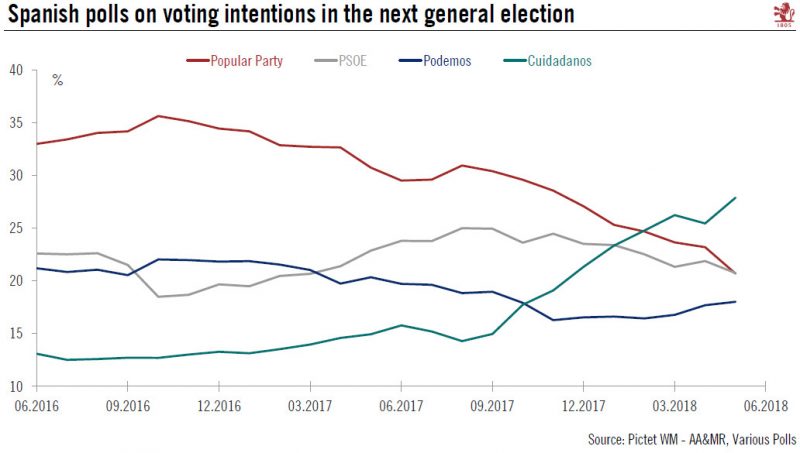

Spain Snap Elections in Sight

Political instability in Spain has added to turmoil in other peripheral countries. The situation is not comparable with the one that Italy is experiencing at the moment, but since it comes at the same time it is increasing market volatility. Last Friday, Spain’s main oppositionparty, the Socialist party (PSOE) filed a no confidence vote against Prime Minister Mariano Rajoy. The debate will start on May 31 with a vote probably on June 1.

Read More »

Read More »

Over 1,000 jobs threatened by OVS liquidation

The Sempione Retail company, owner of the OVS fashion stores in Switzerland, has begun bankruptcy proceedings. Some 140 outlets will close their doors, with 1,150 workers affected. The Italian clothes brand announced in a statement on Wednesday evening that it had reached a financial dead-end.

Read More »

Read More »

Great Graphic: Euro Bulls Stir but Hardly Shaken

Euro has fallen 10.5 cents since mid-February. Net speculative longs in the futures market remain near record. Gross long euros have actually increased over the past month.

Read More »

Read More »

Burrito Index Update: Burrito Cost Triples, Official Inflation Up 43 percent from 2001

Welcome to debt-serfdom, the only possible output of the soaring cost of living. Long-time readers may recall the Burrito Index, my real-world measure of inflation. The Burrito Index: Consumer Prices Have Soared 160% Since 2001 (August 1, 2016). The Burrito Index tracks the cost of a regular burrito since 2001. Since we keep detailed records of expenses (a necessity if you’re a self-employed free-lance writer), I can track the cost of a regular...

Read More »

Read More »

Bricht die Italien-Krise der SNB das Genick?

Am 7. April 2017, dem Tag der Generalversammlung der Schweizerischen Nationalbank, war die Welt der Notenbank noch in Ordnung. Der Euro notierte bei 1.20 zum Franken, und SNB-Chef Thomas Jordan konnte einen Jahresgewinn für das vergangene Geschäftsjahr von 54 Milliarden Franken vorweisen.

Read More »

Read More »

FX Daily, June 01: Ironic Twists to End the Tumultuous Week

The week is ending quite a bit different than it began. The main banking concern is not in Italy but in German, where shares in Deutsche Bank shares fell to a record low yesterday, and S&P Global cut its credit rating one step to BBB+ (third-lowest investment grade).

Read More »

Read More »

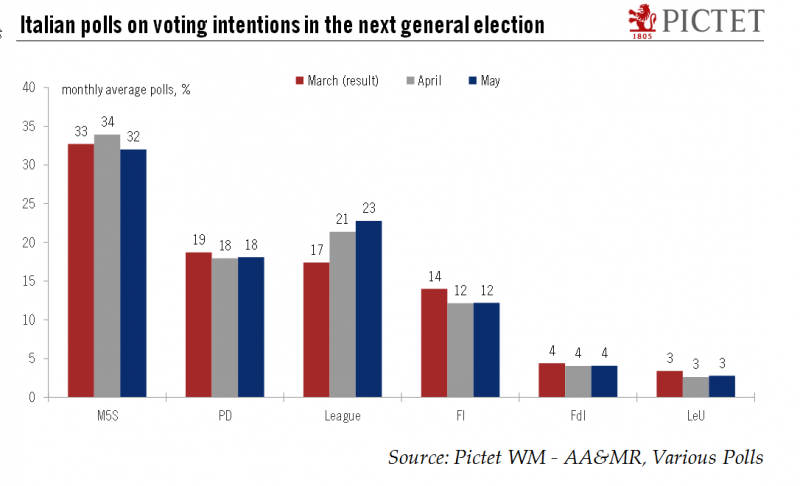

Italy heads towards new elections

Fragmented politics and the risk of a financial crisis continue to hang over the country.This weekend, the Five Star Movement and the League decided to pull the plug on their attempt to form a coalition government after the President of the Republic Sergio Mattarella vetoed the appointment of anti-euro professor Paolo Savona as minister of finance. Mattarella has granted ex-International Monetary Fund official, Carlo Cottarelli, a mandate to form a...

Read More »

Read More »

Swiss Bank to Drop Iranian Business

A Swiss lender is suspending new transactions with Iran following US President Donald Trump’s withdrawal from the nuclear deal with Tehran. Banque de Commerce et de Placements (BCP)external link announced on Tuesday that it was wrapping up its activity in Iran in response to the US pulling out of the Iranian nuclear accord earlier this month.

Read More »

Read More »