Tag Archive: newslettersent

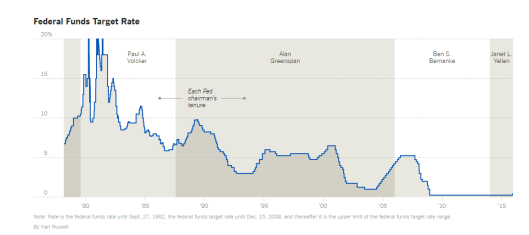

Video: Interest Rate Differentials Increasing Financial Market Leverage To Unsustainable Levels

We discuss the rate differentials between Switzerland, Britain, Europe, Japan and the United States and how this Developed Financial Markets carry trade is incentivizing excessive risk taking with tremendous leverage and destabilizing the entire financial system in the process in this video.

Read More »

Read More »

FX Daily, February 24: Anxiety? What Anxiety?

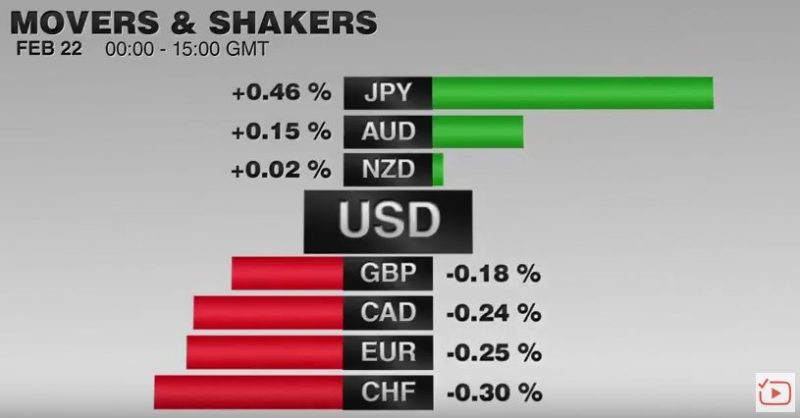

The US dollar is finishing the week on a mixed note in choppy activity in narrow ranges. It is an apt way to finish this week, which has been largely directionless as investors wait for fresh incentives, and are especially looking toward Trump's speech to a joint session of Congress next week.

Read More »

Read More »

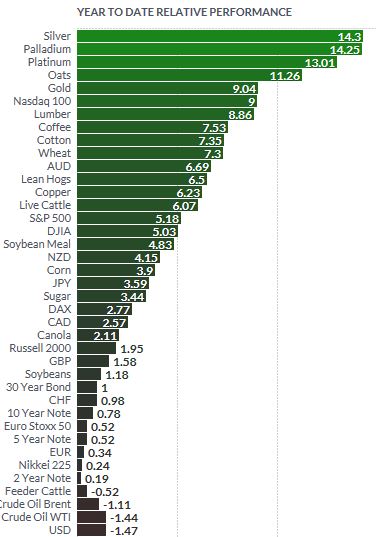

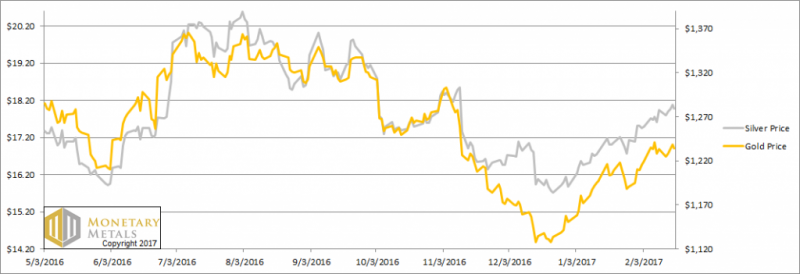

Gold Up 9 percent, Silver 14 percent YTD As Le Pen’s Lead Widens

Gold up 1.5% in euros and dollars this week. Silver up 1.4% this week and now up 14.3% and is the best performing market YTD. Gold up 9% year to date – fourth consecutive higher weekly close and breaks resistance at $1,250/oz. Gold up 9.4% in euros year to date as Le Pen’s lead in polls widened. Gold up another 6.4% in sterling pounds year to date as ‘Hard Brexit’ looms.

Read More »

Read More »

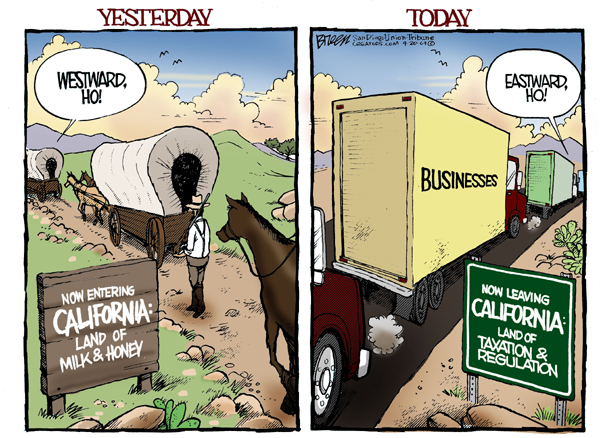

California, Nestle and Decentralization

Nestle USA has announced that it will move its headquarters from Glendale, California, to Rosslyn, Virginia, taking with it about 1200 jobs. The once Golden State has lost some 1690 businesses since 2008 and a net outflow of a million of mostly middle-class people from the state from 2004 to 2013 due to its onerous tax rates, the oppressive regulatory burden, and the genuine kookiness which pervades among its ruling elites.*

Read More »

Read More »

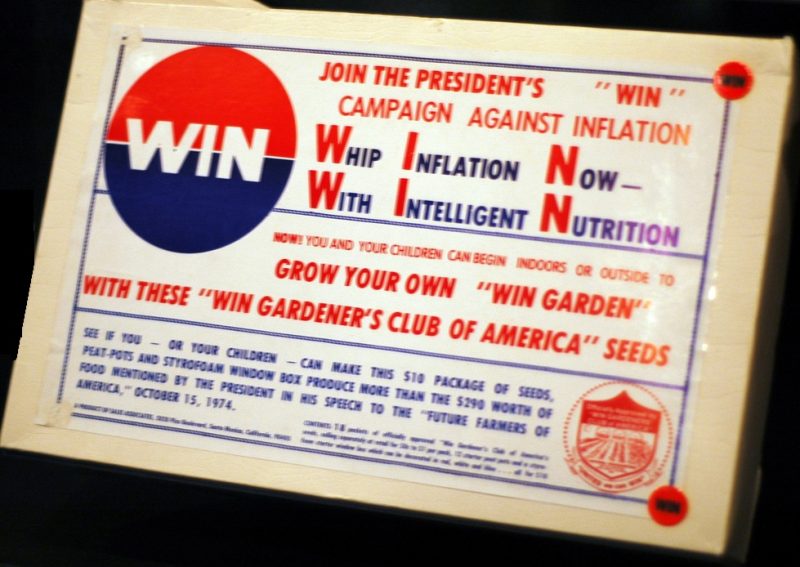

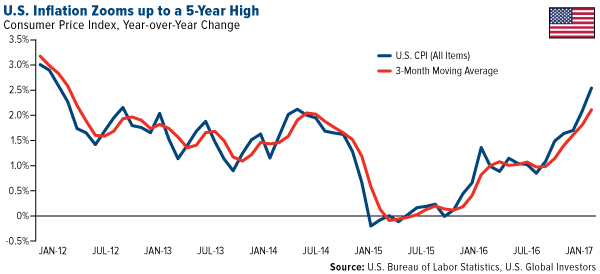

Is an Inflation Comeback in the Works?

LOVINGSTON, VIRGINIA – Amid all the sound and fury of the Trump news cycle, hardly anyone noticed. There is a specter haunting this economy. It is the specter of inflation…

Read More »

Read More »

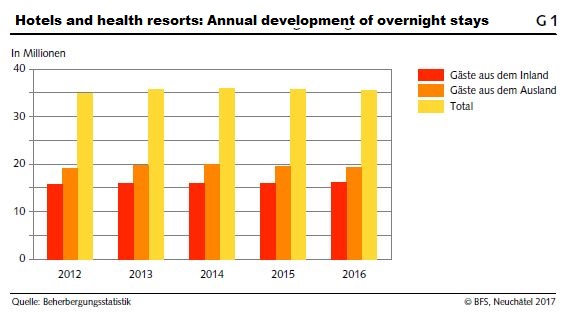

Statistics on tourist accommodation in December and year 2016: Overnight stays declined by 0.3percent in 2016 in Switzerland

The hotel sector registered 35.5 million overnight stays in Switzerland in 2016, representing a moderate decline of 0.3% (-96,000 overnight stays) compared with 2015. Foreign visitors registered 19.3 million overnight stays, a decline of 1.5% (-288,000). The number of overnight stays by domestic visitors (16.2 million) showed an increase of 1.2% (+192,000) and thus registering a positive result for the fourth consecutive year.

Read More »

Read More »

FX Daily, February 23: Dollar Chops About, as “Fairly Soon” Does not Mean mid-March

The US dollar is confined to narrow ranges today within yesterday's ranges. Equity markets posted small gains in Asia and have an upside bias in Europe. Core bond yields are softer, and today this includes France, but peripheral European 10-year benchmark yields are 3-6 bp firmer. Italian bonds are the poorest performer, while the 10-year Dutch bond yields are off the most (3.2 bp to 0.56%) despite the looming election.

Read More »

Read More »

Primary Budget Balances in EMU

Greece debt has rallied as a repeat of the 2015 crisis seems less likely. The EC may turn its attention to Italy's structural deficit. There are several countries, including France that is forecast to have a larger primary deficit in 2018 than 2017.

Read More »

Read More »

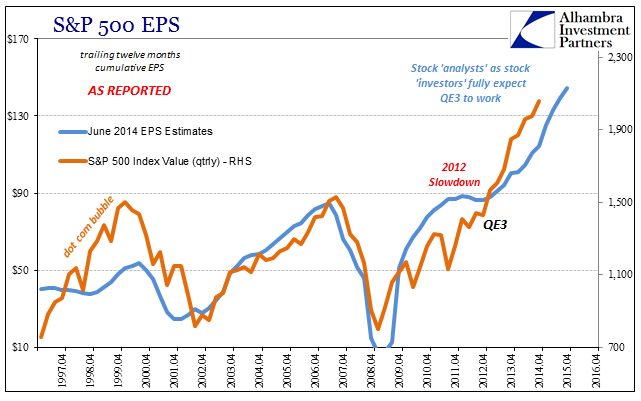

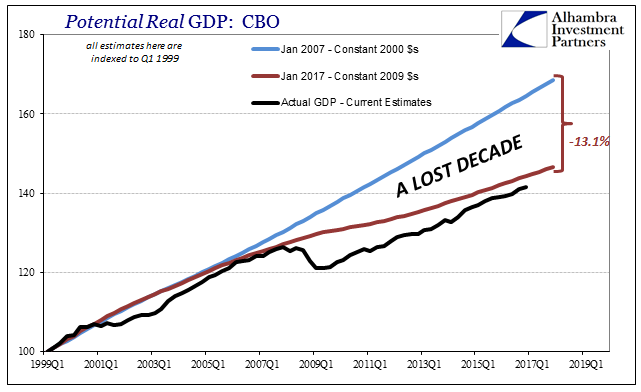

The Market Is Not The Economy, But Earnings Are (Closer)

My colleague Joe Calhoun likes to remind me that markets and fundamentals only sound like they should be related, an observation that is a correct one on so many different levels. Stock prices, in general, and GDP growth may seem to warrant some kind of expected correlation, but it has proven quite tenuous at times especially in a 21st century sense.

Read More »

Read More »

How to Outperform Hedge Funds with Just a Few Trades

In their efforts to beat the market, many investors are spending a lot of time searching for rare undiscovered gems or sophisticated trading rules. There is actually a simpler way. I will show below how one could have beaten the market by a sizable margin over approximately the past 90 years – with only two trades per month, while being invested only one third of the time and without employing any leverage.

Read More »

Read More »

The Problem with Gold-Backed Currencies

Any currency is only truly "backed by gold" if it is convertible to gold. There is something intuitively appealing about the idea of a gold-backed currency --money backed by the tangible value of gold, i.e. "the gold standard." Instead of intrinsically worthless paper money (fiat currency), gold-backed money would have real, enduring value-it would be "hard currency", i.e. sound money, because it would be convertible to gold itself.

Read More »

Read More »

FX Daily, February 22: Euro Meltdown Continues

February has been cruel to the euro. Of the sixteen sessions this month, counting today, the euro has risen in four, and two of those were last week. Its new four-day slide pushed it below $1.05 for the first time in six weeks as European markets were opening. The $1.0560 area that was broken yesterday, and provided a cap today is 61.8% retracement objective of last month's rally.

Read More »

Read More »

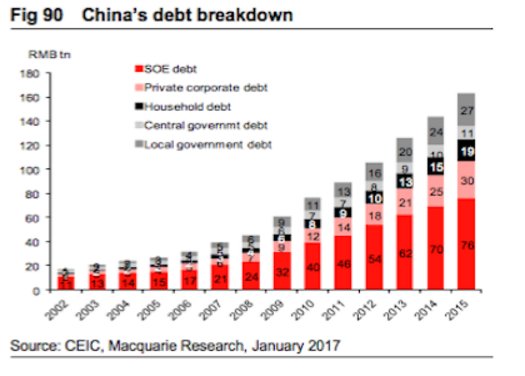

Gold To Benefit from Rising Inflation and Higher Than “Official” China Gold Demand

Frank Holmes joins Lawrie Williams, Koos Jansen and many others in questioning the “official” Chinese gold demand numbers. Real gold demand is likely much higher than the official numbers. Inflation just got another jolt, rising as much as 2.5 percent year-over-year in January, the highest such rate since March 2012. Led by higher gasoline, rent and health care costs, consumer prices have now advanced for the sixth straight month.

Read More »

Read More »

The Criminalization of Financial Independence

Just as the "war on drugs" criminalized and destroyed large swaths of African-American and Latino communities, the "war on cash" will further criminalize the few remaining avenues to financial independence and freedom. The introduction of "entitlement" welfare in the 1960s generated a toxic dependency on the state that institutionalized worklessness, a one-two punch that undermined marriage and family in America's working class of all ethnicities.

Read More »

Read More »

The Stinking Politics of It All

It is largely irrelevant, but still the political theater is fascinating. As is now standard operating procedure, whatever comes out of the Trump administration immediately is conferred as the standard for awful. This is not my own determination, mind you, but that of the mainstream, whatever that is these days. And so it is with the first set of budget figures that include very robust growth projections, a point of contention and an obvious one...

Read More »

Read More »

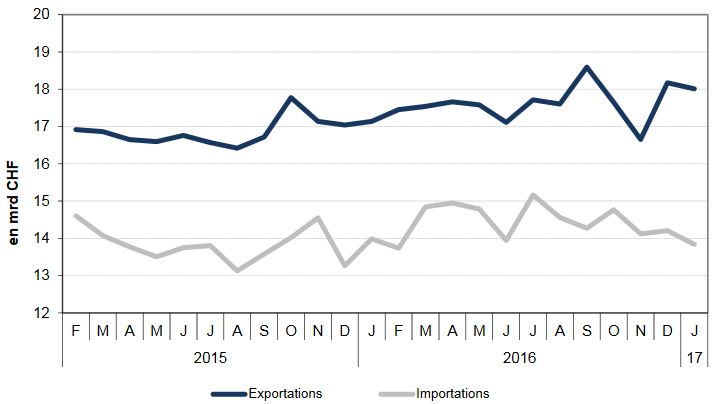

Swiss Trade Balance January 2017: Pharma maintains the Exports in the black figures

After adjusting for working days, exports increased by 5.3% (real: + 2.3%) in January 2017, boosted by chemicals and pharmaceuticals. Imports, on the other hand, fell by 1.2% (real: -6.8%). The trade balance loops on a record monthly surplus of 4.7 billion francs.

Read More »

Read More »

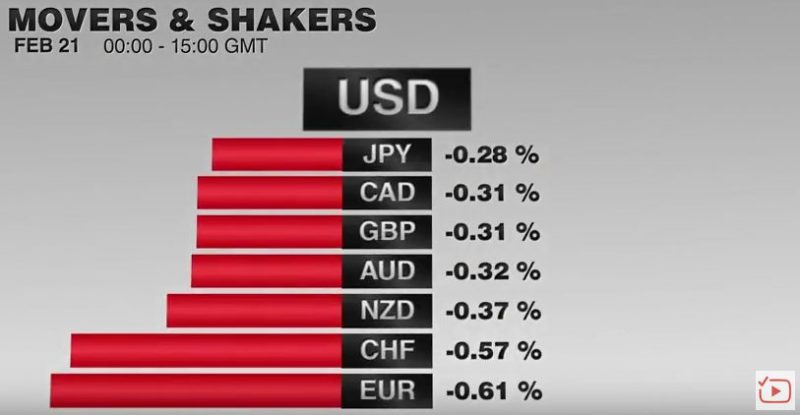

FX Daily, February 21: Dollar Bounces Back

Some profit-taking in the middle of last week pushed the dollar lower and gave rise in some quarters that the run was over. However, the greenback has come back the bid. It is gaining against all the major currencies today and most of the emerging market currencies.

Read More »

Read More »

Russia Gold Buying Returns – Buys One Million Ounces In January

Russia Gold Buying Returns – Adds Substantial One Million Ounces To Reserves In January. Russia gold buying returned in January with the Russian central bank buying a very large 1 million ounces or 37 metric tonnes of gold bullion. The increase in the gold reserves came after Russia did not buy a single ounce in December – a move seen as potentially a signal or an olive branch to the U.S. and the incoming Trump administration.

Read More »

Read More »