Tag Archive: newslettersent

FX Weekly Preview: Looking Through the FOMC Meeting as it Looks Past Poor Q1 GDP

US jobs and auto sales data may be more important than the FOMC meeting. Norway and Australia's central bank meets. Neither is expected to change policy. All three large countries that reported Q1 GDP figures last week - US, UK, France - disappointed expectations.

Read More »

Read More »

FX Weekly Review, April 24 – 29: Dollar Remains the Fulcrum

Often the US dollar, as the numeraire, seems to be the main actor in the foreign exchange market. Other times, the dollar appears to be at the fulcrum between European currencies on one hand, and the dollar-bloc currencies on the other hand. Another way expressing this is whether there is a dollar-move underway or is it really more about the crosses.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended last week on a mixed note. Indeed, the week and the month were also very much mixed for EM, reflecting a variety of global and country-specific drivers impacting these countries. This week’s US jobs data could bring Fed tightening back as a major driver for EM.

Read More »

Read More »

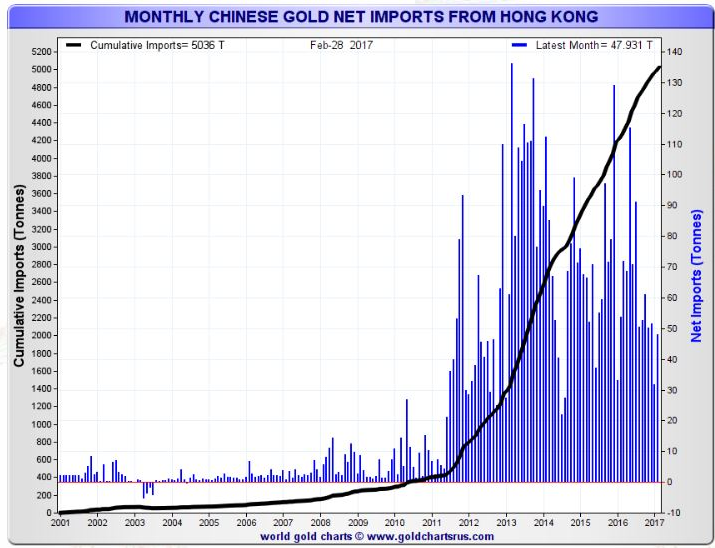

Gold Bullion Imports Into China via Hong Kong More Than Doubles in March

Gold bullion imports into China via main conduit Hong Kong more than doubled month-on-month in March, data showed on Tuesday as reported by Reuters. Net-gold imports by the world’s top gold consumer through the port of Hong Kong rose to 111.647 tonnes in March from 47.931 tonnes in February, according to data emailed to Reuters by the Hong Kong Census and Statistics Department.

Read More »

Read More »

Swiss have never moved as much as they did in 2015

In Switzerland, more than a million people moved house in 2015, 12.1% of the population. The figure has never be higher, according to a report called Immo-Monitoring published by Wüest Partner. The home moving covered around 490,000 dwellings. Of those who moved, 344,000 stayed in the same commune (Gemeinde) while the other 659,000 changed municipality.

Read More »

Read More »

NAFTA Trade Update

The trade tensions between the US and Canada set the Canadian dollar to lows for the year. The dollar's downside momentum against the Mexican peso has eased. The Canadian dollar looks attractive not against the US dollar but against the peso.

Read More »

Read More »

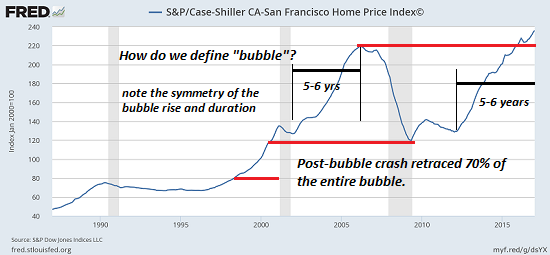

Housing’s Echo Bubble Now Exceeds the 2006-07 Bubble Peak

A funny thing often occurs after a mania-fueled asset bubble pops: an echo-bubble inflates a few years later, as monetary authorities and all the institutions that depend on rising asset valuations go all-in to reflate the crushed asset class.

Read More »

Read More »

New 50 Swiss franc note wins international beauty contest

The new 50 franc note, launched last year, was voted the best new bank note in 2016 by the International Bank Note Society, a society founded in 1961. Nearly 120 new banknotes were released worldwide in 2016. The Swiss 50 only narrowly beat the Maldive Islands 1000 Rufiyaa bill, Argentina’s 500 Peso jaguar, and the Royal Bank of Scotland’s 5 Pound first polymer note.

Read More »

Read More »

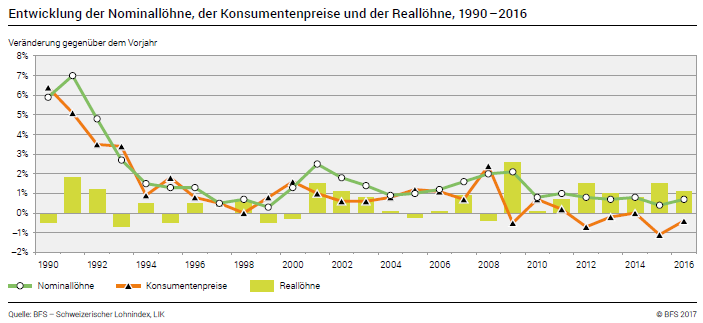

Swiss wage index 2016: Nominal wage increase of 0.7 percent in 2016. Real wages rise by 1.1 percent.

The Swiss nominal wage index rose by +0.7% on average in 2016 compared with 2015. It settled at 100.7 points (base 2015 = 100). Given a negative average annual inflation rate of -0.4%, real wages registered an increase of +1.1% (101.1 points, base 2015 = 100) according to calculations by the Federal Statistical Office.

Read More »

Read More »

Longevity and Income

Rich people live longer than poor people in the US. This disparity undermines the progressive nature of Social Security. Disparity of income seems more important than the slowdown in growth in explaining why few US people are doing better than their parents at the age of 30.

Read More »

Read More »

Emerging Markets: What has Changed

Moody’s moved the outlook on Vietnam’s B1 rating from stable to positive. Nigeria’s central bank introduced a new FX window for portfolio investors. Moody’s moved the outlook on Romania’s Baa3 rating from positive to stable. Central Bank of Russia accelerated its easing cycle. Central Bank of Turkey delivered a hawkish surprise. Brazil’s lower house easily approved the labor reforms, but popular resistance is rising.

Read More »

Read More »

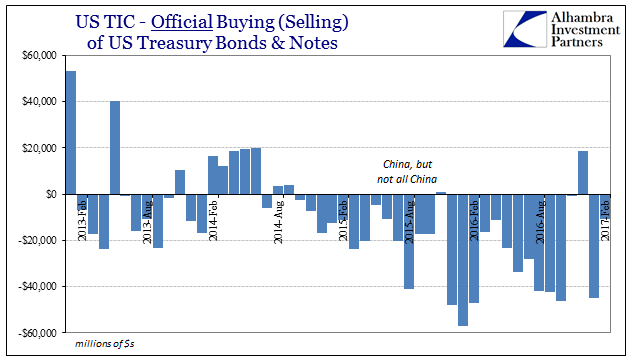

‘Dollar’ ‘Improvement’

According to the headline TIC statistics, foreign central banks have in the past six months sold the fewest UST’s since the 6-month period ended November 2015. That may indicate an easing of “dollar” pressure in the private markets due to “reflation” sentiment.

Read More »

Read More »

FX Daily, April 28: Markets Limp into Month End

Equity markets are stalling into the end of the month. MSCI Asia-Pacific Index is snapping a six-day advance, and the week's gain was sufficient to extend the advancing streak for the fourth consecutive month. The Dow Jones Stoxx 600 is trading off for the second consecutive session, after rallying for six consecutive sessions.

Read More »

Read More »

Who Will Live in the Suburbs if Millennials Favor Cities?

Who's going to pay bubble-valuation prices for the millions of suburban homes Baby Boomers will be off-loading in the coming decade as they retire/ downsize?Longtime readers know I follow the work of urbanist Richard Florida, whose recent book was the topic of Are Cities the Incubators of Decentralized Solutions?(March 14, 2017).

Read More »

Read More »

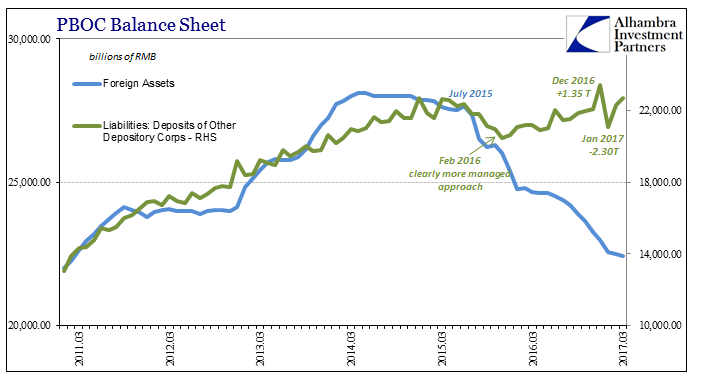

PBoC: Mechanical Tightening PBoC is China Central Bank

The mainstream narrative as it relates to Chinese money is “tightening.” Having survived the economic downturn last year, we are to believe that the PBOC is once again on bubble duty. They raised their reverse repo rates, considered to be their policy benchmarks, three times up to mid-March.

Read More »

Read More »

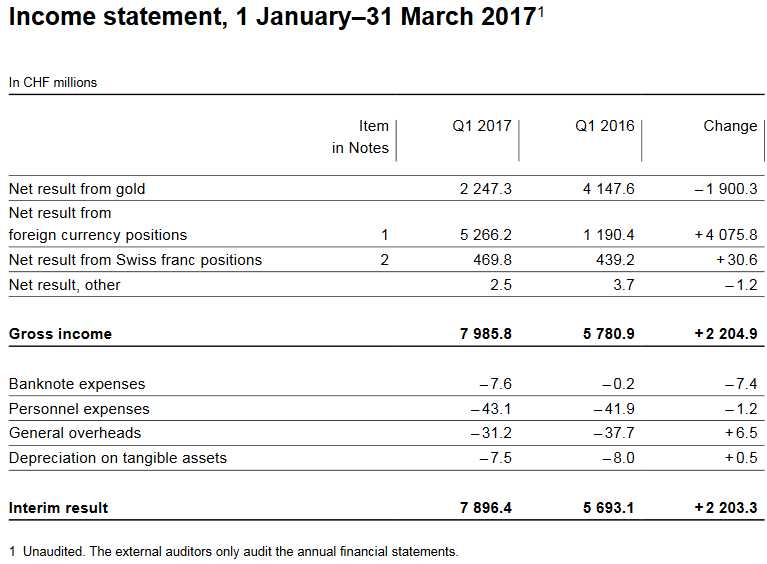

SNB posts 7.9 billion CHF Profit in Q1

The SNB reports a profit of 7.9 bn CHF, of which 2.2 bn come from the gold holdings. Given that the bank has introduced a "minimum euro rate" around 1.06-1.07, this is not very difficult. It comes at the price of continuing interventions.

Read More »

Read More »

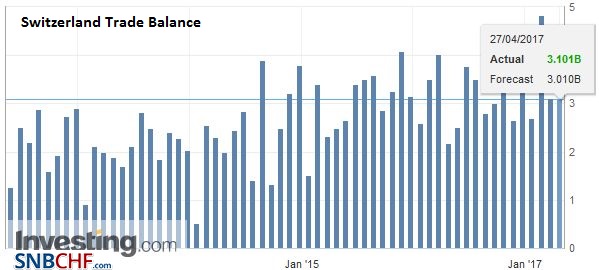

Swiss Trade Balance March 2017: Increase in Exports and Stagnation of Imports

Swiss exports are moving more and more toward higher value sectors: away from watches, jewelry and manufacturing towards chemicals and pharmaceuticals. With currency interventions, the SNB is trying to keep sectors alive, that would not survive without interventions.

Read More »

Read More »

FX Daily, April 27: Several Developments ahead of the ECB meeting

The ECB meeting and the press conference that follows it is the main event. However, it has had to compete with the Bank of Japan and Riksbank meetings, as well as the further reflection of the tax reform proposals by the Trump Administration yesterday.

Read More »

Read More »