Tag Archive: newslettersent

Switzerland Hosts Meeting on Tax Transparency

An international meeting on transparency and exchange of tax data is underway in the Swiss city of Geneva. The five-day gathering of the Global Forum peer review group is to examine the implementation of so-called group requests and the issue of the identification of beneficial owners, according to the State Secretariat for International Financial Matters.

Read More »

Read More »

Oil Update

OPEC meets on July 24. Nigeria and Libya may be pressured to cap output although they were exempt from quotas. US exports and refining appear to be the driving force behind the 13.8 mln barrel decline in inventories. Mexico has reportedly made two large oil finds.

Read More »

Read More »

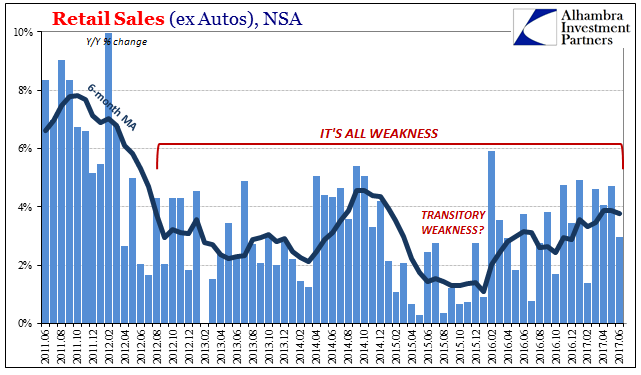

Retail Sales Conundrum

Retail sales were thoroughly disappointing in June. Whereas other accounts such as imports or durable goods had at least delivered a split decision between adjusted and unadjusted versions, for retail sales both views of them were ugly. Seasonally-adjusted first, spending last month was down for the second straight time. Worse than that, estimated sales were just barely more than in January.

Read More »

Read More »

FX Daily, July 19: Dollar Stabilizes on Hump Day, Awaits Thursday’s BOJ and ECB Meetings

After being shellacked to start the week, the US dollar is being given a small reprieve today as investors await tomorrow's BOJ and ECB meetings. The US may also report a bounce back in housing starts (residential investment) after a three-month slide.

Read More »

Read More »

Number of vacant homes rises again in Vaud

At 1 June 2017, 3,650 empty homes, of which 2,655 were for rent and 995 for sale, were on the market in Vaud. This brought the vacancy rate to 0.9%, a rise of 0.1% compared to the year before. This rise follows an increase of 0.1% in 2016 from a rate of 0.7% in 2015. The market is considered balanced when the vacancy rate reaches 1.5%. The last time it was above this mark in Vaud was in 1999.

Read More »

Read More »

Where there’s smoke, there’s political fire

A poster in a Swiss shop window advertises the sale of legal cannabis. The rising popularity of marijuana that doesn’t make you high – a product known as “cannabis light” or “CBD cannabis” – is causing a headache for Swiss politicians. It is sold in many Swiss shops and generates millions of Swiss francs in sales.

Read More »

Read More »

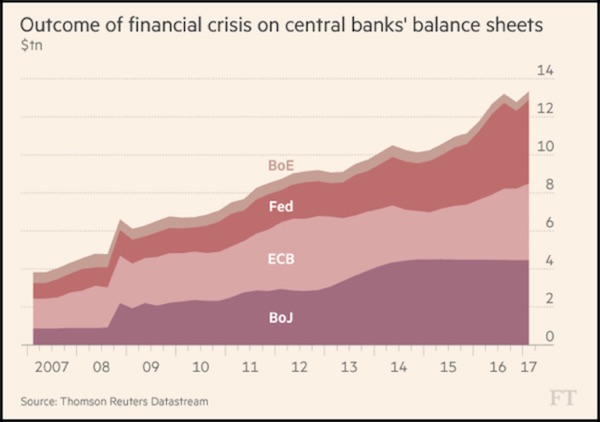

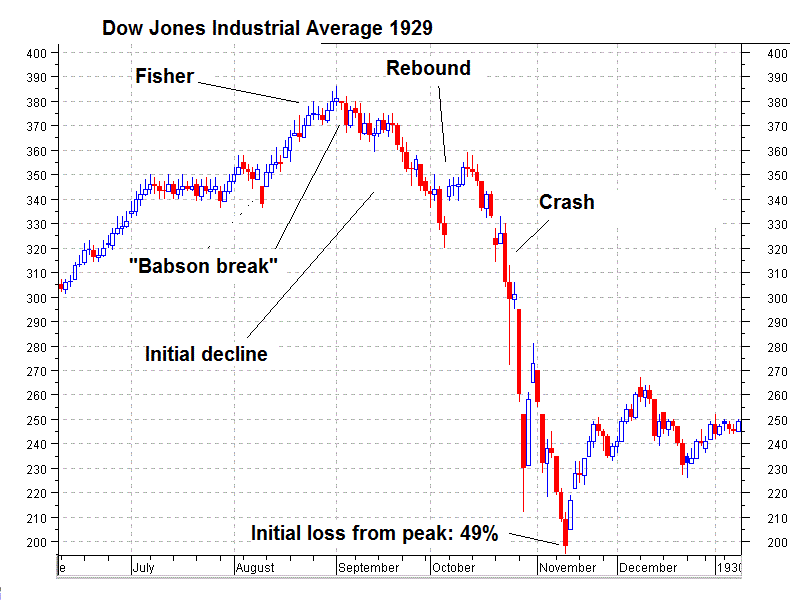

“Financial Crisis” In 2017 Or By End Of 2018 – Prepare Now

John Mauldin of Mauldin Economics latest research note, Prepare for Turbulence, is excellent and a must read warning about the coming financial crisis. Mind refreshed from what sounds like a wonderful honeymoon and having had the time to read some books outside his “comfort zone” he has come to the conclusion that we are on the verge of a “major financial crisis, if not later this year, then by the end of 2018 at the latest.”

Read More »

Read More »

Sterling, McCafferty, and BOE Policy

BOE hawk is arguing for a sooner unwind of QE. He did not favor the renewed asset purchases after the referendum. Sterling has been meeting resistance near $1.30 for past two months.

Read More »

Read More »

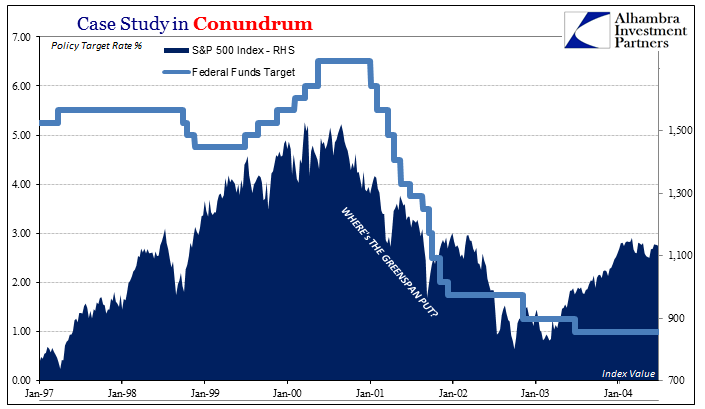

US S&P 500 Index, Federal Funds Target, Manufacturing Payrolls, US Imports and US Banking Data: All Conundrums Matter

Since we are this week hypocritically obsessing over monetary policy, particularly the federal funds rate end of it, it’s as good a time as any to review the full history of 21st century “conundrum.” Janet Yellen’s Fed has run itself afoul of the bond market, just as Alan Greenspan’s Fed did in the middle 2000’s.

Read More »

Read More »

FX Daily, July 18: Dollar Dumped on Doubts on US Economic Agenda

News of the defection of two more Republican Senators doomed the Senate attempt to replace and repeal America's national health care. The failure to replace the system dubbed Obamacare, despite the Republican majority in both legislative chambers and the executive branch raises questions about the broader strategy of the Administration and raises serious questions about the rest of its legislative agenda.

Read More »

Read More »

Global Asset Allocation Update: Not Yet

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolio this month. Growth and inflation expectations rose somewhat since last month’s update. The change is minor though and within the range of what we’ve seen in recent months.

Read More »

Read More »

UBS worried about departing baby-boomers

Switzerland is facing a medium-term future of labour market shortages and ratcheting pension costs, according to the latest economic outlook report by UBS bank. The quarterly appraisal,external link launched Thursday in Zurich, highlighted a paradox in the current shape of the Swiss labour market.

Read More »

Read More »

Swiss abroad react angrily to pension cut comments

The Organisation of the Swiss Abroad (OSA) has reacted angrily to the recent remarks of a politician that questioned the role of expat pensioners. An apology: this is what the OSAexternal link have demanded of Petra Gössi, the Radical Party politician whose “unacceptable” remarks about the pensions of Swiss abroad provoked a flurry of reaction last month.

Read More »

Read More »

Adventures in Quantitative Tightening

All remaining doubts concerning the place the U.S. economy and its tangled web of international credits and debts is headed were clarified this week. On Monday, Mark Yusko, CIO of Morgan Creek Capital Management, told CNBC that:

Read More »

Read More »

FX Daily, July 17: Markets Mark Time, Dollar Consolidates Losses

After falling to new lows for the year against several major currencies in response to disappointing retail sales and uninspiring CPI before the weekend, the US dollar has begun the new week on a more stable note. It is firmer against nearly all the major currencies, though is mixed against the emerging market currencies.

Read More »

Read More »

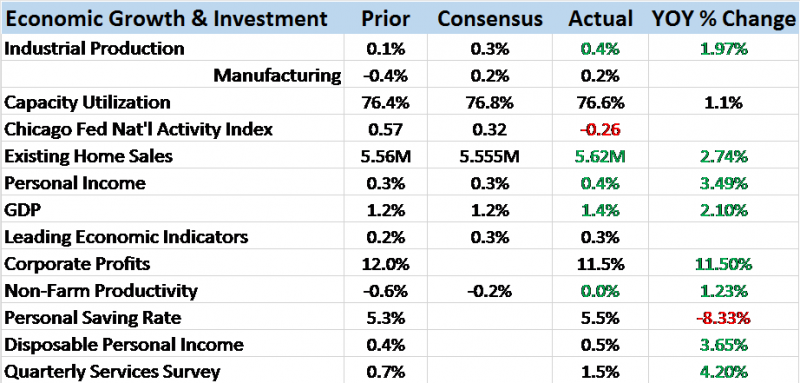

Bi-Weekly Economic Review: Attention Shoppers

The majority of the economic reports over the last two weeks have been disappointing, less than the consensus expectations. The minor rebound in activity we’ve been tracking since last summer appears to have stalled. Retail sales continue to disappoint and inventory/sales ratios are once again rising – from already elevated levels.

Read More »

Read More »

Swiss franc more overvalued than 6 months ago according to Economist burger index

The Economist magazine’s 6-monthly Big Mac index shows the Swiss franc to be even more overvalued than it was in January 2017. The index, which compares the US$ price of a Big Mac around the world places Switzerland at the top with a price of US$ 6.74. This is 27.2% more expensive than the United States where the same burger costs US$ 5.30.

Read More »

Read More »

Swiss private bank accepts bitcoin

Falcon has teamed up with cryptocurrency brokerage Bitcoin Suisse to offer the service. With the value of bitcoin and other cryptocurrencies soaring in recent months, the bank said it was responding to demand from clients. It has also installed a bitcoin ATM at its Zurich HQ.

Read More »

Read More »

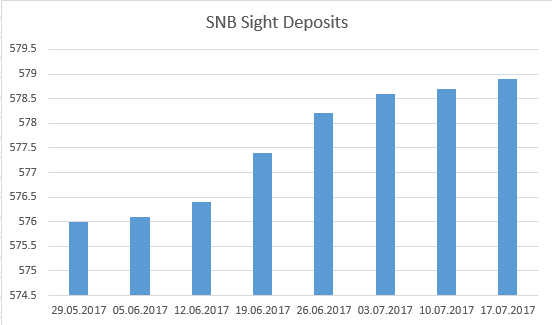

Weekly SNB Interventions and Speculative Positions: Hawkish ECB, less SNB interventions

Hawkish comments by Mario Draghi boosted the EUR against both USD and CHF. It also reduced the need for SNB interventions. The question is how long Draghi will remain hawkish, especially next winter, when headline inflation in the euro zone may fall under 1%.

Read More »

Read More »