Tag Archive: newsletter

Switzerland facing biggest economic slump since 1975

In a revised forecast in the wake of the coronavirus pandemic, federal authorities predict GDP will contract by 6.7% in 2020 and recover slowly in 2021. On Thursday, the State Secretariat for Economic Affairs (SECO) announced that it had adjusted 2020 economic forecasts to take into account sporting events affected by the pandemic.

Read More »

Read More »

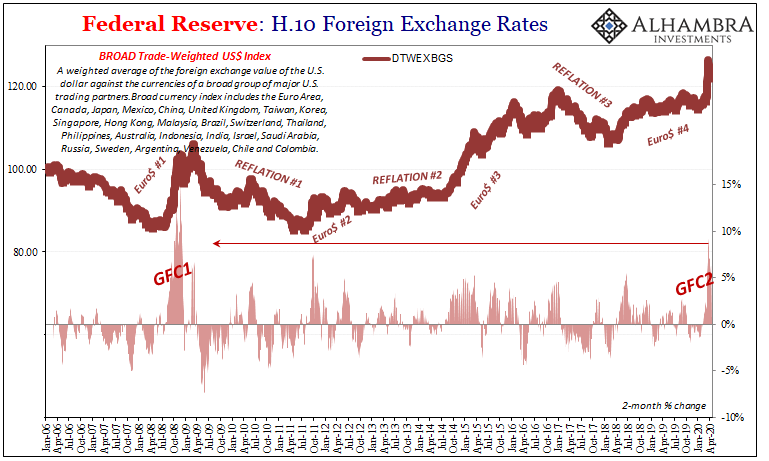

The Fallen Kings & The Bond Throne of Collateral

There is no schadenfreude at times like these, no time to dance on anyone’s grave. Victory laps are a luxury that only central bankers take – always prematurely. The world already coming apart because of GFC1, what comes next with GFC2 and then whatever follows it? Another “bond king” has thrown in the towel.

Read More »

Read More »

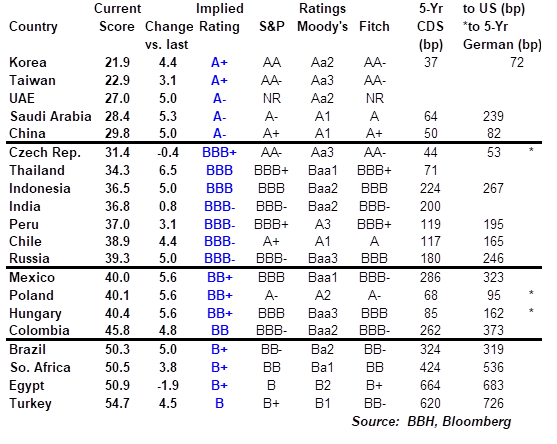

EM Sovereign Rating Model For Q2 2020

The major ratings agencies are punishing Emerging Markets (EM) credits much more than their DM counterparts. Our own sovereign ratings model suggests that there is still more pain to come.

We have produced this interim ratings model to assist investors in assessing relative sovereign risk across the major EMs.

Read More »

Read More »

Your Supermarket Overlords: Why Barbados Needs a Voluntary Quarantine

On Wednesday, April 1, the acting prime minister of Barbados, Hon. Santia Bradshaw, came on the local news station to announce a mandatory partial shutdown to combat COVID-19. She announced that starting April 3, all “nonessential” businesses would remain closed until midnight April 14.

Read More »

Read More »

Kauf von Main Street Capital – Monatszahler im Aktien Depot ??

Am Aktienmarkt ist Erholung zu erkennen, aber ist diese von Dauer? Ich kaufe trotzdem regelmässig nach, komme was wolle. Ich nutze die Gelegenheit, um Main Street Capital mit starkem Abschlag aufzustocken und habe mir 50 Aktien gekauft. Jetzt besitze ich insgesamt 200 Stück. Hier geht’s übrigens zum letzten Aktien Kauf ABB Ltd.

Read More »

Read More »

FX Daily, April 23: Investors Take PMI Crash in Stride

Overview: Investors have remained fairly calm in the face of flash April PMI crashes and an increase of virus cases in several European countries. Most equity markets in the Asia Pacific region rose, with the notable exceptions of China and Australia. The Nikkei rose for the first time this week, and its 1.5% gain led the region.

Read More »

Read More »

How Swiss drones and robots are changing farming

Remote sensing, big data, artificial intelligence and robotics are being integrated into everyday farm management. Based on information relayed by a Swiss start-up, the owner of a sugar mill in India tells local cane farmers it’s almost time to harvest their crop.

Read More »

Read More »

Gold Will Reach $3,000/oz: “Fed Can’t Print Gold” and Is “Ultimate Store Of Value” – Bank of America

Gold in USD – 3 Days Gold prices are 0.7% higher today after falling just 0.3% yesterday as traders sought refuge in safe haven gold as oil prices collapsed lower again. Oil slumped to nearly $15 a barrel, its lowest since 1999 as the economic fallout from government lockdowns and the shutting down of entire economies impacts risk assets and commodities dependent on economic growth.

Read More »

Read More »

An International Puppet Show

It’s actually pretty easy to see why the IMF is in a hurry to secure more resources. I’m not talking about potential bailout candidates banging down the doors; that’s already happened. The fund itself is doing two contradictory things simultaneously: telling the world, repeatedly, that it has a highly encouraging $1 trillion in bailout capacity at the same time it goes begging to vastly increase that amount.

Read More »

Read More »

Dollar Stalls as Market Sentiment Improves

The virus news stream remains mixed; oil remains at center stage with still extreme volatility. The White House and House Democrats struck a deal on a new aid package worth $484 bln. Canada reports March CPI; Mexico delivered a surprise 50 bp cut to 6.0% yesterday afternoon.

Read More »

Read More »

Why Markets Are Rallying as Millions Become Unemployed

The US economy is imprisoned, most of the population is under house arrest, and the inmates in Washington are running the asylum. And yet while the nation appears to be walking the green mile, investors residing in the Wall Street cell block have been extended pardons from the market gods.

Read More »

Read More »

Coronavirus: the age difference behind lower Swiss death rate

Switzerland’s Covid-19 death rate has been lower than much of the rest of Europe. A lower infection rate among older people appears to be one reason. The rates of deaths among those either recovering or dying have been particularly high in Belgium (40%), France (34%) and Italy (31%).

Read More »

Read More »

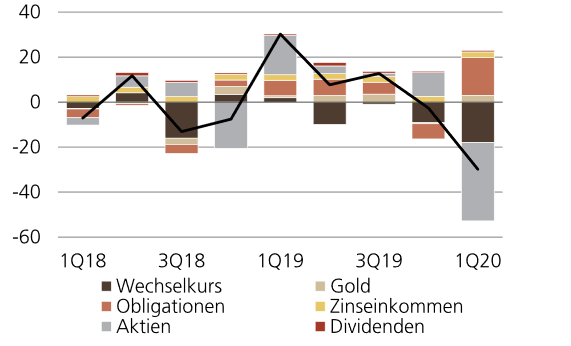

SNB dürfte im ersten Quartal 30Milliarden Franken verlieren

Die SNB dürfte im ersten Quartal des laufendenJahres einen Verlust von rund CHF 30 Mrd.ausweisen. Die Coronakrise führte zu einem Kurssturz anden Aktienmärkten und zu einer Aufwertung desFrankens auf breiter Basis, beides schadete demErgebnis der SNB.

Read More »

Read More »

FX Daily, April 22: Investors Catch Collective Breath, but Sentiment remains Fragile

Overview: Risk-appetites appear to have stabilized for the moment. Most equity markets are higher. Japan and Malaysia were exceptions, but the MSCI Asia Pacific Index rose for the first time this week. In Europe, the Dow Jones Stoxx 600 is recouping about a third of yesterday's loss.

Read More »

Read More »

5 Schritte um mit dem Vermögensaufbau zu Beginnen ??

Heute möchte ich mit euch über die 5 Schritte sprechen, mit denen ihr Vermögen aufbauen könnt. Dieser Beitrag richtet sich eher an die Leute, die mit dem Vermögensaufbau beginnen wollen. Ich gebe euch heute eine kleine Guideline, wie man die ersten Schritte richtig macht. Vieles davon ist aus meiner eigenen Erfahrung, wie ich mit meinem heutigen Wissen nochmal starten würde.

Read More »

Read More »

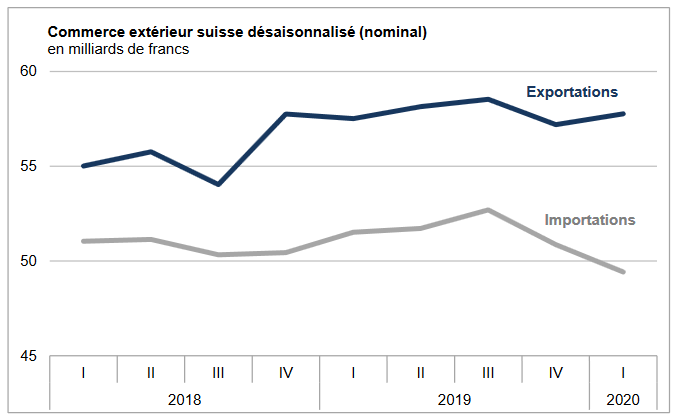

Swiss Trade Balance Q1 2020 : chemistry-pharma keeps exports in black numbers

The boom in chemicals and pharmaceuticals enabled Swiss exports to increase in March as well as in the first quarter of 2020 (+ 2.2% respectively + 1.0%). Despite the global economic situation linked to the “Covid-19”, the performance of this sector offset the decline suffered by most of the other groups. As in the previous quarter, seasonally adjusted imports fell (- 2.8%). The trade balance for the first three months of 2020 ends with a surplus...

Read More »

Read More »

The Greenspan Bell

What set me off down the rabbit hole trying to chase modern money’s proliferation of products originally was the distinct lack of curiosity on the subject. This was the nineties, after all, where economic growth grew on trees. Reportedly. Why on Earth would anyone purposefully go looking for the tiniest cracks in the dam?

Read More »

Read More »

The Experts Have No Idea How Many COVID-19 Cases There Are

In the early days of the COVID-19 panic—about three weeks ago—it was common to hear both of these phrases often repeated: "The fatality rate of this virus is very high!" "There are far more cases of this out there than we know about!"

Read More »

Read More »

FX Daily, April 21: Oil Drilled Below Zero, Equity Rally Stalls, Greenback Advances

Overview: Oil's wild ride has been joined by two other developments that are keeping investors off-balance. First, reports suggest that North Korea's Kim Jong-Un maybe in critical condition after surgery. He apparently was absent from last week's events celebrating his grandfather.

Read More »

Read More »

Is Venezuela’s gold a liability for Switzerland?

Venezuela is illegally mining and trading in gold, and Switzerland could be one of its clients, according to Swiss media reports. swissinfo.ch spoke to law enforcement, customs and financial authorities to find out whether they are taking action.

Read More »

Read More »