Tag Archive: newsletter

Angst vor Energie- und Eurokrise – “DAX Long oder Short?” mit Marcus Klebe – 24.06.22

Angst vor Energie- und Eurokrise - "DAX Long oder Short?" mit Marcus Klebe - 24.06.22

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbrokers.com/de

#DAX #MarcusKlebe #Trading

ÜBER JFD:

WER...

Read More »

Read More »

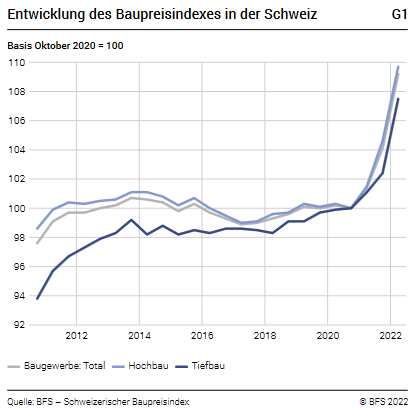

Construction prices rose by 4.9% in April 2022

The construction output price index recorded a rise of 4.9% between October 2021 and April 2022, reaching 109.2 points (October 2020 = 100). This result reflects an increase in building and civil engineering prices. Year on year, construction prices increased by 7.7%.

Read More »

Read More »

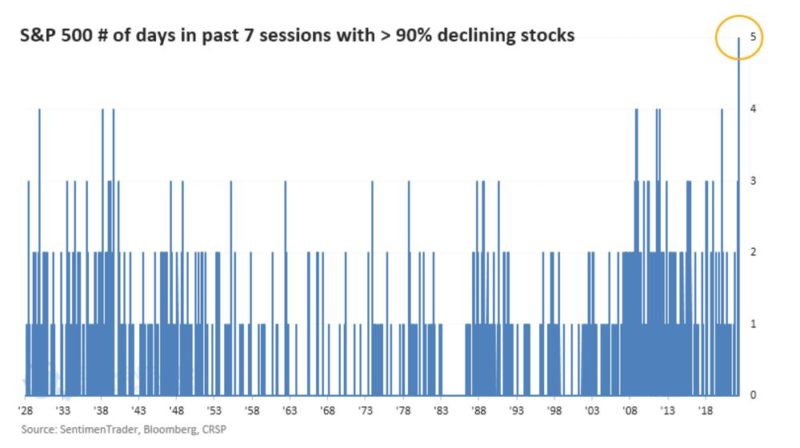

Market Pulse: Mid-Year Update

Note: This update is longer than usual but I felt a comprehensive review was necessary. The Federal Reserve panicked last week and spooked investors into the worst week for stocks since the onset of COVID in March 2020. The S&P 500 is now firmly in bear market territory but that is a fraction of the pain in stocks and other risky assets.

Read More »

Read More »

Musical Chairs in Washington, D.C.

Republicans are licking their chops over the Federal Reserve’s ostensible plans to raise interest rates aggressively in the months ahead to combat soaring prices. They view a coming big recession as a grand opportunity to win control over Congress in the upcoming November elections.

Read More »

Read More »

Alpine rail tunnel and suburban train services to get boost

The government has presented plans for an upgrade of the country’s railway network, including an additional Alpine tunnel in western Switzerland. About CHF720 million ($745 million) have been set aside to upgrade the Lötschberg base tunnel and other regional projects near Zürich and Geneva in the next decade.

Read More »

Read More »

SELBSTBESTIMMTER LEBEN – Das müssen Sie beachten!

Wie lebt man selbstbestimmt? Dies hängt zu einem großen Teil mit den finanziellen Mitteln zusammen. Daher ist nicht nur bei der Standortwahl ein Blick auf die Historie anzuraten sondern auch darauf zu achten, wem man Aufmerksamkeit schenkt...

_

The First Billion is the Hardest: Reflections on a Life of Comebacks *https://amzn.to/3zQGQFj

_

Dr. Markus Elsässer, Investor und Gründer der Value Fonds

„ME Fonds - Special Values“ WKN: 663307

„ME Fonds -...

Read More »

Read More »

Nasdaq Technical Analysis for 24 June 2022, NQ1! 11818.00 ▲ +0.69%

Nasdaq futures reached our target of 11800 and looks like is heading towards 3 price points before temporary partial profits takers (sellers) will probably step in.

Read More »

Read More »

Alasdair Macleod about Stock Market Crash, Japan bank crisis prediction

In latest podcast Alasdair Macleod discusses about Stock Market Crash. Macleod explains the problem of banks fighting the crisis.

Alasdair Macleod started his career as a stockbroker in 1970 on the London Stock Exchange. He is an educator and advocates for sound money thru demystifying finance and economics. Regarded as one of the country's greatest short story writers.

? Subscribe here: https://www.youtube.com/c/InvestNews1?sub_confirmation=1...

Read More »

Read More »

Das Kinderbuch: “Friedrichs Traum von der Freiheit” | Gelesen von Ernst Wolff

Ernst Wolff liest aus seinem Kinderbuch "Friedrichs Traum von der Freiheit".

Klarsicht Verlag

Inh. Robert B. Osten

Bramfelder Str. 102A

22305 Hamburg

Tel.: 040.40185045

____________________

Auf dem offiziellen YouTube-Kanal vom Wirtschaftsexperten Ernst Wolff, finden Sie verschiedene Formate wie das "Lexikon der Finanzwelt", das dem Zuschauer als umfassendes, audiovisuelles Finanzlexikon dienen soll. Komplexe Begriffe und...

Read More »

Read More »

Der Euro zum 2. Mal gerettet – Und was jetzt? / Hans A. Bernecker in der Sendung vom vom 22.06.2022

Themen-Check mit Hans A. #Bernecker ("Die Actien-Börse") - in diesem Video als verkürzte FreeTV-Variante der ansonsten umfangreicheren Sendung im Rahmen von Bernecker.tv vom 22.06.2022. Schlaglichter:

++ #Antifragmentierungstool als Notnagel für den #Euro

++ Euro am Tropf der #EZB

++ Schuldenstrategie kann durch aus funktionieren

++ Euro als Weichwährung

++ Weiche Währung als Rückenwind für deutschen Export?

++ Liquidität als Nährboden...

Read More »

Read More »

Tether wird neuen Stablecoin rausbringen

Tether hat bekanntgegeben, dass man schon im Juli einen neuen Stablecoin launchen wird. Dieser wird mit Britischen Pfund gedeckt sein. Damit folgt man der Strategie, die Tether bereits zuvor dazu veranlasste, einen Cryptocoin namens MXNT herauszubringen – dieser wird durch Mexikanische Pesos gedeckt.

Read More »

Read More »

Stell diese Fragen deinem Bankberater (er wird nervös…)

Oft wurden Anleger bei Gesprächen in der Bank Produkte nahegelegt, die nicht die optimale Lösung für die Situation des Kunden sind. Jens Rabe hat das selber schon erlebt und verrät dir in diesem Video seine Top-Fragen, wie du bei Bankprodukten das richtige finden kannst und zeigt dir, das eigene Erfahrungen dich weit bringen können.

Read More »

Read More »

How gene editing could reduce the cost of cosmetics

The cosmetics business has exploited natural resources for centuries. With consumers now demanding more sustainable products, gene-editing technology could give the industry a makeover—and make cosmetics cheaper.

00:00 - Could gene editing make cosmetics more sustainable?

01:01 - Hunting sharks for skincare

02:58 - How does synthetic biology work?

05:39 - What is the environmental cost of plant-based cosmetics?

07:45 - Can engineered microbes...

Read More »

Read More »

Neue Abhängigkeiten gefährden Energiewende – Leben von Dividenden – www.aktienerfahren.de

Link zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

Have Markets Priced-in Recession? | 3:00 on Markets & Money

(6/23/22) Fed Chair Jerome Powell's testimony Wednesday that he might have to create a recession to contain inflation roiled markets, and he's set for a second round today. Futures have been reversing early losses, and the question now is whether markets can keep it up. We contend that any rally should be sold-in to; selling pressure continues to appear in these rallies because of so many investors feeling trapped, looking for any relief. We're...

Read More »

Read More »

Alasdair MacLeod: Euro Crisis And Market Shutdown! You Have To Prepare For This!

▶︎1000x.net – Enter your Email ▶︎ https://bit.ly/3n5JKOS

▶︎ Subscribe NOW to the channel, click here ▶︎ https://bit.ly/CompactInvestorNews_subscribe

▶︎ Keep your financial education strong with our CompactClub ▶︎ http://bit.ly/CompactClub

Alasdair has been a celebrated stockbroker and Member of the London Stock Exchange for over four decades. His experience encompasses equity and bond markets, fund management, corporate finance and investment...

Read More »

Read More »