Tag Archive: newsletter

FED im Fokus – kommt doch keine Zinswende? – US Opening Bell mit Marcus Klebe – 01.07.22

FED im Fokus - kommt doch keine Zinswende? - US Opening Bell mit Marcus Klebe - 01.07.22

Read More »

Read More »

Das lernen Kinder HEUTE in der Schule

Laut Dr. Christof Niederwieser lag der Fokus in den letzten 200 Jahren vor allem auf numerischem Denken und vorgefertigten Lösungen. Und das ist größtenteils nach wie vor so.

Die Kompetenzen der Zukunft liegen jedoch in den Bereichen Flexibilität und Kreativität.

Read More »

Read More »

Pros and Cons of a Self-Directed IRA

A self-directed individual retirement account (SDIRA) is a type of individual retirement account (IRA) that can hold investments that a typical IRA cannot, such as precious metals, commodities, and real estate.

Read More »

Read More »

Traden mit dem Goersch Trend

"The trend is your friend". Den abgedroschenen Spruch kennen wahrscheinlich die meisten. Allerdings hat er seine Daseinsberechtigung. Gibt es doch keinen größeren Vorteil am Markt, als den Trend.

Read More »

Read More »

Cashkurs*Wunschanalysen: Standard Lithium, Siemens und BYD unter der Chartlupe

Mario Steinrücken hat wieder die Aktienwünsche unserer Mitglieder unter die Chartlupe gelegt: Hier geht’s zum vollständigen Video mit weiteren spannenden Titeln wie Disney, Linde oder Volkswagen: https://bit.ly/Wunschanalysen01Juli

Als Mitglied können Sie sich im Kommentarbereich auf https://www.cashkurs.com/ Ihren Favoriten für die nächste Runde wünschen - Unsere Experten nehmen jeden Freitag die Wunschaktien unter die Chartlupe!

***Bitte...

Read More »

Read More »

Das 2. Halbjahr startet wie das 1. endete – “DAX Long oder Short?” mit Marcus Klebe – 01.07.22

Das 2. Halbjahr startet wie das 1. endete - "DAX Long oder Short?" mit Marcus Klebe - 01.07.22

Read More »

Read More »

Der ANFANG vom ENDE (Aktien-Crash) – Depot Update Juni 2022

Der ANFANG vom ENDE (Aktien-Crash) - Depot Update Juni 2022

Es könnte nicht schlechter laufen aktuell. Krypto-Crash und Aktien-Crash. Dazu wieder ein Depot-Update wo es um meine Kryptoverluste und -40k im Aktiendepot geht. Schreibt mir eure Meinung zu meinem Depot gerne in die Kommentare.

Read More »

Read More »

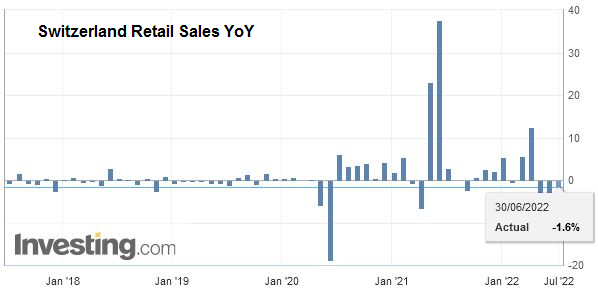

Swiss Retail Sales, May 2022: 0.0 percent Nominal and -1.6 percent Real

Nominal retail trade turnover adjusted for sales days and holidays remained stable in May 2022 compared with the same month of the previous year with a rate of change of 0.0%. Seasonally adjusted, nominal turnover rose by 1.6% compared with the previous month.

Read More »

Read More »

Cartel fined for fixing price of Volkswagens

A group of Volkswagen dealers in southern Switzerland has been fined CHF44 million ($46 million) by the Federal Competition Commission (Comco). The seven cartel members, including car importer AMAG, had fixed the prices of new Volkswagen cars for years.

Read More »

Read More »

Wie Unterscheiden sich Aktien? Diese Aspekte werden oft vergessen!

Aktienunternehmen unterscheiden sich nicht nur im Erfolg, sondern auch in ihrer Art. Oft sind diese Faktoren nicht berücksichtigt bei der Kaufentscheidung, obwohl es einen großen Einfluss auf das Investment hat. Dr. Markus Elsässer teilt seine Erfahrungen aus erster Hand.

Read More »

Read More »

How Bad Were Recessions before the Fed? Not as Bad as They Are Now

With a recession looming over the average American, the group to blame is pretty obvious, this group being the central bankers at the Federal Reserve, who inflate the supply of currency in the system, that currency being the dollar. This is what inflation is, the expansion of the money supply either through the printing press or adding zeros to a computer screen.

Read More »

Read More »

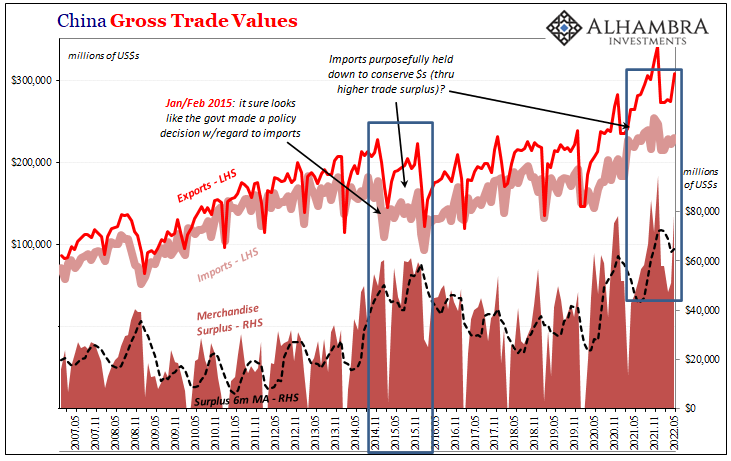

Wait A Sec, That’s Not Really An *RMB* Liquidity Pool…

Ben Bernanke once admitted how the job of the post-truth “central banker” is to try to convince the market to do your work for you. What he didn’t say was that this was the only prayer officials had for any success. Because if the market ever decided that talk wasn’t enough, only real money in hand would do, everyone’d be screwed.

Read More »

Read More »

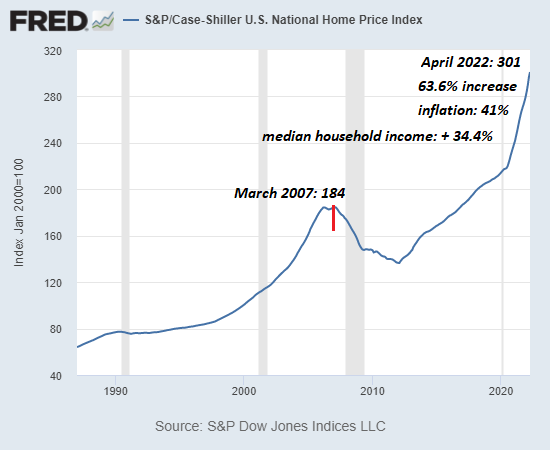

Why the Housing Bubble Bust Is Baked In

Putting this all together, it's clear that the source of the current housing bubble is the explosion of financial speculation fueled by central bank policies. Those benefiting from speculative bubbles have powerful incentives to deny the bubble can bust.

Read More »

Read More »

Eurodollar Futures Interpretation Is Everywhere

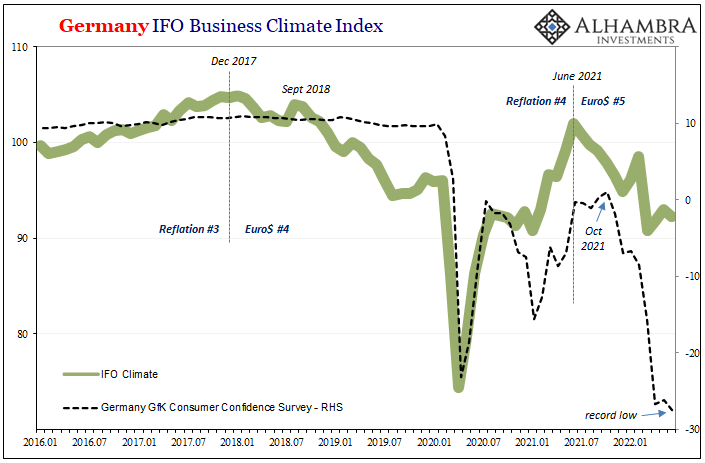

Consumer confidence in Germany never really picked up all that much last year. Conflating CPIs with economic condition, this divergence proved too big of a mystery. When the German GfK, for example, perked up only a tiny bit around September and October 2021, the color of consumer prices clouded judgement and interpretation of what had always been a damning situation.

Read More »

Read More »

How To Make Your First $1 Million (6 step process)

In this video I’ve made a list of 6 actionable steps you can take right now to move closer to your first million dollar goal. The list is based on what Charlie Munger has said and written over the years.

Read More »

Read More »

Was, wenn uns das Gas ausgeht? (Europas Alptraum)

? https://gratiswebinar.live/yt/grundsteuer

? Gratis Grundsteuer Webinar | 10.07.22

⏰ Jetzt Deinen Platz sichern!

------------------------------------

Was passiert, wenn #Russland das Gas abdreht? Welche Auswirkungen hätte eine #Gaskrise auf Deutschland, Österreich und den Rest Europas? Und welche Branchen - an die man bisher noch gar nicht gedacht hat - wären noch betroffen, wenn Putin wirklich kein Gas mehr liefert? Welche Auswirkungen ein...

Read More »

Read More »

Is Becoming an Ex-Pat the Best Way to Blunt Inflation?

(7/7/22) More Americans are choosing to move to less-expensive climes to avoid the averse effects of inflation--like Mexico; the climate crsis and the consequences of politics: The root is Economic Equality. Inflation vs Deflation--caused by a mindset, which the Fed cannot manage or control.

Lance & The Crew are taking the week off, and will return return to live programming next week (7/11/22). Here is an encore segment from a recent episode...

Read More »

Read More »

Inflation is now out of the control of central banks

2022-07-01

by Stephen Flood

2022-07-01

Read More »