- CHF is up as Wall Street indices start the week in the red.

- The level to beat for bears are at the 0.9675 and 0.9660 levels.

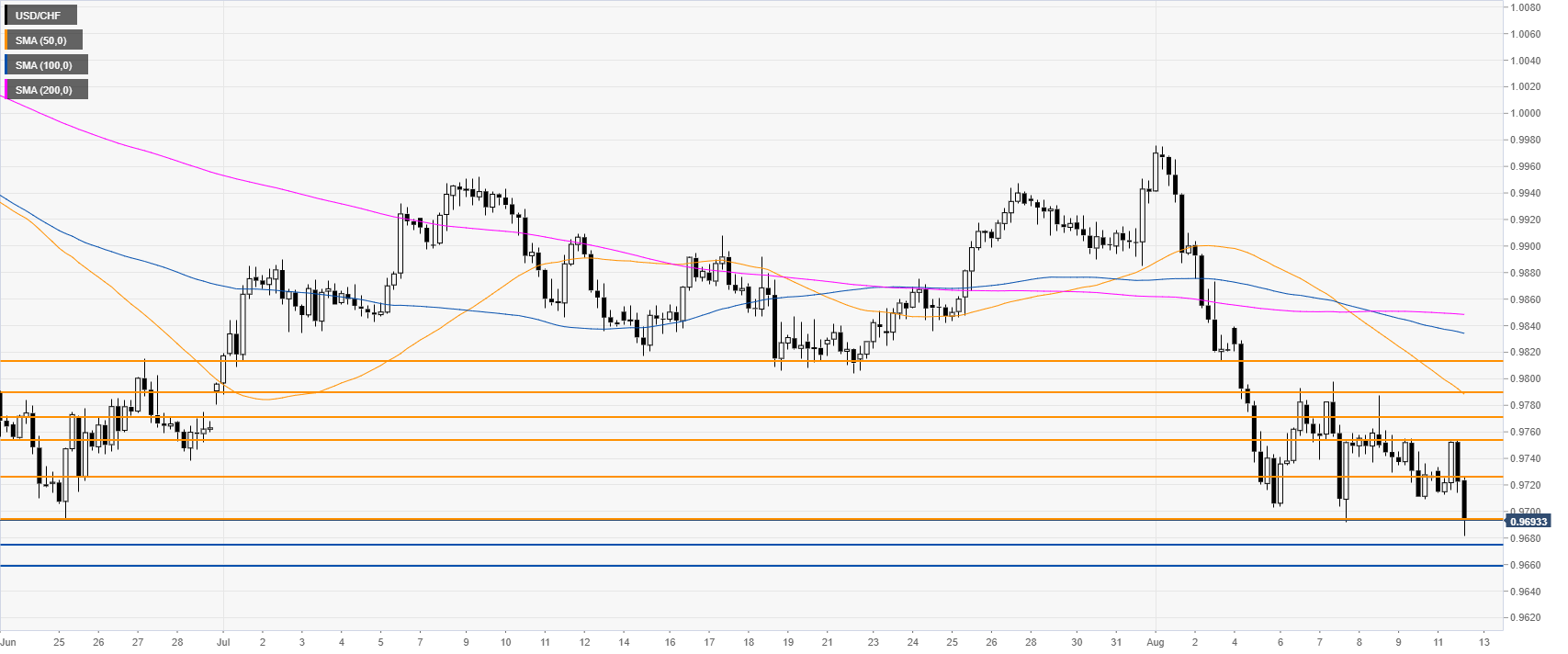

USD/CHF daily chartUSD/CHF is trading near 2-month lows below the main daily simple moving averages (DSMAs). US equity markets are starting the week on the back foot, driving demand for safe-haven currencies such as the Swiss franc. |

USD/CHF daily chart, August 13(see more posts on USD/CHF, ) |

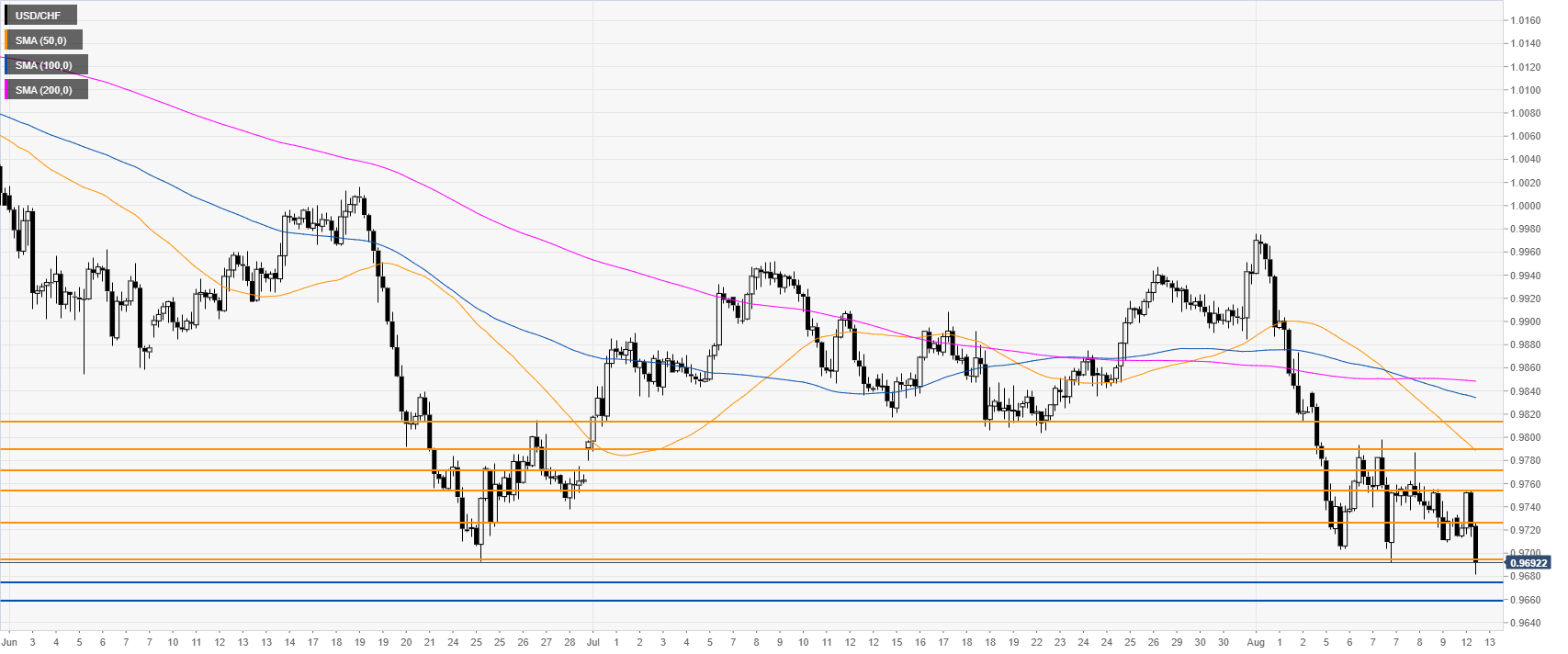

USD/CHF 4-hour chartUSD/CHF is creeping lower while trading below its main SMAs. Bears want to reach 0.9675 and 0.9660 on the way down, according to the Technical Confluences Indicator.

|

USD/CHF 4-hour chart, August 13(see more posts on USD/CHF, ) |

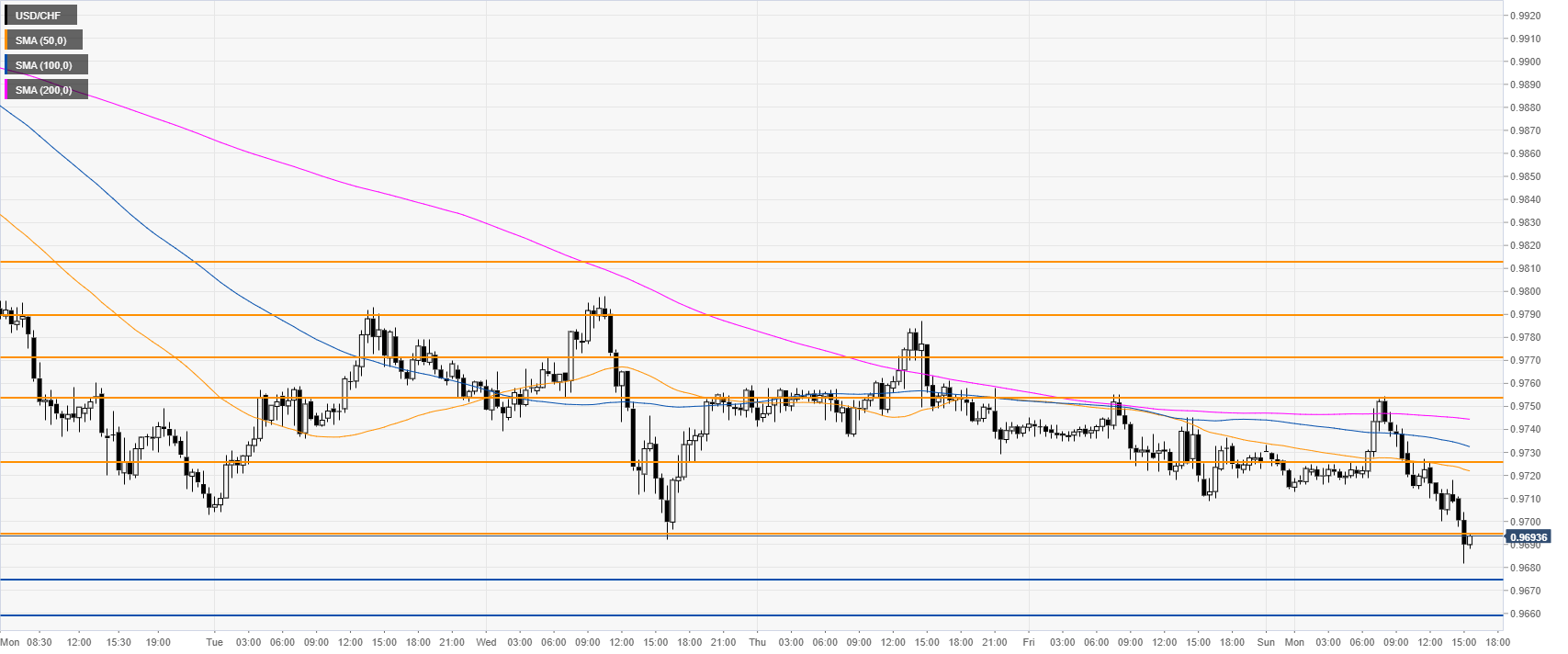

USD/CHF 30-minute chartUSD/CHF is trading below its main SMAs, suggesting bearish pressure in the near term. Immediate resistances are near 0.9694 and 0.9726, according to the Technical Confluences Indicator. |

USD/CHF 30-minute chart, August 13(see more posts on USD/CHF, ) |

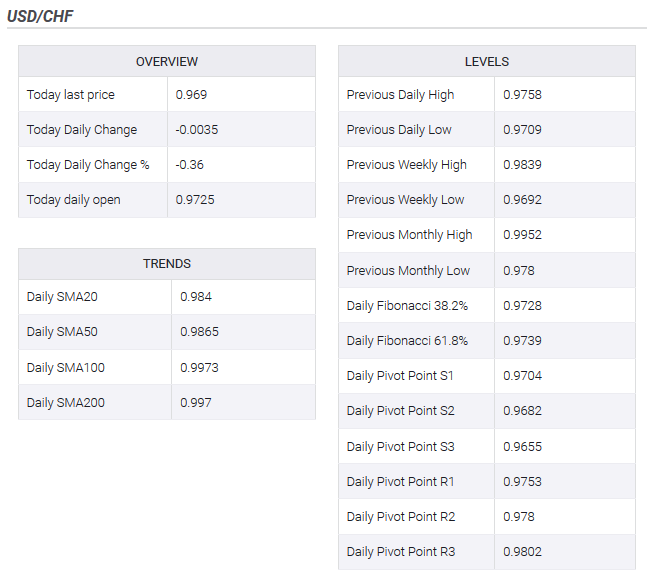

Additional key levels |

Additional key levels, August 13(see more posts on USD/CHF, ) |

Tags: newsletter,USD/CHF