Tag Archive: newsletter

Hallo im trading netzwerk

Das trading netzwerk ist eine Medien Plattform mit dem Schwerpunkt von Online Live Events (Gigs & Stories) und Video Streams.

➡️➡️➡️ https://tradingnetzwerk.com/

Hier geht es um deinen Erfolg!

Top – Experten aus dem Finanz- und Anlagebereich, unser Trainer Team, lassen dich regelmäßig an ihrem Wissen teilhaben. Lerne von ihnen, schau dir deren Denk- und Handlungsweise ab und setze dieses Wissen erfolgreich um.

Darüber hinaus präsentieren...

Read More »

Read More »

Diese Aktien habe ich im Blick!

Dazu gehört zum einen das Wasserversorgungssystem China Water, welches uns als Wert sehr gut gefallen hat.

Im Hinblick auf die Input-Kosten bei Nahrungsmitteln, könnte auch das Unternehmen Unilever interessant sein.

➡️ Zum ganzen Video gelangen Sie hier:

#florianhommklärtauf #renewillrendite #shorts

Read More »

Read More »

EZB-Zwickmühle: Führt die Inflation in die nächste Eurokrise?

Führt die Inflation in die nächste Eurokrise? Saidi geht im heutigen Video auf einen Artikel aus dem Focus Online ein.

Read More »

Read More »

Risk Appetites Improve Ahead of the Weekend

Overview: Equities are higher and bonds lower as the week's activity winds down. Asia Pacific markets rallied, paced by more than 2% gains in Hong Kong and South Korea.

Read More »

Read More »

S and P Technical Analysis for 24 June and the week ahead

Looking for ES to reach the close area of 3900 which is the top of the potential range. Profit partial takers will be attracted to sell there, if it gets there, IMHO. We are stll building a base for a bullish reversal in the medium term, but watch your entry price as we are getting to the top of the potential range and you may want to bet that you can get a more attractive lower entry price during next week.

For more technical analysis including...

Read More »

Read More »

Cashkurs*Wunschanalysen: BASF, Vonovia und PayPal unter der Chartlupe

Cashkurs*Academy: Schnuppern Sie kostenlos in den Kurs Charttechnik rein – Jetzt den Code „Wunschanalysen“ einlösen und das erste Modul gratis belegen: https://bit.ly/CKA_charttechnik

In diesem Video bespricht unser Experte Mario Steinrücken die von der Cashkurs*Community gewünschten Titel am Chart: Heute sehen Sie hier die kurz, knackigen Analysen von BASF, Vonovia und PayPal. Weitere analysierte Aktien finden Sie im vollständigen Video auf...

Read More »

Read More »

Rolex als Investment in Zeiten von Inflation

Rolex als Geldanlage gegen Inflation mit potentiellen 2-stelligen Renditen

Geldtraining: https://thorstenwittmann.com/geldsicherheit-garantiert/

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

Geheimtipp Rolex

Rolex ist nicht nur eine exklusive Uhren-Weltmarke, sondern ein interessantes Investmentobjekt.

Wenn du dein Geld streuen und der Inflation ein Schnippchen schlagen möchtest, wirf einen Blick auf das heutige Video....

Read More »

Read More »

Die INFLATION wird noch viel viel SCHLIMMER…?

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Die INFLATION wird noch viel viel SCHLIMMER...

Benzin wird immer teurer, Essen wurde teuerer und es wurde extrem viel neues Geld gedruckt über die letzten Jahre - Die Inflation nimmt kein Ende. Welche Folgen hat dies für uns alle und was kann man nun machen? Wie geht Ihr aktuell vor? Schreibt es gerne in die Kommentare....

Read More »

Read More »

Confederation and SNB facilitate exchange of Ukrainian currency at Swiss commercial banks

Together with the Federal Department of Finance (FDF) and Swiss commercial banks, the SNB has developed a solution to enable individuals with protection status S to exchange Ukrainian banknotes for Swiss francs up to a limited amount.

Read More »

Read More »

US Opening Bell mit Marcus Klebe – 24.06.22

US Opening Bell mit Marcus Klebe - 24.06.22

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbank.com/de

#DowJones #Trading #MarcusKlebe

ÜBER JFD:

WER WIR SIND:

JFD ist eine führende Unternehmensgruppe,...

Read More »

Read More »

Angst vor Energie- und Eurokrise – “DAX Long oder Short?” mit Marcus Klebe – 24.06.22

Angst vor Energie- und Eurokrise - "DAX Long oder Short?" mit Marcus Klebe - 24.06.22

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbrokers.com/de

#DAX #MarcusKlebe #Trading

ÜBER JFD:

WER...

Read More »

Read More »

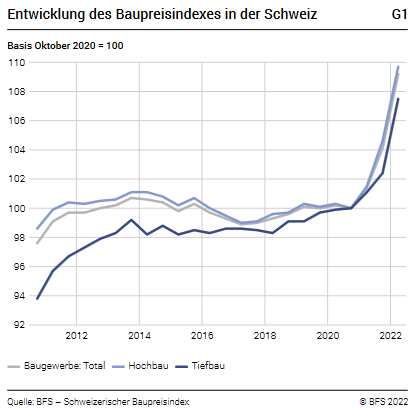

Construction prices rose by 4.9% in April 2022

The construction output price index recorded a rise of 4.9% between October 2021 and April 2022, reaching 109.2 points (October 2020 = 100). This result reflects an increase in building and civil engineering prices. Year on year, construction prices increased by 7.7%.

Read More »

Read More »

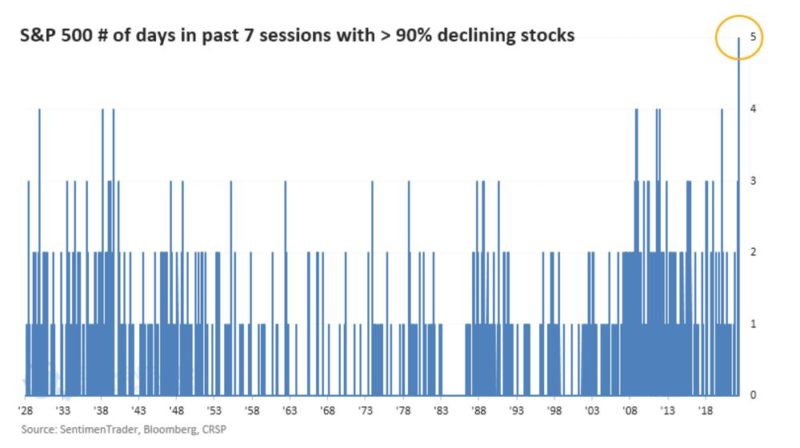

Market Pulse: Mid-Year Update

Note: This update is longer than usual but I felt a comprehensive review was necessary. The Federal Reserve panicked last week and spooked investors into the worst week for stocks since the onset of COVID in March 2020. The S&P 500 is now firmly in bear market territory but that is a fraction of the pain in stocks and other risky assets.

Read More »

Read More »

Musical Chairs in Washington, D.C.

Republicans are licking their chops over the Federal Reserve’s ostensible plans to raise interest rates aggressively in the months ahead to combat soaring prices. They view a coming big recession as a grand opportunity to win control over Congress in the upcoming November elections.

Read More »

Read More »

Alpine rail tunnel and suburban train services to get boost

The government has presented plans for an upgrade of the country’s railway network, including an additional Alpine tunnel in western Switzerland. About CHF720 million ($745 million) have been set aside to upgrade the Lötschberg base tunnel and other regional projects near Zürich and Geneva in the next decade.

Read More »

Read More »

SELBSTBESTIMMTER LEBEN – Das müssen Sie beachten!

Wie lebt man selbstbestimmt? Dies hängt zu einem großen Teil mit den finanziellen Mitteln zusammen. Daher ist nicht nur bei der Standortwahl ein Blick auf die Historie anzuraten sondern auch darauf zu achten, wem man Aufmerksamkeit schenkt...

_

The First Billion is the Hardest: Reflections on a Life of Comebacks *https://amzn.to/3zQGQFj

_

Dr. Markus Elsässer, Investor und Gründer der Value Fonds

„ME Fonds - Special Values“ WKN: 663307

„ME Fonds -...

Read More »

Read More »

Nasdaq Technical Analysis for 24 June 2022, NQ1! 11818.00 ▲ +0.69%

Nasdaq futures reached our target of 11800 and looks like is heading towards 3 price points before temporary partial profits takers (sellers) will probably step in.

Read More »

Read More »