Tag Archive: newsletter

Dirk Müller: Gas- und Stromkrise – Komplett selbstgemacht!

????? ??? ??? ????? ??????????? ??? ???? ?ü???? ????:

https://bit.ly/Marktupdate220704

(Bei diesem Video handelt es sich um einen kurzen Ausschnitt aus dem Marktupdate vom 04.07.2022 auf Cashkurs.com.)

Sie sind noch kein Mitglied?

Zum Einstiegspreis anmelden und vollen Zugriff auf alle Artikel und Videos holen - Sie erhalten den ersten Monat für nur 9,90 Euro - http://bit.ly/ck-registrieren

https://www.cashkurs.com – Ihre unabhängige...

Read More »

Read More »

Bitcoin Miner verdienen wieder mehr als Ethereum Miner

Die Kurse habe sich zwar stabilisiert, sind jedoch im gesamten Markt weit von ihren Höchstständen entfernt. Alle größeren Cryptocoins verloren deutlich an Wert, darunter auch Bitcoin und Ethereum. Interessant wird es jedoch, wenn wir den relativen Wert der beiden Cryptocoins miteinander vergleichen. Bitcoin News: Bitcoin Miner verdienen wieder mehr als Ethereum MinerBis Mitte Juni ging es für den Bitcoin-Preis im Vergleich zu Ethereum runter, doch...

Read More »

Read More »

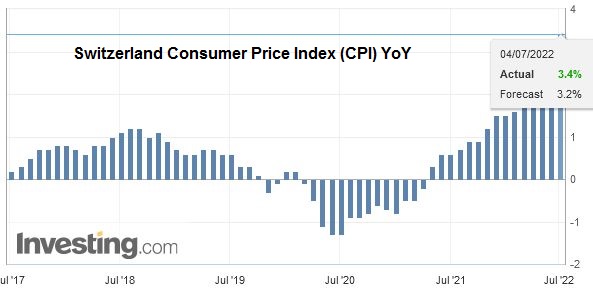

Swiss Consumer Price Index in June 2022: +3.4 percent YoY, +0.5 percent MoM

The consumer price index (CPI) increased by 0.5% in June 2022 compared with the previous month, reaching 104.5 points (December 2020 = 100). Inflation was +3.4% compared with the same month of the previous year.

Read More »

Read More »

Inflation ‘back with a vengeance’ in Switzerland

The price of household goods for Swiss consumers rose 3.4% in June compared to the same month last year, led by the surging cost of fuel and heating oil. “Inflation, which has de facto been absent for more than a decade, is back with a vengeance,” said economic forecast group BAK Economics.

Read More »

Read More »

Weekly Market Pulse: Things That Need To Happen

Perspective is something that comes with age I think. Certainly, as I’ve gotten older, my perspective on things has changed considerably. As we age, we tend to see things from a longer-term view.

Read More »

Read More »

NOTSTAND IN ITALIEN!

Wirtschaft aktuell: Was passiert jetzt? Ray Dalio, Markus Krall, Dirk Müller und andere Experten klären auf! Wirtschaftliche Entwicklung kompakt zusammengefasst! Wie soll ich jetzt investieren?

Read More »

Read More »

Nasdaq Technical Analysis, 05 July

Nasdaq futures rose apx. half a percent and is now stalling close to the VAH and PoC of the range. Watch the daily technical analysis video for a trade ideas. See more on https://www.forexlive.com/technical-analysis/nasdaq-index-technical-analysis-for-mid-to-end-of-june-2022-20220617/

Read More »

Read More »

BIONTECH Aktie -60% Jetzt eine Jahrhundertchance? Biontech Aktienanalyse

0:00 Intro - Biontech Aktie eine Jahrhundertchance?

0:50 Die Corona-Pandemie

2:30 Ist die Pandemie vorbei?

5:00 Impfmüdigkeit

5:30 Biontech in der Analyse

8:40 Kinder-Impfungen

9:40 Umsätze und Gewinne ohne Covid-19

11:50 Antibiotika-Forschung

Read More »

Read More »

Swissquote Erfahrungen Aktien, ETF, Krypto Kaufen 2022 | Schweizer Broker Swissquote

Swissquote Erfahrungen Aktien, ETF, Krypto Kaufen 2022.

Diese Erfahrungen habe ich mit meinem 400.000 CHF grossen Portfolio bei der Swissquote über die letzen Jahre gesammelt. Alle Vorteile und wie Ihr dort Aktien, ETF's, Kryptos und mehr kaufen und verkaufen könnt erfahrt ihr im Video heute.

Read More »

Read More »

S&P 500 Emini Futures Technical Analysis, 05 July

Bulls are still looking fair to stage a reversal up. We draw the volume profile of the current price range and set stops and take profits according to price levels that take it into account and the recent candle high and lows. Furthermore, the reward vs risks of the trade ideas are mentioned.

Read More »

Read More »

Nupur Sharma Issue & The Irrationality Of Indians | The Labyrinth #68

Jayant Bhandari is an investor and entrepreneur. He is a contributing editor for the Liberty Magazine and he has written on political, economic and cultural issues for numerous publications.

Read More »

Read More »

Dow Jones Technical Analysis, 05 July

Bias continues to be bullish, following our analysis yesterday for the Nasdaq futures. We offer a trade idea to consider based on the volume profile, the past days' candles and a possible measured move.

Read More »

Read More »

Ukraine hits Russian base in South, blasts kill 3 in Russian city of Belgorod | World News

As per the reports, at least 3 people were killed and dozens of buildings damaged in the Russian city of Belgorod. Russia claimed that Ukraine has targeted citizens in Belgorod.

Read More »

Read More »

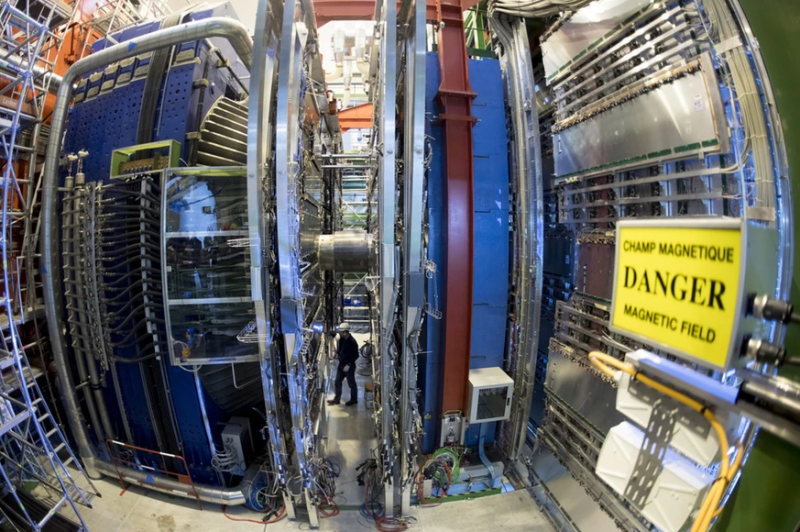

Large Hadron Collider primed to hit record energy levels

Ten years after it discovered the Higgs boson, the world’s biggest particle accelerator is poised to smash together protons at record energy levels at the CERN particle physics laboratory near Geneva, as scientists resume their search for clues to the origins of the universe.

Read More »

Read More »

SMART BOURSE – L’invité de la mi-journée : Thomas Costerg (Pictet WM)

Lundi 4 juillet 2022, SMART BOURSE reçoit Thomas Costerg (Économiste senior US, Pictet WM)

Read More »

Read More »

This Is Why You Should Buy GOLD & SILVER In 2022 ! | Alasdair MacLeod Gold & Silver Price Forecast

This Is Why You Should Buy GOLD & SILVER In 2022 ! | Alasdair MacLeod Gold & Silver Price Forecast

#gold #goldprice #silver

Read More »

Read More »

Massive Silver Price Change When Banking System Collapses | Alasdair MacLeod Silver Analysis

In this video, Alasdair MacLeod explains why the banking system is in the state of collapse and it's effects on silver and markets

Read More »

Read More »

What Happened Today in a Few Bullet Points

1. The most important thing to appreciate is that the market has moved to price not one but two cuts next year. The first is priced into the September Fed funds futures and the second is in the Dec Fed funds futures.

Read More »

Read More »

10 Minuten DAX mit Marcus Klebe – 04.07.2022

Die DAX-Analyse vom Tradingprofi

#DAX #MarcusKlebe #erfolgreichtraden

Meega Trading Marcus Klebe

Read More »

Read More »