Tag Archive: newsletter

The weekend forex technical report for the week of August 15, 2022

In this video, I preview the upcoming week in the forex market with the focus on the major currencies vs the USD.

Read More »

Read More »

Bitcoin technical analysis and shorting BTCUSD close to $24500 since bulls might be giving up soon.

Today's daily candle, while closing only in apx 4 hours, is now showing a sign that bulls are NOT about to break the presented channel to the upside, following this 4th attempt to do so, on the daily timeframe.

Even if we had a coin flip for this trade, the reward vs risk merits to short BTCUSD here. Why? Because the stop loss is half the take profit target for the first part of this trade plan, and only 25% of the profit target of the 2nd part,...

Read More »

Read More »

Major Financial System Collapse! Buy GOLD & SILVER To Save Your Money!

Major Financial System Collapse! Buy GOLD & SILVER To Save Your Money! | Alasdair Macleod Forecast

Read More »

Read More »

Warning! Recession Is Inevitable! This Will Hurt Ordinary People | Marc Faber

Warning! Recession Is Inevitable! This Will Hurt Ordinary People | Marc Faber

▶︎ Subscribe NOW to the channel, click here:

https://www.youtube.com/channel/UCUHDPhUWJ6GZDad-QLDdB1g/channels

Marc Faber Wikipedia :

https://en.wikipedia.org/wiki/Marc_Faber

Marc Faber is a Swiss investor based in Thailand. He is the publisher of the Gloom Boom & Doom Report newsletter and the director of Marc Faber Ltd, which acts as an investment advisor and...

Read More »

Read More »

Huobi steht vor Übernahme durch Justin Sun

Der derzeitige Hauptinvestor Huobis Leon Li hat offenbar den Vorstand darüber informiert, dass er 60 Prozent seines Investments in die Crypto-Börse verkaufen möchte – dies würde ungefähr 5 Prozent des Gesamtvolumens Huobis ausmachen.

Read More »

Read More »

So spare ich 10-12% bei meinen Einkäufen!

Viele kritisieren zwar, dass das zu viel Zeit kostet, aber ich verstehe wirklich nicht, wie schwer es sein kann, ein paar Gutscheine herauszusuchen oder in einer App zu aktivieren. Ich meine überlege mal du gehst 1x pro Woche einkaufen und sparst dabei 10 Euro, dann sind das über 500 Euro, die du im Jahr sparen kannst!

Read More »

Read More »

Week Ahead: More Evidence US Consumption and Output are Expanding, and RBNZ and Norges Bank to Hike

After two-quarters of contraction, many still do not accept that the US economy is in a recession. Federal Reserve officials have pushed against it, as has Treasury Secretary Yellen. The nearly 530k rise in July nonfarm rolls, more than twice the median forecast in Bloomberg's survey, and a new cyclical low in unemployment (3.5%) lent credibility to their arguments. If Q3 data point to a growing economy, additional support will likely be...

Read More »

Read More »

Life Behind the Berlin Wall – Full Video

Channel of: https://www.youtube.com/c/izzitorg

My Homepage: https://www.rainer-zitelmann.com/

Read More »

Read More »

6 Gründe warum viele bald ihre Immobilie verlieren werden!

Wie wird sich die aktuell kritische Lage weiter entwickeln?

Wir schauen uns regelmäßig an, was Experten wie Ernst Wollf, Dr. Markus Krall, Prof. Hans-Werner Sinn, Dirk Müller, Max Otte oder Marc Friedrich zur aktuellen Lage sagen.

Read More »

Read More »

Dr. Andreas Beck: Darum schätzt Du den Immobilien-Markt völlig falsch ein!

Lohnen sich Immobilien noch als Investment? Oder lauert grade eine böse Falle? Dr. Andreas Beck warnt schon länger vor einem möglichen Ende des Booms! Der Portfolio-Manager achtet dabei vor allem auf die Demographie und Wohnflächen-Nachfrage. Doch jetzt hat der Finanzexperte seine Meinung zum Thema Immobilien geändert. Was dahintersteckt und welche Faktoren viele Investoren übersehen – das erklärt Andreas Beck im Gespräch mit Mario Lochner und gibt...

Read More »

Read More »

Cassis discusses finance and innovation with UAE minister

Swiss Foreign Minister Ignazio Cassis has met the foreign minister of the United Arab Emirates (UAE), Sheikh Abdullah bin Zayed Al Nahyan, in Ticino, southern Switzerland. The working lunch on the Brissago Islands in Lake Maggiore focused on the economy and finance, education, research and innovation, and sustainable development, the foreign ministry said in a statement on Thursday.

Read More »

Read More »

Economies Cannot Produce Wealth without Patience and Long-Term Horizons

People decrying poverty in developing countries usually overlook the fact that there is a dearth of long-term economic thinking.

Original Article: "Economies Cannot Produce Wealth without Patience and Long-Term Horizons"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

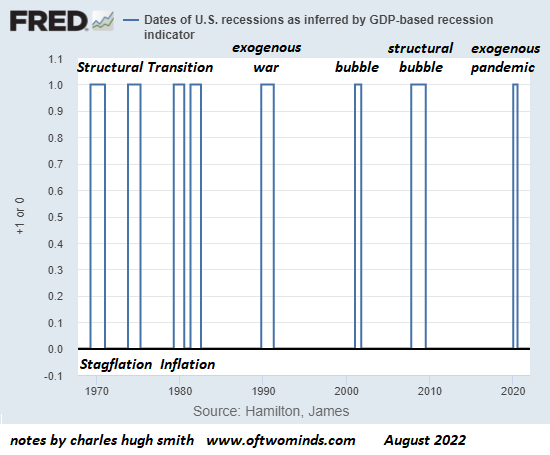

A Tale of Two Recessions: One Excellent, One Tumultuous

Events may show that there are no winners, only survivors and those who failed to adapt.Some recessions are brief, necessary cleansings in which extremes of leverage and speculation are unwound via painful defaults, reductions of risk and bear markets. Some are reactions to exogenous shocks such as war or pandemic.

Read More »

Read More »

Russia-Ukraine crisis: Fresh strikes at Zaporizhzhia nuke plant, UNSC convenes emergency meet

While the two neighbors are busy trading charges over shelling at Zaporizhzhia nuke plant, the world stands in fear of a possible catastrophe.

Read More »

Read More »

Why the IRS Needs Armed Agents

Markets' counter-trend rally despite no changes fundamentally; "Inflation" and "easing" shouldn't be in the same sentence; Janet Yellen as "Grand Theft Granny:" Why the IRS needs armed agents; now is the time for all good men to trim equity exposure; why "The Flintstones," "Bewitched," and "Leave it to Beaver" could never be produced today;

Read More »

Read More »

Keith Weiner | Fed Policy Errors, Reverse Repo, Keynesian Illusion, Russia & China, Bitcoin, Gold

Keith Weiner PhD Economics and Founder/CEO of both Monetary Metals and the Gold Standard Institute joins us for an interview on the 5th installment of the Gold and Silver Precious Metals Twitter Spaces.

Read More »

Read More »

5 Steps to Grow Your Business – Millennial Money – Alexandra Gonzalez, Kim Kiyosaki

Employees of all different backgrounds have recently left their jobs due to the Great Resignation. Millennials have proven to be especially impulsive.

Freelancing, becoming an influencer, or changing your employment classification to an independent contractor are growing in popularity among Millennials and Gen Z. While the initiative is commendable, these jobs have their downside—one being working 24/7 in your business.

In this episode, host...

Read More »

Read More »

More energy blows are dealt to Europe, causing a cold chill to be even colder

2022-08-13

by Stephen Flood

2022-08-13

Read More »