Tag Archive: newsletter

Tax Liens als Investment – bis zu 36 % Rendite im Jahr

Tax-Liens – so holst du dir staatlich GARANTIERT zweistellige Immobilienrenditen

Tax-Liens-Training: https://thorstenwittmann.com/tax-lien-training

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

In den heutigen Zeiten wären 5% planbare Immobilienrendite bereits ein recht guter Wert, sind jedoch kaum zu finden.

Stell dir vor es gäbe eine planbare Möglichkeit, wie du regelmäßig eine zweistellige Rendite einholen kannst? Und das...

Read More »

Read More »

Wann bist Du Multi-Millionär? Spätestens nach dieser Krise (hoffentlich)

Wann bist Du Multi-Millionär? - Börsentag Zürich Q&A

Multi-Millionär ist eine Person, die mehrere Millionen Einheiten der entsprechenden

Read More »

Read More »

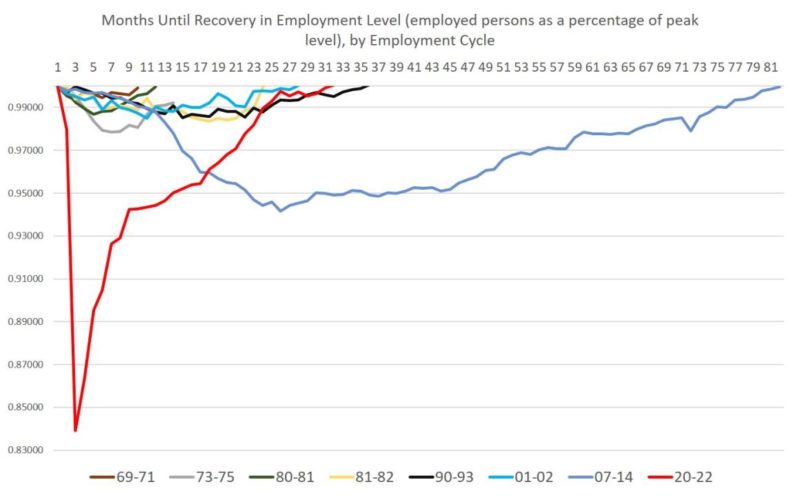

Thanks to the Fed, You’ll Work More this Year to Keep Last Year’s Standard of Living

According to the establishment survey of employment, released last week by the Bureau of Labor Statistics, total employment increased, month-over-month by 263,000 jobs. The "job market stays strong" reads one CNBC headline, and the new jobs print was hailed as a great achievement of the Biden Administration by MSNBC pundit Steve Benen.

Read More »

Read More »

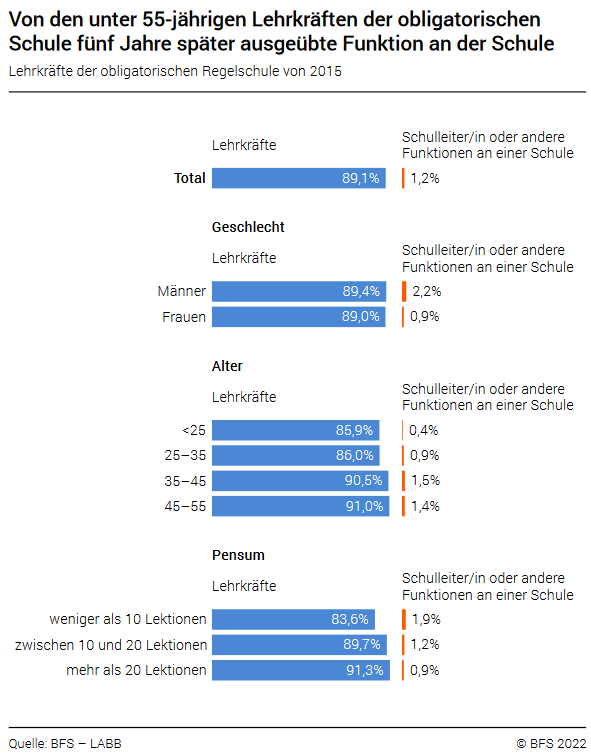

The number of teachers in compulsory education is expected to grow by around 6 percent by 2031

The number of teachers in compulsory education is expected to rise by around 6% up until 2031 due to population growth. Between 43 000 and 47 000 new primary teachers will have to be recruited by then. For the lower secondary level, between 26 000 and 29 000 new teachers will be needed.

Read More »

Read More »

Credit-default swaps: the case for the defence

Vultures, rats and maggots are often the focus of disgust, less because of anything for which they can be blamed, and more because of the conditions with which they are associated. Death, disease and squalor carry a stigma that is hard to shake.

Read More »

Read More »

BÖRSENKURS MANIPULATION

Chancen und Gefahren für Investoren durch den Verlauf von Börsenkursen

_

Dr. Markus Elsässer, Investor und Gründer der Value Fonds

„ME Fonds - Special Values“ WKN: 663307

„ME Fonds - PERGAMON“ WKN: 593117

_

1.? "Dieses Buch ist bares Geld wert" *https://amzn.to/3wr2Vq5

Als Hörbuch *https://amzn.to/3xnT6rW

2.? "Des klugen Investors Handbuch" *https://amzn.to/38UCXQg

Als Hörbuch *https://amzn.to/3nAM7IU

_

00:00 - Börsenkurs

02:20...

Read More »

Read More »

This Has Never Happened Before

Alasdair Macleod: This Has Never Happened Before Gold & Silver | Silver Forecast

#alasdairmacleod #Silver

Read More »

Read More »

Die EZB auf den Spuren der Reichsbank

Ein Vortrag von Thorsten Polleit, gehalten beim Friedrich August von Hayek-Club Köln am 22. Uni 2020.

Read More »

Read More »

Buy Gold & Silver, Market Is Mispriced?

Gold & Silver Is Undervalued? | Alasdair Macleod Silver & Gold Price Prediction & Andrew Maguire Gold & Silver Price Prediction

Read More »

Read More »

NEUE INFLATIONSZAHLEN USA?! KEIN DIVIDENDEN DIENSTAG MEHR?!

Der #DividendenDienstag Livestream findet jeden Dienstag um 19:00 Uhr auf YouTube statt, zusammen mit Johannes Lortz philosophieren wir über #Dividenden #Aktien, das Investieren, die Börse und vieles mehr.

Read More »

Read More »

Why the markets made an incredible reversal today from a technical perspective

Adam clearly pointed out reasons for the incredible reversal today more from a fundamental perspective. Sentiment is horrible from Mom and Pop and from institutions too. The UK is not imploding is another storyline that gave some support. You can read the post here.

When looking at the price action and apply tools to it, that too told a story that said "the market is not doing what we all thought it should do". In technical terms, the...

Read More »

Read More »

Crash-Lüge: Warum der Mythos von 1929 Nonsens ist! // Gerd Kommer

“Entschuldigung, aber das ist absoluter Nonsens”, sagt Gerd Kommer im exklusiven Interview über den Crash-Mythos von 1929. 25 oder gar 30 Jahre soll es nach der Katastrophe an der Börse gedauert haben, bis Anleger ihre Verluste wieder drin hatten. Aber was stimmt daran nicht? Vermögensverwalter Kommer erklärt, warum beispielsweise Dirk Müller falsch liegt, wenn er das wie jüngst im Interview anführt. Finanzexperte Kommer nennt 4 Gründe, warum der...

Read More »

Read More »

Great Reset & World Economic Forum | Vortrag von Ernst Wolff

Die Welt befindet sich seit 2 ½ Jahren im Ausnahmezustand. Im Namen der Gesundheit haben fast 200 Regierungen Maßnahmen ergriffen, die den Lebensstandard von Millionen gesenkt, die Weltwirtschaft schwer angeschlagen und das Finanzsystem an den Rand des Zusammenbruchs gebracht haben.

Read More »

Read More »

Marc Faber packt gnadenlos aus! Wir werden zum Ziel!

ABONNIERE UNSEREN KANAL KOSTENLOS UND TEILE UNSER VIDEO:

https://bit.ly/3OYzW5L

___________________

Videobeschreibung:

?Marc Faber packt gnadenlos aus! Wir werden zum Ziel!?

© 2022 Finance Experience

___________________

Videoinhalte:

Marc Faber, Dr. Doom, Gloom Boom & Doom Reports, Zentralbanken, FED, EZB, Weltwirtschaft, Rezession, Inflation, Staatspleite, Steigende Zinsen, Weltwirtschaft, Geldanlage

___________________

Wichtige...

Read More »

Read More »

Warum Kryptowährungen wichtiger sind, als viele ahnen

?https://gratiswebinar.live/y/27-10-22 Kostenloses KRYPTO ? Geburtstags-Webinar

? LIVE am 27.10.22

Die #Inflation ist so hoch wie seit Jahrzehnten nicht und sämtliche Vermögenswerte von Aktien über Immobilien, #Kryptowährungen & Co befinden sich auf Talfahrt. Gibt es überhaupt noch Anlageklassen, die #Inflationsschutz bieten? Worin investieren bei hoher Inflation und wo ist mein Geld überhaupt noch sicher, fragen sich Anleger und Investoren zu...

Read More »

Read More »

Die perfekte Taktik: So erreichst du deine Ziele an der Börse

Viele Börsianer haben noch keine konkreten Ziele für den eigenen Handel an der Börse festgelegt. Wie du die Strategie findest, welche zu deinem Ziel passt, erkläre ich dir im heutigen Video.

0:00 Strategie: Buy and Hold

4:54 Ziel: ±0 (Kein Drawdown)

7:21 Ziel: Vom Börsenhandel leben

10:39 Unterschiede

Vereinbare jetzt Dein kostenfreies Beratungsgespräch:

https://jensrabe.de/ZieleAnDerBoerseErreichen

Schaut auf dem neuen Instagram-Account...

Read More »

Read More »

Max Otte: “Schlimmer als im Korea Krieg” | Katastrophal und verheerend für die deutsche W.

? Investieren wie ein Profi? Ganz einfach mit diesem Weiterbildungsangebot:

►► https://www.rieger-consulting.com/shop

Aber wo kann ich investieren? Hier kostenlos anmelden:

? Aktiendepot (Captrader) ►► https://bit.ly/3BQTxzk *

? Aktiendepot (Smartbroker ) ►► https://bit.ly/3mMxnEO *

? Bitcoin kaufen 15€ for free (Bison) ►► https://bit.ly/3Bs4Kb1 *

? Krypto & Aktiendepot (Etoro) ►► https://bit.ly/3qvhYeK *

? ETF Sparpläne (Consorsbank) ►►...

Read More »

Read More »

The commodity currencies all moved to new lows vs the USD, but have seen rebounds. What next?

The commodity currency pairs - the USDCAD, AUDUSD and NZDUSD - all raced to new lows vs the stronger USD after the hotter than expected CPI data. However, there has been a bounce that now threatens that move in the short term at least. IN this video, I look at the price action and show what would ruin the USD buying party vs these commodity pairs today and explain why.

Read More »

Read More »