We are sticking to our forecast of 2.0% euro area GDP growth for 2018, but with risks tilted to the downside.

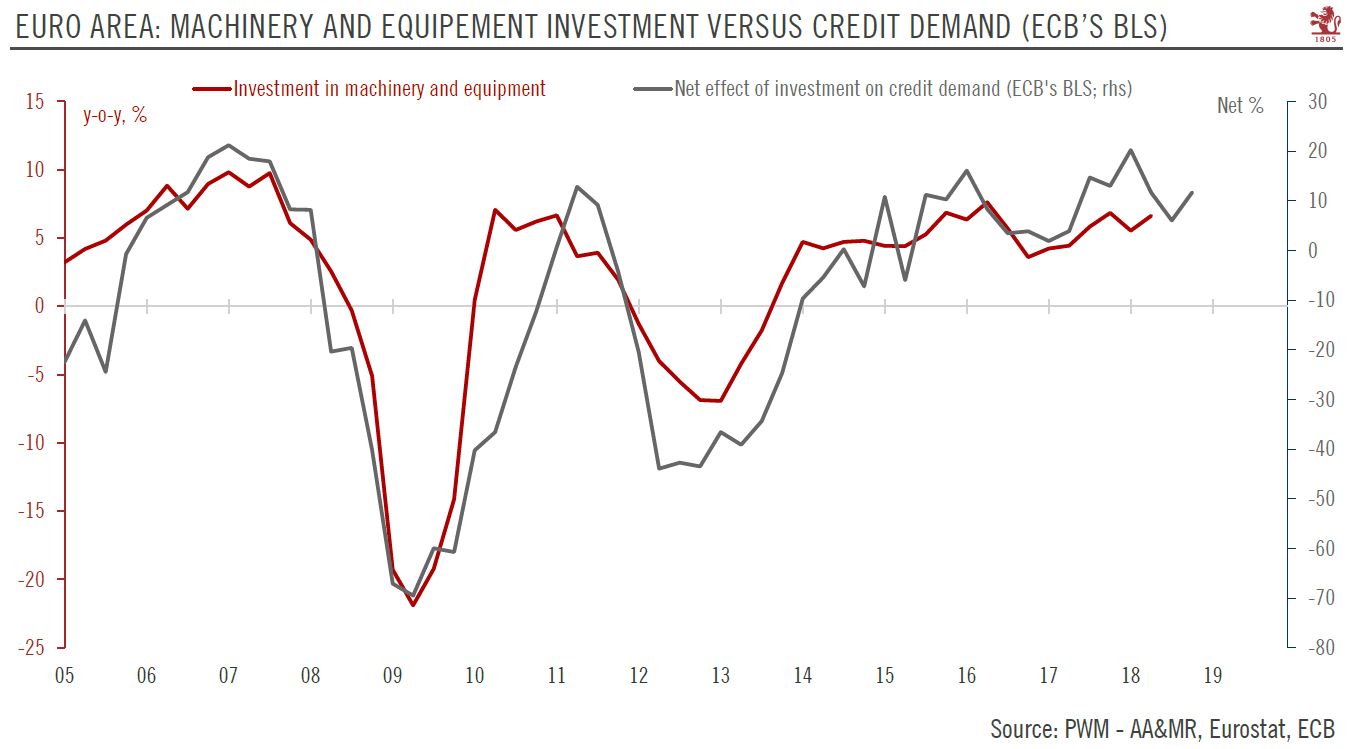

Investment is an important driver of the business cycle and a key determinant of potential growth. In the euro area, total investment makes up about 20% of GDP. Construction, machinery and equipment (including weapons systems), intellectual property rights and agricultural products account, respectively, for 48%, 32%, 18% and 2% of total investment. Machinery and equipment spending occurs largely in the corporate sector and is hence a close proxy for business investment.

Total investment contracted significantly during the financial crisis and in the worst of the euro crisis in 2011-2012. The steep decline during these periods was the consequence of lower corporate spending and a strong correction in the housing market, resulting in lower construction in some countries. Moreover, budgetary constraints limited public investment.

Investment has recovered since early 2013, mainly driven by non-construction investment, while construction investment itself started to rise only in 2015. By asset class, business investment surpassed its 2008 (pre-crisis) level in Q4 2017, while construction investment is still 15% lower. Business investment is now above its pre-crisis level in the four biggest euro area economies except Italy.

| The recovery has been driven by a combination of factors, including improving demand, better corporate profitability and declining uncertainty as well as supportive credit conditions (largely driven by the ECB’s expansionary monetary policies). Some of these factors are still at work. For example, credit conditions remain extremely accommodative. Corporate borrowing costs are at a record low. Furthermore, the ECB’s Q3 bank lending survey showed that demand and supply conditions remain favourable for corporates. Bank lending standards (the criteria used for approval of loans) eased and a majority of banks reported rising demand for corporate loans.

However, while credit conditions remain supportive, euro area corporates face rising uncertainties. Trade tensions, unresolved Brexit negotiations, confrontation between the European Commission and Italy, vulnerability in emerging markets and a return of financial market volatility are all risks that could lead corporates to postpone their investment and employment decisions. Our analysis of recent data suggests that domestic demand (investment and household consumption) remain resilient in most euro area countries and should ensure the euro area continues to grow above its long-term potential in the coming quarters. We are sticking to our forecast of 2.0% euro area GDP growth for 2018, but with risks tilted to the downside. |

Euro Area Investment, 2005 - 2018 |

Tags: euro area growth,Macroview,newsletter