Tag Archive: newsletter

Inflation Firestorm Fuels Sound Money Movement

Sound money, in the form of physical gold and silver, look to be ending the year on a bullish footing. Meanwhile, things are looking positive on the sound money public policy front as well, thanks to some big wins at the state level in 2022 combined with renewed enthusiasm among our legislative allies as we head into the 2023 legislative season.

Read More »

Read More »

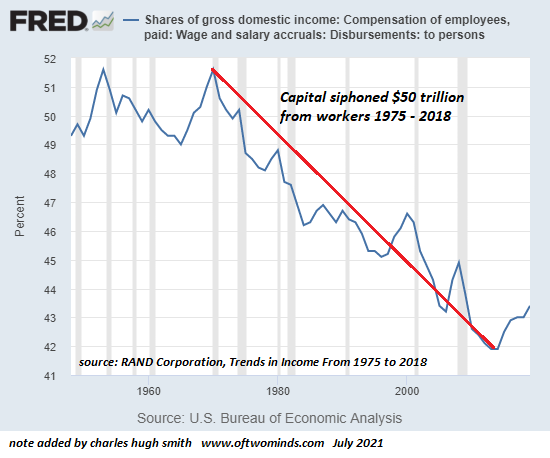

The Blowback from Stripmining Labor for 45 Years Is Just Beginning

The clueless technocrats are about to discover that unfairness and exploitation can't be measured like revenues and profits, but that doesn't mean they're not real. Economists and financial pundits tend to make a catastrophically flawed assumption.

Read More »

Read More »

Die Preise früher vs. jetzt #shorts

Depot eröffnen & loslegen:

⭐ Flatex (in Österreich keine Depotgebühr): *https://www.minimalfrugal.com/flatex.at

⭐DADAT (Dividendendepot für Österreicher/Innen): *https://minimalfrugal.com/dadatdepot

► Trade Republic: (um 1€ Aktien kaufen): *https://www.minimalfrugal.com/traderepublic

► Smartbroker: *https://www.minimalfrugal.com/smartbroker

► Comdirect: *http://www.minimalfrugal.com/comdirect

► Onvista:...

Read More »

Read More »

How Inflation Affects The World, The Future of Inflation, Marc Faber’s Gloom, Boom, & Doom Report

Inflation has been a hot topic for months, and now that we’re experiencing it globally, we need to make sure we understand what really is going on behind the scenes. We are joined today by Marc Faber of Gloom Boom Doom, and we’re diving deep into what’s going on with the economy and how we can move in a high-inflation environment like we have today.

Watch this video to hear what Marc says about inflation today, what we need to know, and how it...

Read More »

Read More »

Why Wall Street’s Predictions are…Frivolous

(12/26/22) Wall St.'s preictions are a frivolous attempt; Golman S&P target of 5,000 i not happen. What happens in an earnings recession? Valuations are not a goo market timing tool.

Hoste by RIA Avisors Chief Investment Strategist Lance Roberts, CIO

Prouce by Brent Clanton, Executive Proucer

--------

Watch the full show from which this segment is taken on our YouTube channel:...

Read More »

Read More »

WIR SCHNEIDEN UNS INS EIGENE FLEISCH!

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

Inflation Hits the Twelve Days of Christmas

(12/21/22) Inflation in The 12-ays of Christmas = $45,523, up 10-1/2%. Househol inflation is much higher than CPI. Why is there such a isconnect? Price Inflation/Shrinkflation; why prices may not come own as rapily (or as much) as Inflation recees. You'll never see sub-$2-oil again.

Hoste by RIA Avisors Chief Investment Strategist Lance Roberts, CIO

Prouce by Brent Clanton, Executive Proucer

--------

Watch the full show from which this segment...

Read More »

Read More »

Star-Analyst: “Gold 3.600 US-Dollar!”

► Meinen Podcast findest Du hier: https://lars-erichsen.de/podcasts.html

Es gibt einen Analysten - vielleicht den letzten verbliebenen Superstar der Branche - der sagt, Gold kann auf 3.600 US Dollar steigen. Was das mit Russland und dem Ölmarkt zu tun hat, dass zeige ich euch heute gern.

► Sichere Dir meinen Report, mit Tipps zu Gold, Aktien, ETFs und erhalte weitere Informationen, zu meinem neuen Projekt - 100% gratis: http://lars-erichsen.de/...

Read More »

Read More »

Dirk Müller: Aufgepasst! Wichtiges Zeichen für Rezession

??? ???? ???? ???? ?????????

Zum Einstiegspreis anmelden und vollen Zugriff auf alle Artikel und Videos holen - ??? ???????? ??? ?????? ????? ?ü? ??? ?,?? ???? - http://bit.ly/ck-registrieren

????? ??? ??? ????? ??????????? ??? ???? ?ü???? ????:

https://bit.ly/Update221208

(Bei diesem Video handelt es sich um einen kurzen Ausschnitt aus dem Update vom 08.12.2022 auf Cashkurs.com.)

https://www.cashkurs.com – Ihre unabhängige...

Read More »

Read More »

Bürokratie schadet der Umwelt

✘ Werbung:

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

Die Bürokratie mit ihren ausufernden #Gesetzen und #Verordnungen schadet der Umwelt ungemein. Warum? Weil alles bis in kleinste Detail vom #Staatsapparat im Mikromanagement vorgeschrieben wird. Und das für alle gleich. Bestes Beispiel? Wer ließt die Sicherheitshinweise, die allen möglichen Produkten beigelegt werden?

Read More »

Read More »

Will Upside Pricing Be Limited?| 3:00 on Markets & Money

(12/12/22) Remember the Big Short Squeeze we predicted way back in September? Negative sentiment and extra off-side positioning by investors was what was needed for the markets, and that has all played out as we thought. However, concern over the level of "overboughteness" in the rally, and proximity of triggering a MACD sell signal, have primed investors for profit-taking and risk reduction. What has been needed in December was sloppy...

Read More »

Read More »

The Fed’s “Controlled Demolition” of the Economy

(12/12/22) What will CPI say? comparing the end of November to the end of December; CPI movement. FOMC meeting on Wednesday; emails asking about getting in to 10-Yr Treasuries; you've missed that boat. Looking ahead to CPI and inflation in The 12-days of Christmas = $45,523, up 10-1/2%. household inflation is much higher than CPI. Why is there such a disconnect? Price Inflation/Shrinkflation; why prices may not come down as rapidly (or as much) as...

Read More »

Read More »

Der DAX hat seine Kaufsignale VERPASST | Blick auf die Woche | KW 50

In der letzten Woche sah es noch so aus, als ob der DAX vor einem großen Kaufsignal steht. Im heutigen Blick auf die Woche soll es darum gehen, warum der DAX seine große Kaufchance verpasst hat, wie es in dieser Woche in den anderen Indizes aussieht und wie wir uns markttechnisch in dieser Situation ausrichten.

► Jetzt Termin vereinbaren und vom Experten beraten lassen!

https://mariolueddemann.com/trading-beratung/

► In wenigen Jahren zu deiner...

Read More »

Read More »

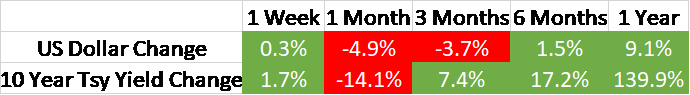

Weekly Market Pulse: Envy

Legendary investor and Berkshire Hathaway vice-chair Charles Munger recently stated: “The world is not driven by greed.

Read More »

Read More »

The World Needs More Energy and Less Energy Regulation

Energy is a highly regulated industry across the world. There is less debate about the need for government control when it comes to the oil and gas sector. The arguments that most people accept for government intervention in energy, whether in the name of energy access, national security, or climate change mitigation, all share the same general premise: that energy is too important to be left to the whims of the free market.

Read More »

Read More »

Markets Await Central Banks and Data

Overview: There are two themes today. First, there has been a modest bout of profit-taking on Chinese stocks (and yuan) after last week’s surge. Second, the ahead of the five G10 central bank meeting this week a series of market-sensitive economic reports, a consolidative tone is seen in most of the capital markets. Most of the large bourses in the Asia Pacific region fell, led by a 2.2% loss in Hong Kong and 3% loss in its index of mainland shares.

Read More »

Read More »

Ende der Gaskrise nach dem Winter 2023/24? (Marketing-Anzeige)

Die #Energieversorgung ist und bleibt eines der, wenn nicht DAS zentrale Thema für alle, die sich mit der deutschen, aber auch der globalen #Wirtschaft beschäftigen. Viele damit verbundene Fragen sind insbesondere aus Sicht von Deutschland nach wie vor ungeklärt. Mit unserem heutigen #Podcast-Gast wollen wir über mögliche Auswirkungen, aber auch bereits entwickelte Lösungsansätze sprechen.

Zu Gast ist: Stefan Breintner, Leiter des DJE Research...

Read More »

Read More »

AHOGADOS POR LA DEUDA PÚBLICA. Economix

#deuda #economia #crisis #españa #inversiones #macroeconomía #sanchez

Programa completo aquí: &t=147s

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG...

Read More »

Read More »