Tag Archive: newsletter

Wie investiert man mit 5’000 CHF Netto?

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Wie investiert man mit 5'000 CHF Netto?

#Investieren #5000CHF #Finanzrudel

?? Swissquote Trading Day Anmeldung ►► https://www.sparkojote.ch/swissquote-trading-day-26-januar-2023-finanzrudel-community-treffen/

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

☛ Die BESTEN Gutscheine aus dem Finanzrudel ☚

Tools die ich tagtäglich nutze findet ihr...

Read More »

Read More »

Achtung Inflation: Deine Rente wird wertlos! (WAS TUN?)

? https://betongoldwebinar.com/yt ?Jetzt Gratis Immobilien-Webinar ansehen!

Die #Inflation in Europa ist so hoch wie seit Jahrzehnten nicht. Doch vielen Arbeitnehmern ist nicht klar, dass die Inflation ihre Pension auffrisst. Da wir gleichzeitig in Deutschland und Österreich eine Überalterung der Gesellschaft erleben, droht vielen im Alter eine massive #Pensionslücke (in Deutschland Rente), die sie jetzt noch nicht erahnen. Wie du diesem...

Read More »

Read More »

Meine 8 Top Picks 2023 Teil 1

Das Börsenjahr 2023 hat gerade begonnen und alle schauen sich nach den Topmärkten für dieses Jahr an der Börse um. Aus diesem Grund präsentiere ich dir meine persönlichen Highlights für das Jahr 2023 in diesem Video.

Sicher dir jetzt dein Ticket für den Börsen-Strategie-Tag:

https://jensrabe.de/boersenstrategietag2023

0:00 Der Plan für 2023

1:38 Der beste Währungsindex

3:26 Emerging Markets im Fokus

5:33 Asiatische Märkte für Händler

7:18...

Read More »

Read More »

Switzerland and US sign deal on pharmaceutical supply chain

US and Swiss authorities have agreed to share inspection documents on pharmaceutical manufacturing facilities in a move to improve efficiency and safety in the drug supply chain.

Read More »

Read More »

Russia-Ukraine war live: Why is Russia replacing its top military commander in Ukraine again? | WION

Facing multiple setbacks, Russia replaces top General in charge of the War in Ukraine. The Chief of General Staff now becomes the overall commander for the active conflict. Watch this live to track all details.

Read More »

Read More »

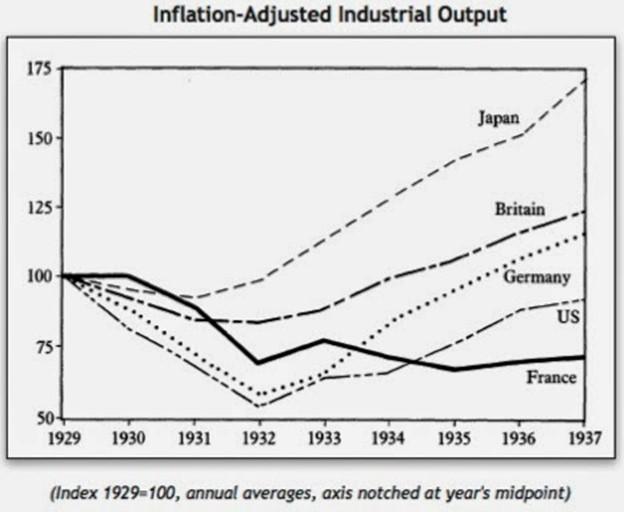

The Great Depression’s Patsy

The culprit responsible for the Wall Street crash of 1929 and the Great Depression can be easily identified—the government. To protect fractional reserve banking and generate a buyer for its debt, the US government created the Federal Reserve System in 1913 and put it in charge of the money supply.

Read More »

Read More »

Gold Warning: What Is About To Happen to Silver

Are you looking for the latest trends in financial markets? Don't miss out on The Financial Weekily! Learn from the experts and get up to date with the best strategies and advice to make better decisions. Understand the ever-changing markets with concise, actionable and expert-driven financial education from The Financial Weekly. It's your key to success in finance!

Read More »

Read More »

Wie viel verdient man in der Schweiz? #shorts

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Ganzes Video ►►

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

☛ Die BESTEN Gutscheine aus dem Finanzrudel ☚

Tools die ich tagtäglich nutze findet ihr hier. Mein 6-stelliges Aktien-Depot habe ich bei Swissquote und Yuh. Für meine privaten Finanzen nutze ich Zak von der Bank Cler. Meine Säule 3a für die Altersvorsorge betreibe ich bei frankly...

Read More »

Read More »

NUTZE DIE NEUEN TECHNOLOGIEN!

Gratis Trading-Workshop (Jetzt in 2023 absichern): https://us02web.zoom.us/webinar/register/2216698238673/WN_HGjVPNwDQlCJ34S41vZeyA (jetzt anmelden!)

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht...

Read More »

Read More »

Trading Wochenanalyse für KW 03/2023 mit Marcus Klebe – DAX – DOW – EUR/USD – Gold #Chartanalyse

HIER geht´s direkt zur Demo-oder Livekontoeröffnungt:

https://partners.jfdbrokers.com/visit/?bta=35101&nci=5424

In dieser Analyse blickt Marcus Klebe auf die vergangene Handelswoche im DAX, Dow, EUR/USD und Gold und bespricht wichtige charttechnische Bereiche und mögliche Bewegungen für die kommenden Handelstage.

#Chartanalyse #MarcusKlebe #LevelUpTrading

DAX: xx:xx

DOW JONES: xx:xx

EUR/USD: xx:xx

GOLD: xx:xx

WTI xx:xx

DAX/ DE30Cash -...

Read More »

Read More »

“DAX Long oder Short?” mit Marcus Klebe – 20.01.23

HIER geht´s direkt zur LIVE- oder DEMOKONTOERÖFFNUNG:

https://partners.jfdbrokers.com/visit/?bta=35101&nci=5424

Ich freue mich über eure Daumen ???

#DAX #MarcusKlebe #Trading

ÜBER JFD:

WER WIR SIND:

JFD ist eine führende Unternehmensgruppe, die Finanz- sowie Investmentdienstleistungen und -aktivitäten anbietet. Die Muttergesellschaft, JFD Group Ltd, wurde im Dezember 2011 gegründet und ist heute ein international lizenzierter, globaler...

Read More »

Read More »

“DAX Long oder Short?” mit Marcus Klebe – 19.01.23

HIER geht´s direkt zur LIVE- oder DEMOKONTOERÖFFNUNG:

https://partners.jfdbrokers.com/visit/?bta=35101&nci=5424

Ich freue mich über eure Daumen ???

#DAX #MarcusKlebe #Trading

ÜBER JFD:

WER WIR SIND:

JFD ist eine führende Unternehmensgruppe, die Finanz- sowie Investmentdienstleistungen und -aktivitäten anbietet. Die Muttergesellschaft, JFD Group Ltd, wurde im Dezember 2011 gegründet und ist heute ein international lizenzierter, globaler...

Read More »

Read More »

Could We See Hyperinflation? with Marc Faber

Original Full Interview -

This video is a clip from the WTFinance Podcast Interview with Marc Faber, Editor and Publisher of the ‘’Gloom, Boom & Doom Report’’.

Dr Marc Faber was born in Zurich, Switzerland. He went to school in Geneva and Zurich and finished high school with the Matura. He studied Economics at the University of Zurich and, at the age of 24, obtained a PhD in Economics magna cum laude.

Between 1970 and 1978, Dr Faber worked...

Read More »

Read More »

On Our Radar Screen for the Week Ahead

The week ahead is chock full of data, including Japan, the UK, and Australia's CPI. The UK and Australia report on the labor market. The US, UK, and Canada also report retail sales. The early Fed surveys from New York and Philadelphia for January will be released.

Read More »

Read More »

The Government Throws Money at Heart Disease, but Prevention Is Better than Cure

You’re more likely to die of heart disease than anything else, partly because, well, if nothing else gets you, your heart will give out. And a heart attack could cost you upwards of $760,000 these days, when you consider hospital charges, prescription drugs, additional care for the rest of your life, and then indirect costs like loss of time at work.

Read More »

Read More »

Pannenministerin Christine Lambrecht tritt endlich zurück!? Ex-Soldat spricht KLARTEXT

Verteidigungsministerin Christine Lambrecht tritt laut Medienaussagen zurück! Das ist sehr wichtig, da sie völlig inkompetent war. Nur sollte jetzt die Politik den Fehler nicht wiederholen und die nächste Quoten-Frau als Ministerin einsetzen, die dem Job nicht gewachsen ist!

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT

?JETZT auch als Hörbuch bei Audible ►► https://goo.gl/iWvTRR

? Meine Shirts & Hoodies ►►...

Read More »

Read More »