Tag Archive: MXN

FX Daily, September 22: Swiss Franc Strongest Currency Again

Once again the Swiss Franc was the strongest. The EUR/CHF depreciated to 1.0875. As said yesterday, the reasons: the Fed and the strong Swiss trade balance.

Read More »

Read More »

FX Daily, September 19: Dollar Begins Important Week on Softer Note

The US dollar, which finished last week on a firm note, is under pressure to start the new week that features Bank of Japan and Federal Reserve meetings. The slighter stronger August CPI reading helped lift the greenback ahead of the weekend, but investors continue to see a low probability of a Fed hike this week.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM ended the week on a soft note. Volatility is likely to remain high as markets are jittery and choppy ahead of the BOJ/FOMC meetings on Thursday. Dollar gains were broad-based last week, but EM certainly underperformed. China markets will reopen after a two-day holiday, but good news out of the mainland is doing little to help EM.

Read More »

Read More »

FX Weekly Preview: Punctuated Equilibrium and the Forces of Movement

Shifting intermarket relationships pose challenge for investors. The market is convinced the Fed will not raise rates. Greater uncertainty surrounds the BOJ; there seems less willingness to shock and awe.

Read More »

Read More »

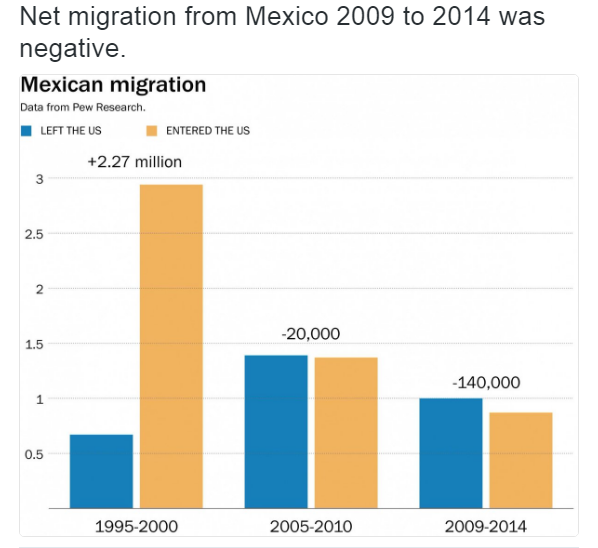

Great Graphic: Net Mexican Migration to the US–Not What You Might Think

Net migration of Mexicans into the US has fallen for a decade. The surge in Mexican migration into the US followed on the heels of NAFTA. Although Trump has bounced in the polls, and some see this as negative for the peso, rising US interest rates and the slide in oil price are more important drivers.

Read More »

Read More »

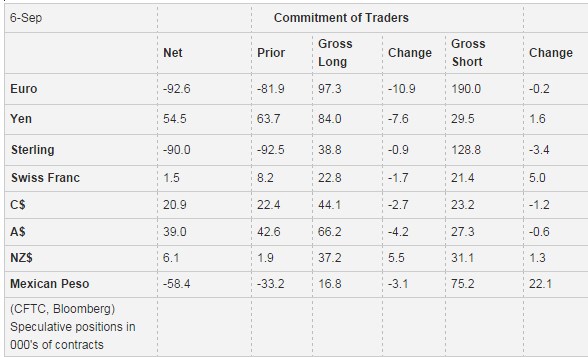

Weekly Speculative Postions: CHF net long positions down from 8.2K down to 1.5K

The Swiss Franc depreciated this week again. The euro rose to 1.960. One reason is the reduction in net long CHF speculative position from 8.2K to 1.6K contracts. Given the weak ISM non-manufacturing PMI, it remains unclear. why speculator now move into the dollar.

Read More »

Read More »

Net Speculative Positions, Global Stock Markets, Week October 22

Submitted by Mark Chandler, from marctomarkets.com Our big picture view is that the US dollar is carving out an important bottom, after selling off in Q3 as policy makers moved to reduce the extreme tail risks. The position adjustment that inspired among investors appears to have largely run its course.This bottoming of the dollar is …

Read More »

Read More »

The Three Main Forex strategies: Trend Following, Mean Reversion and the Carry trade. Is the Carry Trade Dead ?

Submitted by Mark Chandler, from marctomarkets.com Net Speculative Positions, FX Outlook, Global Stock Markets, Week October 15 Market participants have to confront a stark asymmetry. There are many ways to lose money, but there appears to be only three ways to make money. Nearly all strategies seem to come down to some variant …

Read More »

Read More »

Net Speculative Positions, FX Outlook, Global Stock Markets, Week October 8

Submitted by Mark Chandler, from marctomarkets.com The Price of Protection We have been tracking the deterioration in the technical condition of the major foreign currencies in this weekly note for the past three weeks. The euro’s recovery, off the support we identified here last week near $1.2800, should not overshadow the fact that the dollar’s …

Read More »

Read More »