Market participants have to confront a stark asymmetry. There are many ways to lose money, but there appears to be only three ways to make money. Nearly all strategies seem to come down to some variant of momentum or trend following, mean reversion, and carry trades.

Each is associated with different market conditions and require different behaviors and tactics. In momentum trades, one wants to buy what is going up and sell what is going down. The use of trailing stops may be more beneficial than exiting a trade at a pre-determined level. This seems to be the most common of the three strategies.

Mean reversion is the picking of market extremes. It is the opposite of trend following strategies. It requires selling that which has been rising and buying that which has been falling. The mean used can by dynamic, such as a 20- or a 200-day moving average. The mean also can be more stable, such a purchasing power parity. Since picking tops and bottoms is difficult, the win-loss ratio tends to be less advantageous. This in turn requires strict money management discipline. The losses associated with a few failed attempts to pick an extreme need to be limited so the time it is successful more than pays for the failures and more.

Carry trade strategies are deceivingly complicated and most controversial. They entail the selling of a low yielding asset to fund the purchase of a higher yielding asset. Such strategies require three conditions: sufficiently wide interest rate differentials, stable funding rate, and low volatility.

This last condition might not seem so obvious, so permit a brief explanation. The goal of the strategy is to earn the interest rate differential. If the currencies are too volatile, they threaten to overwhelm the carry. Indeed, foreign exchange prices are often more volatile than interest rate market.

So typically what happens is one makes a little money (from the carry), makes a little money and then loses a lot of money on an abrupt move in the currency market. This is why many traders and observers have compared carry trades to picking up pennies in front of a steam roller.

Recently a large investment house (and one that should know better) issued a report that the FT and Dow Jones jumped on claiming the carry trade is dead. It was killed by unconventional monetary policy, under which, as one journalist wrote, “global interest rates have gravitated toward zero” and such policies make currencies more unpredictable.

Yet the death of the carry trade has been exaggerated. Ironically, other articles in the same publications disprove the claim by offering examples of carry trades. In fact the persistence of carry trades is why some suggest it is the second oldest profession.

It is not really true that interest rates are gravitating toward zero. Carry trades are not simply interest rate arbitrage, but also can have a temporal component. Consider a carry trade in which one sells a three-month US dollar deposit, paying 0.4%, and buys a six-month Australian deposit yielding 3.75%.

Japanese investors can borrow funds even cheaper. The US-Japanese 10-year yield differential stands near 90 bp, which is above the 100-day moving average. This may be one of the reasons why preliminary data may soon show Japan has surpassed China as the largest foreign holder of US Treasuries.Add in a temporal component. Consider investors that borrowing 2-year Japanese money for around 10 bp and lend to the US Treasury for 165 bp (10-year yield). If one believes Japanese rates will not rise (reasonable) and the US Treasury 10-year yields will not rise much, and might actually fall, within one’s investment horizon, it may be an interesting carry trade. It does still require that the yen does not strengthen, or it can quickly eat away the carry.

With a notable exception of Americans, typically when people invest outside their home country, fixed income investments are clearly preferred over equity investments. Currency variability has a larger role in the total return of fixed income investments than equities. This means that a low volatile foreign exchange environment is more important to carry trade strategies.

The euro, yen and Swiss franc volatility (against the US dollar) are near multi-year lows. Within the G10, there are four countries that are typically used as the long-leg of carry trades: Australia and New Zealand dollars, the Norwegian krone and Swedish krona. Their short term interest rates are some multiple above the lowest yielding G-10 currencies.

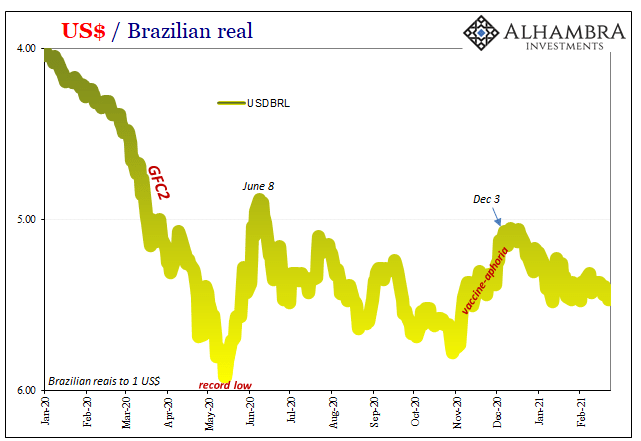

Investors, of course, are not confined to G10 currencies. Mrs. Watanabe has shown a new interest this year in Turkish lira denominated uridashi bonds and Australian dollar and South African rand samurai bonds. Or consider the attractiveness of the Brazilian real. The dollar has been confined to a BRL2.00-BRL2.05 range for more than three months. If one expects that range to more of less hold, selling dollars and buying the real may offer an interesting carry opportunity.

As we will see below, the speculative participants in the futures market have continued to be attracted to the Mexican peso. It was the only liquid currency future that saw an increase last week in gross long positions. It is the highest yielding of the currency futures and speculators have accumulated a larger net long peso position than next two currency futures put together. Against the dollar, the peso has been flat, but the carry an be 30 bp a month (as a conservative estimate, depending on the particulars).

The good news then is that market participants continue to deploy all three strategies (momentum, mean reversion and carry). The bad news is that market participants are deploying all three strategies and the foreign exchange market is as difficult to predict as ever.

We nevertheless make our best attempt. Below is the overview of the near-term technical outlook for the major currencies and review of the latest Commitment of Traders report.

Euro:

For the first time in few weeks, the technical tone appears to have improved. Technical support held in near $1.28 and the outside up-date on Thursday coupled with the follow-through gains on Friday helped stabilize the euro’s technical tone. Momentum indicators are curling up and the MACDs will likely cross higher over the next few days.

However, the euro has yet to prove itself to the upside. It won’t unless it can move above the trend line drawn off of the Sept 17 high near $1.3170 and the October 5 high near $1.3070 and comes in near $1.3030 on Monday. It is dropping about 5-6 ticks day. Stops appear to be stacked just below $1.28 and a convincing break is needed to confirm a top is in place.

Yen:

The dollar’s down trend line identified

here last week held. It comes in near JPY78.80 on Monday and it drops a couple of ticks a day. Strong demand for dollars emerged on the brief dip below JPY78. The yen is technically uninspiring against the dollar, but may be more interesting on the crosses. It looks best against the dollar-bloc, broadly neutral against the euro, and more vulnerable against the Swiss franc and sterling.

Sterling:

After reversing lower last Friday (Oct 5), sterling dropped nearly two cents in the first half of the week before stabilizing and then turned up ahead of the weekend to recoup about 50% of what it had lost. Initial resistance is seen near $1.6100 and then a down trend line drawn off Sept 21 high (~$1.6310), Sept 28 high (~$1.6270) and the Oct 5 high (~$1.6215), which comes in near $1.6160 on Monday. It drops 7-8 ticks a day.

Swiss franc:

The Swiss franc does not appear to be going anywhere quickly. The dollar is stuck in a range roughly between CHF0.9245 and CHF0.9450. For its part, the euro also appears range bound between CHF1.2050 and CHF1.2150.

Canadian dollar:

In recent days the Canadian dollar has been trading broadly sideways. A month-long up trend lie drawn off the September 14 low near CAD0.9635 has held back US dollar losses. It is a slowly rising trend line It comes in near CAD0.9300 on Monday and finishes the week near CAD0.9315. On the upside, the greenback will likely encounter offers in the CAD0.9770-CAD0.9835 band.

Australian dollar:

The Aussie has fallen out of favor, under the weight of rate cuts, weakening commodity prices and the slowdown in China. Nevertheless, it recorded higher lows every day last week, but then failed to move above the $1.03 level in the second half of the week. Support is now seen near $1.02. Despite a better than expected jobs report, the market continues to anticipate rate rate cut in early November. That said, the Australian dollar looks potentially more interesting against the New Zealand dollar. The Aussie has fallen a little more than 5% against it cousin, but appears to be bottoming, as it has done before just below NZD1.25. It looks to have near-term potential toward NZD1.2625 and then possibly NZD1.2700.

Mexican Peso:

As anticipated last week, the dollar recovered from six-month lows against the peso to test the MXN13.00 level. New dollar offers emerged and pushed it back down to MXN12.85. Dollar support is seen in the MXN12.80-MXN12.83 area. With the broad sideways range that has been carved out over the past month, the various momentum indicators are not very instructive presently. Market positioning continues to appear stretched and vulnerable to a squeeze, but a compelling catalyst is elusive and good buying of the peso continues to be seen on pullbacks.

| week ending Oct 9 |

Commitment of Traders |

|

|

|

(speculative position in

thousand of contracts) |

|

|

Net |

Net (Prior Week) |

Gross Long |

Long Change |

Gross Short |

Short Change |

| Euro |

-72.6 |

-50.3 |

39.9 |

-8.4 |

112.5 |

13.9 |

| Yen |

12.9 |

29.3 |

40.8 |

-11.9 |

27.9 |

4.5 |

| Sterling |

22.6 |

30.1 |

54.1 |

-10.5 |

31.6 |

-3.0 |

| Swiss Franc |

0.3 |

1.0 |

11.7 |

-1.0 |

12.0 |

-1.6 |

| C$ |

95.6 |

101.0 |

106.3 |

-6.4 |

10.6 |

-0.9 |

| A$ |

39.8 |

63.7 |

78.5 |

-20.1 |

38.7 |

3.9 |

| Mexican Peso |

136.0 |

136.0 |

139.4 |

1.4 |

3.0 |

0.9 |

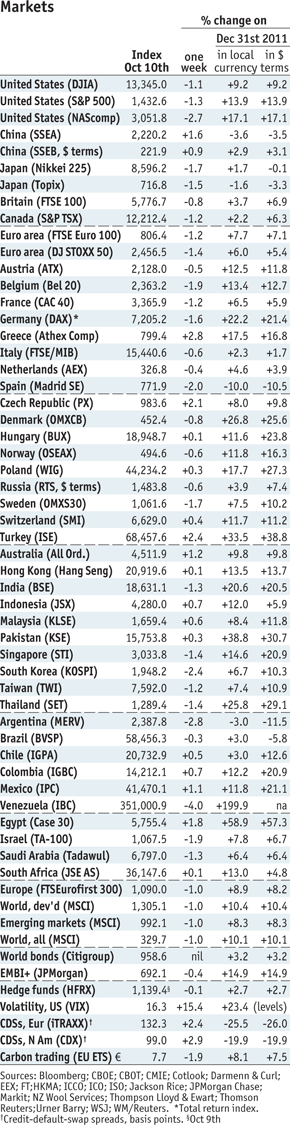

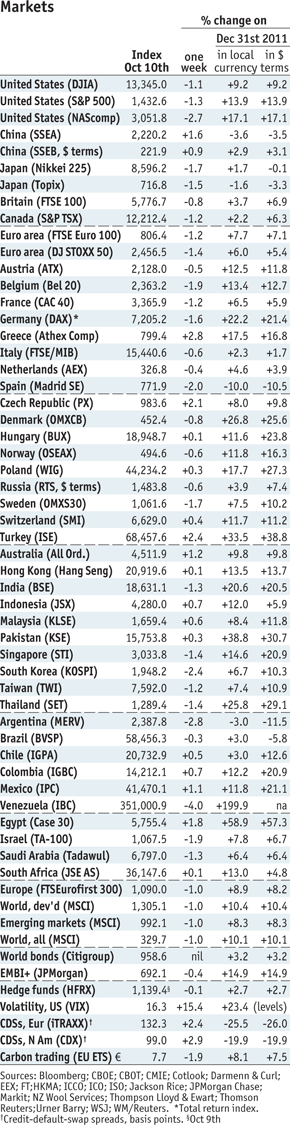

Economist market data October 09 - Click to enlarge

Global Stock Markets (by George Dorgan):

The last week was mixed for stocks. Thanks to continued negative interest rates, Denmark’s OMX still occupies the first place for stock markets. It could extend its advantage in $ terms against the German DAX on the second and the NASDAQ on the third position for this year. Chinese stocks could recover again last week, but Japanese ones lacked once again. Given that also the yen depreciated against the euro, Japanese stocks seem to be undervalued, the car fabrication issues in China overblown. The US, Britain and Canada saw moderate losses last week.

In the euro area, the Greek Athex continued its rise, Eastern Europe showed a mostly unchanged performance. Poland’s WIG has appreciated even more than the OMX; still we consider Poland as emerging economy. The Swiss SMI has achieved 11.7% return in CHF and 11.2% in USD terms.

Thanks to the RBA rate cut and good jobs data, Australia’s All Ordinary saw gains of 1.2%. Turkey, Singapore, Thailand, Pakistan and India see gains over 20% for this year in $ terms, but lost about 1% the last week.

In Latin America, Brazil and Argentina’s markets continued its slide, whereas investor’s hope is on Mexico and Columbia, because they offer higher rates and are more closely connected to the recovery in the United States. Stocks in developed economies continue to outpace emerging markets, the difference is 2.1% return.

Why does this global stock analysis make sense for Forex traders ?

See the details on the Asset Market Model for Forex trading.

More related posts directly from Marc’s website:, , , , , ,

Are you the author?

He has been covering the global capital markets in one fashion or another for more than 30 years, working at economic consulting firms and global investment banks. After 14 years as the global head of currency strategy for Brown Brothers Harriman, Chandler joined Bannockburn Global Forex, as a managing partner and chief markets strategist as of October 1, 2018.

Previous post

See more for 4.) Marc to Market

Next post

Tags: Asset Market Model,Canadian Dollar,Carry Trade,Commitments of Traders,COT,Currency Positioning,FX Positioning,Japanese yen,Marc Chandler,MXN,Peso,Purchasing Power Parity,Speculative Positions,Technical Analysis