Tag Archive: Technical Analysis

All Inflation Is Transitory. The Fed Will Be Late Again.

In this issue of “All Inflation Is Transitory, The Fed WIll Be Late Again.“

Market Review And Update

All Inflation Is Temporary

The Fed Should Be Hiking Now

Portfolio Positioning

#MacroView: No. Bonds Aren’t Overvalued.

Sector & Market Analysis

401k Plan Manager

Follow Us On: Twitter, Facebook, Linked-In, Sound Cloud, Seeking Alpha

Catch Up On What You Missed Last Week

Market Review & Update

Last week, we...

Read More »

Read More »

Taleb Explains How He Made Millions On Black Monday As Others Crashed

Former trader and author of best-selling book “The Black Swan” sat down for an interview with Bloomberg News to mark the upcoming thirtieth anniversary of the stock-market crash that occurred on Oct. 19, 1987 – otherwise known as Black Monday.

Read More »

Read More »

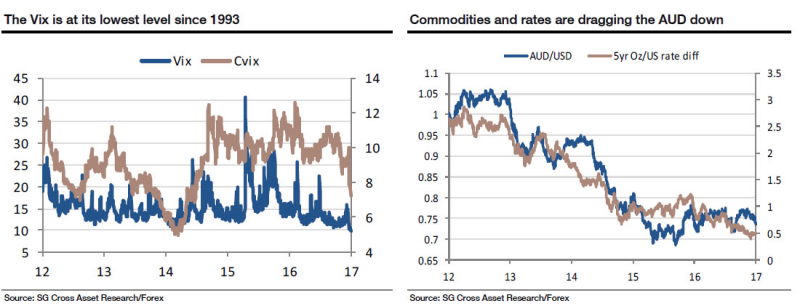

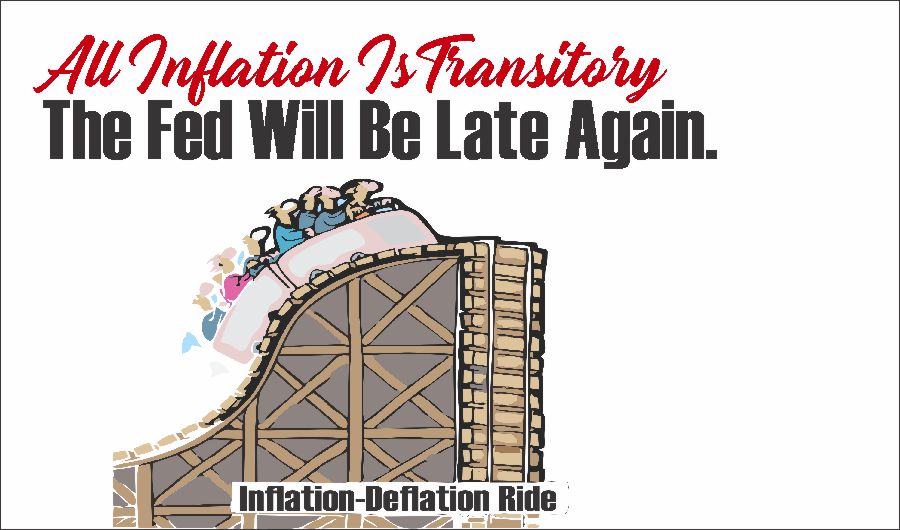

SocGen: Beware The Ghost Of 1993

With Monday's financial media blasting reports about the VIX collapse to levels not seen in 24 years, going all the way back to 1993, it is worth remembering that the near record low volatility collapse of 1993 did not end well either for stocks, or for bonds, with the great 1994 bond tantrum. Reminding us of that, and of broader implications for the cross-asset space, is SocGen's Kit Juckes with his overnight note, "The ghost of 1993"

Read More »

Read More »

The Psychological Impact Of Loss

For the third time in four weeks, the market was closed on Monday due to a holiday. Not only is this week shortened by a holiday, it is also coinciding with the annual Billionaire’s convention in Davos, Switzerland and the Presidential inauguration on Friday. Increased volatility over the next couple of days will certainly not be surprising.

Read More »

Read More »

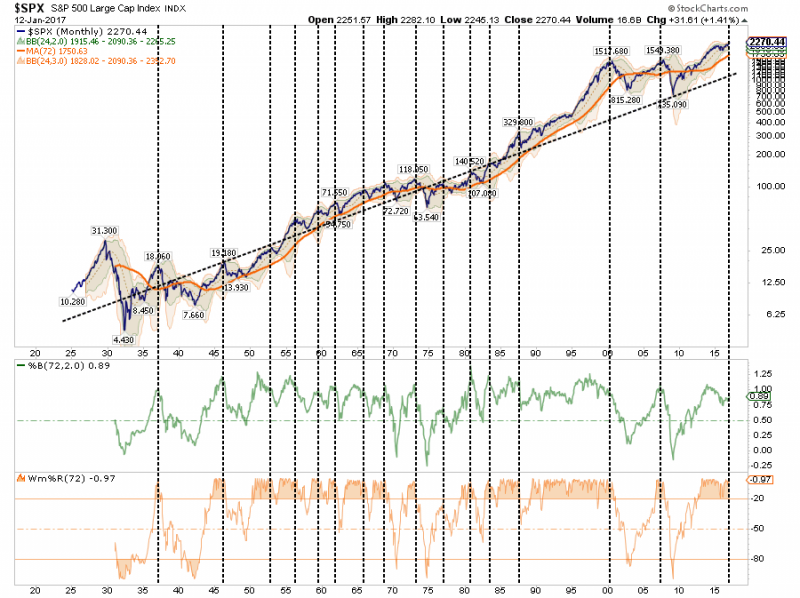

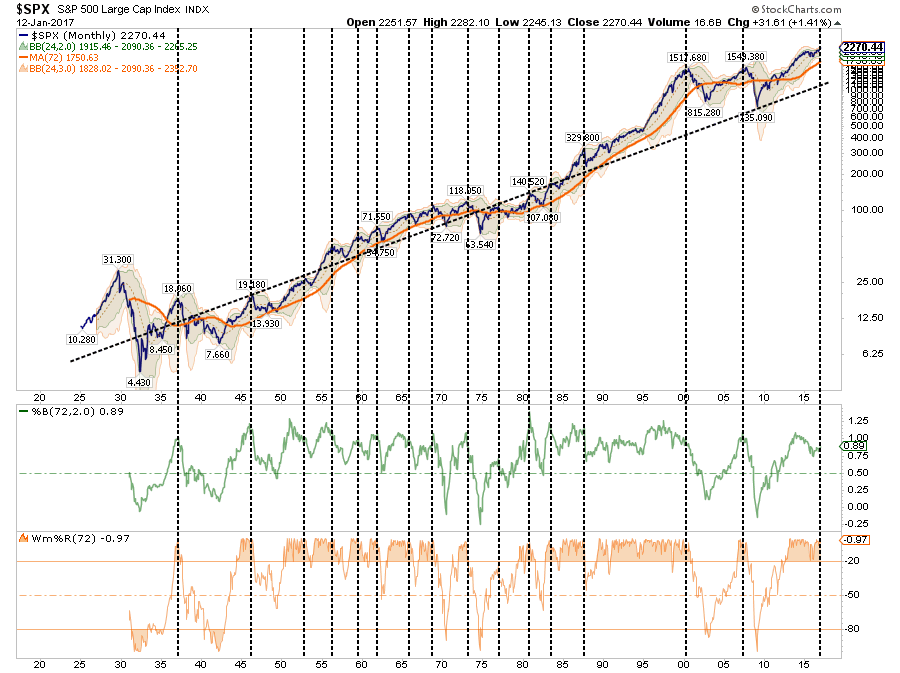

Risk Reward Analysis for Financial Markets

We focus this video regarding the potential upside for stocks versus the considerable downside risk for investors. All Technical Analysis is flawed and backward looking, it is a Critical Thinking flaw to extrapolate the future from the most recent past. I want to know the next market move, and not still be stuck on the most recent market move. And the most important fact of all is valuations, stocks are in a bubble right now due to Central Banks...

Read More »

Read More »

BIS: The VIX is Dead, The Dollar is the new “Fear Indicator”

Over the past few years, one of the recurring themes on this website has been an ongoing discussion of how the VIX has lost its predictive value as a market risk indicator. This culminated recently with a note by Russel Clark who explained in clear term why the "VIX is now broken." Today, in a fascinating note Hyun Song Shin, head of research at the Bank for International Settlements, the "central banks' central bank" has agreed with the...

Read More »

Read More »

The Three Main Forex strategies: Trend Following, Mean Reversion and the Carry trade. Is the Carry Trade Dead ?

Submitted by Mark Chandler, from marctomarkets.com Net Speculative Positions, FX Outlook, Global Stock Markets, Week October 15 Market participants have to confront a stark asymmetry. There are many ways to lose money, but there appears to be only three ways to make money. Nearly all strategies seem to come down to some variant …

Read More »

Read More »

Net Speculative Positions, FX Outlook, Global Stock Markets, Week October 8

Submitted by Mark Chandler, from marctomarkets.com The Price of Protection We have been tracking the deterioration in the technical condition of the major foreign currencies in this weekly note for the past three weeks. The euro’s recovery, off the support we identified here last week near $1.2800, should not overshadow the fact that the dollar’s …

Read More »

Read More »

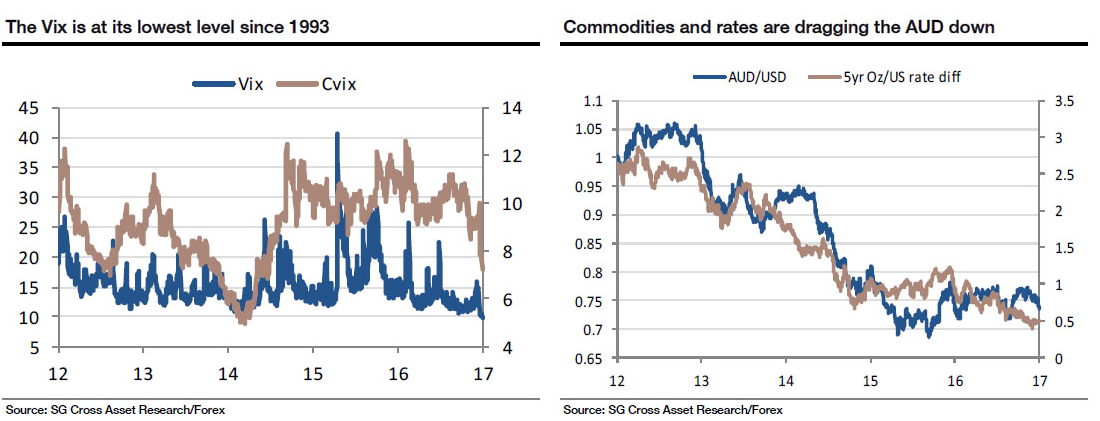

Net Speculative Positions, FX Outlook, Global Stock Markets, Week of October 1

Submitted by Mark Chandler, from marctomarkets.com If the third quarter was about the reduction of tail-risk by official actions, then Q4 will be about the limitations of the policy response. It will pose a challenging investment climate after what turned out to be a favorable performance in Q3. Equities generally did well. The US …

Read More »

Read More »

Net Speculative Positions, FX Outlook, Global Stock Markets, Week September 17

Submitted by Mark Chandler, from marctomarkets.com Nearly every development in recent days has been embraced by the foreign exchange market as a reason to continue to do what it has been doing since late July, and that is to sell the dollar. The German Constitutional Court ruling, allowing the European Stability Mechanism to …

Read More »

Read More »

Net Speculative Positions, Technical Outlook, Global Markets Ahead of Eventful Week September 3rd

Submitted by Mark Chandler, from marctomarkets.com The week ahead kicks off what we expect to be a period of intense event risk. The combination of positioning, judging from the futures market and anecdotal reports, and the low implied volatility in currencies and equity markets warn of heightened risk in the period ahead. The week begins …

Read More »

Read More »

FX Technical Outlook, Net Speculative Positions, Global Markets, week August 27

Submitted by Mark Chandler, from marctomarkets.com There are two main drivers behind the price action in the foreign exchange market and they will likely persist in the days ahead. First, there continues to be position adjustment ahead of the what promises to be eventful few weeks. Second, the release of the minutes from the August 1 …

Read More »

Read More »

Net Speculative Positions , Global Markets and Outlook, week from August 20

Currency Positioning and Outlook, week from August 20 Submitted by Mark Chandler, from marctomarkets.com The market is like expectant parents who don’t know the gender of the fetus. They know something big is around the corner, but they don’t have enough information to make some important decisions. They can contemplate the future, but there …

Read More »

Read More »

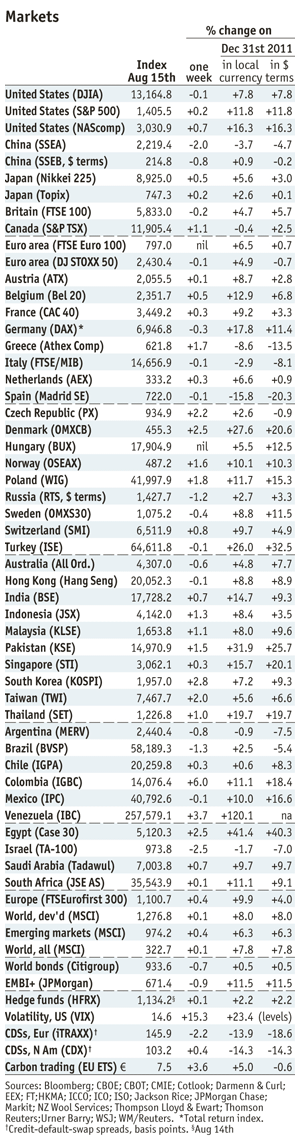

Net Speculative Positions and Outlook, week of August 13

Currency Positioning and Outlook, week of August 13 Submitted by Marc Chandler from MarctoMarkets.com Market positioning in the week ending August 10 suggests that speculators in the futures market generally agree with our assessment that ECB President Draghi’s recent proposal was not a game changer. The recent pattern continued. Essentially what this entails is buying …

Read More »

Read More »

Net Speculative Positions and Technical Analysis,week from August 6

Currency Positioning and Technical Analysis, week from August6 Submitted by Marc Chandler from MarctoMarkets.com The overall technical tone of the US dollar is suspect. During the last few months, it has been trending lower against the dollar-bloc currencies, Canadian and Australian dollars and the Mexican peso. The greenback has trended higher against the euro and Swiss …

Read More »

Read More »

Episode 5 of The M3 Report with Steve St. Angelo

2022-09-28

by Stephen Flood

2022-09-28

Read More »