Tag Archive: Japanese yen

FX Weekly Review, February 13 – 18: Why still long the dollar?

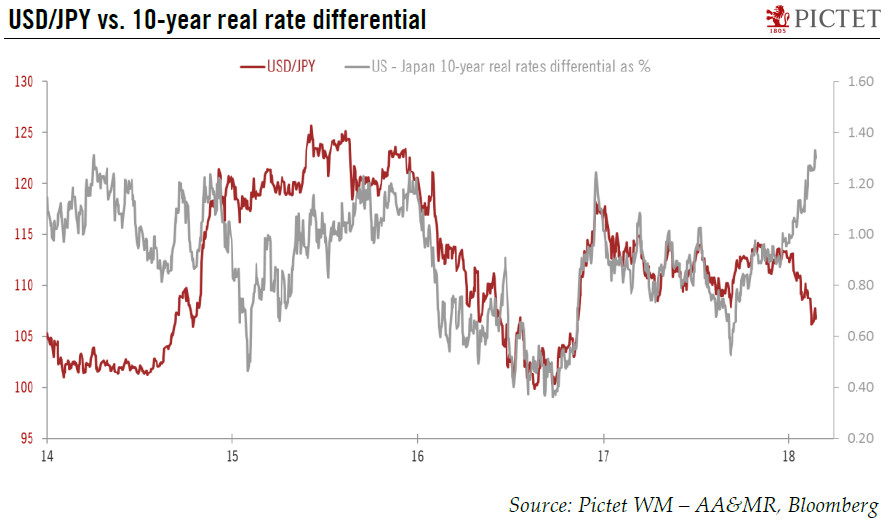

Arguments for being long the dollar: FX investors because of the difference in monetary policy (e.g. higher US rates), Bond investors long US Bonds because higher bond yields, On the other side, European and Swiss equities are not so much overvalued as U.S. stocks are.

Read More »

Read More »

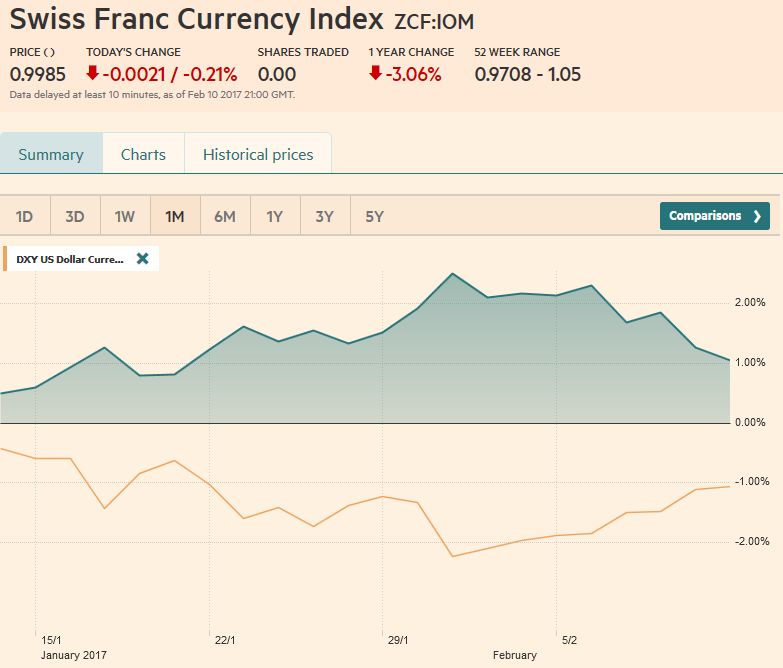

FX Weekly Review, February 06 – 11: Further Dollar and CHF Strength versus Euro weakness ahead?

We are expecting a further strengthening of both dollar and Swiss Franc against the euro over the next 3 months. Reason is the rising Swiss demand the continued dovishness of the ECB, despite rising inflation.

Read More »

Read More »

FX Traders Have To (Re)Learn A New Skill

Dear FX traders: forget the dot plot, and prepare to learn a new - or to some forgotten - skill: how to read trade flows. As Bloomberg's Vincent Cignarella and Andrea Wong point out, currency traders accustomed to analyzing the Fed’s dot plot and monthly U.S. jobs figures to predict the direction of the world's reserve currency are having to learn, or in some cases re-learn, a largely forgotten ability: how to scrutinize trade data. With...

Read More »

Read More »

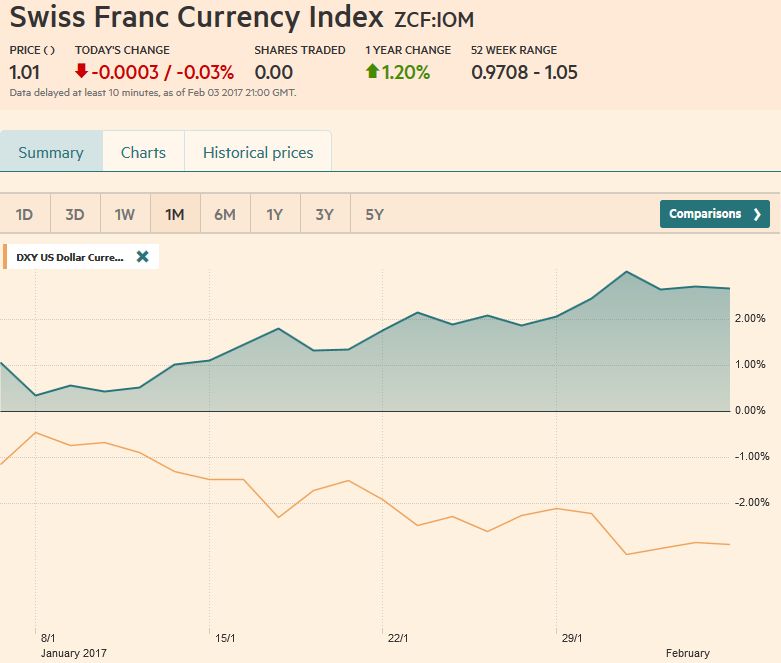

FX Weekly Review, January 30 – February 04: Reversal of Trump Reflation Trade Continues

The Swiss Franc index remained around the 2% gain that for the last month, the recovery from the Trump reflation trade. In this trade, investors preferred U.S. against European stocks. This tendency, however, is reversing now - and with it the franc recovered.

Read More »

Read More »

FX Weekly Review, January 23 – 28: Dollar Downwards and CHF Upwards Correction, for how long?

The US dollar spent the first month of the new year correcting lower after a strong advance in the last several months of 2016. We argue that the correction actually began in mid-December following the Federal Reserve's rate hike.

Read More »

Read More »

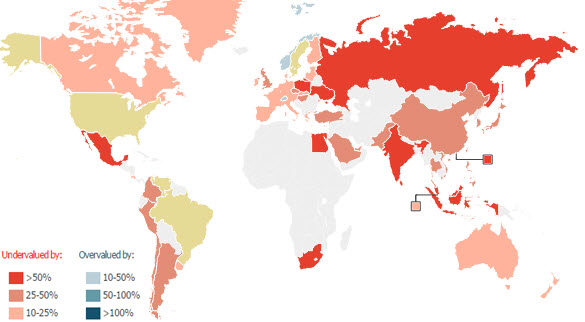

The US Dollar Is Now Overvalued Against Almost Every Currency In The World

In September 1986, The Economist weekly newspaper published its first-ever “Big Mac Index”. It was a light-hearted way for the paper to gauge whether foreign currencies are over- or under-valued by comparing the prices of Big Macs around the world. In theory, the price of a Big Mac in Rio de Janeiro should be the same as a Big Mac in Cairo or Toronto.

Read More »

Read More »

FX Weekly Review, January 16 – 21: Dollar Still Appears to Carving out a Bottom

The US dollar turned in a mixed performance over the past week. The technical indicators continue to support our expectation that after correcting since mid-December, following the Fed's hike, the dollar is basing.

Read More »

Read More »

FX Weekly Review, January 09 – 14: Dollar Correction may be Over or Nearly So

For the first week since the election of Trump, the Swiss Franc index had a clearly better performance than the dollar index. It improved by 1.5% in the last ten days.

Read More »

Read More »

SNB announces 24 bn CHF profit for 2016 thanks to rising stock markets.

The Swiss National Bank has announced 24 bn profits from 2016. Profits came from the dollar, yen and Canadian dollar, while the pound retreated by 15%. The EUR/CHF is only slightly weaker, mostly because the SNB actively supported the euro.

Read More »

Read More »

FX Weekly Review, January 02 – 07: Is the corrective phase of the dollar over?

The lack of full participation and the resulting choppy conditions may have obscured the signal from the capital markets. That signal we think was one of correction since shortly after the Fed's rate hike in id-December. The question now, after the US employment data showed continued labor market strength and that earnings improvement remains intact, is whether the corrective phase is over.

Read More »

Read More »

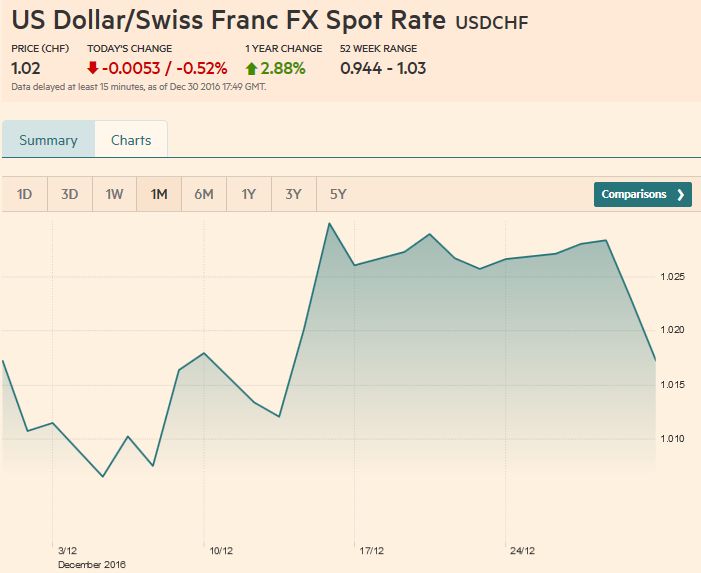

FX Weekly Review, December 26 – 30: Dollar Correction Poised to Continue

The technical condition of the US dollar, which has been advancing through most of the Q4 16, has been deteriorating This led us to anticipate a consolidative or corrective phase.

Read More »

Read More »

FX Weekly Review, December 19 – December 23: Assessment of the Dollar’s Technical Condition

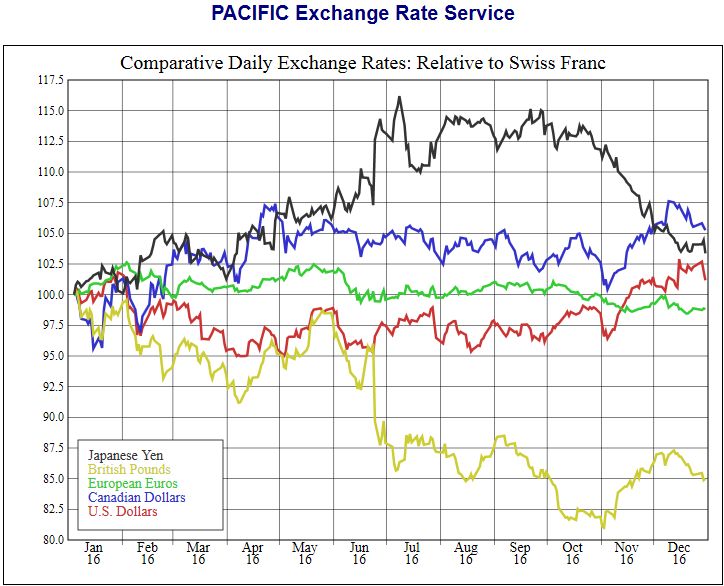

The small adjustment to Fed’s anticipated path for the Fed funds target helped lift the US dollar to its highest level against the euro since 2003, and to ten-month highs against the Japanese yen. The graph shows that the dollar has improved by 25% against the euro, but only by 10% against CHF over the last 3 years.

Read More »

Read More »

FX Weekly Review, December 12 – December 16: Fed Lifts Dollar, but Consolidation may be on Tap

The small adjustment to Fed’s anticipated path for the Fed funds target helped lift the US dollar to its highest level against the euro since 2003, and to ten-month highs against the Japanese yen. The graph shows that the dollar has improved by 25% against the euro, but only by 10% against CHF over the last 3 years.

Read More »

Read More »

FX Weekly Review, December 05 – December 09: Dollar Bulls Running Out of Time to See Parity vs Euro in 2016

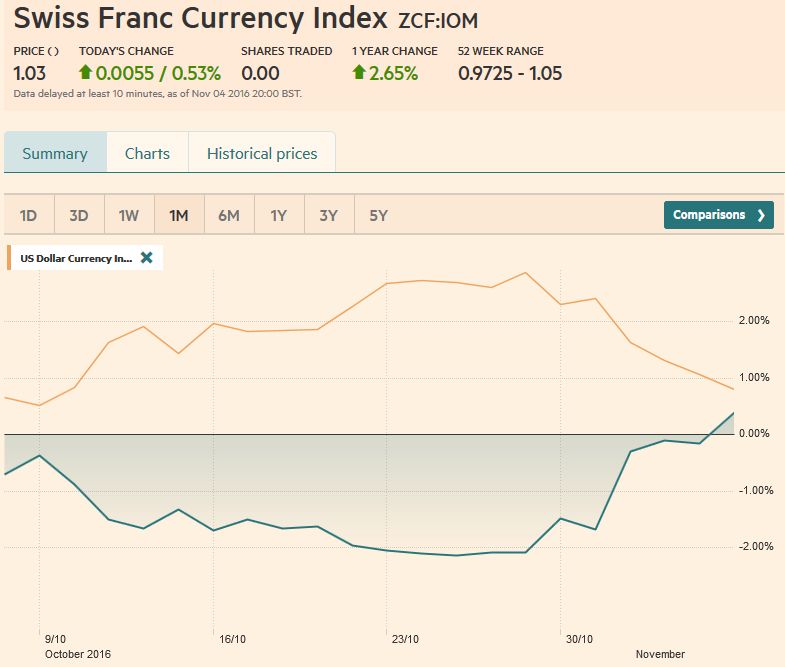

Swiss Franc Currency Index The Swiss Franc index remained in a losing position compared to the dollar index. However since November 25, it has remained stable. Given that the ECB extended the QE period, the EUR/CHF has fallen to 1.0730 again. USD/CHF The US dollar is finishing the year on a firm note. It rose … Continue reading »

Read More »

Read More »

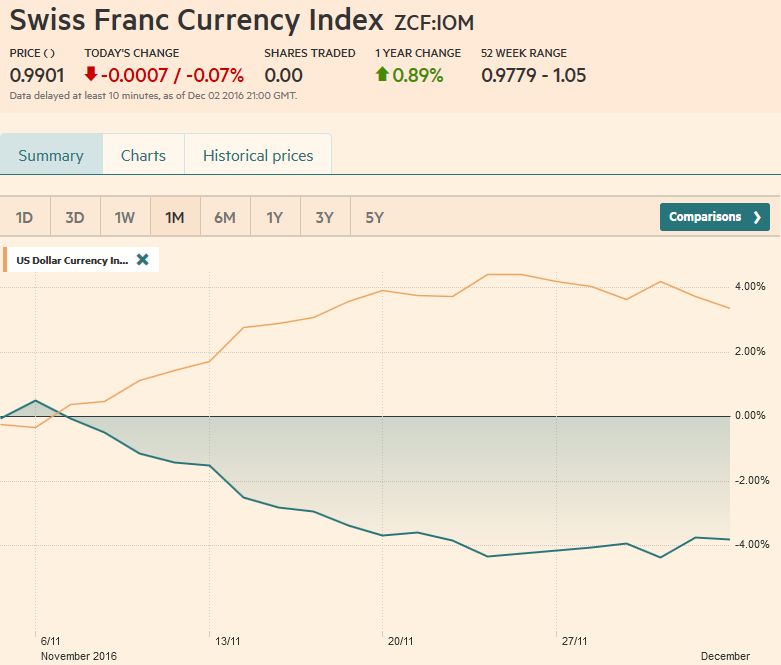

FX Weekly Review, November 28 – December 02: CHF Index still at its 4% loss since U.S. Elections

The Swiss Franc index continued around its 4% loss since the U.S. elections, while the US Dollar index had a 4% increase. The focus shifts to the ECB meeting, where participants are wary of a "hawkish ease".

Read More »

Read More »

FX Weekly Review, November 21 – November 25: Dollar Strength Losing Steam

After a three-week rally, the dollar bulls finally showed signs of tiring ahead of the weekend. At least against the Swiss Franc index, the dollar index could further advance. We had observed SNB interventions in the previous week that kept the euro mostly above 1.07.

Read More »

Read More »

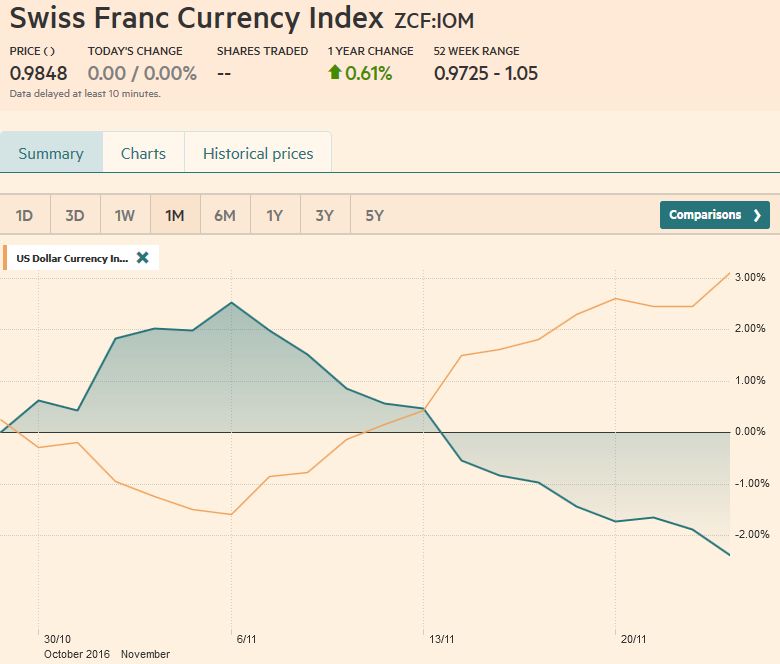

FX Weekly Review, November 14 – November 18: Best Dollar Weeks since Reagan

The US dollar has recorded its best two-week performance since Reagan was President. The weeks after Trump's election continue to see a weakening of the Swiss Franc, while the dollar index is on a steady rise. Still both the euro and the yen have seen worse performance than the Swiss Franc. The euro is currently under 1.07.

Read More »

Read More »

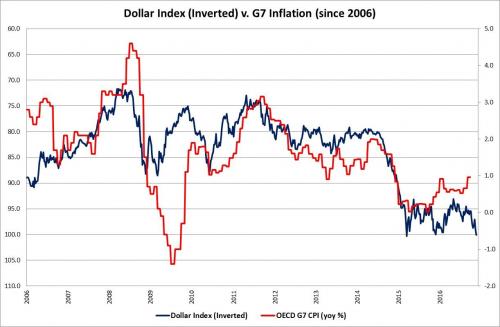

Dollar Illiquidity Getting Critical: A $10 Trillion Short Which The Fed Does Not Understand

In the latest report from ADM ISI’s strategy team, “Dollar Liquidity Threat is Getting Critical and Fed is M.I.A.”, Paul Mylchreest argues that mainstream economic luminaries (like Carmen Reinhart) are finally acknowledging the evolving crisis due to the dollar shortage outside the US, a topic which even the head researcher at the BIS shone a spotlight on yesterday suggesting that the strength of the dollar, not the VIX is the new "fear...

Read More »

Read More »

FX Weekly Review, November 07 – November 11: The Trump Reflation Trade

The Swiss Franc Index rose sharply, shortly after the U.S. elections. But then the Trump reflation trade came. Trump may fulfills the wet dreams of many economists. With tax cuts he might extend the U.S. fiscal deficit up to 10% per year. This resulted in:

Gains on U.S. stocks, inflows in U.S. Bonds, inflation hedges gold and Swiss Francs.

Read More »

Read More »