Tag Archive: Japan

FX Daily, August 28: Powell and Abe Drive Markets

After a confused and volatile reaction to the Federal Reserve's formal adoption of an average inflation target, it took Asian and European traders to embrace the signal and take the dollar lower. It is falling against nearly all the currencies and has slumped to new lows for the year against sterling and the Australian dollar.

Read More »

Read More »

FX Daily, August 26: Hurricane Laura Lifts Oil Prices

A consolidative tone has emerged after US equity benchmarks reached new highs yesterday. The MSCI Asia Pacific Index had reached seven-month highs on Tuesday, but Japan, China, and Australian stocks saw modest profit-taking today. European shares are recouping yesterday's minor loss, and US shares are flat.

Read More »

Read More »

FX Daily, August 24: Markets Prove Resilient to Start New Week

New virus outbreaks in Europe and Asia are not adversely impacting the capital markets today. Global equities are firmer. Some reports suggesting the US ban on WeChat may not be as broad as initially signaled helped lift Hong Kong shares, but nearly all the markets in the region traded higher.

Read More »

Read More »

FX Daily, August 21: PMIs Shake Investor Confidence

The second disappointing Fed manufacturing survey report and an unexpected rise in weekly jobless claims helped reverse the disappointment over the FOMC minutes. Bonds and stocks rallied--not on good macroeconomic news, but the opposite, which underscores the likelihood of more support for longer.

Read More »

Read More »

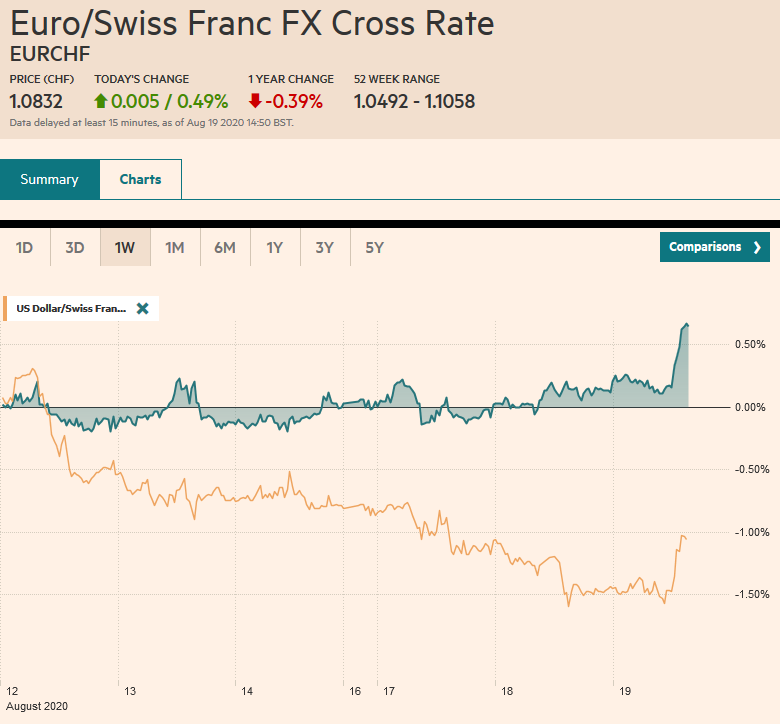

FX Daily, August 19: US Equities Outperform but Does Little for the Heavy Greenback

Overview: The S&P 500 and NASDAQ set new all-time highs yesterday, but the continued outperformance of US equities have failed to lend the dollar much support. It was sold to new lows for the year yesterday against the euro, sterling, the Swedish krona, and the Australian dollar.

Read More »

Read More »

It Was Bad In The Other Sense, So Now What?

According to the latest figures, Japan has tallied 56,074 total coronavirus cases since the outbreak began, leading to the death of an estimated 1,103 Japanese citizens. Out of a total population north of 125 million, it’s hugely incongruous.

Read More »

Read More »

FX Daily, August 17: The Dollar Softens to Start the New Week

The capital markets are looking for direction. Asia Pacific equity markets were mixed, with gains in China, Hong Kong, and Taiwan countering losses in Japan, South Korea, and Australia. European and US shares are trading slightly firmer.

Read More »

Read More »

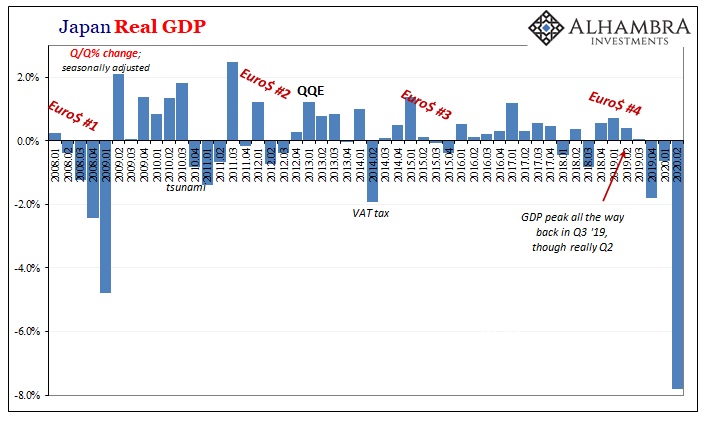

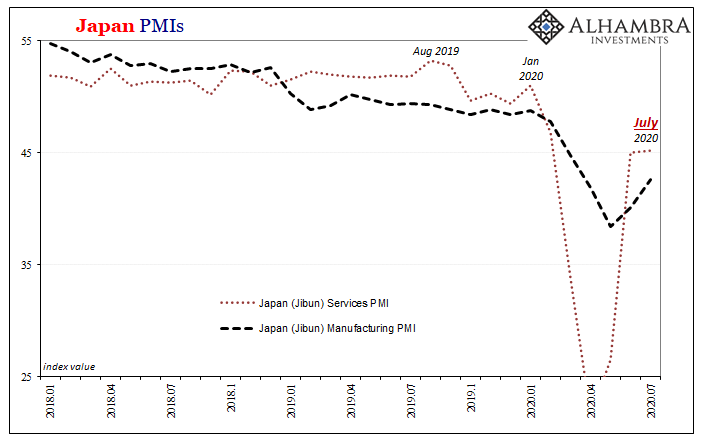

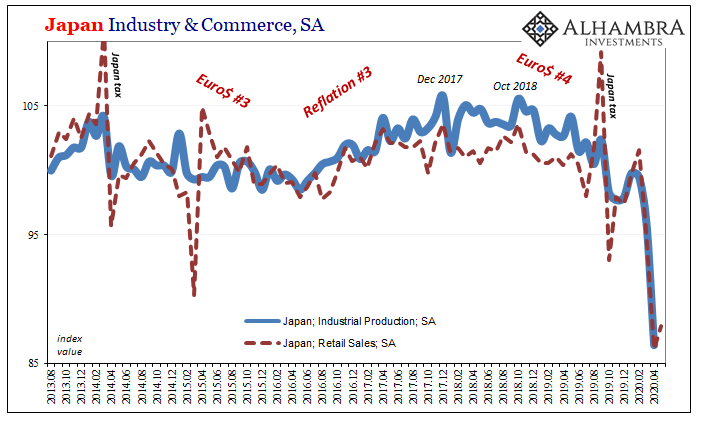

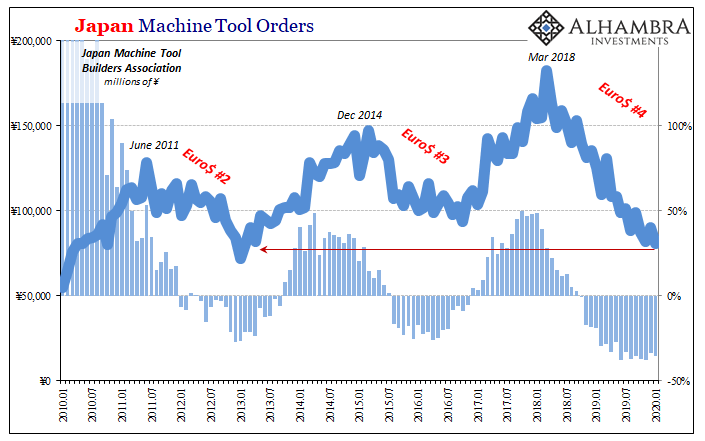

A Japanese Stall?

In sharp contrast to the sentimental deference towards central bank stimulus exhibited by Germany’s ZEW, for example, similar Japanese surveys are starting to describe potential trouble developing. Like Germany, Japan is a bellwether country and a pretty reliable indicator of global economy performance.

Read More »

Read More »

FX Daily, July 20: Markets Yawn, Deal or No Deal

Overview: While there are signs that Europe has reached a compromise on the grant/loan issue, the spillover into the markets is quite limited. China, with Shanghai's 3.1% gain, led a few markets in the Asia Pacific region higher, including Japan and India. Most markets were lower, and Europe's Dow Jones Stoxx 600 is a fractionally firmer, recovering from initial losses.

Read More »

Read More »

FX Daily, July 16: Equities Slide and the Greenback Bounces After China’s GDP and Before the ECB

Overview: Profit-taking, perhaps spurred by disappointing retail sales figures, sent Chinese equity markets down by 4.5%-5.2% today, the most since early February. It appears to be triggering a broader setback in equities today. The Hang Seng fell 2%, and most other markets in the region were off less than 1%.

Read More »

Read More »

FX Daily, June 30: When Primary is Secondary

The gains in US equities yesterday carried into Asia Pacific trading today, but the European investors did not get the memo. The Dow Jones Stoxx 600 is succumbing to selling pressure and giving back yesterday's gain. Energy and financials are the biggest drags, while real estate and information technology sectors are firm. All the markets had rallied in the Asia Pacific region, with the Nikkei and Australian equities leading with around 1.3%...

Read More »

Read More »

Looking Ahead Through Japan

After the Diamond Princess cruise ship docked in Tokyo with tales seemingly spun from some sci-fi disaster movie, all eyes turned to Japan. Cruisers had boarded the vacation vessel in Yokohama on January 20 already knowing that there was something bad going on in China’s Wuhan. The big ship would head out anyway for a fourteen-day tour of Vietnam, Taiwan, and, yes, China.

Read More »

Read More »

FX Daily, June 11: Are Risk Appetites Satiated, or Simply Taking the Day Off?

Many observers are attributing the sell-off in risk assets today to the Federal Reserve's pessimistic outlook, yet, as we note below, the Fed's median GDP forecast this year is better than many international agency forecasts, including the OECD's that was issued yesterday. Moreover, some near-term trends were already in place.

Read More »

Read More »

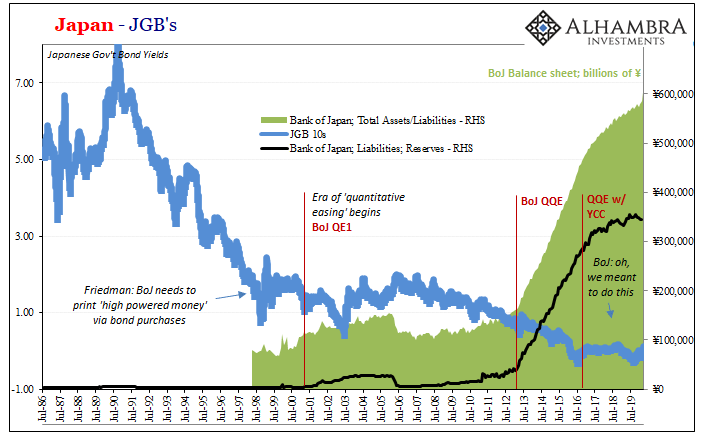

From QE to Eternity: The Backdoor Yield Caps

So, you’re convinced that low rates are powerful stimulus. You believe, like any good standing Economist, that reduced interest costs can only lead to more credit across-the-board. That with more credit will emerge more economic activity and, better, activity of the inflationary variety. A recovery, in other words. Ceteris paribus. What happens, however, if you also believe you’ve been responsible for bringing rates down all across the curve…and...

Read More »

Read More »

FX Daily, May 27: China and Hong Kong Pressures are Having Limited Knock-on Effects

Overview: The S&P 500 gapped higher yesterday, above the recent ceiling and above the 200-day moving average for the first time since early March. The momentum faltered, and it finished below the opening level and near session lows. The spill-over into today's activity has been minor. The heightened tensions weighed on China and Hong Kong markets, but Japan, South Korea, Taiwan, and Indian equity markets rose.

Read More »

Read More »

There Was Never A Need To Translate ‘Weimar’ Into Japanese

After years of futility, he was sure of the answer. The Bank of Japan had spent the better part of the roaring nineties fighting against itself as much as the bubble which had burst at the outset of the decade. Letting fiscal authorities rule the day, Japan’s central bank had largely sat back introducing what it said was stimulus in the form of lower and lower rates.No, stupid, declared Milton Friedman.

Read More »

Read More »

FX Daily, April 6: Glimmer of Hope Lifts Markets

Overview: Reports suggesting that some of the hot spots for the virus contagion appear to be leveling off, and this is helping underpin risk appetites today. The curve seems to be flattening in Italy, Spain, and France. In the US, there are some early signs of leveling off in NY, and now, the number of states with infection rates above 20% is less than 10 from over 40 last week.

Read More »

Read More »

FX Daily, April 2: Optimism on Oil Deal Steadies Risk Appetites…for the Moment

Overview: After US stocks dropped more than 4% yesterday, investor sentiment has improved, apparently sparked by ideas that the pain will force oil producers to find a way to reduce supply. Oil prices have surged, with the May WTI contract rallying around 7%. Asia Pacific equities were mostly higher, with Japan and Australia the notable exceptions.

Read More »

Read More »

FX Daily, March 25: Relief, but…

Overview: Global equities are marching higher. While the Dow Jones Industrials posted its biggest advance since 1933, the US is lagging behind other leading benchmarks. The MSCI Asia Pacific advanced, led by Japan's Nikkei's 8% gain. It was third consecutive gain, during which time the Nikkei has rallied 17%. Europe's Dow Jones Stoxx 600 is up about 3.5% after bouncing 8.4% yesterday.

Read More »

Read More »

What Happens When Central Banks Buy Stocks (ETFs)? Well, We Already Know

Can we please dispense with all notions that monetary policy works? Specifically balance sheet expansion via any scale asset purchase programs. Nowhere has that been more apparent than Japan. Go back and reread all the promised benefits from BoJ’s Big Bang QQE that were confidently written in 2013. The biggest bazooka ever conceived has fallen short in every conceivable way.

Read More »

Read More »