Tag Archive: Japan

Great Graphic: US and Japan Five-Year Credit Default Swaps

For the first time since the financial crisis, the 5-year CDS on JGBs is dipping below the 5-year US CDS. It appears to be more a function of a decline in Japan's CDS than a rise in the US CDS. We are reluctant to read too much into the small price changes in the mostly illiquid instruments.

Read More »

Read More »

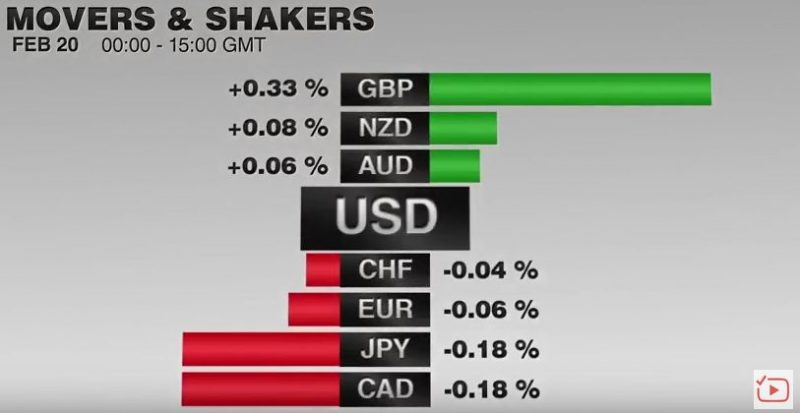

FX Daily, February 20: Marking Time on Monday

US markets are closed for the Presidents' Day holiday, but it hasn't prevented its pre-weekend gains giving a bullish tone to global equities. The S&P 500 and NASDAQ recovered from early weakness to close at new record levels before the weekend. Global equity markets are following suit today.

Read More »

Read More »

What Will Trump Do About The Central-Bank Cartel?

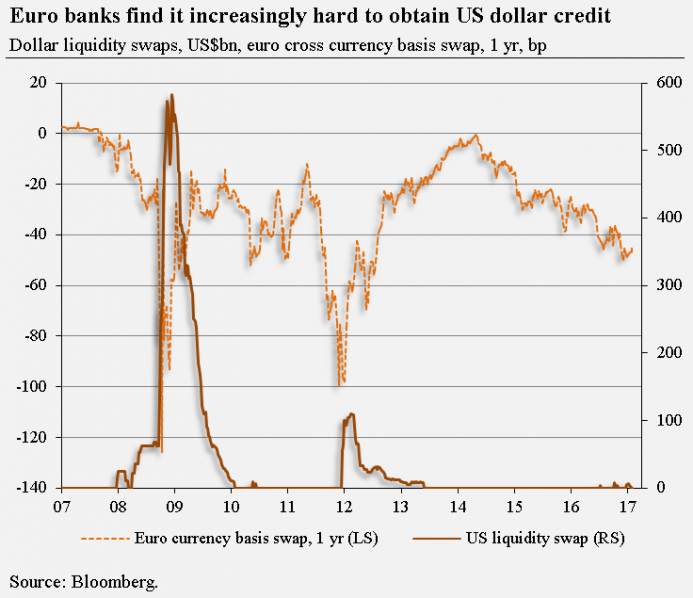

The US is by far the biggest economy in the world. Its financial markets — be it equity, bonds or derivatives markets — are the largest and most liquid. The Greenback is the most important transaction currency. Many currencies in the world — be it the euro, the Chinese renminbi, the British pound or the Swiss franc — have actually been built upon the US dollar.

Read More »

Read More »

FX Traders Have To (Re)Learn A New Skill

Dear FX traders: forget the dot plot, and prepare to learn a new - or to some forgotten - skill: how to read trade flows. As Bloomberg's Vincent Cignarella and Andrea Wong point out, currency traders accustomed to analyzing the Fed’s dot plot and monthly U.S. jobs figures to predict the direction of the world's reserve currency are having to learn, or in some cases re-learn, a largely forgotten ability: how to scrutinize trade data. With...

Read More »

Read More »

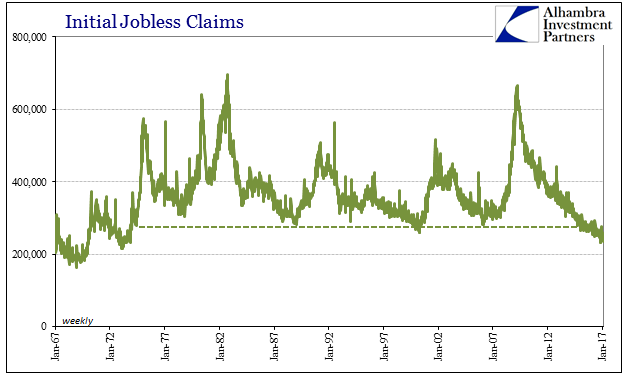

Jobless Claims Look Great, Until We Examine The Further Potential For What We Really, Really Don’t Want

Initial jobless claims fell to just 234k for the week of February 4, nearly matching the 233k multi-decade low in mid-November. That brought the 4-week moving average down to just 244k, which was a new low going all the way back to the early 1970’s. Jobless claims seemingly stand in sharp contrast to other labor market figures which have been suggesting an economic slowdown for nearly two years.

Read More »

Read More »

Europe Proposes “Restrictions On Payments In Cash”

Having discontinued its production of EUR500 banknotes, it appears Europe is charging towards the utopian dream of a cashless society. Just days after Davos' elites discussed why the world needs to "get rid of currency," the European Commission has introduced a proposal enforcing "restrictions on payments in cash.

Read More »

Read More »

Policy Makers – Like Generals – Are Busy Fighting The Last War

The Maginot Line formed France's main line of defense on its German facing border from Belgium in the North to Switzerland in the South. It was constructed during the 1930s, with the trench-based warfare of World War One still firmly in the minds of the French generals. The Maginot Line was an absolute success...as the Germans never seriously attempted to attack it's interconnected series of underground fortresses. But the days of static warfare...

Read More »

Read More »

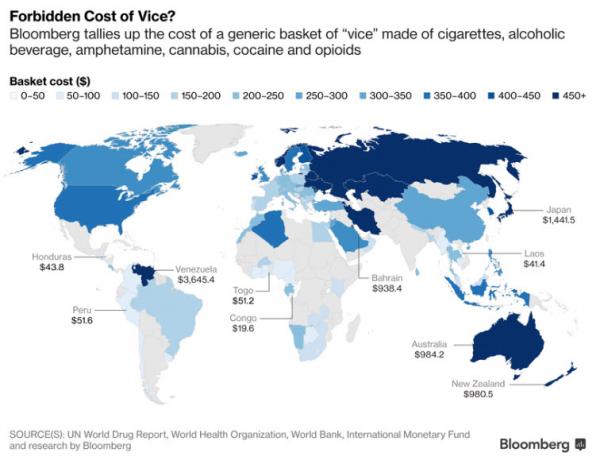

What Vice Costs – The World’s Cheapest (& Most Expensive) Countries For Drugs, Booze, & Cigarettes

Indulging in a weekly habit of drugs, booze and cigarettes can cost you as little as $41.40 in Laos and a whopping $1,441.50 in Japan, according to the Bloomberg Vice Index.

Read More »

Read More »

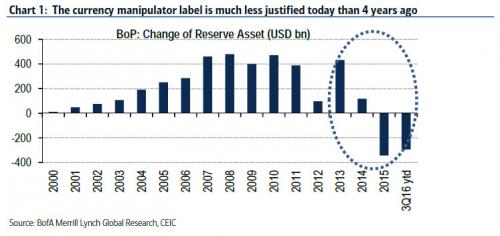

Trump Is Set To Label China A “Currency Manipulator”: What Happens Then?

While China has been banging the nationalist drums in its government-owned tabloids, warning daily of the adverse consequences to the US from either a trade war, or from Trump's violating the "One China" policy, a more tangible concern for deteriorating relations between China and the US is that Trump could, and most likely will, brand China a currency manipulator shortly after taking over the the Oval Office.

Read More »

Read More »

Nomi Prins’ Political-Financial Road Map For 2017

As tumultuous as last year was from a global political perspective on the back of a rocky start market-wise, 2017 will be much more so. The central bank subsidization of the financial system (especially in the US and Europe) that began with the Fed invoking zero interest rate policy in 2008, gave way to international distrust of the enabling status quo that unfolded in different ways across the planet.

Read More »

Read More »

A Biased 2017 Forecast, Part 1

A couple weeks ago I was lucky enough to see a live one hour interview with Michael Lewis at the Annenberg Center about his new book The Undoing Project. Everyone attending the lecture received a complimentary copy of the book. Being a huge fan of Lewis after reading Liar’s Poker, Boomerang, The Big Short, Flash Boys, and Moneyball, I was interested to hear about his new project.

Read More »

Read More »

FX Daily, December 27: Markets Becalmed in Wait-and-See Mode

As skeleton teams return to the trading desks in New York, the US dollar is largely where they left it at the end last week. Japanese markets were open yesterday, while UK, Australia, New Zealand, Hong Kong and Canadian markets are still closed today.

Read More »

Read More »

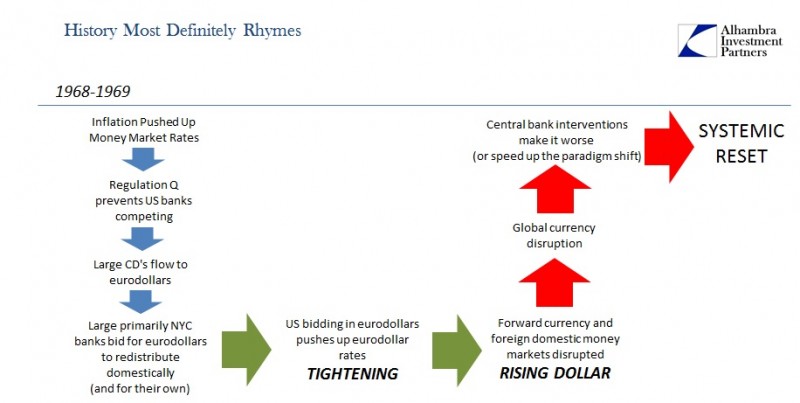

We Know How This Ends – Part 2

In March 1969, while Buba was busy in the quicksand of its swaps and forward dollar interventions, Netherlands Bank (the Dutch central bank) had instructed commercial banks in Holland to pull back funds from the eurodollar market in order to bring up their liquidity positions which had dwindled dangerously during this increasing currency chaos.

Read More »

Read More »

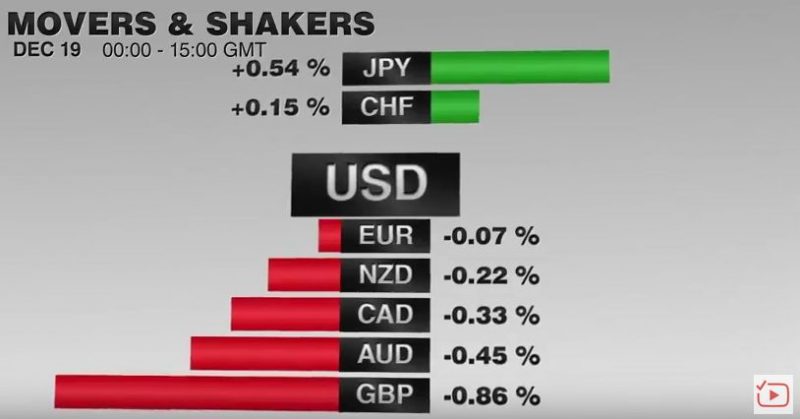

FX Daily, December 19: EUR/CHF Dives under 1.07

Once again a line in sand for the Swiss National Bank is broken. The EUR/CHF falls under 1.07. But trading algorithms are like this: When the EUR/USD is falling, then the EUR/CHF must follow. The SNB decided not to intervene any more at 1.07.

Read More »

Read More »

Swiss 10 year bond yields still negative, but approaching zero.

The global bond rout returned with a bang, sending 10Y US Treasury yields as much as six basis points higher to 2.53%, the highest level in over two years. The selloff happened as oil prices surged by more than 5% following Saturday's agreement by NOPEC nations agreed to slash production, leading to rising inflation pressures. At last check, the 10Y was trading at 2.505%, up from 2.462% at Friday and on track for its highest close since September...

Read More »

Read More »

Net National Savings Rate, the Best Alternative Indicator to GDP Growth

For us the Net National Savings Rate is the best alternative indictator to GDP growth. It is positively correlated with the change in wealth, with the establishment of future productive capacity, the price of government bonds and currency valuations. But today GDP growth is often negatively correlated to the Net Savings Rate. Hence GDP is often a less useful measure.

Read More »

Read More »

The War On Cash Is Happening Faster Than We Could Have Imagined

It’s happening faster than we could have ever imagined. Every time we turn around, it seems, there’s another major assault in the War on Cash. India is the most notable recent example– the embarrassing debacle a few weeks ago in which the government, overnight, “demonetized” its two largest denominations of cash, leaving an entire nation in chaos.

Read More »

Read More »

FX Daily, November 25: Corrective Forces Emerge, but Underlying Trend is Evident

The US dollar's recent gains are being trimmed today, and it is down against all the major currencies. Many emerging market currencies, including the Turkish lira, Indian rupee, and Hungarian forint are firmer today.

Read More »

Read More »

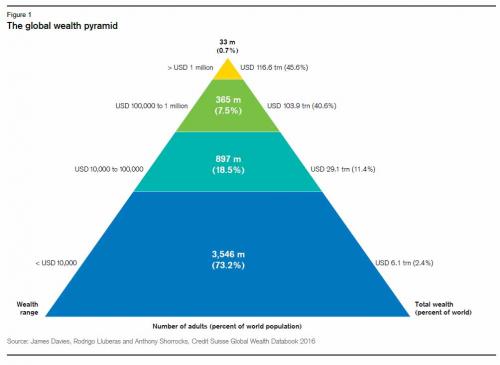

Global Wealth Update: 0.7 percent Of Adults Control $116.6 Trillion In Wealth

Today Credit Suisse released its latest annual global wealth report, which traditionally lays out what is perhaps the biggest reason for the recent "anti-establishment" revulsion: an unprecedented concentration of wealth among a handful of people, as shown in its infamous global wealth pyramid, an arrangement which as observed by the "shocking" political backlash of the past few months suggests that the lower 'levels' of the pyramid are...

Read More »

Read More »