Tag Archive: Japan Retail Sales

Retail sales are an aggregated measure of the sales of retail goods over a stated time period, typically based on a data sampling that is extrapolated to model an entire country. Measuring consumer demand for finished goods, retail sales help gauge the pulse of an economy and its projected path toward expansion or contraction. As a leading macroeconomic indicator, healthy retail sales figures typically elicit positive movements in equity markets.

FX Daily, June 29: USD is Offered in Quiet Start to the New Week

The combination of rising virus cases and the sell-off in the US before the weekend dragged nearly all the Asia Pacific bourses lower. The Nikkei led the way with more than a 2% drop, but most bourses were off more than 1%. China and Taiwan were also greeted with selling as markets re-opened from a two-day holiday at the end of last week.

Read More »

Read More »

FX Daily, February 28: Fallout Accelerates

Overview: The dramatic response by investors to Covid-19 continues unabated and worse. The slide is accelerating. The S&P 500 posted a 4.4% loss yesterday, its worst session since 2011, and the sell-off is continuing. Many markets in Asia Pacific, including Japan, China, Korea, Australia, India, Singapore, and Thailand, fell by more than 3%.

Read More »

Read More »

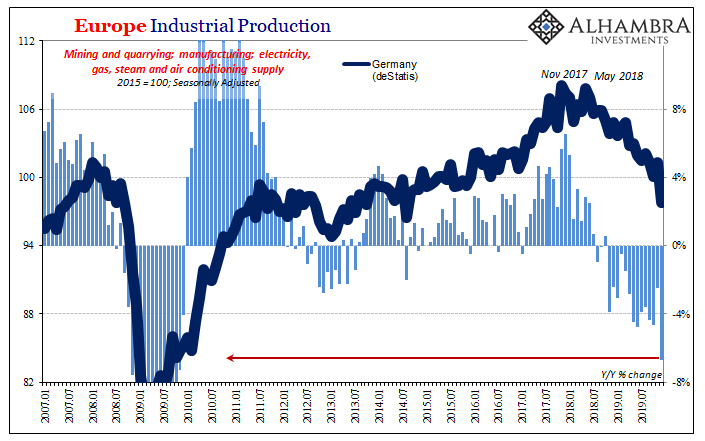

Two Years And Now It’s Getting Serious

We knew German Industrial Production for December 2019 was going to be ugly given what deStatis had reported for factory orders yesterday. In all likelihood, Germany’s industrial economy ended last year sinking and maybe too quickly. What was actually reported, however, exceeded every pessimistic guess and expectation – by a lot.

Read More »

Read More »

FX Daily, October 30: All About Perspective

Overview: The global capital markets are mostly treading water ahead of the Federal Reserve meeting. Asia Pacific and European equities drifted lower. The MSCI Asia Pacific Index appears to have snapped a four-day advance, while the Dow Jones Stoxx 600 was trading slightly lower for the second consecutive session following a six-day rally.

Read More »

Read More »

FX Daily, September 30: A Busy Week Begins Quietly

Overview: As the quarter ends, the capital markets are mixed. Equities in Asia Pacific were heavier, except in Hong Kong and Australia, while shares were mixed, leaving the Dow Jones Stoxx 600 little changed through the European morning. US shares are trading firmer. Benchmark 10-year bond yields are 2-3 basis points higher, though Australia's bond yield was up seven basis points.

Read More »

Read More »

FX Daily, May 31: US Struggles to Build Physical Wall, Tries Tariff Wall on Mexico

Overview: The US announcement to lay a 5% tariff on all goods coming from Mexico (starting June 10) until it stops the flow of "illegal migrants" spurred sharp losses in the Mexican peso and general risk-off move that strengthened the yen. The tariffs are set to rise every month until reaching 25%. This is a significant surprise and especially given that the Trump Administration is preparing to formally submit the USMCA to Congress.

Read More »

Read More »

FX Daily, April 26: Greenback Consolidates Ahead of Q1 GDP

Overview: The equities are finishing softly after the rally stalled in the middle of the week. The large markets in Asia fell, led by China, and the MSCI Asia Pacific Index fell for a third session, the longest losing streak in two months. Europe's Dow Jones Stoxx 600 ended an eight-day advance with a two-day loss coming into today where it is a little softer.

Read More »

Read More »

FX Daily, May 30: Italian Reprieve, Euro Bounces, Trade Tensions Rise

After what could be described as a 15-sigma event yesterday in the Italian bond market, a reprieve today has seen the euro recover a cent from yesterday's lows. While the political situation in Italy is worrisome, many observers suspect that the new banking rules exacerbated the illiquidity that explains outsized moves.

Read More »

Read More »

FX Daily, March 29: Bonds and Stocks are Firm, While the Greenback Consolidates Upticks

The choppy US equity session yesterday, ultimately ending with modest losses as the tech sector remained under pressure, has been shrugged off in Asia and Europe, where modest gains have been seen. The dollar is little changed after yesterday's gains, and bonds are mostly firmer.

Read More »

Read More »

FX Daily, February 28: It Takes Powell to Convince the Market that Yellen was Right

Many market participants think they heard Fed Chair Powell give a fairly strong signal that he favored a more aggressive course. The implied yield on the December Eurodollar futures rose five basis points to 1.535%. The December Fed funds futures contract rose three basis points.

Read More »

Read More »

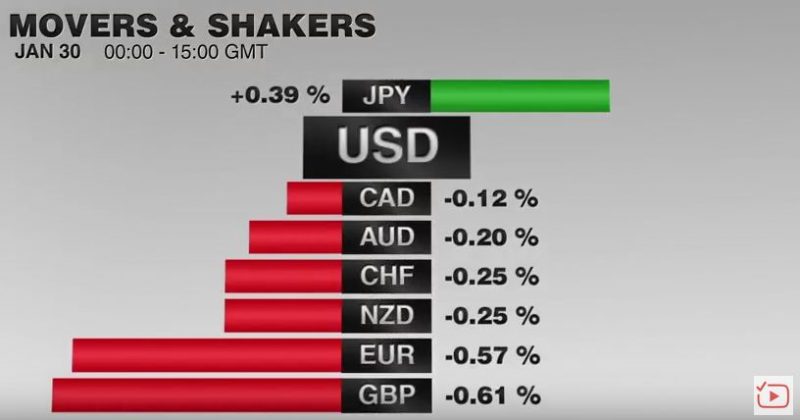

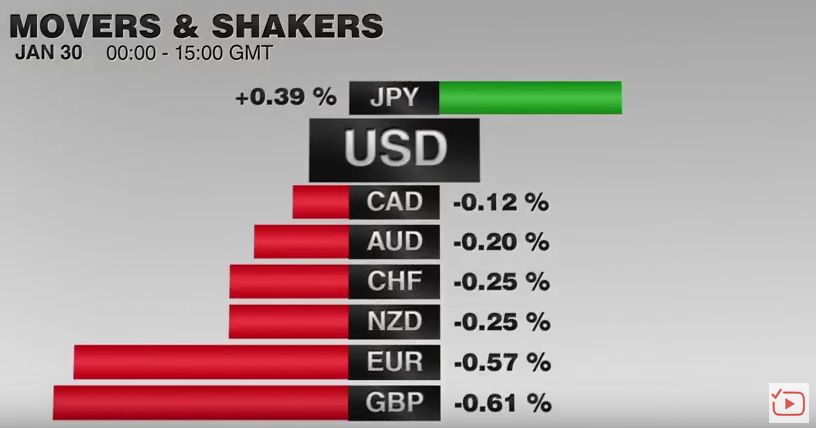

FX Daily, January 30: Dollar and Bonds Stabilize; Equities not Yet

The US dollar is paring yesterday's gains, and the 10-year Treasury yield has slipped back below the 2.70% level after pushing 2.73% briefly. European bonds have also eased, with yields one-two basis points lower. It is thus far a mild Turn Around Tuesday but suggests that the market psychology that has driven the dollar lower and yields higher persistently since mid-December have not been broken.

Read More »

Read More »

FX Daily, November 29: Sterling Charges Ahead on Brexit Hopes

Prospects of a deal with the EU has sent sterling to its best level in two months against the dollar. It reached $1.3430 in early European turnover. It had sunk to nearly $1.3220 yesterday as European markets were closing, which was a four-day low. It is the strongest of the major currencies today, gaining about 0.4%. With today's gains has met our retracement target near $1.3415. The momentum appears to give it potential toward $1.3500 in the...

Read More »

Read More »

FX Daily, October 30: Dollar Slips in Consolidative Activity

The markets are mixed, mostly responding to idiosyncratic developments, as the week's large events loom ahead. These BOJ, BOE, and FOMC meetings, eurozone flash CPI and US jobs reports. In addition, US President Trump is expected to announce his nomination of the next Fed chair, and the initial House tax bill will be unveiled.

Read More »

Read More »

FX Daily, September 29: Dollar’s Gains Pared, but Set to Snap Six Month Losing Streak Against the Euro

Supported by a sharp rise in interest rates and ideas of tax reform, the US dollar is closing one of its best months of the year. The Dollar Index is snapping a six-month decline, and the euro's monthly advance since February is ending. This month, the US 10-year yield has risen 18 bp, and the two-year yield has risen 13 bp. It is the biggest increase since last November.

Read More »

Read More »

FX Daily, August 30: US Dollar Recovery Extended

The US dollar recovery that began in North American yesterday continued to in Asia and Europe. The geopolitical anxiety sparked by North Korea's missile over Japan subsided. The US response was seen as measured and tempered.

Read More »

Read More »

FX Daily, June 29: Run on Dollar and Yen Continues

The main driver of the foreign exchange market is the continued reassessment of the trajectory of monetary policy in the UK, EMU, and Canada. The OIS market does not show that higher rates are discounted for the next policy meeting (August, September, and July respectively), but rather there is greater confidence that, outside of Japan, peak monetary stimulus is behind us.

Read More »

Read More »

FX Daily, May 30: Mixed Dollar as Market Awaits Preliminary EMU CPI and US Jobs

With the backdrop of US interest rates unable to get much traction, despite the strong probability of another Fed rate hike in a couple of weeks, the third since last November election, the US dollar mixed today. The chief story today, though, is not the greenback but the euro. The euro is trading heavily for the fourth session.

Read More »

Read More »

FX Daily, April 28: Markets Limp into Month End

Equity markets are stalling into the end of the month. MSCI Asia-Pacific Index is snapping a six-day advance, and the week's gain was sufficient to extend the advancing streak for the fourth consecutive month. The Dow Jones Stoxx 600 is trading off for the second consecutive session, after rallying for six consecutive sessions.

Read More »

Read More »

FX Daily, February 28: Markets Little Changed as Breakout is Awaited

The capital markets are becalmed, and the US dollar is in narrow trading ranges. Month-end considerations are at work, but the key event is much-awaited speech US President Trump to a joint session of Congress this evening (early Wednesday in Asia). The hope is that he provides the policy signals that allow the dollar to break out of its recent ranges.

Read More »

Read More »

FX Daily, January 30: EUR/CHF falls further to 1.650

The EUR/CHF collapsed once again to 1.0650. This rate broke the 1.0680 - 1.0700 that constituted the previous intervention area.

Reasons can be found in the weak U.S. GDP weak, in Trump's foreign trade policy and in the strong Swiss trade balance.

Read More »

Read More »