Tag Archive: Italy Services PMI

The Service PMI release is published monthly by Markit Economics. The data are based on surveys of over 400 executives in private sector service companies. The surveys cover transport and communication, financial intermediaries, business and personal services, computing & IT, hotels and restaurants.

FX Daily, March 05: Italian Election Weighs on Italian Assets, but Little Systemic Risk Seen

The US dollar is narrowly mixed. The Japanese yen remains firm. The dollar appears stuck in a narrow range. Near JPY105.20 the seems to be some short-covering pressure in front of JPY105. On the top side, the greenback is encountering offers in front of JPY105.80. Sterling is firm against the dollar as it recovers against the euro. Before the weekend, the euro reached GBP0.8950, its best levels since last November. The euro is testing GBP0.8900...

Read More »

Read More »

FX Daily, February 05: Dollar Consolidates while Equity Rout may be Ebbing

Asian equity markets were weighed down by losses in the US markets ahead of the weekend. The MSCI Asia Pacific Index was off 1.4% after the 1.0% pre-weekend loss. The Nikkei gapped lower and shed 2.5% and has fallen in eight of the past nine sessions. The notable exception in Asia was the Shanghai Composite. The 0.75% was led by the financial sector amid talk that a report later this week will show a strong jump in yuan lending from banks, which...

Read More »

Read More »

FX Daily, January 04: Greenback Continues to Consolidate Recent Losses

The US dollar is sporting a softer profile across the board, though remaining largely in the ranges seen over the past couple of sessions. At the same time, the news stream suggests that the global synchronized growth cycle strengthened late last year and is bound to carry over into the New Year.

Read More »

Read More »

FX Daily, December 05: Sterling Sold on Negotiating Snafu, Aussie Bounces on Retail Sales and RBA

The US dollar is confined to narrow ranges against the euro and yen, straddling unchanged levels in the Asian session and the European morning. The action in elsewhere. The British pound is the weakest of the majors, paring 0.4% against the greenback, though around $1.3425, it can hardly be considered weak. A month ago, sterling was a few cents lower. Still, its gains reflected two things: broader dollar weakness and optimism on Brexit talks.

Read More »

Read More »

FX Daily, September 5: Greenback Mixed, North Korea and PMIs in Focus

Reports suggesting that North Korea is moving an ICBM missile toward launch pad in the western part of the country at night to minimize detection, while South Korea is escalating its military preparedness and the US seeks new sanctions, keep investors on edge. Risk assets are mixed. Gold is slightly lower. While the yen is stronger, the Swiss franc is heavier. Asia equities slipped, and European shares are recouping much of yesterday's 0.5% loss.

Read More »

Read More »

FX Daily, August 03: Dollar-Bloc Currencies Turning, but Euro Downticks Limited

The high-flying dollar-bloc currencies may be a preliminary sign market change. The US dollar is gaining on the Canadian dollar for the fourth consecutive session. It is probing resistance we identified in the $1.2620 area. The US dollar has not traded above its 20-day moving average since the Fed hiked rates on June 14. It is found today near CAD1.2625.

Read More »

Read More »

FX Daily, July 05: Dollar Firm as Investors Await Fresh Directional Cues

The US dollar is enjoying a firm tone today. Yesterday's two weakest major currencies, the Australian dollar and Swedish krona are the strongest currencies, but little changed on the session. After a strong rebound in the greenback to start the week, it mostly consolidated yesterday.

Read More »

Read More »

Euro Shrugs off European Banking Woes

Spain's Banco Popular is scrambling ahead of its meeting with the ECB tomorrow; shares are around 50% in three sessions. Italy has two banks that may see the same deal Monte Paschi negotiated with the EU. Portugal banks are still putting loan loss reserves and provisions aside.

Read More »

Read More »

FX Daily, June 05: US Dollar Starts Important Week Mostly Stable to Higher

The US dollar is beginning what promises to be an important week on a steady to firmer note against most of the major currencies. It is a holiday in parts of Europe (e.g.,m Germany and Switzerland). Although excitement is not until Thursday's ECB meeting, UK election, and the testimony of former US FBI Director Comey, there are several developments today to note.

Read More »

Read More »

FX Daily, March 03: Yellen and Jobs Report Last Two Hurdles to US Hike

The US dollar is narrowly mixed as Yellen's speech in Chicago is awaited. The greenback's three-day advance against the euro and four-day advance against the yen is at risk. The dollar-bloc currencies, where speculators in the futures market had gone net long, continue to underperform.

Read More »

Read More »

FX Daily, December 05: Dollar Comes Back Bid, but Still Vulnerable to Corrective Pressures

After softening ahead of the weekend, the US dollar has begun the new week on a firm note. It is gaining against most major and emerging market currencies. Outside of what appears to be a staged call between US President Elect Trump and the Taiwanese President, the developments in Europe grabbed the markets' attention. Austria turned back the populist right Freedom Party's bid for the presidency. The Freedom Party does not appear to have carried...

Read More »

Read More »

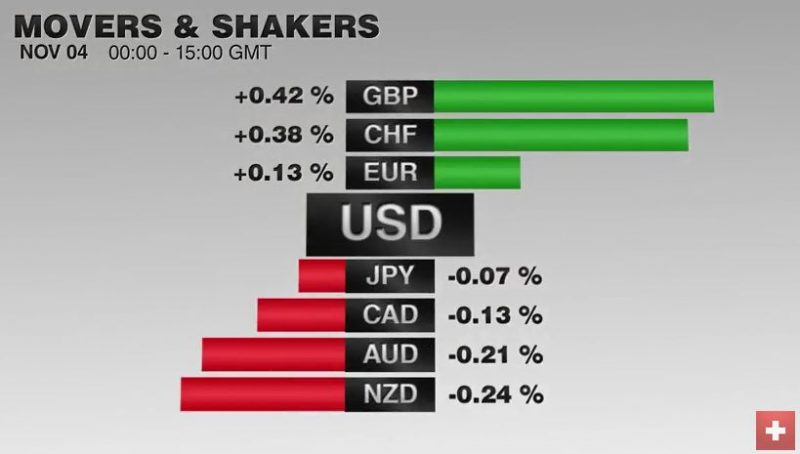

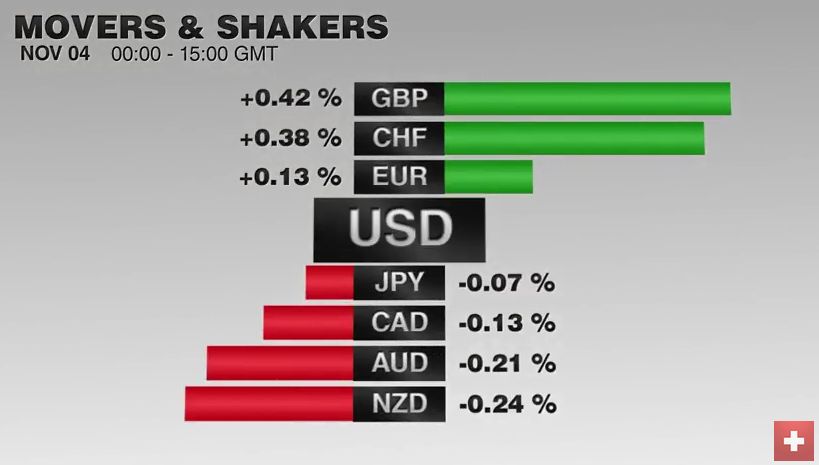

FX Daily, November 04: US Jobs Figures: Another Time the Swiss Franc Strengthens

With the not convincing U.S. jobs number, both the EUR and, in particular, the Swiss Franc could improve. With continuing political uncertainty in the U.S., more speculators closed their short CHF positions

Read More »

Read More »

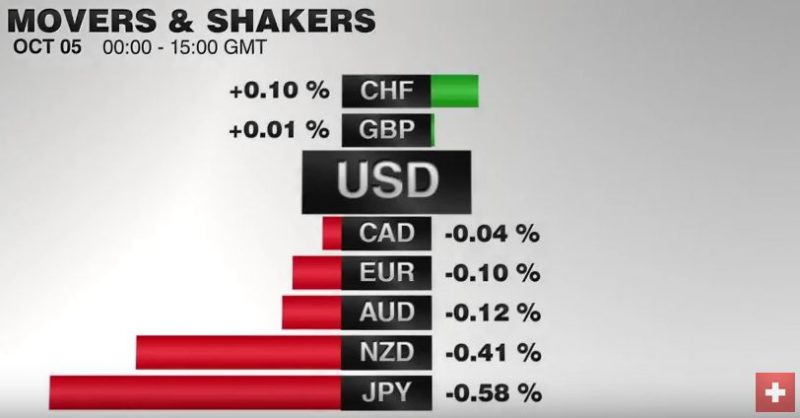

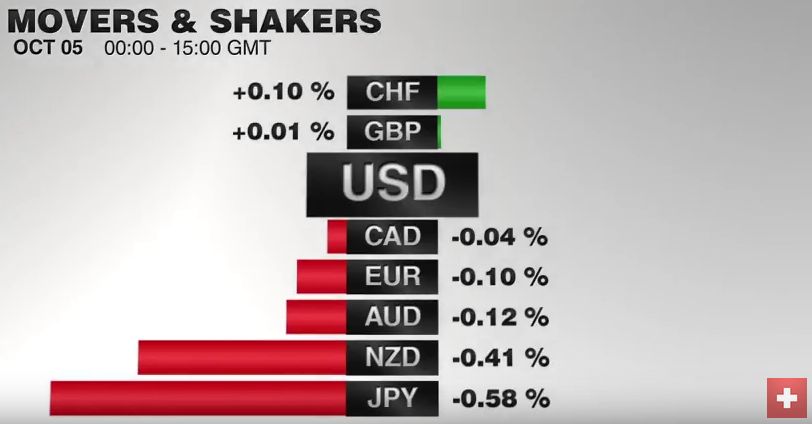

FX Daily, October 05: Euro Remains Firm Despite Dubious Tapering Story

After the sudden rise to 1.0973 the EUR/CHF is falling again. The volatiliy is related to the CHF speculative postion, that suddenly was Short CHF. Traders that moved with the SNB Window Dressing for Q3 are closing their shorts again.

Read More »

Read More »

FX Daily, September 5: While Americans were Celebrating Labor Day

There were several developments that took place while US markets were closed for its Labor Day holiday. Most of the economic news was favorable. This included a strong snap back in the UK service PMI, more evidence that the moral suasion campaign to lift wages in Japan is yielding some success and a rise in the Caixin's China's service PMI.

Read More »

Read More »

FX Daily, August 03: Consolidation Featured

The US dollar is consolidating yesterday's losses. The greenback's upticks have thus far been shallow and unimpressive, except perhaps against the New Zealand dollar, which is off 0.8% ahead of next week's RBNZ meeting. Softer than expected labor cost increase reinforces the conviction that a 25 bp rate cut will be delivered next week.

Read More »

Read More »

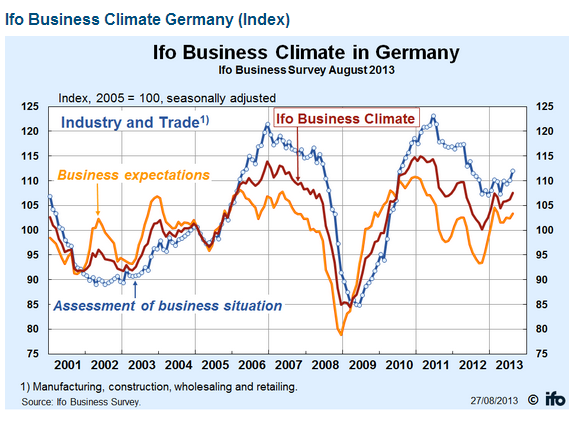

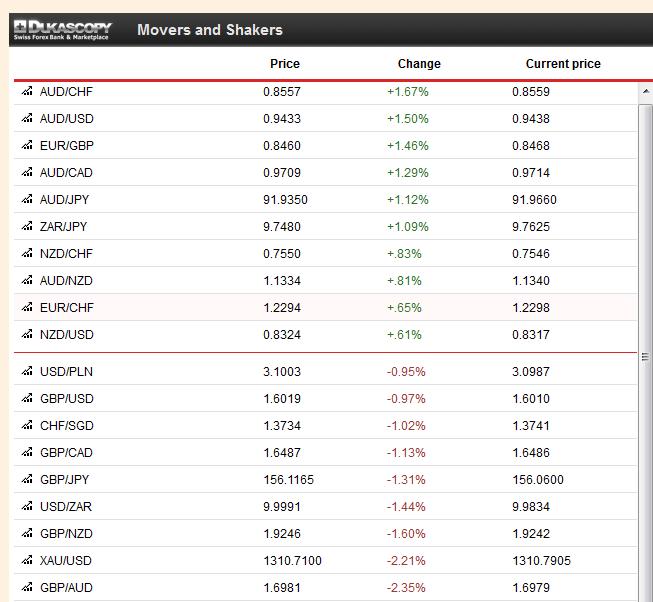

Fundamentals, Gold and FX Movements, Week September 30 to October 4

Our weekly summary of fundamental news on FX that aims to explains price movements, with particular emphasis on the possibly biggest mysteries: the gold price (GLD) and the Swiss franc (FXF) . The clear winner of the week was the Aussie, supported by a positive PMI and positive news from the RBA. In the previous …

Read More »

Read More »