Tag Archive: gbp-chf

FX Daily, March 10: US Jobs Data: Deja Vu All Over Again?

A week ago, after nine Fed officials had spoken, the market widely expected Yellen and Fischer to confirm that the table was set for a rate hike later this month. They did, and the dollar and US interest rates fell. Now, after a strong ADP jobs report (298k), everyone recognizes upside risk to today’s national report, and the dollar has lost its upside momentum against most major currencies, but the Japanese yen.

Read More »

Read More »

FX Daily, March 09: Pre-ECB Squaring Lifts Euro in a Strong USD Context

The euro tested the lower of its range near $1.05 in Asia before short covering in Europe lifted back toward yesterday's highs near $1.0575. However, buoyed by the upside surprise in the ADP estimate of private sector jobs growth, the dollar is firmer against most other currencies today. The US 10-year yield is up 20 bp this week.

Read More »

Read More »

FX Daily, March 08: Dollar Bid as Rates Firm

The US dollar is moving higher against nearly all the other major foreign currencies today. As far as we can tell, the driving force remains interested rate considerations. US rates are rising in absolute terms and about Europe and Japan. The US 10-year yield is moving above the downtrend that has been in place since the day after the Fed hiked rates last December.

Read More »

Read More »

FX Daily, March 07: Greenback Continues to Recover from the Late Pre-Weekend Slide

The US dollar has continued to recover from the slide on what still largely appears to have been a buy the rumor sell the fact response to Yellen's speech just before last weekend. Yellen was the last of around 11 Fed officials that spoke last week, and nearly all but Bullard signaled readiness to hike rates at next month's meeting.

Read More »

Read More »

FX Daily, March 03: Yellen and Jobs Report Last Two Hurdles to US Hike

The US dollar is narrowly mixed as Yellen's speech in Chicago is awaited. The greenback's three-day advance against the euro and four-day advance against the yen is at risk. The dollar-bloc currencies, where speculators in the futures market had gone net long, continue to underperform.

Read More »

Read More »

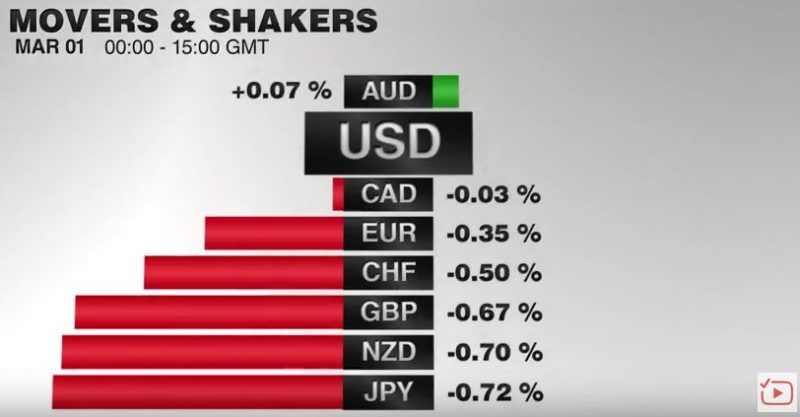

FX Daily, March 01: Greenback Bounces, More Fed than Trump

The much-anticipated speech by US President Trump was light on the details that investors interested in, like the tax reform, infrastructure initiative, and deregulation. There appears to be an agreement to repeal the national healthcare, but there is no consensus on its replacement.

Read More »

Read More »

FX Daily, February 28: Markets Little Changed as Breakout is Awaited

The capital markets are becalmed, and the US dollar is in narrow trading ranges. Month-end considerations are at work, but the key event is much-awaited speech US President Trump to a joint session of Congress this evening (early Wednesday in Asia). The hope is that he provides the policy signals that allow the dollar to break out of its recent ranges.

Read More »

Read More »

FX Daily, February 23: Dollar Chops About, as “Fairly Soon” Does not Mean mid-March

The US dollar is confined to narrow ranges today within yesterday's ranges. Equity markets posted small gains in Asia and have an upside bias in Europe. Core bond yields are softer, and today this includes France, but peripheral European 10-year benchmark yields are 3-6 bp firmer. Italian bonds are the poorest performer, while the 10-year Dutch bond yields are off the most (3.2 bp to 0.56%) despite the looming election.

Read More »

Read More »

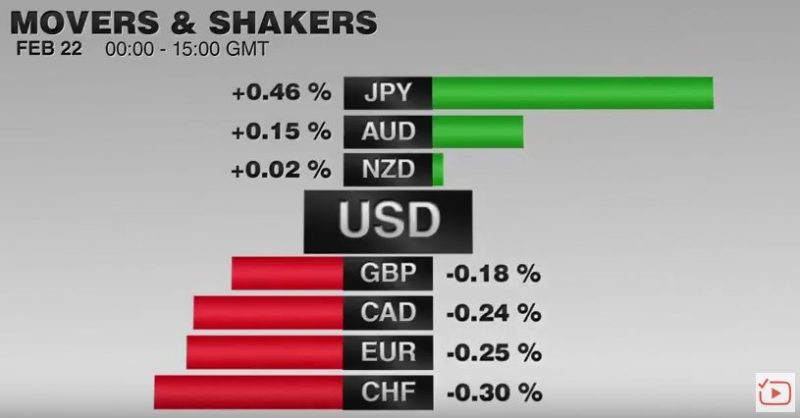

FX Daily, February 22: Euro Meltdown Continues

February has been cruel to the euro. Of the sixteen sessions this month, counting today, the euro has risen in four, and two of those were last week. Its new four-day slide pushed it below $1.05 for the first time in six weeks as European markets were opening. The $1.0560 area that was broken yesterday, and provided a cap today is 61.8% retracement objective of last month's rally.

Read More »

Read More »

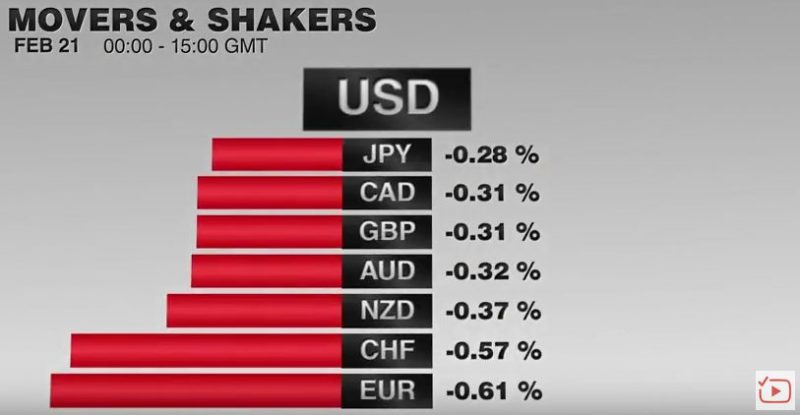

FX Daily, February 21: Dollar Bounces Back

Some profit-taking in the middle of last week pushed the dollar lower and gave rise in some quarters that the run was over. However, the greenback has come back the bid. It is gaining against all the major currencies today and most of the emerging market currencies.

Read More »

Read More »

FX Daily, February 16: Corrective Forces Emerge, Tempering the Dollar’s Rally

The Dollar Index had moved higher for ten consecutive sessions before reversing yesterday's gains to close lower. Yesterday and today's losses have seen the Dollar Index retrace 38.2% of the advance since February 2. That retracement objective was near 100.80. The 50% retracement is found near 100.50 and the 61.8% retracement by 100.20.

Read More »

Read More »

FX Daily, February 15: Yellen Helps the Dollar Extend Streak

The Dollar Index's ten-day rally was at risk yesterday, but Yellen's reiteration of the commitment to continue to lift rates gradually helped extend the streak to eleven sessions.This surpassed the streak around the election (November 7-November 18). With today's gains, it may draw closer to what appears to be the long streak, 14 sessions between April 30, 2012 and May 17.

Read More »

Read More »

FX Daily, February 14: Markets Showing Little Love on Valentines

Corrective pressures are gripping the major capital markets today.The Dollar Index's nine-day advancing streak is being threatened by the position adjustment ahead of Yellen's testimony later today. Despite record high closes in the main US equity markets yesterday, Asia could not follow suit. It tried to initially, and recorded new highs since July 2015, but sellers emerged and the MSCI Asia Pacific Index closed marginally lower on the lows of the...

Read More »

Read More »

FX Daily, February 13: Quiet Start of Busy Week

With inflation and growth reports due out this week and Federal Reserve Chair Yellen's testimony before Congress, it promises to be a busy week for investors. However, the week has begun off fairly quietly, while the recent rally in equities continues.

Read More »

Read More »

FX Daily, February 10: US Dollar Holding on to Week’s Gains

The US dollar is about 12 hours away from gaining against all the major currencies this week. The main talking points today remain Trump-centric. The US dollar is mixed as European trading gets underway. Of note the dollar is continuing to gain on the yen. The yen is off 0.4%, which is nearly half the week's decline. The Aussie is the strongest on the day, up about 0.2% to trim the week's loss to about 0.45%.

Read More »

Read More »

FX Daily, February 09: Dollar Bounce in Asia is Sold in the European Morning

The US dollar is firmer against most of the major currencies in fairly quiet Asian turnover, but is seeing those gains pared in early Europe. The highlights include the RBNZ meeting that left rates on hold, as widely expected. The concern about the strength of the Kiwi saw the market reduce the perceived likelihood of a rate hike. NZD came off.

Read More »

Read More »

FX Daily, February 08: EUR/CHF down to 1.630, Swiss Boom Starting?

The reader might have seen the latest Swiss Consumer Sentiment and the UBS consumption indicator. They suggest that the Swiss boom phase should finally come.

I anticipated the boom already in my slides for the CFA Society. The Swiss boom was postponed when the SNB decided to remove the euro peg in early 2015.

Read More »

Read More »

FX Daily, February 02: Dollar Remains on Back Foot After ADP and FOMC

The US dollar remains on its back foot despite the stronger than expected ADP job estimate and the FOMC that said nothing to dissuade investors that it will be gradually raising rates this year.

Read More »

Read More »

FX Daily, 01 February: Markets Stabilize, Investors Await Signals from US data and FOMC, and POTUS

(commentary will be sporadic for the next couple of weeks during a European business trip) The US dollar is consolidating yesterday's losses that were spurred speculation that the US was abandoning the more than 20-year old strong dollar policy. The meaning of that policy was clear to global investors even if it was often parodied.

Read More »

Read More »

FX Daily, January 27: Week Ending on Mixed Note as Year of Rooster Begins

The Lunar New Year celebration thinned participation in Asia, where several centers are closed. Although the MSCI Asia Pacific Index slipped slightly, it rose 1.5% on the week, the fourth weekly gain in the past five weeks. The Nikkei advanced 0.35%, the third rise in a row. The 1.75% gain for the week snaps a two-week decline.

Read More »

Read More »