Tag Archive: Featured

FX Daily, August 24: Markets Prove Resilient to Start New Week

New virus outbreaks in Europe and Asia are not adversely impacting the capital markets today. Global equities are firmer. Some reports suggesting the US ban on WeChat may not be as broad as initially signaled helped lift Hong Kong shares, but nearly all the markets in the region traded higher.

Read More »

Read More »

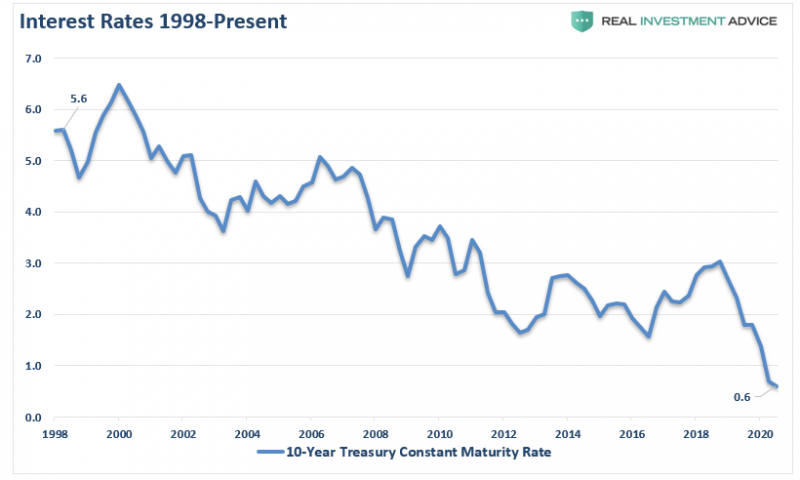

The 4.0 percent Rule Is Dead. What Should Retirees Do Now?

The 4% Rule Is Dead. A recent article by Shawn Langlois via MarketWatch pointed out this sobering fact but is one we have discussed previously. Retirees have long counted on being able to retire on their assets and take out 4% each year. However, a little more than 20-years later, the “death of the withdrawal rate” has arrived. What should retirees do now?

Read More »

Read More »

Unemployment up in second quarter of 2020 in Switzerland

Switzerland’s unemployment rate rose from 4.2% to 4.6% in the second quarter of 2020, according to a recent survey that measures unemployment more broadly than Switzerland’s official unemployment measure. The method used for these calculations is the one defined by the International Labour Organisation (ILO), which includes all available job seekers – ILO definition of unemployment.

Read More »

Read More »

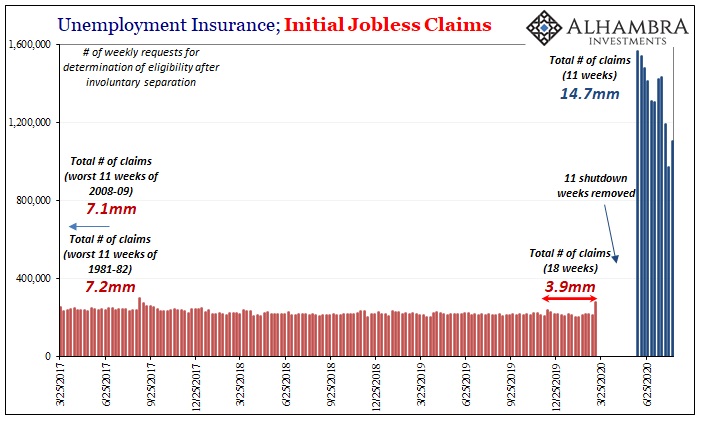

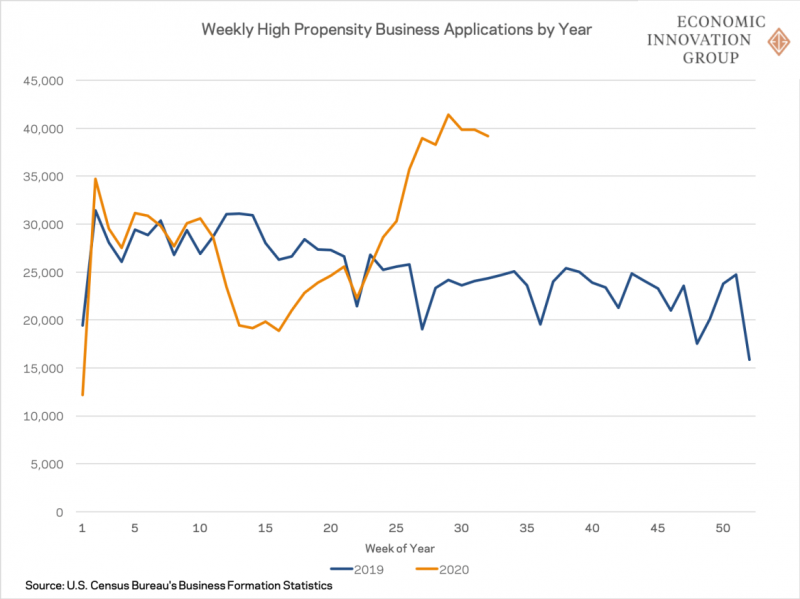

*These* Are The Real Huge Jobs Numbers, And They Will Make Your Blood Run Cold

There is simply no way to spin these figures as anything good. Not just the usual ones were talking about here, but more so some new data that you probably haven’t seen before. Beginning with the regular, it doesn’t matter that the level of initial jobless claims has declined substantially over the past few weeks

Read More »

Read More »

Was Mises a Fascist? Obviously Not.

Every once in a while, Mises is accused of having been a fascist by slanderers who are either ignorant or acting in bad faith—or even both.

Read More »

Read More »

Shoppers in Basel must wear face masks to reduce Covid-19 risks

Basel City has become the first German-speaking canton to require customers to wear face masks in shops to combat the spread of the coronavirus.

Read More »

Read More »

Anti-corona protest planned later this month in Zurich

After protests in May 2020, an eclectic group of anti-corona protestors is planning to protest against vaccines, masks and other measures aimed at limiting the spread of the virus on 29 August 2020 in Zurich, according to the newspaper Le Matin.

Read More »

Read More »

Will Skilled Hands-On Labor Finally Become More Valuable?

The sands beneath what's scarce and what's over-abundant are shifting. On a recent visit to the welding shop where my niece's husband works, I asked him if they had enough welders for their workload.

Read More »

Read More »

The Failed Dream of a Laissez-Faire Monarch

One problem that any laissez-faire liberal thinker must face is: Granted that government interference should be minimal, what form should that government take? Who shall govern?

Read More »

Read More »

Coronavirus: a quarter of Swiss employees don’t want to be vaccinated, suggests survey

A survey run by the Bern University of Applied Sciences on behalf of the trade union Travail suisse suggests a significant portion of Switzerland’s workforce does not want to be vaccinated against the SARS-CoV-2 virus, reports the newspaper 20 Minutes.

Read More »

Read More »

How do you separate the good companies from the bad apples?

Our regular analysis of what the biggest global companies in Switzerland are up to. This week: dubious gold origins, luxury watch straps, and vaccine deals. Gold refineries are under scrutiny for sourcing gold from Dubai traders with questionable ties to illegal mines in Africa. But is it fair to lump all refineries into one basket of bad apples?

Read More »

Read More »

Monthly Macro Monitor – August 2020

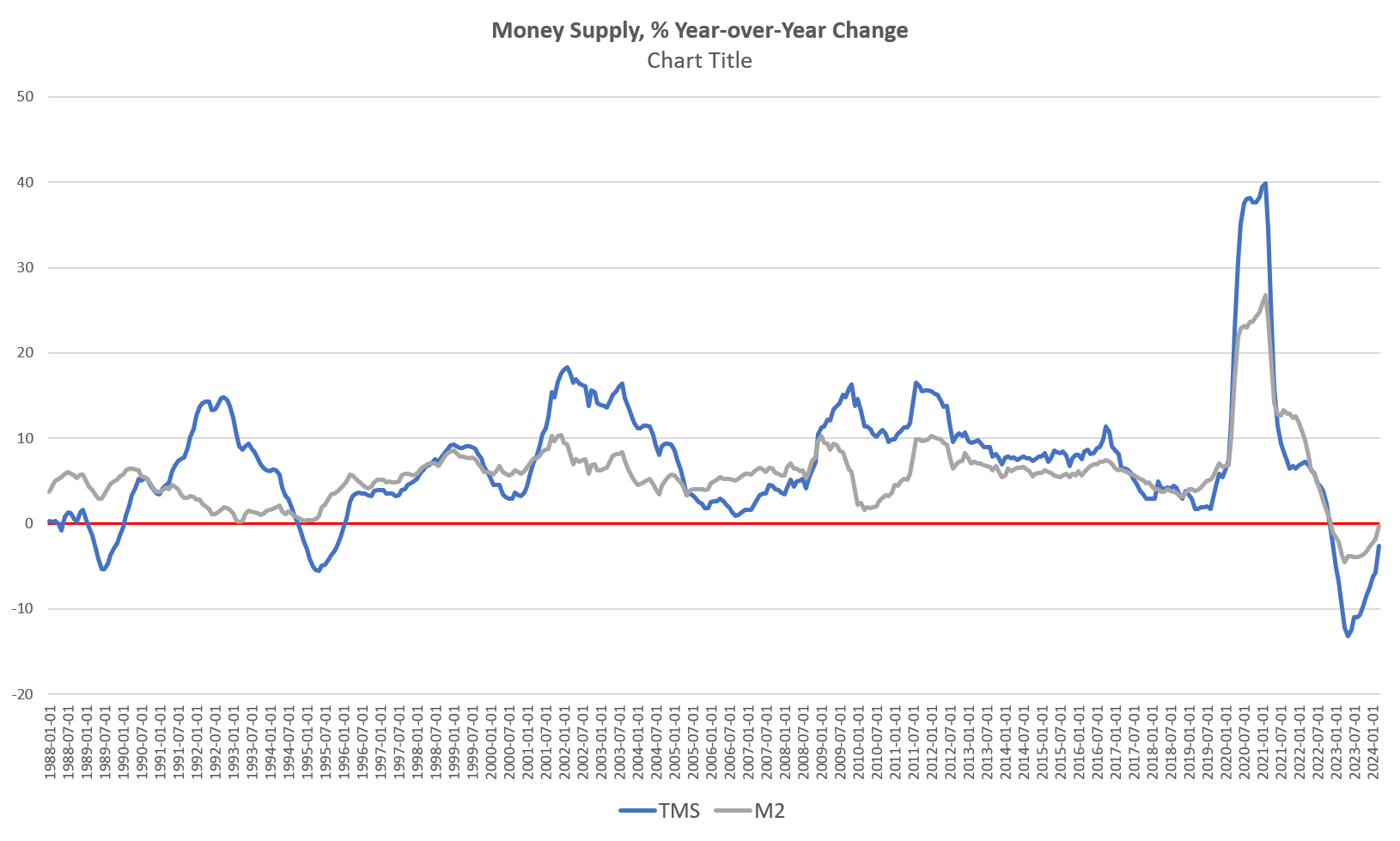

One of the advantages we enjoy here at Alhambra is the opportunity to interact with a lot of investors. We talk to hundreds of individual investors on a monthly basis, giving us a front-row seat to everyone’s fear and greed. Economic data tells us about the past, which isn’t particularly useful for investors focused on the future.

Read More »

Read More »

How the Lockdowns Will Drive Up Healthcare Costs

The covid-19 lockdowns have done untold amounts of economic damage, most of which has yet to reveal itself. Permanent unemployment for millions, countless bankruptcies, rent defaults and much more will jar the economy for the foreseeable future.

Read More »

Read More »

FX Daily, August 21: PMIs Shake Investor Confidence

The second disappointing Fed manufacturing survey report and an unexpected rise in weekly jobless claims helped reverse the disappointment over the FOMC minutes. Bonds and stocks rallied--not on good macroeconomic news, but the opposite, which underscores the likelihood of more support for longer.

Read More »

Read More »

U.S. dollar liquidity-providing operations from 1 September 2020

In view of continuing improvements in U.S. dollar funding conditions and the low demand at recent 7-day maturity U.S. dollar liquidity-providing operations, the Bank of England, the Bank of Japan, the European Central Bank and the Swiss National Bank, in consultation with the Federal Reserve, have jointly decided to further reduce the frequency of their 7-day operations from three times per week to once per week.

Read More »

Read More »

Part 2 of June TIC: The Dollar Why

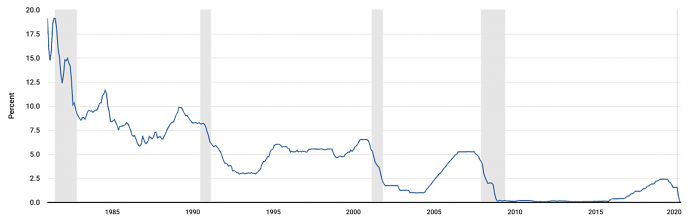

Before getting into the why of the dollar’s stubbornly high exchange value in the face of so much “money printing”, we need to first go back and undertake a decent enough review of the guts maybe even the central focus of the global (euro)dollar system.

Read More »

Read More »

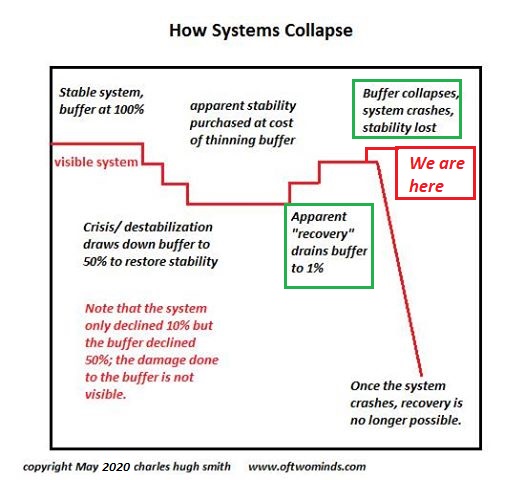

Our Systemic Drift to Collapse

Thus do the lazy complacent passengers drift inexorably toward the cataracts of collapse just ahead. The boat ride down to the waterfall of systemic collapse is not dramatic, it's lazy drifting: a lazy complacency that doing more of what worked in the past will work again, and an equally lazy disregard for how far the system has drifted from the point when things actually worked.

Read More »

Read More »

Where Has All the Carry Gone?

Despite broad-based dollar weakness, EM currencies have not fully participated in the risk on environment that’s now in place. The good news is that fundamentals matter again. The bad news is that there are a lot of EM countries with bad fundamentals, and the secular decline in carry no longer gives these weaklings any cover.

Read More »

Read More »

As the Bubble Slowly Pops, the Economic Chain Reaction Is Now in Progress

Much has been written about the economic consequences of covid-19, yet, just as in many of the analyses of the Great Depression and the 2008 crisis, the years of accumulating debt preceding the event do not attract the attention they deserve.

Read More »

Read More »

Calculating GDP Correctly

There are many reasons we should be skeptical of the GDP statistic. But it is nonetheless important to understand how it is calculated.

Read More »

Read More »