Tag Archive: Featured

FX Daily, August 10: Monday in August

Overview: The new week has begun slowly with Singapore and Tokyo markets closed for national holidays. The MSCI Asia Pacific Index rose 2% last week and edged higher today, led by 1.5%-1.7% rallies in South Korea and Australia. Hong Kong was a notable exception and eased around 0.6%.

Read More »

Read More »

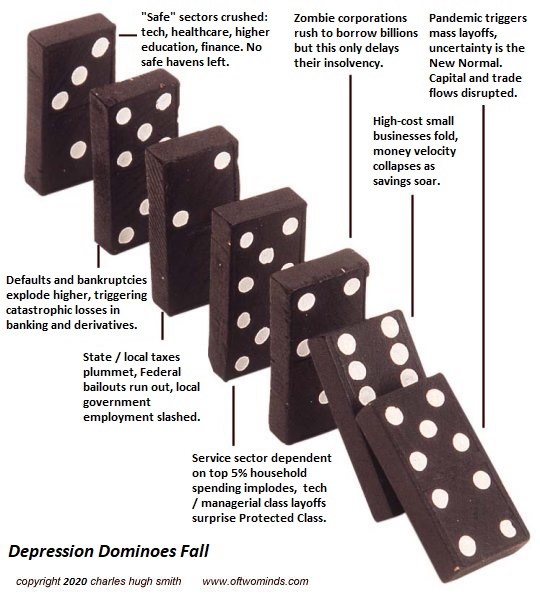

The Economy Is Mortally Wounded

A fully financialized, totally debt and speculation-dependent economy is terminal once leverage and debt stop expanding exponentially. We all know the movie scene in which the character is wounded but dismisses it as no big deal, and then lurches into the closing sequence where we discover the wound was not inconsequential, it was mortal, and the character expires.

Read More »

Read More »

House View, August 2020

We have revised up our euro area GDP forecast for 2020 to -8.5%, mainly due to improving data in Germany, which is better positioned to recover rapidly from the downturn than its European peers. Meanwhile, the US economy has shown signs of flatlining amid escalating covid-19 cases in the South. Consumer confidence has taken a hit, while weekly unemployment claims have been rising again.

Read More »

Read More »

The Ant and the Grasshopper: A Window into Macro Part II

Regardless of the dollar's role and function in the world economy and the halls of finance, in the near and intermediate terms, investors and businesses are more concerned with foreign exchange prices. The greenback has fallen out of favor. Its main supports, like wide interest rate differentials, favorable growth differentials, and political certainty if not stability, have weakened.

Read More »

Read More »

Why Fed Bugs Really, Really Hate Gold

Judy Shelton, a Trump nominee to the Fed Board of Governors, may not have coined the excellent term "Fed Bug," but she used it to delicious effect in this 2019 Financial Times interview:

“People call me a goldbug, and I think, well, what does that make them? A Fed bug,” she says.

Read More »

Read More »

EM Preview for the Week Ahead

The dollar got some traction against the majors towards the end of last week. This weighed on EM FX, with the high best currencies TRY, BRL, CLP, and ZAR leading the losers. We downplay risk of contagion from Turkey, but we acknowledge it will keep investors wary of the countries with poor fundamentals.

Read More »

Read More »

Coronavirus: Swiss health authority adds pregnant women to risk list

After a number of recent studies that suggest pregnant women are exposed to higher risks from the SARS-CoV-2 virus, Switzerland’s Federal Office of Public Health (FOPH) adds them to the list of people vulnerable to Covid-19. The FOPH reached its recent conclusion based on discussions with the Swiss society of gynecology and obstetrics. The society sets out the findings of a number of studies in a report.

Read More »

Read More »

If the “Market” Never Goes Down, The System Is Doomed

"Markets" that never go down aren't markets, they're signaling mechanisms of the Powers That Be. Markets are fundamentally clearing houses of information on price, demand, sentiment, expectations and so on--factual data on supply and demand, shipping costs, cost of credit, etc.--and reflections of trader and consumer emotions and psychology.

Read More »

Read More »

Coronavirus: new cases in Switzerland remain at last week’s level

In the seven days to 7 August 2020, the reported number of new SARS-CoV-2 infections recorded in Switzerland was 1037, roughly the same as the 1,078 cases recorded the week before. Over the weeks prior to this there were 772 and 692 new cases, according to worldinfometer.com.

Read More »

Read More »

Shoe V arning

It’s no wonder we’re obsessed with shoes these days. Even the V-people, as I’ll call them, keep one wary eye glued looking behind them. Survivor’s euphoria means a lot of potentially bad things, only beginning with a false sense of survivor-hood.

Read More »

Read More »

FX Daily, August 07: Position Adjustment Dominates ahead of US/Canada Employment Reports

Escalating dramas may be behind the position adjustment today ahead of the US jobs data. The US and China feud expanded beyond Tiktok to WeChat, and efforts to tighten disclosure rules for Chinese companies listed in the US are nearing. The negotiations between the White House and the Democrats broke down, preventing or at least delaying additional stimulus.

Read More »

Read More »

Wann darf ich mehr als 2 ETFs im Depot haben?

Per möchte wissen: Ab wann ist mein Depot so groß, dass ich mehr als nur die Kombi MSCI World / MSCI Emerging Markets besparen kann?

Viele Zeilen im Depot = Diversifikation

Hm, der Finanzwesir hat eine klare Meinung dazu.

Bonus-Meinung: Der Finanzwesir weiß, was Dr. Gerd Kommer von vielen Zeilen im Depot hält und sagt es auch. In diesem Clip!

**Mehr vom Finanzwesir**

- Blog: https://www.finanzwesir.com

- Buch:...

Read More »

Read More »

Swiss International Air Lines’ turnover halved due to coronavirus

The economic repercussions of the coronavirus have caused turnover at SWISS to fall by 55% in the first half of 2020. With a turnover of CHF1.17 billion ($1.28 billion) between January and the end of June, the carrier suffered an operating loss of CHF266.4 million in the first half of the year, following an operating profit of CHF245.3 million a year earlier.

Read More »

Read More »

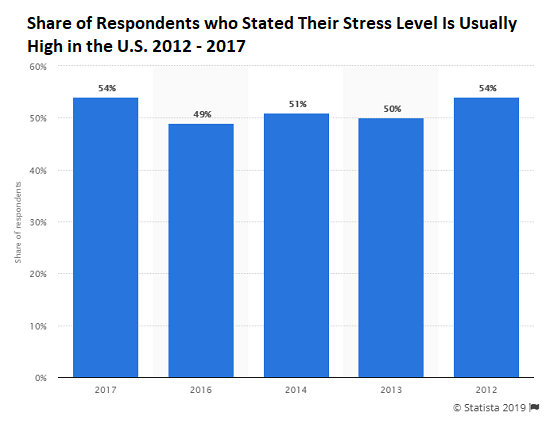

The Bogus “Recovery,” Stress and Burnout

We have three basic ways to counter the destructive consequences of stress.We have all experienced the disorientation and "brain freeze" that stress triggers. The pandemic and the responses to the pandemic have been continuous sources of stress, i.e. chronic stress, which is the pathway to burnout, the collapse of our ability to cope with the burdens pressing on us.

Read More »

Read More »

FX Daily, August 06: Markets Consolidate

The Australian dollar powered to marginal news highs for the year as the move against the US dollar continued yesterday. The euro stopped a few hundredths of a cent below the high seen at the end of last week. However, neither sustained the upside momentum and have come back offered today.

Read More »

Read More »

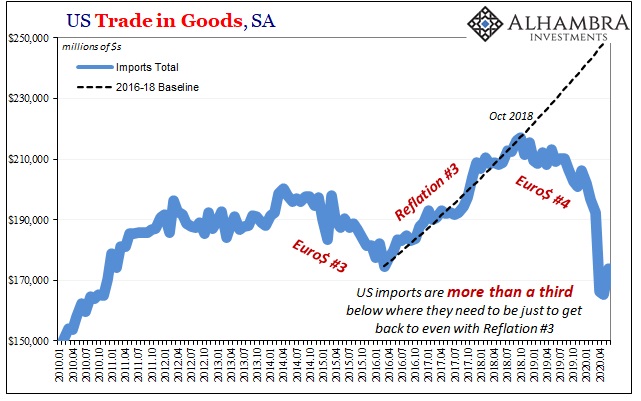

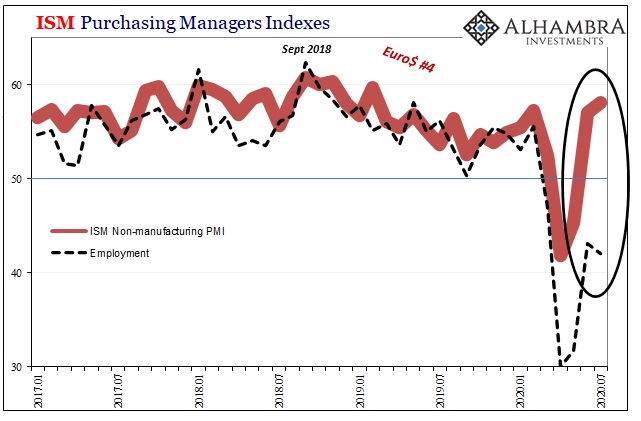

Purchasing Managers Indigestion

There’s already doubt given how the two major series supposedly measuring the same thing seemingly can’t agree. If the rebound was truly robust, it would show up unambiguously everywhere. But IHS Markit’s purchasing managers indices struggled to get back above 50 in July, barely getting there, suggesting the economy might be slowing or even stalling way too close to the bottom.

Read More »

Read More »

FragDichReich! Das neue Online Format | Ausgabe 1

FragDichReich! Das neue Online Format | Ausgabe 1. In diesem Format beantworte Ich eure Börsen und Finanz orientierten Fragen in einem Online Seminar.

Intro: (00:00)

Über Mich: (00:48)

Können Sie grundsätzlich etwas zu Indikatoren Sagen?: (01:15)

Können Sie etwas zu Sell sagen?: (03:23)

Was ist ein Take-Profit? (04:44)

Was sagst du zu keine Positionen vor Unternehmenszahlen die veröffentlicht werden?: (06:49)

Was bedeutet das 6 Phasen Modell:...

Read More »

Read More »

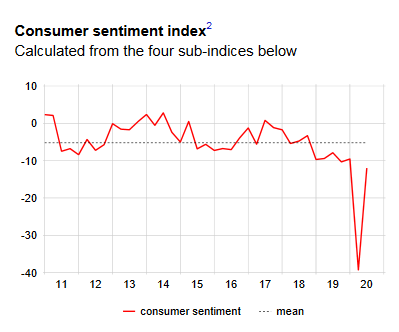

Swiss Consumer sentiment makes a strong recovery but remains below average

Consumer sentiment in Switzerland has largely recovered from its slump in April. Expectations regarding general economic development have improved, but those regarding the labour market remain very negative. Accordingly, respondents believe that now is not a good time to make major purchases.

Read More »

Read More »

Switzerland’s dark business with Ukrainian coal

Pro-Russian separatists are financing their war in Ukraine with coal deliveries to the West. Now the role of Swiss companies in Zug and Geneva is being investigated, according to a report in the SonntagsZeitung.

Read More »

Read More »

Why Keynes Was Wrong about Consumer Spending

As a result of the coronavirus pandemic, most experts are of the view that it is the role of the government and central bank to minimize the damage inflicted by the virus—and the policy response to it—on the economy.

Read More »

Read More »