Tag Archive: Featured

‘Death Cross’ Strikes U.S. Dollar As Virus Cases Grow

A resurgent coronavirus pandemic in the United States and the prospect of improving growth abroad are souring some investors on the dollar, threatening a years-long rally in the currency.

Read More »

Read More »

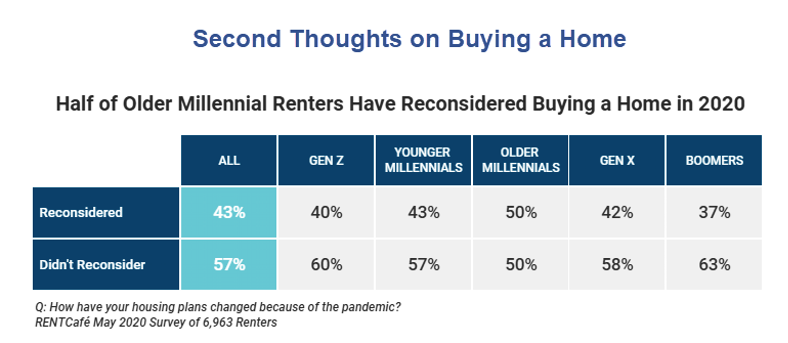

Shedlock: Millennial Renters Abandon Their Home Buying Plans

Millennial renters who were in the market pre-Covid just abandoned their home buying plans. A lifestyle survey shows millennials top the list of those canceling home-buying plans.

Read More »

Read More »

FX Daily, July 16: Equities Slide and the Greenback Bounces After China’s GDP and Before the ECB

Overview: Profit-taking, perhaps spurred by disappointing retail sales figures, sent Chinese equity markets down by 4.5%-5.2% today, the most since early February. It appears to be triggering a broader setback in equities today. The Hang Seng fell 2%, and most other markets in the region were off less than 1%.

Read More »

Read More »

Coronavirus: immunity might disappear within months in some patients

A recently published study by researchers at King’s College London shows SARS-CoV-2 antibodies fall to undetectable levels within 60 days in some patients. These findings potentially undermine the efficacy of vaccines aimed at triggering an antibody response, along with hopes of herd immunity.

Read More »

Read More »

Swatch hopes for sales to pick up quickly after pandemic slump

Swatch Group said it expected sales and profits to improve quickly in the months ahead after the coronavirus pandemic caused a “massive decline” in business for the first half of the year.

Read More »

Read More »

Market Sentiment Dented by Weak Data and Rising US-China Tensions

Market sentiment has been dented by more than just rising virus numbers; yet the dollar continues to trade within recent well-worn ranges. California’s decision to reverse partial reopening will likely have a huge economic impact; June CPI may hold a bit more interest in usual; June budget statement is worth a quick mention.

Read More »

Read More »

Precious metal stablecoin plugs into gold frenzy

The price of gold and silver is rising in the face of a sharp economic downturn. Swiss company AgAu has chosen this moment to announce a precious metal-backed stablecoin onto the blockchain. It aims to provide better access to gold and silver and an alternative to bank-printed money.

Read More »

Read More »

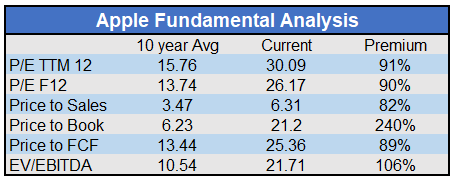

Passive Fingerprints Are All Over This Crazy Market

Passive Fingerprints Are All Over This Crazy Market. Apple’s stock is up over 20% since the market peak in February. Without a doubt, Apple, the company, is worse off due to the crisis and global recession. Revenue and earnings will be inferior to what Wall Street had forecast at lower stock prices. Valuations, shown below, are now astronomical.

Read More »

Read More »

FX Daily, July 15: The Dollar Slumps and EU Court Rules in Favor of Apple

A recovery in US stocks yesterday, coupled with optimism over Moderna's vaccine, is providing new fodder for risk appetites today. Equities are being driven higher, and the dollar is under pressure. Most equity markets in Asia advanced. China and Taiwan were exceptions, and, in fact, the Shanghai Composite fell for the second consecutive session for the first time in a month.

Read More »

Read More »

Switzerland a leader in 3D printing technology, patent records show

In relation to its population size, between 2010 and 2018 Switzerland filed more patent applications for 3D printing technologies than any other European country, the European Patent Office said on Monday.

Read More »

Read More »

How Do We Change the Leadership of our Quasi-Sovereign Big Tech Neofeudal Nobility?

You better bow low and pay up, peasant, or your voice in the digital world will disappear just as quickly as your democracy's control over Big Tech. Who's the junior partner in global hegemony, Big Tech or the U.S. government?

Read More »

Read More »

Could America Have a French-Style Revolution?

As with the French Revolution, that will be the trigger for a wholesale replacement of our failed institutions. Since it's Bastille Day, a national holiday in France celebrating the French Revolution, let's ask a question few even think (or dare) to ask: could America have a French-style Revolution? Not in some distant era, but within the next five years?

Read More »

Read More »

Why Bolivia Needs to Decentralize

It was only eight months ago that Bolivia concluded a bizarre political conflict that saw President Evo Morales step down from office. Morales was pursuing a fourth presidential term but encountered numerous constitutional roadblocks.

Protesters cited irregularities and alleged voter fraud during elections in October 2019 as the principal motive behind their demonstrations.

Read More »

Read More »

FX Daily, July 14: Turn Around Tuesday Began Yesterday

Overview: Turn around Tuesday began yesterday with a key reversal in the high-flying NASDAQ. It soared to new record highs before selling off and settling below the previous low. The S&P 500 saw new four-month highs and then sold-off and ended on its lows with a loss of nearly 1% on the session. Asia Pacific shares fell, led by declines in Hong Kong and India.

Read More »

Read More »

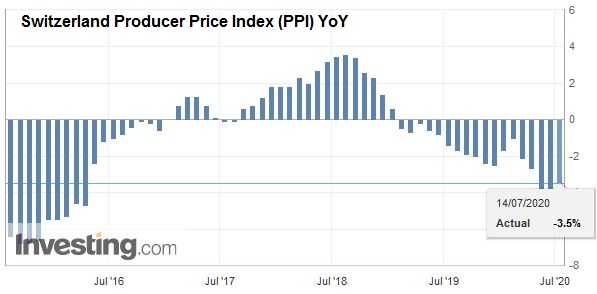

Swiss Producer and Import Price Index in June 2020: -3.5 percent YoY, +0.5 percent MoM

14.07.2020 - The Producer and Import Price Index rose in June 2020 by 0.5% compared with the previous month, reaching 98.1 points (December 2015 = 100). The rise is due in particular to higher prices for petroleum products as well as petroleum and natural gas. Compared with June 2019, the price level of the whole range of domestic and imported products fell by 3.5%.

Read More »

Read More »

Julius Baer to offer private equity to ultra-wealthy clients

Julius Baer has poached a senior executive from rival Swiss wealth manager UBS to set up a new division offering private equity and debt investments to its ultra-wealthy clients. The move illustrates how a prolonged period of low interest rates has forced the likes of UBS and Credit Suisse to prioritise offering illiquid private investments to their super-rich clients, who agree to forgo access to their capital in the hope of achieving higher...

Read More »

Read More »

Doubts over EU regulations deal raise prospect of higher City costs

On a Monday morning, just over a year ago, investment firms across the EU found they were no longer allowed to trade on the Swiss stock exchange. It happened almost overnight — simply because Brussels refused to extend a regulatory “equivalence” deal with Switzerland, which gave each side free access to the other’s markets.

Read More »

Read More »

Dollar Rangebound in Quiet Start to an Eventful Week

Today marks a relatively quiet start to what is likely to be one of the most eventful weeks we’ve seen in a while; the dollar remains within recent well-worn ranges. The US continues to ratchet up trade tensions; the only US data report today is the June budget statement.

Read More »

Read More »

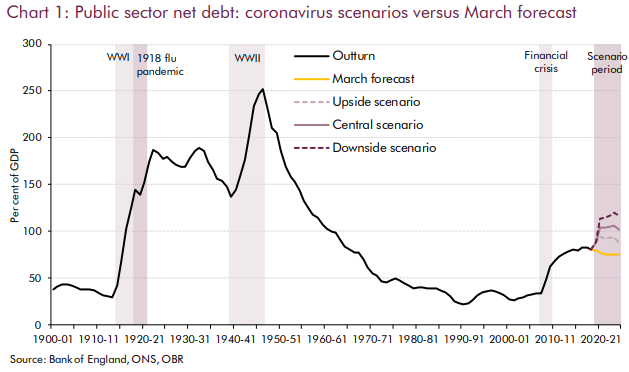

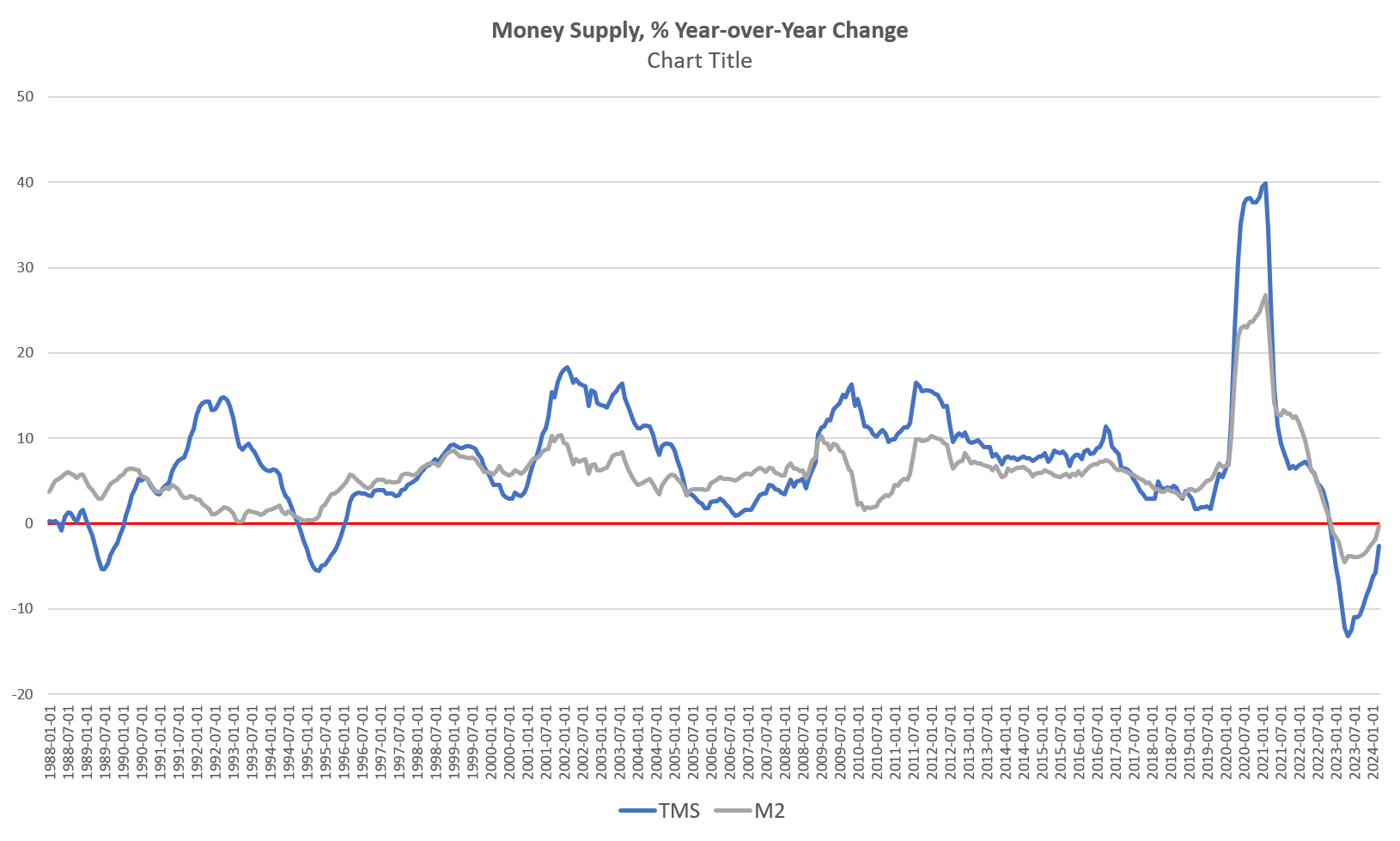

The Fed Is Trapped In QE As Interest Rates Can’t Rise Ever Again.

Since the onset of the pandemic, the Fed has entered into the most aggressive monetary campaign. Its goal was to bolster asset markets to restore confidence in the financial system. However, the trap is the Fed is in a position where they can never stop QE as interest rates can’t rise ever again.

Read More »

Read More »