Tag Archive: Featured

Travel destinations seek tourists, but not the crowds

Some popular travel destinations have enjoyed the break – however temporary – from tourist crowds following Covid-19 restrictions. Others hope the hordes will return soon. Switzerland had not yet opened its border with Italy when its southern neighbour unexpectedly announced that Swiss citizens could enter the country starting on June 3.

Read More »

Read More »

What Germany Must Do for a Speedy Recovery

On June 29, the German parliament reacted as parliaments normally do when there is a problem, namely, by allowing the government to spend more. In order to respond to the economic difficulties due to the corona epidemic and the government restrictions, it passed a typical Keynesian stimulus package in order to boost aggregate demand.

Read More »

Read More »

FX Daily, July 07: Fade the Dollar Gains

The S&P 500 rallied 1.6% yesterday to extend the streak to a fifth consecutive session, and the longest of the year and completed the negation of a bearish technical pattern. However, the main feature today is a wave of profit-taking on risk assets. Most equity markets moved lower in the Asia Pacific region. Chinese markets were a notable exception.

Read More »

Read More »

Motorway station supplier goes into liquidation

A company that supplies Swiss motorway service stations and convenience stores has gone into liquidation after failing to find new investors. Some 144 jobs at Lekkerland Switzerland are now at risk of disappearing by the end of the year.

Read More »

Read More »

New UBS report reveals that joint financial participation is the key to gender equality

Significant majority of men and women believe women need to be equally involved in long-term financial decisions to achieve true gender equality, yet half of women let their spouses take the lead .

Read More »

Read More »

Cool Video: Dollar, Trade, and China on TDA Network

I began my career as a reporter on the floor of the Chicago Mercantile Exchange, covering the currency futures and short-term interest rate futures for a news wire. Among other things, I learned that often, the locals, people trading with their own money and wits, would take the opposite side of trades of the institutional players.

Read More »

Read More »

Monthly Market Monitor – July 2020

Most Long-Term Trends Have Not Changed. A lot has changed over the last 4 months since the COVID virus started to impact the global economy. Asia was infected first with China at ground zero. Their economy succumbed first with a large part of the country shut down to a degree that can only be accomplished in an authoritarian regime.

Read More »

Read More »

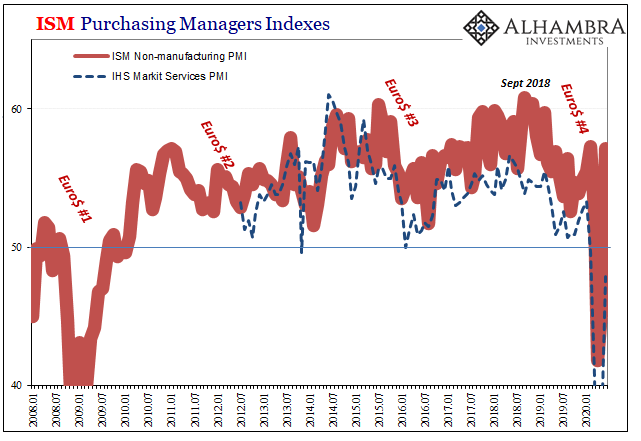

Gratuitously Impatient (For a) Rebound

Jay Powell’s 2018 case for his economic “boom”, the one which was presumably behind his hawkish aggression, rested largely upon the unemployment rate alone. A curiously thin roster for a period of purported economic acceleration, one of the few sets joining that particular headline statistic in its optimism resides in the lower tiers of all statistics.

Read More »

Read More »

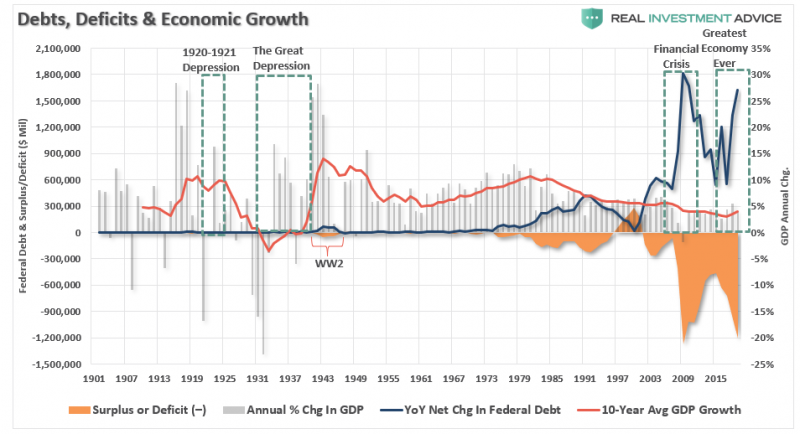

The Theory Of MMT Falls Flat When Faced With Reality (Part II)

If you missed Part-1 of our series on the “Theory Of MMT Falls Flat When Faced With Reality,” start there. In Part-2, we complete our analysis of the theory and the potential ramifications. The premise of our discussion was this recent explanation of “Modern Monetary Theory” by Stephanie Kelton.

Read More »

Read More »

FX Daily, July 6: New Record Number of Covid Cases Doesn’t Curtail Appetite for Risk

Overview: A new daily high number of contagions globally has been reported, but the risk-appetites have been stoked. Chinese stocks have been on a tear. The Shanghai Composite rallied 5.7% today to bring the five-day advance to 13.6%. Most other regional markets, including Hong Kong, rallied as well (3.8%). Australia was the main exception, and it pulled back by 0.7%. It is still up a solid 3.4% over the past five sessions.

Read More »

Read More »

Swiss sustainable finance: world leader or wishful thinking?

The Swiss financial centre wants to take a lead in ethical investing. NGOs, however, fear the banks are more interested in cashing in than saving the planet. One thing everyone agrees on is the need for a universal definition of sustainable finance and measures to oversee the sector.

Read More »

Read More »

What Makes You Think the Stock Market Will Even Exist in 2024?

Given the extremes of the stock market's frauds and even greater extremes of wealth/income inequality it has created, tell me again why the stock market will still exist in 2024? When I read a financial pundit predicting a bull market in stocks through 2024, blah-blah-blah, I wonder: what makes you think the stock market will even exist in 2024, at least in its current form?

Read More »

Read More »

EM Preview for the Week Ahead

Risk assets remain hostage to swings in market sentiment. Stronger than expected US jobs data last week was welcome news. However, the tug of war between improving economic data and worsening viral numbers is likely to continue this week, with many US states reporting record high infection rates.

Read More »

Read More »

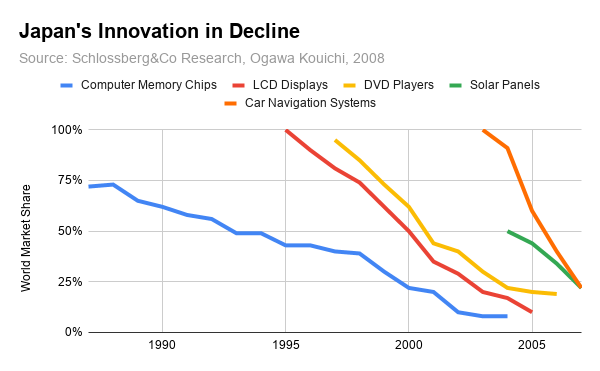

The Social Consequences of Zero Interest Rates

Anyone who has ever been to Japan knows: Japan is special. The country has many strange habits. The Japanese culture is simply different and many peculiarities are hardly understood in the West. But it's not only the old established traditions that are foreign to us Westerners.

Read More »

Read More »

Will the Police Crack Down on Lockdown Violators the Second Time Around?

It will be very interesting if the police—who did nothing to disperse protests that were obviously in violation of bans on mass gatherings—turn around and arrest business owners and other "violators" of a second round of stay-at-home orders.

Read More »

Read More »

New cars on Swiss roads failed to meet emissions targets

Fuel consumption and emissions limits for new cars in Switzerland missed their target in 2019 for the fourth year in a row. This resulted in sanctions totalling CHF78 million for car importers.

Read More »

Read More »

Swiss retail sales up 30 percent in May after COVID-19 measures eased

Recently published figures show a overall jump of 30.2% in retail sales in May 2020 compared to April 2020. May’s rise of 30.2% follows falls of 6.5% in March and 13.7% in April.

Read More »

Read More »

Reality Beckons: Even Bigger Payroll Gains, Much Less Fuss Over Them

What a difference a month makes. The euphoria clearly fading even as the positive numbers grow bigger still. The era of gigantic pluses is only reaching its prime, which might seem a touch pessimistic given the context. In terms of employment and the labor market, reaction to the Current Employment Situation (CES) report seems to indicate widespread recognition of this situation. And that means how there are actually two labor markets at the moment.

Read More »

Read More »

Gold Will “Trend Toward $10,000 Per Ounce Or Higher” Over The Next Four Years

You’re likely aware of the price action in gold lately. Gold has rallied from $1,591 per ounce on April 1 to $1,782 per ounce as of today. That’s a 12% gain in less than three months.

Read More »

Read More »

Swiss salaries rise faster than inflation for the first time in 2 years

In 2019, Swiss salaries were on average of 0.9% higher than the year before. A nominal rise of +0.9% combined with low inflation of 0.4% delivered a real boost of 0.5% to someone earning an average salary in Switzerland.

Read More »

Read More »