Tag Archive: Eurozone Consumer Price Index

The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

FX Daily, September 29: Dollar’s Gains Pared, but Set to Snap Six Month Losing Streak Against the Euro

Supported by a sharp rise in interest rates and ideas of tax reform, the US dollar is closing one of its best months of the year. The Dollar Index is snapping a six-month decline, and the euro's monthly advance since February is ending. This month, the US 10-year yield has risen 18 bp, and the two-year yield has risen 13 bp. It is the biggest increase since last November.

Read More »

Read More »

FX Daily, September 28: Greenback Consolidates while Yields Continue to March Higher

The US dollar is consolidating inside yesterday's ranges against the euro and yen while extending its gains against sterling and the dollar-bloc currencies. The sell-off in the US debt market continues to drag global yields higher. The 10-year Treasury yield reached 2.01% on September 8 and now, nearly three weeks later, is near 2.35%. It had finished last week at 2.25%.

Read More »

Read More »

FX Daily, September 18: More Thoughts from Berlin

The unexpected weakness in US retail sales and industrial production reported before the weekend did not prevent US yields and stocks from rising. Asia followed suit, and with Japanese markets closed, the MSCI Asia Pacific Index rallied a little more than 1%, the largest gain in two months. Of note, foreigners returned to the Korean stock market, buying about $260 mln today, which cuts the month's liquidation in half. The Kospi rallied 1.3%...

Read More »

Read More »

FX Daily, August 31: US Core PCE Deflator may Challenge the Greenback’s Firmer Tone

The US dollar recovery was marginally extendedin Asia, and while it remains firm, it is lost some of its momentum. The Fed's target inflation measure, the core PCE deflator, may decline from 1.5% to 1.4%, according to the median forecast in the Bloomberg survey. That would be the lowest read since the end of 2015 and likely spur more speculation against another Fed hike before the end of the year.

Read More »

Read More »

Data Dependent: Interest Rates Have Nowhere To Go

In October 2015, Federal Reserve Vice Chairman Bill Dudley admitted that the US economy might be slowing. In the typically understated fashion befitting the usual clownshow, he merely was acknowledging what was by then pretty obvious to anyone outside the economics profession.

Read More »

Read More »

FX Daily, August 17: Euro Softens on Crosses, Treasuries Stabilize

The US dollar had steadied after softening in the North American afternoon yesterday when the dissolution of President Trump's business councils as a series of executives stepped down. The FOMC minutes added more fuel to the move.

Read More »

Read More »

FX Daily, July 31: Monday Morning Blues

The euro is up by 0.15% to 1.1385 CHF. The US dollar is enjoying a respite from the recent selling, but its gains have been shallow, and will likely prove brief. The upticks have been concentrated in the recently high-flying dollar-bloc currencies, and sterling. The tone appears to be more consolidative than corrective, and month-end adjustment provides an additional wrinkle.

Read More »

Read More »

FX Daily, July 17: Markets Mark Time, Dollar Consolidates Losses

After falling to new lows for the year against several major currencies in response to disappointing retail sales and uninspiring CPI before the weekend, the US dollar has begun the new week on a more stable note. It is firmer against nearly all the major currencies, though is mixed against the emerging market currencies.

Read More »

Read More »

FX Daily, June 30: Greenback Stabilizes

The US dollar has been battered this week amid a shift in sentiment seen in how the market responded to comments mostly emanating from the ECB's annual conference. It is not really clear that Draghi or Carney gave new policy indications.

Read More »

Read More »

FX Daily, June 16: Dollar Slips In Consolidation, but Extends Recovery Against the Yen

As the market heads into the weekend, the US dollar is trading softer as it consolidates. It is within yesterday's ranges against the major currencies but the Japanese yen. The dollar has made a dramatic recovery against the yen. It traded near JPY108.80 in the middle of the week and pushed through JPY111 in late in the Tokyo morning. The greenback is above its 20-day moving average against the yen for the first time in a month.

Read More »

Read More »

FX Daily, May 31: Sterling Takes it On the Chin

Projections showing that the UK Tories could lose their outright majority in Parliament in next week's election spurred sterling sales, which snapped a two-day advance. Polls at the end of last week showed a sharp narrowing of the contest, and this saw sterling shed 1.3% last Thursday and Friday.

Read More »

Read More »

FX Daily, May 19: Markets Trying to Stabilize Ahead of Weekend

Judging from investors' reactions, the only thing worse that than the low volatility environment is when volatility spikes higher, as it did yesterday. Higher volatility is associated with weakening equity markets, falling interest rates, pressure on emerging markets, a strengthening yen and, sometimes, as was the case yesterday, heavier gold prices.

Read More »

Read More »

FX Daily, May 17: Drama In Washington Adds To Dollar Woes

The US dollar has drifted lower against most of the major currencies as the culmination of news from Washington, escalating already rising concerns about the economic agenda that was to bolster growth with dramatic tax reform, infrastructure initiative, and re-orienting trade.

Read More »

Read More »

FX Daily, April 28: Markets Limp into Month End

Equity markets are stalling into the end of the month. MSCI Asia-Pacific Index is snapping a six-day advance, and the week's gain was sufficient to extend the advancing streak for the fourth consecutive month. The Dow Jones Stoxx 600 is trading off for the second consecutive session, after rallying for six consecutive sessions.

Read More »

Read More »

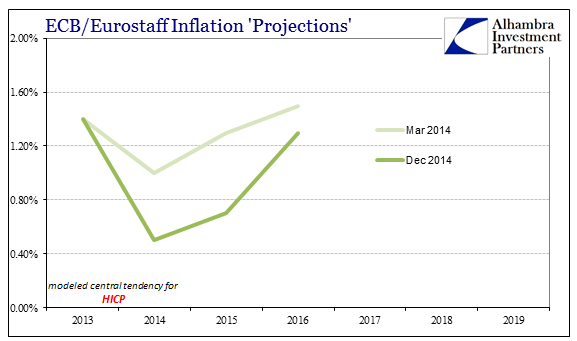

Consensus Inflation (Again)

Why did Mario Draghi appeal to NIRP in June 2014? After all, expectations at the time were for a strengthening recovery not just in Europe but all over the world. There were some concerns lingering over currency “irregularities” in 2013 but primarily related to EM’s and not the EU which had emerged from re-recession. The consensus at that time was full recovery not additional “stimulus.” From Bloomberg in January 2014:

Read More »

Read More »

FX Daily, March 31: Greenback Finishing Weak Quarter in Mixed Fashion

The US dollar fell against all the major currencies in the first three months of 2017. The weakness initially seemed to be a correction to the rally, which began before the US election last year. The dollar recovered in February, in anticipation of a hawkish Fed in March.

Read More »

Read More »

FX Daily, March 16: Greenback Consolidates Losses as Yields Stabilize

The US dollar remained under pressure in Asia following the disappointment that the FOMC did not signal a more aggressive stance, even though its delivered the nearly universally expected 25 bp rate hike. News that the populist-nationalist Freedom Party did worse than expected in the Dutch elections also helped underpin the euro, which rose to nearly $1.0750 from a low close to $1.06 yesterday.

Read More »

Read More »

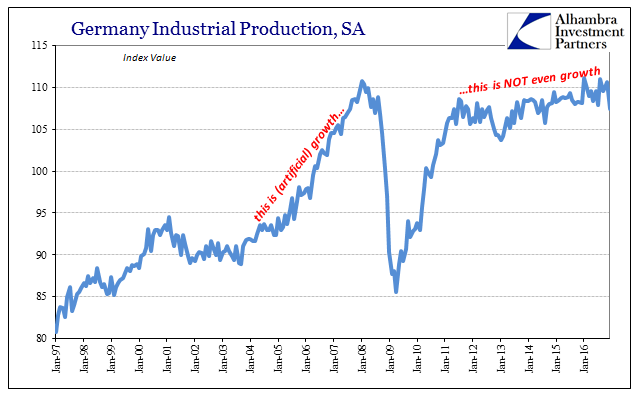

Economic Dissonance, Too

Germany is notoriously fickle when it comes to money, speaking as much of discipline in economy or industry as central banking. If ever there is disagreement about monetary arrangements, surely the Germans are behind it. Since ECB policy only ever attains the one direction, so-called accommodation, there never seems to be harmony.

Read More »

Read More »

FX Daily, March 02: Dollar Remains Bid

The US dollar is bid against the major currencies as the combination the increased expectation of a Fed rate hike and the President's commitment to fiscal stimulus buoys sentiment. The dollar-bloc, where speculators in the futures market, have grown a net long position, are leading the move.

Read More »

Read More »