Tag Archive: $EUR

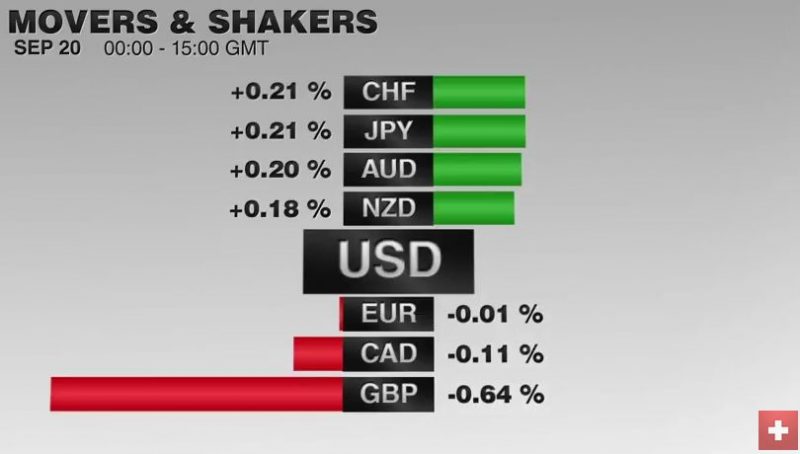

FX Daily, September 20: The Swiss Franc Continues To Rise.

The trade balance express if a currency is overvalued or not. The Swiss trade surplus is constant or rather rising, hence the Swiss Franc is correctly valued or rather undervalued. And the franc continues to appreciate.

Read More »

Read More »

FX Daily, September 19: Dollar Begins Important Week on Softer Note

The US dollar, which finished last week on a firm note, is under pressure to start the new week that features Bank of Japan and Federal Reserve meetings. The slighter stronger August CPI reading helped lift the greenback ahead of the weekend, but investors continue to see a low probability of a Fed hike this week.

Read More »

Read More »

FX Daily, September 15: Early Update: Full Calendar but Little News

Looking at the diary, today is the most important day of the week. The Bank of England and the Swiss National Bank meet. The UK reports retail sales. EMU reports CPI figures. The US reports retail sales, industrial output, and two September Fed surveys. Yet the economic updates are unlikely change sentiment ahead of next week FOMC and BOJ meetings.

Read More »

Read More »

FX Daily, September 14: Precarious Stabilization

Swiss ZEW expectations came in better than expected. The value was +2.7 instead of expected negative value. The US dollar advanced yesterday and is in narrow ranges with a mostly softer bias today. The exception is the Japanese yen. Japanese press have reported that more negative rates are under consideration may have contributed to the weakness of the yen.

Read More »

Read More »

Thoughts on the Price Action

Global interest rates are rising. Something important is happening. It appears to be dollar positive.

Read More »

Read More »

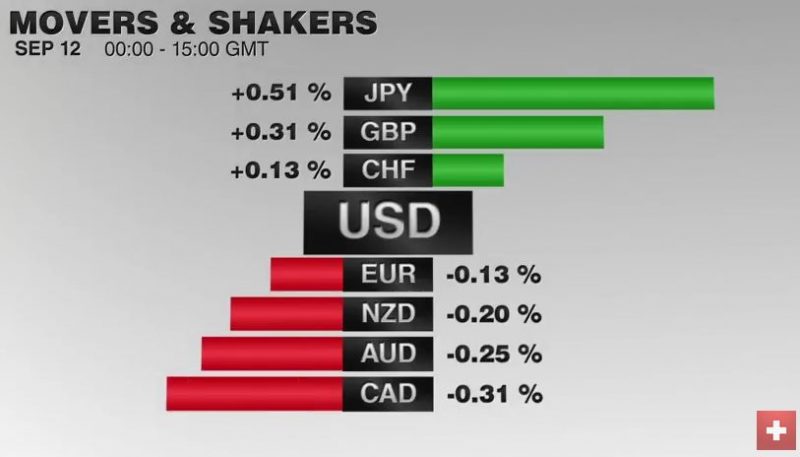

FX Daily, September 12: Markets Off to a Wobbly Start

The EUR/CHF retreated today together with falling stock prices. When investors sell their stocks and move into cash, then the Swiss Franc very often appreciates. This is the safe haven effect: cash in Swiss Franc is perceived as more secure.

Read More »

Read More »

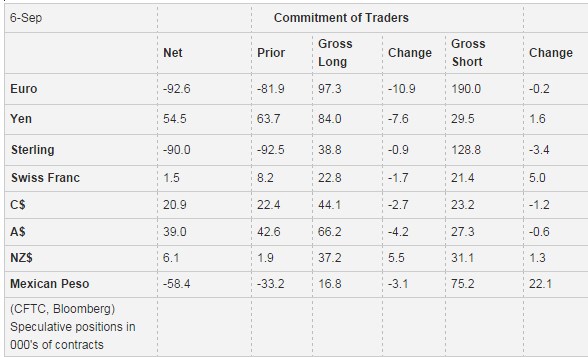

Weekly Speculative Postions: CHF net long positions down from 8.2K down to 1.5K

The Swiss Franc depreciated this week again. The euro rose to 1.960. One reason is the reduction in net long CHF speculative position from 8.2K to 1.6K contracts. Given the weak ISM non-manufacturing PMI, it remains unclear. why speculator now move into the dollar.

Read More »

Read More »

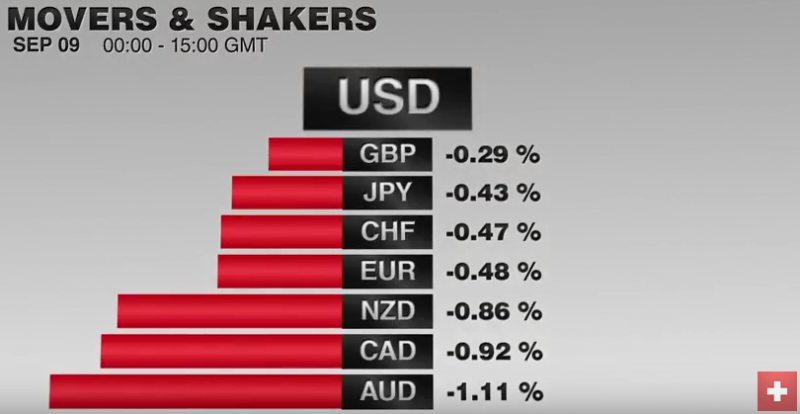

FX Daily, September 9: Ahead of the Weekend

The US dollar is lower against all the major currencies this week as North American participants close it out. On the day, the dollar is consolidating swings yesterday and is narrowly mixed.Bond yields are higher and equities are mostly lower. The euro has finished lower the last three Fridays. The streak may end today. The euro has found support nearly $1.1260, and the intraday technicals favor a move higher in the US morning.

Read More »

Read More »

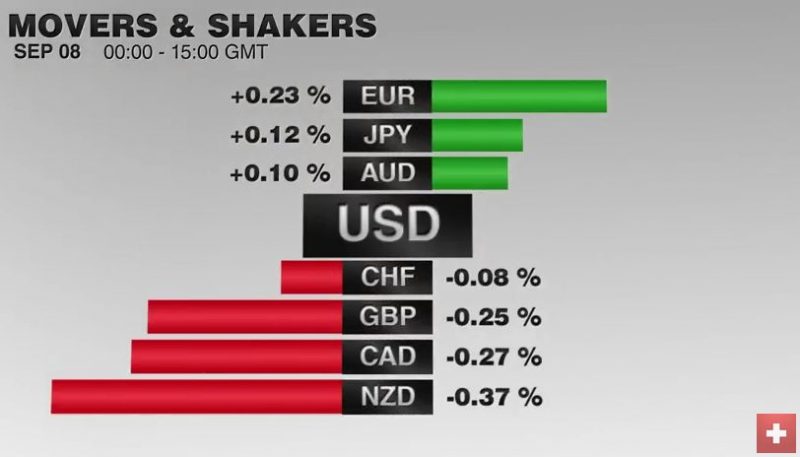

FX Daily September 8: Draghi Says Little, Door Still Open for More

In the last two days, the euro moved upwards against CHF. Given that Swiss GDP was stronger than the one in the euro zone, this is surprising. But we must recognize that Draghi could be the reason. Inflation forecasts of 1.2% in 2017 and 1.8% in the euro zone would mean the ECB hikes rates maybe in 2018 or 2019. I personally do not believe it, given that wage inflation in Italy or Spain is clearly under 1%. This is lower than Swiss wage inflation...

Read More »

Read More »

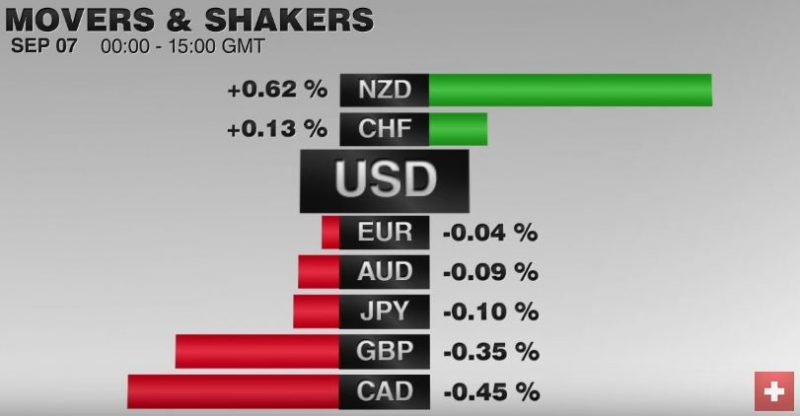

FX Daily, September 07: Dollar Stabilizes, but Hardly Recovers

Disappointing industrial output figures from Germany and UK are helping stabilize the US dollar after yesterday's shellacking. Investors have been fickle about the prospects for a rate hike this month, and the unexpected dramatic slide in the service spurred a downgrading of such expectations, and a flight out of the dollar. It was not simply a quest for yields, though that was part of it. Surely the yen and euro's strength is not a function of...

Read More »

Read More »

FX Daily, September 6: Dollar Heavy in Quiet Markets

The US dollar is trading heavily against most of the major and emerging market currencies. However, the losses are modest, and the greenback remains within recent ranges. The Antipodean and Scandi bloc currencies are performing best.

Read More »

Read More »

Services ISM Sends Greenback Reeling

ISM showed unexpected weakness in Aug non-mfg PMI. Markit measure slipped but not as much as ISM. Odds of a Sept Fed hike slip to about 15%. Watch trendline in Dollar Index near 94.45.

Read More »

Read More »

FX Daily, September 5: While Americans were Celebrating Labor Day

There were several developments that took place while US markets were closed for its Labor Day holiday. Most of the economic news was favorable. This included a strong snap back in the UK service PMI, more evidence that the moral suasion campaign to lift wages in Japan is yielding some success and a rise in the Caixin's China's service PMI.

Read More »

Read More »

FX Weekly Preview: Parsing Divergence: Focus Shifts from Fed to ECB

Net-net, the September Fed funds futures contract was little changed on the week. Four high-income central banks meet in the week ahead; the ECB is the only one in play. China accounted for a full three quarters of the US trade deficit in July.

Read More »

Read More »

FX Daily, September 2: US Jobs Data–Higher Anxiety, Thank You Mr. Fischer

The US dollar is little changed ahead of the job report. Our near-term bias is for a lower dollar. Sterling is flat and is holding on to about a 1% gain this week. The Japanese yen is about a 0.3% lower and is off 1.7% this week. The euro was coming into today for the week.

Read More »

Read More »

FX Daily, September 01: A Couple of Surprises to Start the New Month

The new month has begun with a couple of surprises. The biggest surprise has been the record jump in the UK manufacturing PMI to 53.3 from 48.3. A much smaller rebound was expected in August after the Brexit shock drop in July.

Read More »

Read More »

FX Daily, August 31: Dollar Bides Times, Month-End at Hand, Jobs Data Ahead

The US dollar is a little softer against most of the major and emerging market currencies. The exception is the Japanese yen, where the greenback has moved above JPY103 for the first time in a month. The tone is consolidative as the market awaits assurances that the jobs growth this month has been sufficiently strong as to keep the prospects of a September meeting still alive.

Read More »

Read More »

Spain’s Political Deadlock Likely Leads to Third Election

Rajoy is hoping to form a minority government this week. It seems unlikely to succeed, which could lead to an election on Christmas. Regional elections and corruption trials may change Spain's political dynamics.

Read More »

Read More »

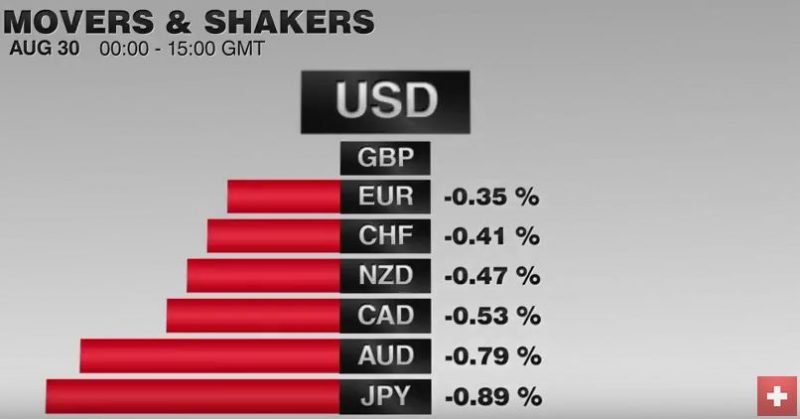

FX Daily, August 30: Greenback Remains Firm, Awaiting Fresh Cues

The US dollar is trading firmly, largely within yesterday's ranges. The odds implied by the September Fed fund futures eased to 36% from 42% before the weekend, but ahead of Fischer's Bloomberg TV appearance, and tomorrow's ADP employment estimate, the market seems cautious about fading the dollar's strength.

Read More »

Read More »

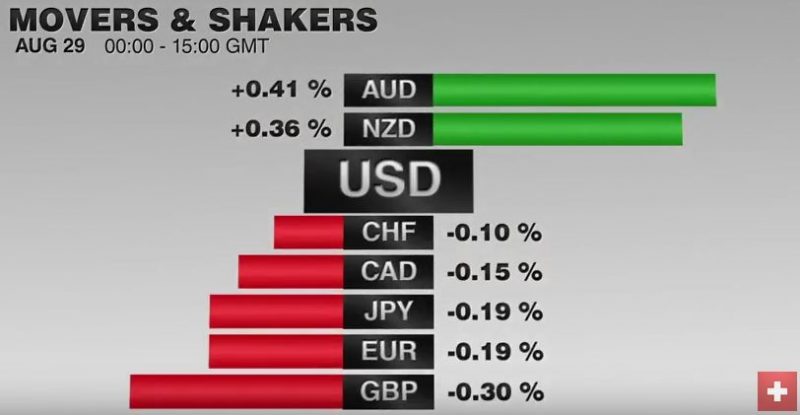

FX Daily, August 29: Dollar Gains Extended, but Momentum Fades

The US dollar staged a strong pre-weekend rally on hints that the Fed will raise rates before the end of the year. There was initially follow through dollar buying in Asia before a more stable tone emerged in Europe, where London markets are closed for a bank holiday. The easing of the dollar’s upside momentum may set the stage for a bout of profit-taking later today and tomorrow.

Read More »

Read More »