Tag Archive: $EUR

FX Daily, November 29: Dollar Comes Back Mostly Firmer, but Focus is Elsewhere

The US dollar correctly lowered yesterday, but most of the selling was over by the end of the Asian session, and the greenback steadied in Europe and North America. The dollar is firm against the euro and yen but within yesterday's broad trading ranges. The Australian and Canadian dollar's gains from yesterday are being pared.

Read More »

Read More »

FX Daily, November 28: Corrective Forces Seen in Asia, Subside in Europe

As soon as markets opened in Asia, the greenback was sold, and corrective forces that had been nipping below the surface took hold. The euro, which had finished last week below $1.0590, rallied nearly a cent. Before the weekend, the greenback had pushed to almost JPY114, an eight-month high, before closed near JPY113.20. It was sold to almost JPY111.35 in early Asia. Sterling extended last week's gains and briefly poked through $1.2530, to reach...

Read More »

Read More »

FX Weekly Preview: Shifting Portfolio Preferences Continue to Drive Capital Markets

Forces emanating from the US and Europe are driving the capital markets. The moves may be stretched technically, but the market adjustment has further to run as not even two Fed hikes are discounted for next year. European political concerns and an ECB expected to continue its asset purchases have driven German 2-year yields to new record lows.

Read More »

Read More »

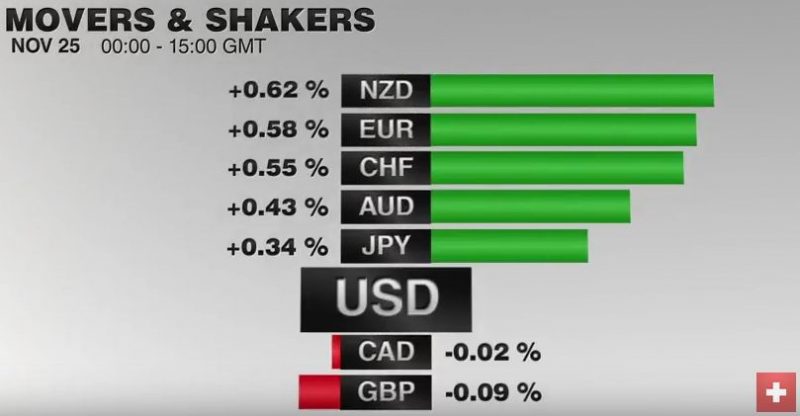

FX Daily, November 25: Corrective Forces Emerge, but Underlying Trend is Evident

The US dollar's recent gains are being trimmed today, and it is down against all the major currencies. Many emerging market currencies, including the Turkish lira, Indian rupee, and Hungarian forint are firmer today.

Read More »

Read More »

Short Summary on US Thanksgiving

Euro fell to new 20-month lows before steadying. The dollar extended its recovery against the yen. Emerging markets remained under pressure, and Turkey's central bank surprised with a 50 bp hike in the repo rate.

Read More »

Read More »

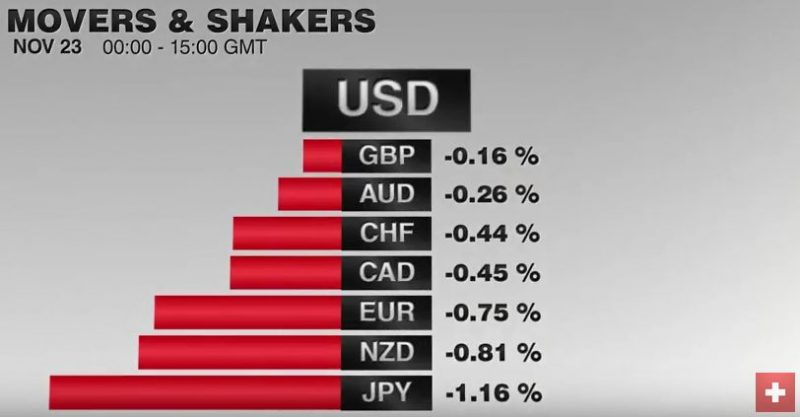

FX Daily, November 23: Dollar Sees Flat Consolidation while the Equity Advance Fizzles in Europe

The US dollar is trading inside yesterday's ranges against the euro and yen. The dollar's tone matches the consolidation in the debt market ahead of today's slew of US data and tomorrow's holiday. Tokyo markets were on holiday.

Read More »

Read More »

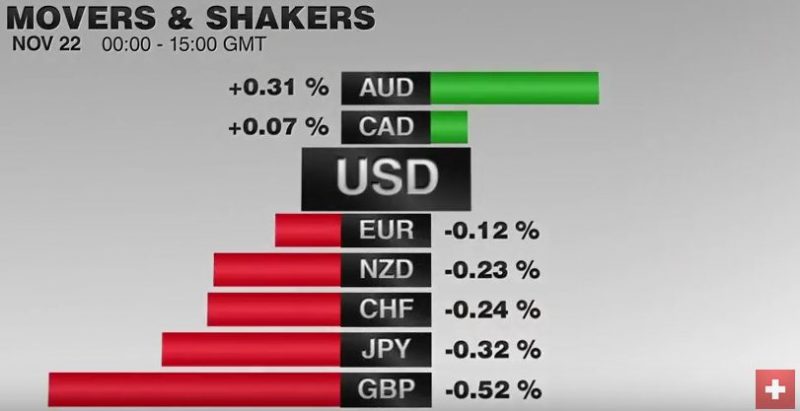

FX Daily, November 22: Bonds and Stocks Rally, Leaving Greenback to Meander

The US dollar entered a consolidative phase yesterday, and this carried into today's activity.While the foreign exchange market is sidelined as the two-week trend slows, the stocks and bonds are posting strong gains today. Equities are being led by energy and materials, as oil and industrial metals continue to advance. Bond are recovering from their recent slide.

Read More »

Read More »

FX Daily, November 21: Flattish Consolidation Hides Dollar Strength

The news over the weekend is primarily political in nature. Sarkozy is going to retire (again) after taking a drubbing in the Republican Party primary in France. Fillon, the self-styled French Thatcher unexpected beat Juppe, but without 50% and therefore the results set up the run-off this coming weekend. It is as if, knowing their candidate will likely face Le Pen in the final round next spring, the Republican Party might as well chose the most...

Read More »

Read More »

The Italian Job

Italy is the epicenter of the next potential populist "shock." A defeat of the referendum is seen as intensifying the political risk. Renzi has wavered again regarding his political future if the referendum loses.

Read More »

Read More »

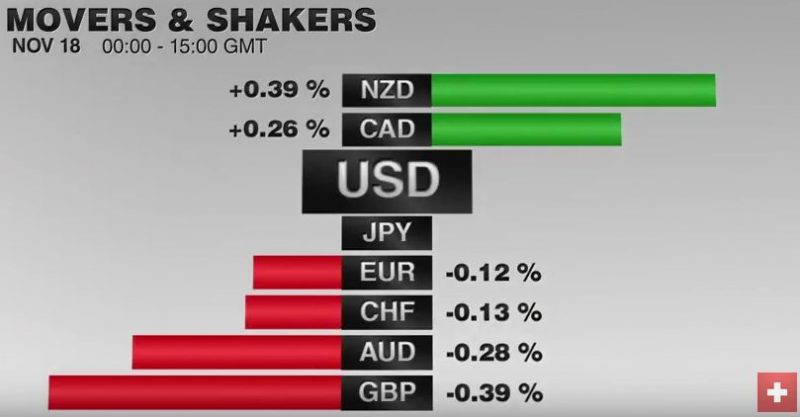

FX Daily, November 18: Revaluation of the Dollar Continues

Since the US election, the dollar has been on a tear. Pullbacks have been brief and shallow. There are powerful trends in place. The euro has fallen nearly five percent over the past ten sessions, during which it is not closed higher once. The dollar rose four days this week against the yen and four days last week.

Read More »

Read More »

FX Daily, November 17: Consolidation Gives Dollar Heavier Tone

The US dollar is trading with a heavier bias today as its recent run is consolidated. The euro is trying to snap the eight-day slide that brought it to nearly $1.0665 yesterday, the lows for the year. It is almost as if participant saw the proximity of last year's lows ($1.0460-$1.0525) and decided to pause, perhaps to wait for additional developments, such a Fed Chief's Yellen's testimony before the Joint Economic Committee of Congress.

Read More »

Read More »

FX Daily, November 16: The Greenback Remains Resilient

The US dollar remains bid. It is at its year high against the euro and five-month highs against the Japanese yen. Sterling, which has performed better recently, remains in the trough around 30-year lows. It surge since the election reflects three considerations. The first is December Fed hike. Prior to the election, the market was assessing around a two-thirds chance. Now both the CME and Bloomberg's WIRP estimate the odds above 90%....

Read More »

Read More »

Great Graphic: Euro-the Big Picture

Most economists are focusing on either US monetary policy or US fiscal policy. We focus on the policy mix. After the policy mix, politics is also a weigh on the euro. Our long-term call is for the euro to revisit the lows from 2000.

Read More »

Read More »

Cool Video: Reiterate Bullish Dollar Call on Bloomberg

I was on Bloomberg TV this morning to weigh in on the dollar's rally. The US Dollar Index is flirting with the 100 area that has blocked side since last year. In my work, after a big run-up form around 80 in mid 2014, the Dollar Index has been consolidating. I have long anticipated a spring board for another leg up.

Read More »

Read More »

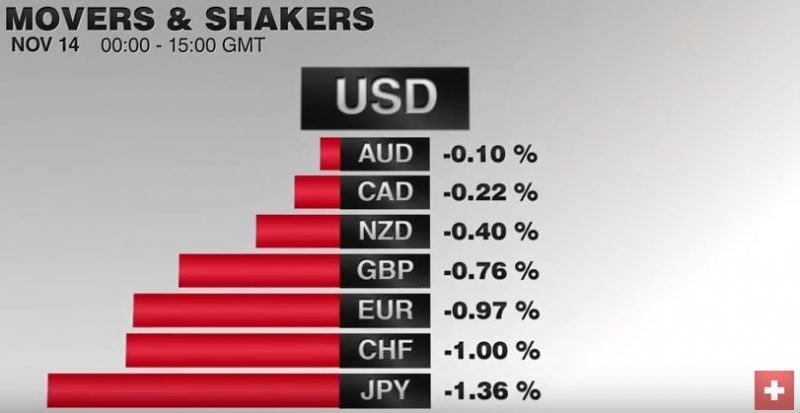

FX Daily, November 14: Dollar Steps Up to Start Week

The US dollar rally that moved into a higher gear in the second half of last week has begun the new week with a bang. It is up against nearly all the major and emerging market currencies. Even sterling, which last week, managed to eke out modest gains against the greenback is under pressure today.

Read More »

Read More »

An English Breakfast Causes Less Indigestion than the British Brexit

Prime Minister May is appealing the High Court decision and preparing to present broad guidelines of her strategy. An early election; even if it could be arranged, it is not clear which wing of the Tories would win. May missed the opportunity to provide strong leadership when it was most needed.

Read More »

Read More »

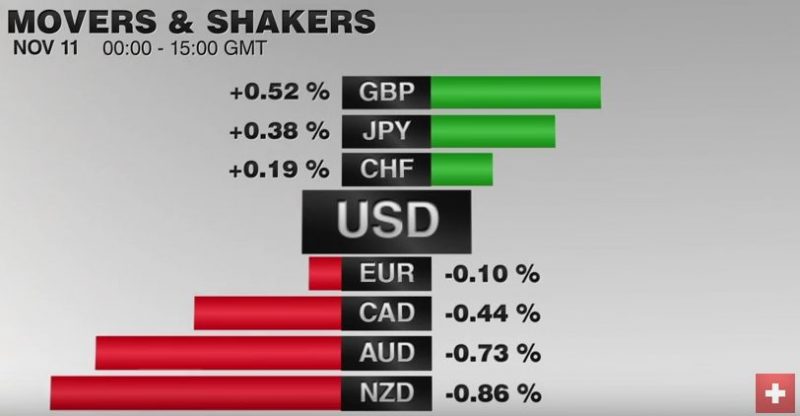

FX Daily, November 11: Ramifications of Trump’s Election Continue to Drive Markets

The forces unleashed by the US election results continue to drive the capitals markets. The combination of nationalism, reflation and deregulation are seen as good for US equities and the US dollar. It has not been so kind to US Treasuries, where the 10- and 30-year yield has risen about 32 bp this week coming into today's federal holiday that closes the bond market, while the stock market is open.

Read More »

Read More »

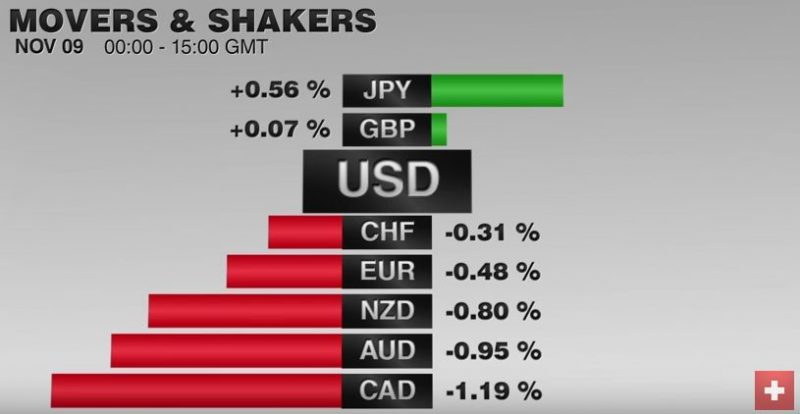

FX Daily, November 09: Mourning in America?

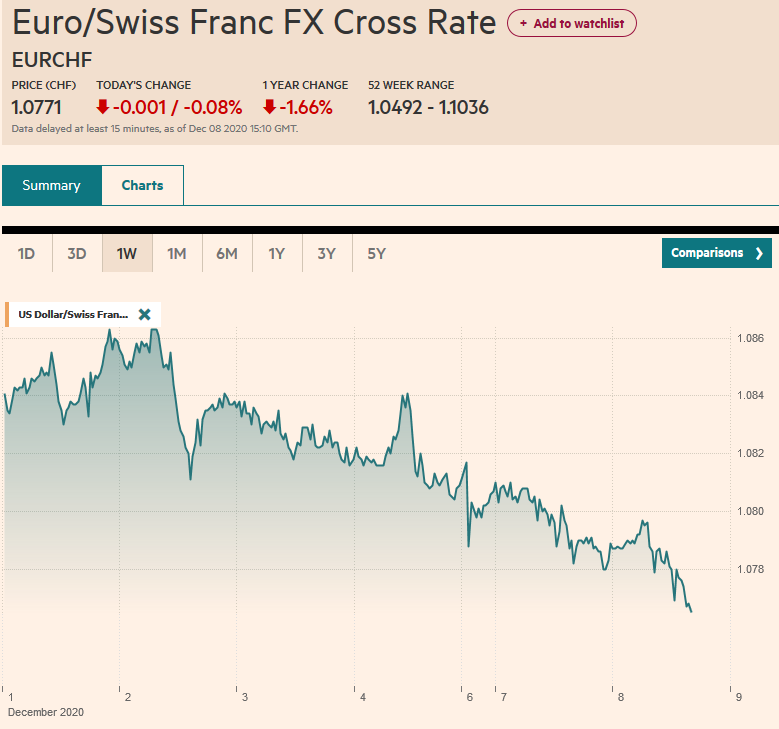

Global capital markets have been roiled by Trump's stunning victory Swiss National Bank's Andrea Maechler promised interventions for the case that Trump wins the elections. It was probably not necessary. Only the EUR/CHF fell to 1.0753. Strangely the dollar and markets recovered.

Read More »

Read More »

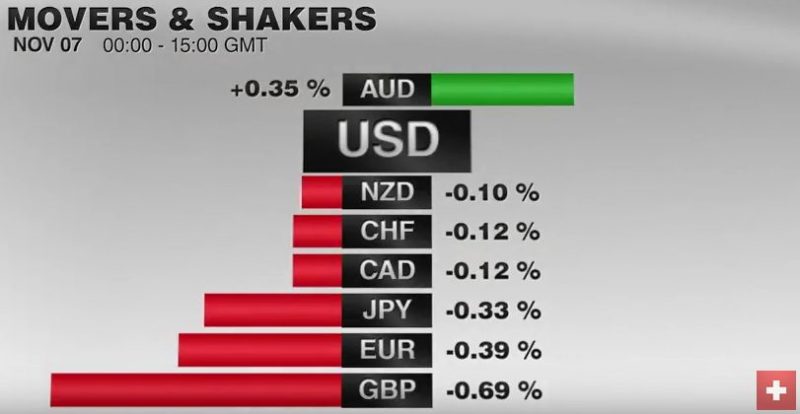

FX Daily, November 07: Dollar Stabilizing After Bounce

The DAX also gapped lower before the weekend and gapped higher today. It is stalling just ahead of the earlier gap from last week (10460-10508). It is up about 1.6% in late-morning turnover. The strongest sector is the financials, up 2.5%, with the banks up 3.4%. Deutsche Bank is snapping a five-session drop. It fell 9.1% last week. It has recouped more than half of that today.

Read More »

Read More »

Carney’s Tenure: Brief Thoughts

Not only is Carney not resigning, but he agreed to stay a year longer than initially agreed. He will stay for the two years that Brexit is negotiated. Sterling rallied, but did not challenge last week's highs.

Read More »

Read More »