Swiss FrancIn the Swiss Television, Swiss National Bank’s Andrea Maechler promised interventions for the case that Trump wins the elections. It was probably not necessary. The EUR/CHF fell to 1.0753, but interventions were rather limited to our view. The inflationary cycle that comes with Trump’s trade policies, has not started yet. First we will see U.S. wages rising, which will result in stronger GDP growth and at first to a stronger dollar. |

EUR/CHF - Euro Swiss Franc, November 09(see more posts on EUR/CHF, ) |

|

Buying Swiss Franc rates are always expected to see heavy movement following such a tumultuous event as the US election. The CHF’s status as a safe-haven means that it is always seen as an escape route for anyone worried about the value of any particular currency. This is such a well-known phenomenon that even ahead of the election the Swiss National Bank announced they were introducing controls to make sure that the value of their particular currency didn’t spiral incredibly as the day progressed if markets were surprised by the result. Surprise was certainly a feature as results began to roll in this morning with Trump’s potential Presidency spooking markets ahead of time that confirmation may cause uncertainty towards the US economy. Preemptive Dollar sell offs caused the US Dollar to plummet and a reasonable amount of this capital was funnelled into safe havens such as the Japanese Yen and Swiss Franc which moved up to 2% stronger against the likes of the Pound at its peak. Trump then decided to turn most expectations of him on his head. He delivered a measured, unifying speech, and all of a sudden market concern about heavy fallout evaporated. People begun to buy back USD’s in droves and much of the artificial strength of the Swiss Franc began to backtrack. We are now seeing much better buying levels for GBP/CHF and given that this is still a heavily evolving political situation, could be subject to change. |

GBP/CHF - British Pound Swiss Franc, November 09 |

FX RatesGlobal capital markets have been roiled by Trump’s stunning victory, and the Republicans hold of both houses of Congress. The initial reaction was dramatic and severe. The dollar and equities were crushed and bonds rallied as the message from the electorate was clear. However, in late Asia, the markets reversed and early moves were retraced. Trump’s policy prescriptions were mostly defined by opposition to the status quo. Trumps advocates the repeal of the Affordable Care Act (Obamacare) and Dodd-Frank, the omnibus financial regulation. He wants to clamp down on immigration. These three positions appear to enjoy widespread support among Republicans in Congress. Traditionally, the Republican Party has been more associated with free-trade, but Trump wants to re-open trade agreements. The next focus will be on Trump’s cabinet picks. Speculation begins immediately. |

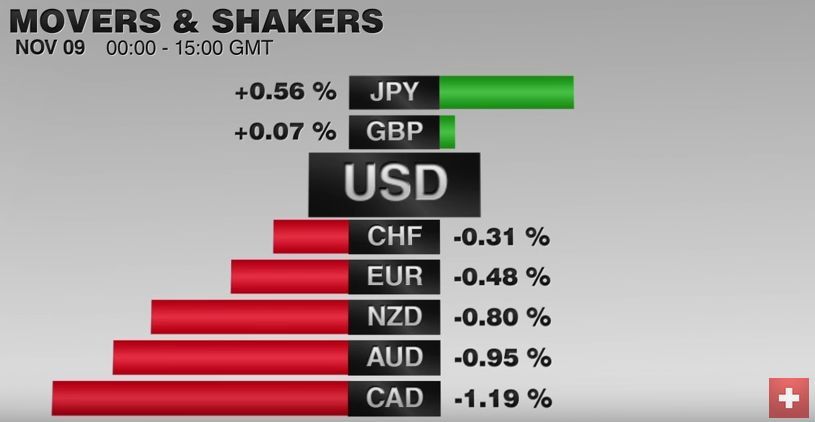

FX Performance, November 09 2016 Movers and Shakers . Source: Dukascopy - Click to enlarge |

| The implications of US monetary policy are not immediately clear. A December rate hike was the most likely scenario, and it still is, provided that the global capital markets are stable. Presently that seems like the most likely consideration to deter the Fed from hiking.

The euro initially dipped below $1.10 in early and thin Asian activity. It rallied to $1.13 and then reversed. By early European activity is was back near $1.11, and then slipped to the upper end of yesterday’s ranges near $1.1050, where it found a bid. The intraday technicals suggest North American operators may push the euro higher. The greenback was bid to almost JPY105.50 in early Asia, and as the election results began to be clear, it was sold to JPY101.20. It rebounded to nearly JPY103.80 in early Europe. Here too the intraday technicals warn of dollar weakness in North America. |

FX Daily Rates, November 09 (GMT 16:07) |

| The similar pattern is evident in sterling as well. A rally as the results was becoming evident (~$1.2550) followed by a sell-off that brought it back toward yesterday’s lows (~$1.2350) by the time London was in full swing. It then a recovered (~$1.2430) A move back toward $1.25 as today progresses would not be surprising from a technical perspective.

Risk assets, including the dollar-bloc currencies, have been sold. Asian equities were hit hard. MSCI Asia-Pacific Index fell 2.6% to reach its lowest level since July. The Nikkei shed nearly 5.4%. Chinese shares fared the best, losing only 0.5%. Asian markets that are open late, like Thailand, have recouped more of their losses. The Dow Jones Stoxx 600 is off a mild 0.5% in late-European morning dealings after gapping lower at the opening. It closed the gap and is moving sideways, perhaps waiting for fresh directional cues from the US. |

FX Performance, November 09 |

United States

The initial flight from risk assets saw the US 10-year yield fall from around 1.85% to nearly 1.70%, but it subsequently rose to 1.96% in early-Europe before consolidating near 1.90%. The curve itself is steepening. The two-year yield is off almost four basis points to 0.82%, while the 10-year yield is up now up five basis points at 1.90%. The five-year yields are also lower. Some observers are attributing the steepening to the anticipated fiscal plans of the new Administration. Asian bonds closed broadly higher, catching the risk-off phase. European bonds are mostly lower, but German and Dutch bonds are firmer.

The Brexit shock has been followed by the US electoral surprise. Leaving aside the demographics and the polls, the common element is a retreat from the path of at least the last several decades. Is continental Europe next? The French center-right party, recently renamed Republicans, will hold a primary on November 20, with the second round on November 27. In early December, Italy holds a referendum on constitutional changes (reducing the role and size of the Senate). Next year, there are Dutch, French and German elections. The odds of a UK election and even an Italian election are not negligible.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next post

Tags: #GBP,#USD,$EUR,$JPY,Andrea Maechler,EUR/CHF,newslettersent