Tag Archive: debt

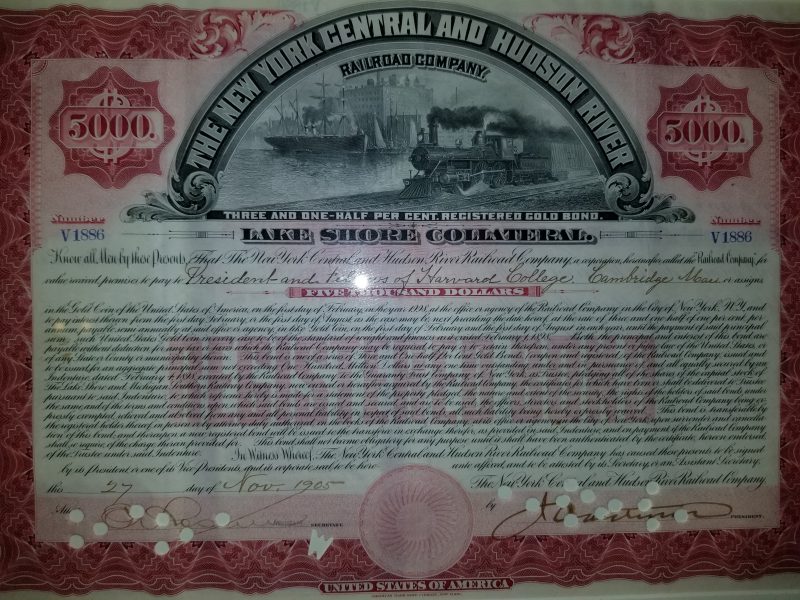

The Benefits of Issuing Gold Bonds

A gold bond is debt obligation that is denominated in gold, with interest and principal paid in gold. As I will explain below, it’s a way for the issuer to pay off its debt in full, and there are other advantages. Sometimes, I find that it’s helpful to show a picture of what I’m talking about. At the Harvard Club in New York, an old gold bond is hanging on the wall among other memorabilia.

Read More »

Read More »

Currency Risk That Isn’t About Exchange Values (Eurodollar University)

This week the Bureau of Economic Analysis will release updated estimates for Q2 GDP as well as Personal Consumption Expenditures (PCE) and Personal Incomes for July. Accompanying those latter two accounts is the currently preferred inflation standard for the US economy. The PCE Deflator finally hit 2% and in two consecutive months, after revisions, earlier this year.

Read More »

Read More »

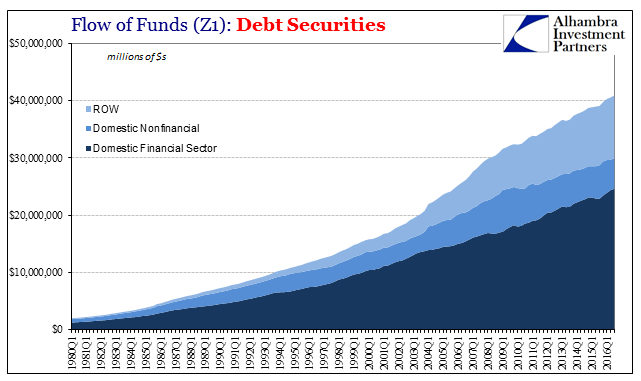

Do Record Debt And Loan Balances Matter? Not Even Slightly

We live in a non-linear world that is almost always described in linear terms. Though Einstein supposedly said compound interest is the most powerful force in the universe, it rarely is appreciated for what the statement really means. And so the idea of record highs or even just positive numbers have been equated with positive outcomes, even though record highs and positive growth rates can be at times still associated with some of the worst. It...

Read More »

Read More »

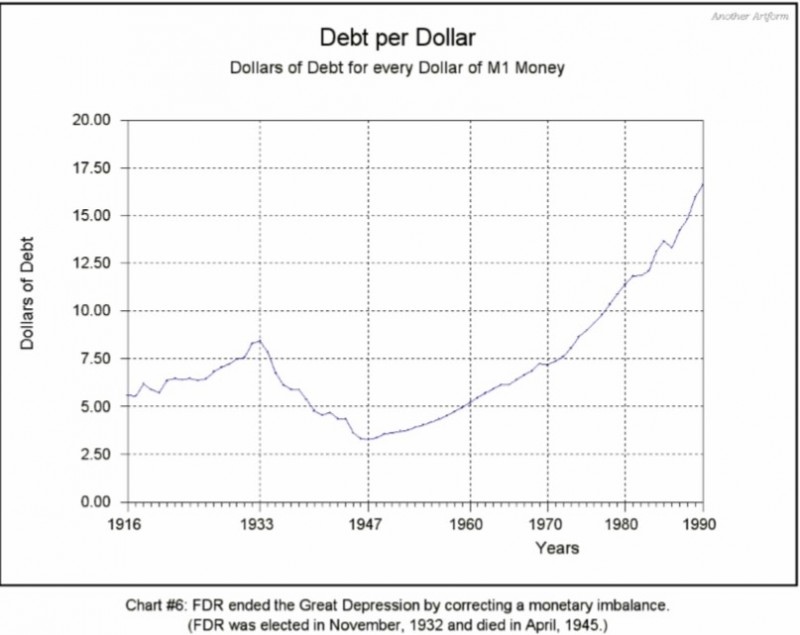

No Paradox, Economy to Debt to Assets

It is surely one of the primary reasons why many if not most people have so much trouble accepting the trouble the economy is in. With record high stock prices leading to record levels of household net worth, it seems utterly inconsistent to claim those facts against a US economic depression.

Read More »

Read More »

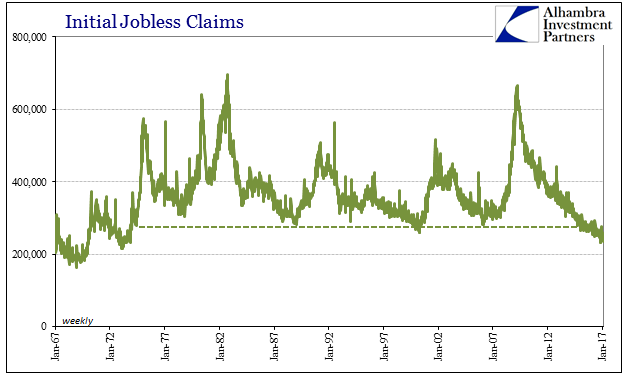

Jobless Claims Look Great, Until We Examine The Further Potential For What We Really, Really Don’t Want

Initial jobless claims fell to just 234k for the week of February 4, nearly matching the 233k multi-decade low in mid-November. That brought the 4-week moving average down to just 244k, which was a new low going all the way back to the early 1970’s. Jobless claims seemingly stand in sharp contrast to other labor market figures which have been suggesting an economic slowdown for nearly two years.

Read More »

Read More »

BIS: The VIX is Dead, The Dollar is the new “Fear Indicator”

Over the past few years, one of the recurring themes on this website has been an ongoing discussion of how the VIX has lost its predictive value as a market risk indicator. This culminated recently with a note by Russel Clark who explained in clear term why the "VIX is now broken." Today, in a fascinating note Hyun Song Shin, head of research at the Bank for International Settlements, the "central banks' central bank" has agreed with the...

Read More »

Read More »

China: Services Companies Benefit on Lower Tax with VAT introduction

Yesterday, China announced one of the most important tax reforms of the past twenty years. It is replacing a business tax on gross revenue for non-manufacturing companies with a VAT. Manufacturing companies have been subject to a VAT approach subject

Read More »

Read More »

Great Graphic: Measuring Cost of Extend and Pretend

There is a debate. On one hand is Summers, who argues that modern economies have entered an era of secular stagnation. Full utilization of the factors of production and particularly capital and labor is not possible without stimulating aggregate demand in a way that facilitates bubbles. The broad strokes of the argument can be found …

Read More »

Read More »

The Fed and the Cotton Candy Market

For Keith Weiner the Federal Reserve operates like a Cotton Candy Machine for the housing market. It creates a massive bubble, financed with debt. It spins the price of a house, with the help of credit and debt, into something many times its original size.

Read More »

Read More »

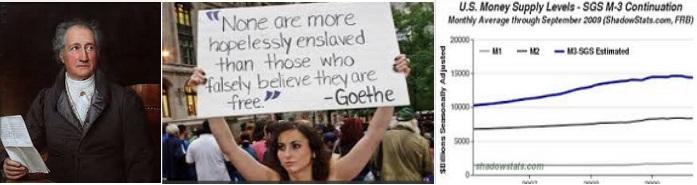

Goethe Predicted Dollar Slavery

In 1809 Goethe wrote "None are more hopelessly enslaved than those who falsely believe they are free." According to Keith Weiner, this is today's status of American workers, stuck with debt and the losing value of the dollar.

Read More »

Read More »

(5.2) FX Rates, the Balance of Payments Model and Central Bank Interventions

We will apply the balance of payments model for determining FX rate movements and FX interventions by central banks.

Read More »

Read More »

How Long Will the Dollar Be the Major World Reserve Currency? A Look at Wealth

We examine how long the U.S. Dollar will remain the unique world reserve currency. The most important criterion for being a reserve currency is wealth. While China has recently overtaken the U.S. as for inflation-adjusted GDP, in the next step, it will overtake the U.S. as for wealth.

Read More »

Read More »

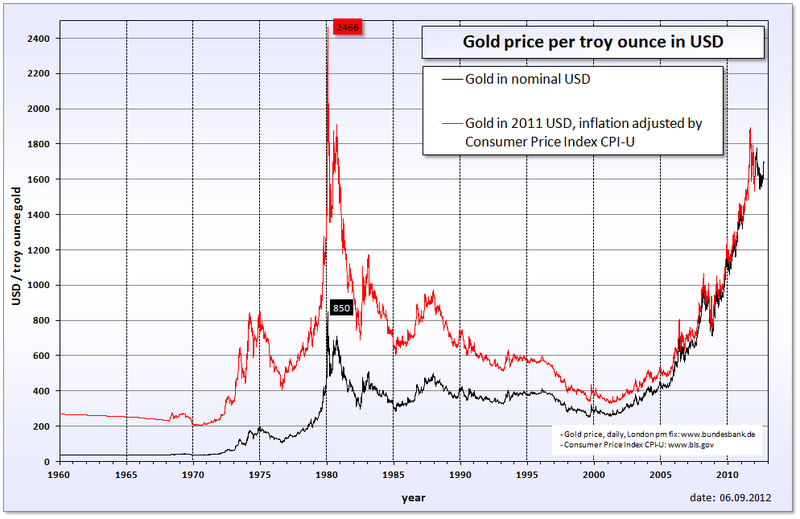

Swiss Franc History: Volcker Shock, Oil Glut and the Breakdown of Gold and Emerging Markets

After the Volcker moment or sometimes called "Volcker shock", commodity prices plunged, the gold price collapsed. Thanks to additional supply, e.g. from Northsea oil, a so-called oil glut appeared. After the increase of debt in the 1970s, some economies in Southern America collapsed. The major reason was Volcker's tight monetary policy with high interest rates and the dependency on US funds.

Read More »

Read More »

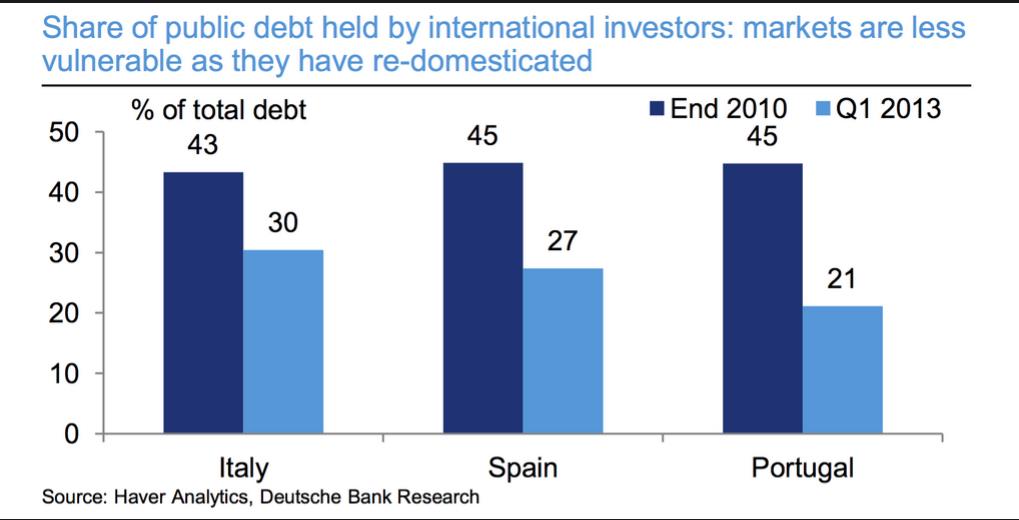

European Banking Assets and Debt

Still in summer 2013, too much debt was an issue. By 2014 things have changed: Europeans have too many savings.

Read More »

Read More »

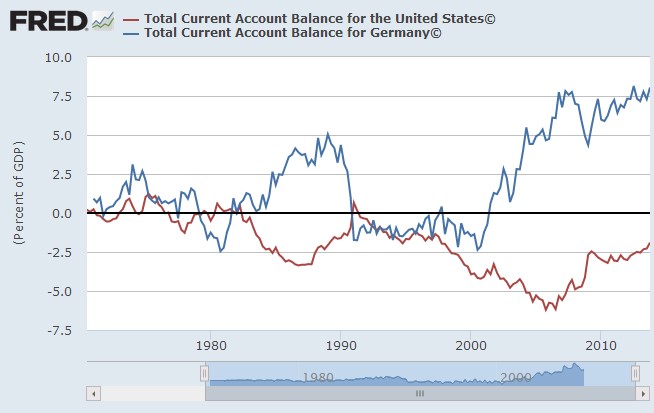

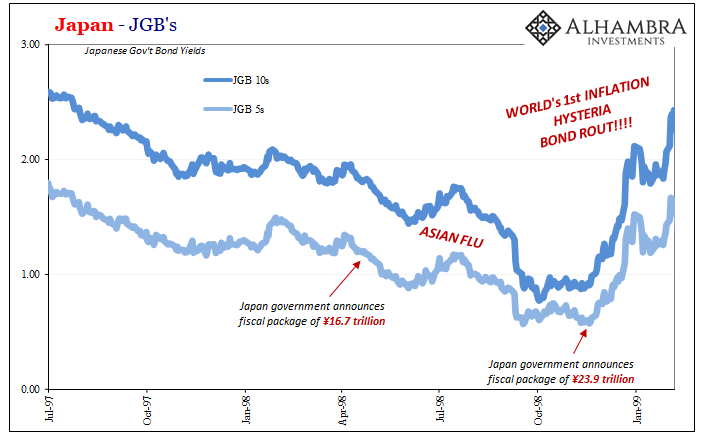

Who is the Biggest Debt Time Bomb: Japan, France, the UK or the United States?

Some must reads: According to the Economist the biggest time bomb in the euro zone crisis is France.

We wonder why the United States and Britain, that have same weak trade balances, the same weak competitiveness and a debt overhang, shouldn't have a problem?

Just because France must do austerity according to the German Fiscal Compact wish, and the US and Britain do not need to do this?

Or like Ray Dalio called it, are the US and Britain...

Read More »

Read More »

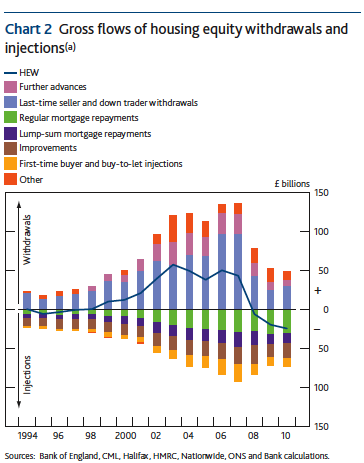

The Balance Sheet Recession: UK Q2 Housing Equity Injection Largest Since Q2 2011

The American-Taiwanese economist Richard Koo, is the chief-economist of the Nomura Research Institute. In his theory of the Balance Sheet Recession he distinguishes between the “Yang” phase of the economy and the “Yin” phase (the so-called “balance sheet recession”). In “Yang” times companies want to increase profit and people consume a big part of their pay …

Read More »

Read More »

Don’t Sell Economic Stability to Buy Economic Growth, Warns Tomáš Sedláček

Don’t sell economic stability to buy economic growth,” warned Tomáš Sedláček, chief macroeconomic strategist at CSOB Bank. Sedláček’s unconventional view is that our problem is not lack of growth but too much of it. See more at the

Read More »

Read More »