Tag Archive: Daily Market Update

Government Shutdown Ends – Markets Ignore Looming Debt and Bond Market Threat

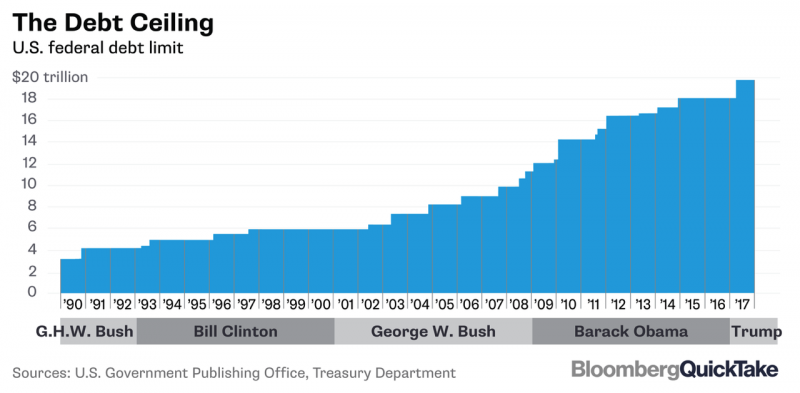

Government Shutdown Ends – Markets Ignore Looming Debt and Bond Market Threat For Now. U.S. Senate pass a temporary spending plan through Feb. 8 to end shutdown. Markets shrug off both government shutdown and re-opening. Markets, government and media ignoring worsening US debt position. Gold responding positively to U.S. dysfunction, rising US Treasury yields & weaker dollar. U.S. government national debt is $20.6 trillion and increasing rapidly....

Read More »

Read More »

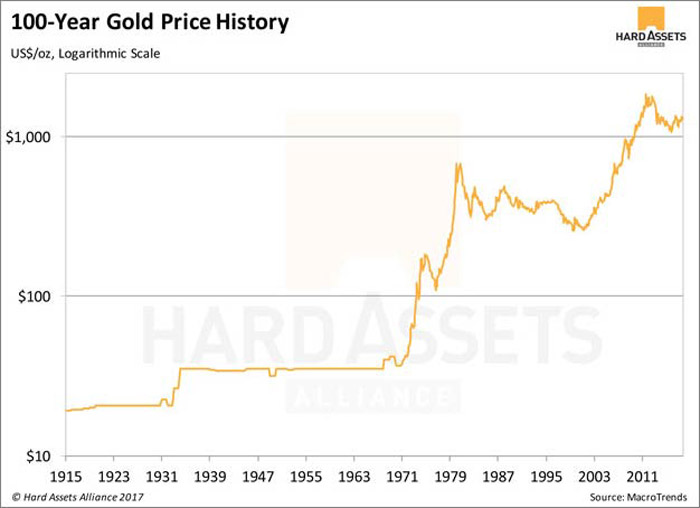

The Next Great Bull Market in Gold Has Begun – Rickards

The Next Great Bull Market in Gold Has Begun – Rickards on Peak Gold And Technicals. ‘Gold is in the early stages of a sustainable long-term bull market’ Rickards. Rickards believes the next bull market in gold will be even more powerful than those of 1971–1980 and 1999–2011. This new rally could send gold $1,475 or higher by next summer thanks to Fed rate hikes. Warns of Peak Gold ‘Physical gold is in short supply. Refiners can’t get enough to...

Read More »

Read More »

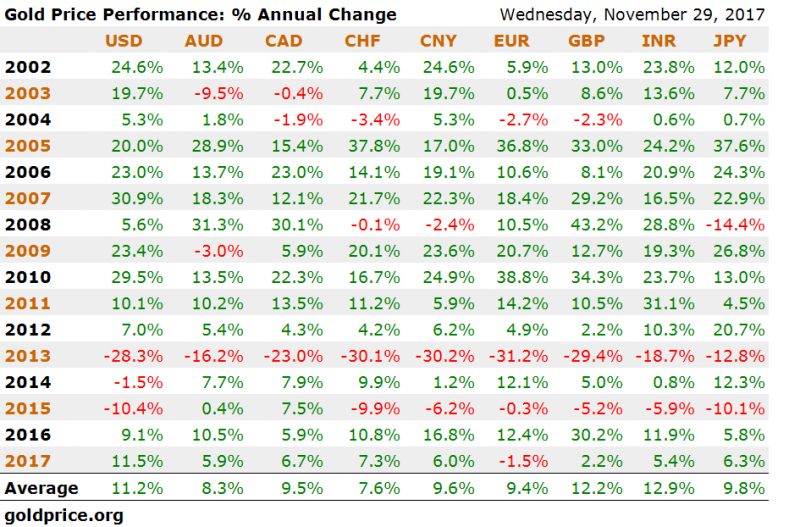

Gold Bullion May Have Room to Run As Chinese New Year Looms

Gold bullion tends to rise January and February before Chinese New Year (see table). Gold is nearly 8% and $100 higher since Fed raised rates one month ago. Options traders are bullish and suggest gold has room to run (see chart). Nervous in short term, positive in medium term – gold at $1,500 in 2018.

Read More »

Read More »

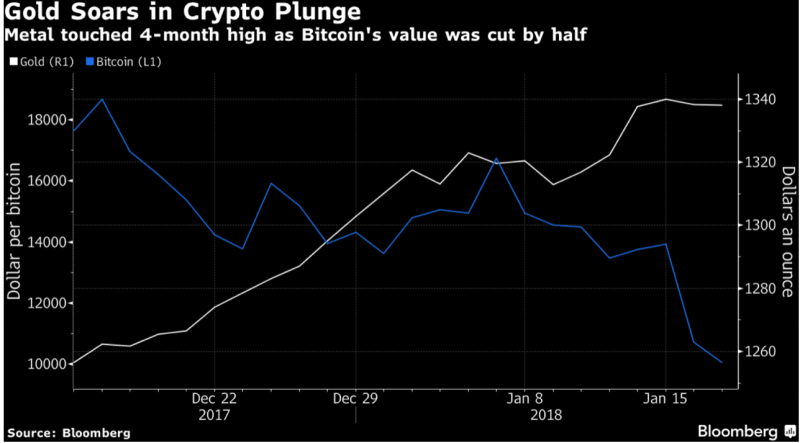

Digital Gold Flight To Physical Gold Coins and Bars

‘Digital Gold’ Bitcoin Flight To Safe Haven Physical Gold. Latest bitcoin, crypto crash causes gold coin and bar demand to surge. Bitcoin down 40% from high, Ripple down 50% and Ethereum down 30%. Ripple and ‘Digital gold’ Bitcoin fall past key psychological price levels. $300bn wiped from cryptocurrency fortunes in just 36 hours. New research says that there is ‘Price Manipulation in the Bitcoin Ecosystem’.

Read More »

Read More »

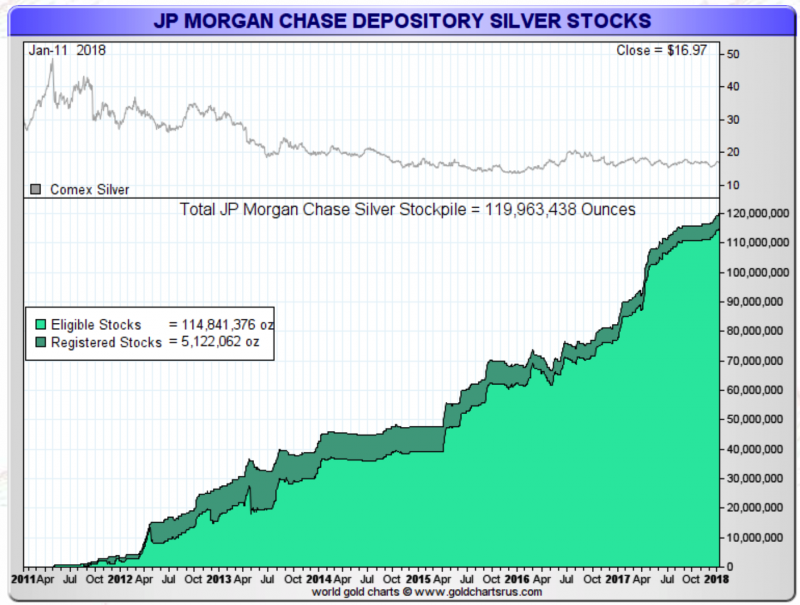

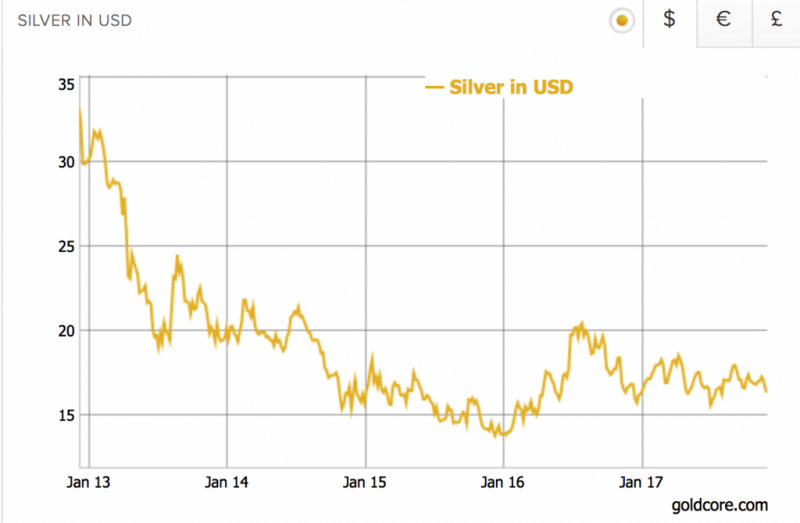

Silver Prices To Surge – JP Morgan Has Acquired A “Massive Quantity of Physical Silver”

JP Morgan continues to accumulate the biggest stockpile of physical silver in history. “JPM now holds more than 133m oz -more than was held by the Hunt Bros” – Butler. Silver hoard owned by JPM has increased from Zero ozs in 2011 to 120m ozs today. Money managers showing more optimism towards silver through record buying. “Near impossible to rule out an upside price surprise at any moment”

Read More »

Read More »

London Property Crash Looms As Prices Drop To 2 1/2 Year Low

London homeowners cut property prices by another 1.4% in January. Average price for a London house dropped by £22,000 to £600,926 in 2017. Takes 78 days to sell a home on average, the highest level since 2012. London’s downtrend continues after 2017 performance as worst UK housing market. UK regional house prices begin to falter as house prices climb slows down.

Read More »

Read More »

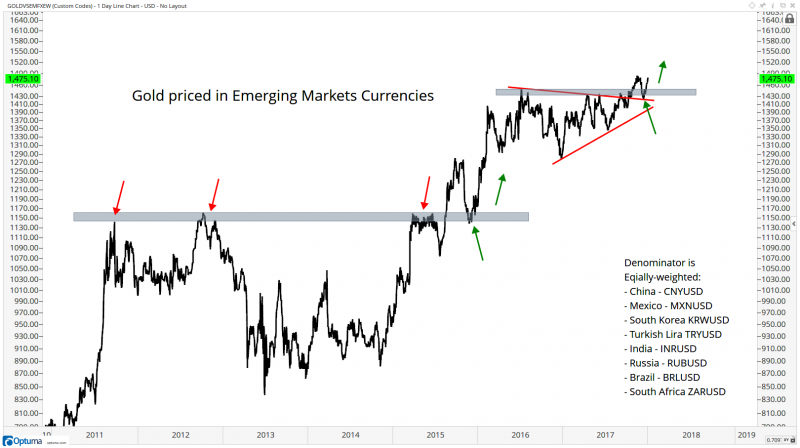

Gold Hits All-Time Highs Priced In Emerging Market Currencies

Gold Hits All-Time Highs Priced In Emerging Market Currencies. Gold at all time in eight major emerging market currencies. A stronger performance than seen when priced in USD, EUR or GBP. As world steps away from US dollar hegemony expect new gold highs in $, € and £. Gold is a hedge against currency debasement and depreciation of fiat currencies.

Read More »

Read More »

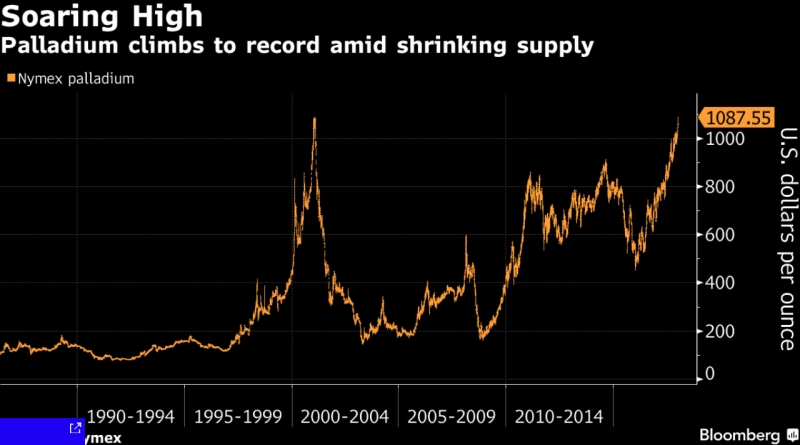

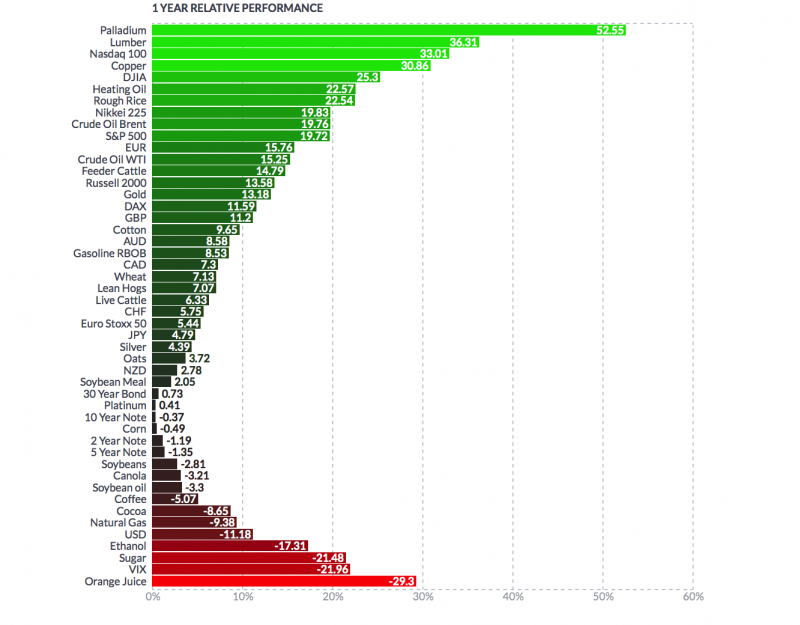

Palladium Prices Surge To New Record High Over $1,100 On Supply Crunch Concerns

Palladium prices surge to new record high over $1,100/oz today. Palladium surges past record nominal price seen in 2001 after 55% surge in 2017. Best-performing precious metal and commodity of 2017 is palladium. Palladium prices top platinum prices for first time in 16 years. Strong Chinese car demand and switch from diesel to petrol cars sees demand surge. Supply crunch as six year supply deficit & 2017 deficit expected to hit 83,000 ounces

Read More »

Read More »

Gold Has Best Year Since 2010 With Near 14percent Gain In 2017

Gold Has Best Year Since 2010 With Near 14% Gain In 2017. Gold posted second straight annual gain in USD in 2017. Gold in 2017: up 13.6% USD, up 2.7% GBP, down 1.4% EUR. 2017 is gold’s best year since 29.5% gain in 2010. Strong performance despite rate hikes and stock bubble. India’s gold imports surged 67% in 2017, Turkish, Chinese demand strong. Gold finished 2017 with longest rally since June 2016. 2018: Currency War and The Year of the...

Read More »

Read More »

Happy 2nd Birthday Bail-in Tool! We Suggest Gold As The Perfect Gift

Happy 2nd Birthday Bail-in Tool! We Suggest Gold As The Perfect Gift. Two years since bail-in rules officially entered EU regulations. EU bail-in rules have wiped out billions for savers and and businesses, with more at risk. Future of many failing banks now rests on depositors who may no longer be protected by deposit insurance.

Read More »

Read More »

98,750,067,000,000 Reasons to Buy Gold in 2018

98,750,067,000,000 Reasons to Buy Gold in 2018. World equity index market capitalization touching distance of $100 trillion dollars at beginning of December. Key indicators across global financial markets are looking decidedly bubble-like. Little indication that we are through the worst of the financial crisis that started in 2007. Apparent lack of concern regarding the over-heated and overpriced markets.

Read More »

Read More »

Gold, Bitcoin and the Blockchain Replaces the Banks – Realists Guide To The Future

Gold, Bitcoin and the Blockchain Replaces the Banks – Realists Guide To The Future. Futurist guide to 2028 shows a world of uncertainty and disruption. One scenario suggests cybersecurity attacks will result in bitcoin and blockchain’s dominance of financial systems. Cybersecurity threat will still loom large and wreak havoc. Gold, silver and other real assets will benefit. Adoption of cryptocurrencies and blockchain will send gold price soaring....

Read More »

Read More »

New Rules For Cross-Border Cash and Gold Bullion Movements

New EU Rules For Cross-Border Cash, Gold Bullion Movements. War on cash continues and expands to affect non-criminals including gold owners. New definitions of “cash” to be drawn up by EU to include gold and precious metals. Claim cash and gold bullion “often used for criminal activities such as money laundering, or terrorist financing”. Legislation will allow authorities to seize assets from those ‘without a criminal conviction’. New rules usurp...

Read More »

Read More »

‘Gold Strengthens Public Confidence In The Central Bank’ – Bundesbank

‘Availability of gold strengthens public confidence in the central bank’s balance sheet’ say Bundesbank. Bundesbank has Audited Reserves amounting to almost 3,400 tonnes, around 68% of Bundesbank’s reserve assets. Bank taken series of steps to increase transparency around Germany’s gold holdings. Germany has second largest gold holdings in the world; U.S. believed to be largest. Transparency important and all central banks should follow the...

Read More »

Read More »

Silver’s Positive Fundamentals Due To Strong Demand In Key Growth Industries

Silver’s Positive Fundamentals Due To Strong Demand In Key Growth Industries. Increased efforts in green energy and advanced technology set to boosts silver’s demand. Four-year supply deficit set to increase due to fewer mine openings and discoveries. Bank manipulation may be why silver under performing. TD Securities and the Bank of Montreal expect silver to be best performing precious metal in 2018.

Read More »

Read More »

Low Cost Gold In The Age Of QE, AI, Trump and War

‘Fear and Loathing In the Age of QE … AI’ is a presentation given at Mining Investment London earlier this week. Stephen Flood, CEO of GoldCore presentation (28 minutes) was well received at the conference which is a strategic mining and investment conference for leaders in the mining and investment sectors, bringing together attendees from 20 countries.

Read More »

Read More »

Own Gold Bullion To “Support National Security” – Russian Central Bank

We own gold bullion to “support national security” – Russian Central Bank. Russia warns Washington: Confiscating fx reserves would be “declaration of financial war”. Russia has quadrupled its gold bullion reserves in decade. BRICs discussing ‘the possibility of establishing a single (system of) gold trade’. Russia, China & maybe Saudi Arabia form alliances to unseat petrodollar. Putin warns state-owned and private companies: be ready for rapid...

Read More »

Read More »

Bitcoin $10,000 – Huge Volatility of Cryptocurrencies and Risky Fiat Making Gold Attractive

Bitcoin tops $10,000, soaring more than 850% since beginning of 2017. Irrational exuberance arguably main driver of price performance. Google Trends shows search for ‘Bitcoin Bubble’ hit highest level this morning. Buyers need to be aware of hacking and security risks. Other primary risks to widespread adoption is volatility and liquidity risk. World’s largest online trading platform IG Markets suspends BTC trading

– Volatility of...

Read More »

Read More »

Geopolitical Risk Highest “In Four Decades” – Gold Demand in Germany and Globally to Remain Robust

Geopolitical risk highest “in four decades” should push gold higher – Citi. Elections, political and macroeconomic crises and war lead to gold investment. Political uncertainty in Germany means “gold likely to remain in good demand as a safe haven” say Commerzbank. “There has rarely been such political uncertainty in Germany at any time in the country’s post-war history” – Commerzbank. Reduce counter party risk: own safe haven allocated and...

Read More »

Read More »

Gold Versus Bitcoin: The Pro-Gold Argument Takes Shape

Gold versus Bitcoin: The pro-gold argument takes shape. Why cryptocurrencies will not replace gold as a store of value. Similarities between crypto and gold but that does not make them substitutes. Gold remains a highly liquid market, cryptocurrencies continue to be fragmented and difficult to spend. Bitcoin does not make it an effective hedge against stocks

Read More »

Read More »