Tag Archive: Daily Market Update

Brexit, Stagflation Pressures UK High Street

Brexit, Stagflation Pressures UK High Street. UK high street and wider consumer market feeling effects of financial crisis, Brexit and inflation. 350,000 retails jobs expected to disappear between 2016 and 2020. Centre for Retail Research predicts 9,500 shops to close this year and 10,200 in 2019. UK is ‘worst performing’ European market for new car registrations – Moody’s. UK’s growth outlook is the ‘worst in the G20’ – Institute of Fiscal...

Read More »

Read More »

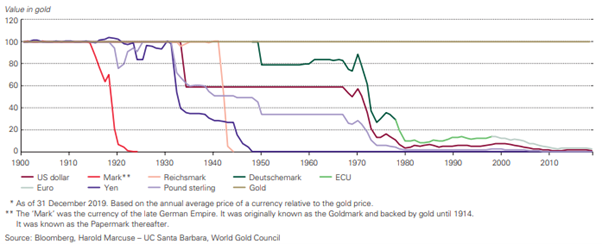

Gold Is Money While Currencies Today Are “IOU Nothings”

Now that the international monetary system we have long known has broken down, and the world is groping through monetary reform for a new one, it is time to consider some fundamentals. What is money anyway? First, it is a means of payment or medium of exchange. I prefer that first phrase. It is simpler. We all use money to pay our bills, to buy goods and services. We also accept money when we sell.

Read More »

Read More »

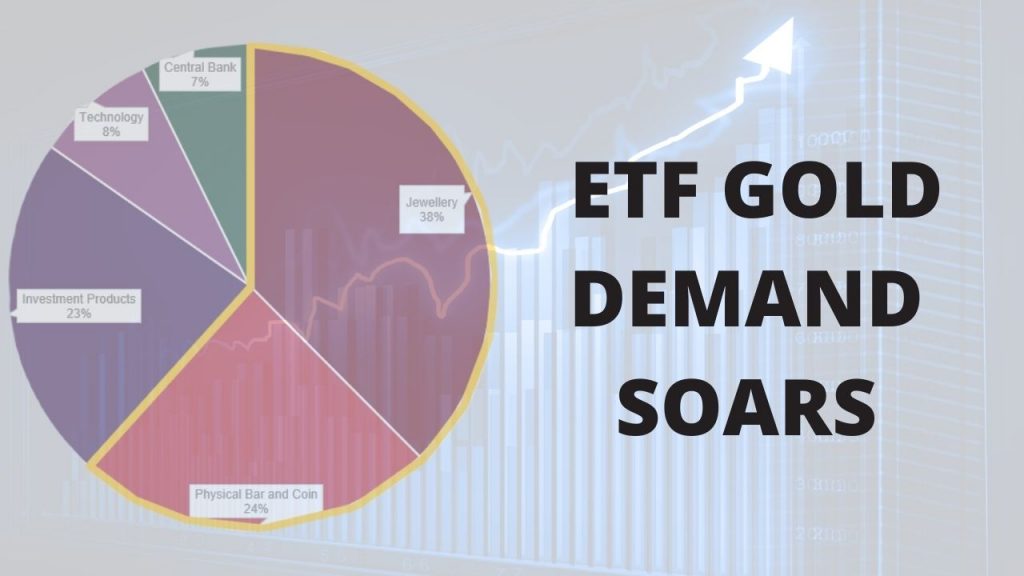

Gold Outperforms Stocks In Q1, 2018

Gold Outperforms Stocks In Q1, 2018. Gold signs off Q1 2018 with best run since 2011. Gold price supported by safe haven demand, interest-rate concerns and inflation. Trade wars and concerns over equity market have sent investors towards gold. ETF holdings highest in nearly a decade. Goldman Sachs: ‘The dislocation between the gold prices and U.S. rates is here to stay’.

Read More »

Read More »

“Stars Are Slowly Aligning For Gold” – Frisby

“Stars Are Slowly Aligning For Gold” – Frisby. Gold ends March with a third-quarterly gain, a feat not seen since 2011. Impressive gains seen despite tightening of monetary policy from Federal Reserve. Frisby – gold is set to break through technical resistance of $1,360. Gold’s safe haven role back in focus with Trump trade wars and increasing geopolitical tensions. Now is opportune time for investors to buy gold, ahead of next quarter.

Read More »

Read More »

Uncle Sam Issuing $300 Billion In New Debt This Week Alone

US needs to borrow almost $300 billion this week alone. This is the largest debt issuance since 2008 financial crisis. Trump threatens trade war with its biggest creditor – China. Bond auctions have seen weak demand due to large supply and trade war concerns. $20 trillion mark reached in early September 2017; $1 trillion added in just 6 months. US total national debt level now exceeds $21.05 trillion and is accelerating higher.

Read More »

Read More »

Eurozone Faces Many Threats Including Trade Wars and “Eurozone Time-Bomb” In Italy

Eurozone threatened by trade wars, Italy and major political and economic instability. Trade war holds a clear and present danger to stability and economic prospects. Italy represents major source of potential disruption for the currency union. Financial markets fail to reflect the “eurozone time-bomb” in Italy. Financial volatility concerns in Brussels & warning of ‘sharp correction’ on horizon.

Read More »

Read More »

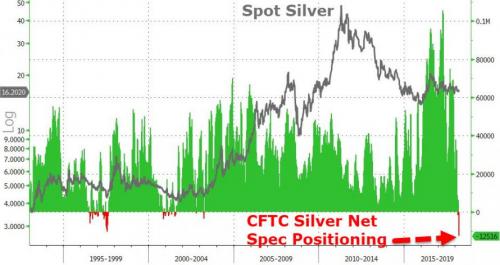

Silver Futures Report and JP Morgan Record Silver Bullion Holding Is Extremely Bullish

Silver Futures Report, JP Morgan Record Silver Bullion Holding Is Extremely Bullish. JP Morgan Continues Adding To Massive Silver Bullion Holdings (see chart). Silver Speculators Go Short – Which Is Extremely Bullish. Stunning Silver COT Report: One For the Ages (see chart).

Read More »

Read More »

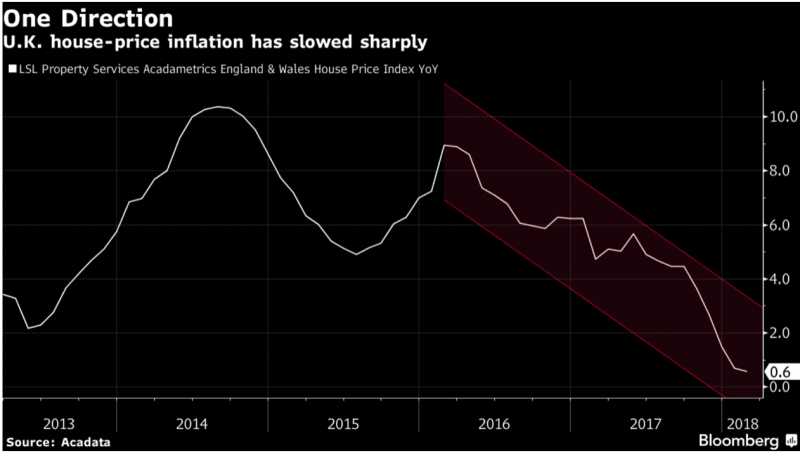

London House Prices Falling Sharply – UK’s Much Needed Wake-Up Call

London house prices falling at fastest pace since 2009. Values fell by 2.6% in year through January. London house prices likely to be weakest in UK over next five years. Inflated prices make London property more exposed to economic and political shocks. Worries over house prices are having a knock-on effect in wider economy. Physical gold to act as much needed hedge against falling property prices.

Read More »

Read More »

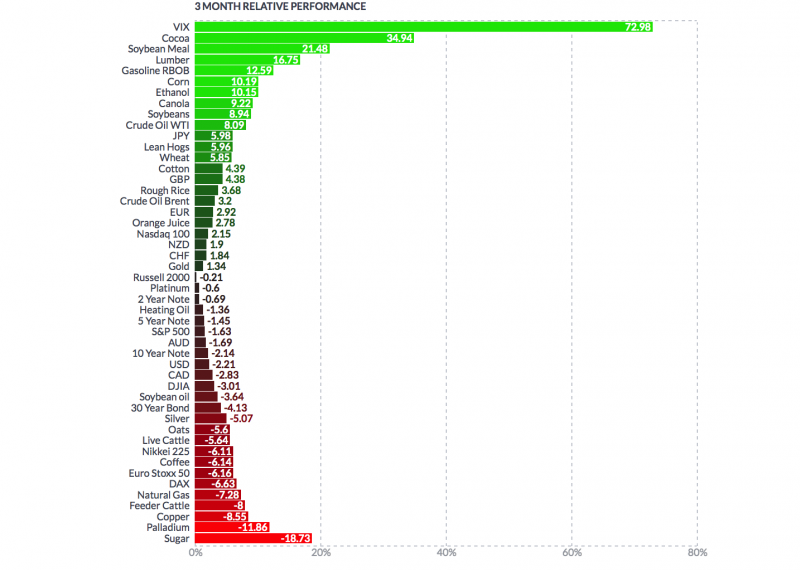

Global Trade War Fears See Precious Metals Gain And Stocks Fall

– Market turmoil as trade war concerns deepen and Trump appoints war hawk Bolton

– Oil, gold and silver jump as ‘Russia China Hawk’ Bolton appointed

– Oil up 4%, gold up 2.2% and silver up 1.6% this week (see table)

– Stocks down sharply – Nikkei down 4.5%, S&P 4.3% & Nasdaq 5.5%

– Bolton scares jittery markets already shell-shocked by US’ tariffs against China

– Currency wars and trade wars tend to proceed actual wars

– Gold now...

Read More »

Read More »

Gold +1.8 percent, Silver +2.5 percent As Fed Increases Rates And Trade War Looms

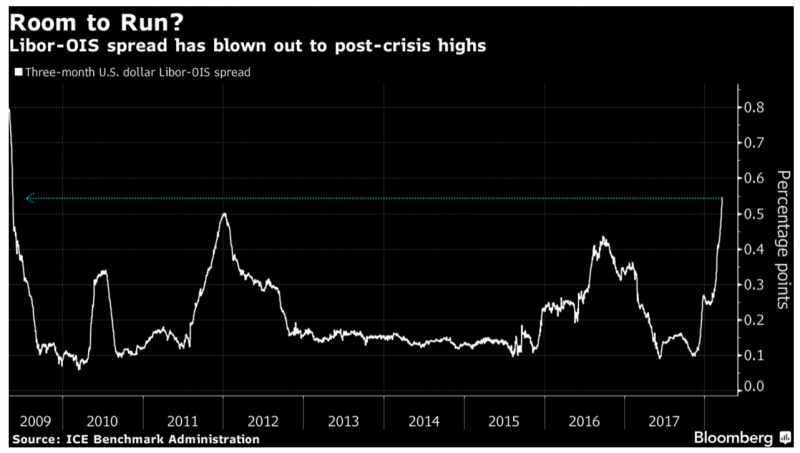

Gold gained 1.8% and silver 2.5% to $1,333/oz and $16.60/oz yesterday. Gold climbs as Fed increases interest rates by 0.25% – now 1.5% to 1.75% range. Dovish Fed Chair Powell plans fewer than expected rate hikes in 2018. Markets disappointed at lack of hawkish comments from new Fed Chair. Dollar LIBOR rises to highest level since November 2008 – $200 trillion worth of dollar-denominated financial products including mortgages based off LIBOR.

Read More »

Read More »

Credit Concerns In U.S. Growing As LIBOR OIS Surges to 2009 High

Key Metric LIBOR OIS Signals Major Credit Concerns. Widening of the spread between LIBOR OIS (overnight index swap) rate raises concerns. Spread jumped to 9 year widest spread, rising to 54.6bps, most since May 2009. Libor recently moved to over 2% for first time since 2008. Wider spread usually associated with heightened credit concerns.

Read More »

Read More »

Four Charts: Debt, Defaults and Bankruptcies To See Higher Gold

$8.8B Sprott Inc. sees higher gold on massive consumer debt, defaults & bankruptcies. Rising and record U.S. debt load may cause financial stress, weaken dollar and see gold go higher. Massive government and consumer debt eroding benefits of wage growth (see chart).

Read More »

Read More »

Gold Cup At Cheltenham – Gold Is For Winners, Not For the Gamblers

Gold Cup at Cheltenham – ‘The Olympics’ of the European horse racing calendar. Gold Cup trophy contains 10 troy ounces of gold – worth £9,000. £620 million bets on horses, 230,000 pints of Guinness will be drunk, 9.2 tonnes of potato eaten. Since the 5th century BC, gold has been the ultimate prize to award champions and gold has been constantly and universally awarded as top prize.

Read More »

Read More »

Hungary’s Gold Repatriation Adds To Growing Protest Against US Dollar Hegemony

Hungary’s Gold Repatriation Adds To Growing Protest Against US Dollar Hegemony. Hungarian National Bank (MNB) to repatriate 100,000 ounces gold from Bank of England. Follows trend of Netherlands, Germany, Austria and Belgium each looking to bring gold back to home soil. Hungary one of the smallest gold owners amongst central banks, with just 5 tonnes. Central bank gold purchases continue to be major drivers of gold market.

Read More »

Read More »

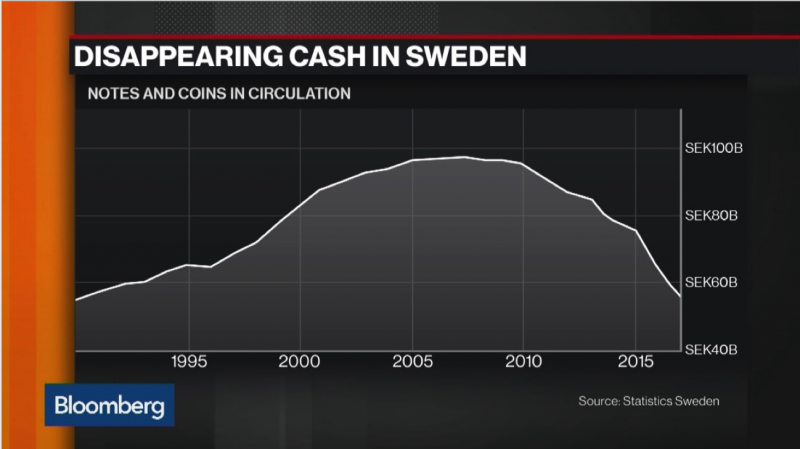

Gold Protects As Cashless Society Threatens Vulnerable

Gold Protects As Cashless Society Threatens Vulnerable. Swedish authorities concerned cashless society is happening ‘too quickly’ and heading into ‘negative spiral’. Only 25% of Swedes paid in cash at least once a week in 2017, 36% never use cash. Cash usage in Sweden falling both as share of GDP and in nominal terms. Sweden may be world’s first economy to introduce a cryptocurrency, the e-krona. Cashless is not a disincentive for illegal drug...

Read More »

Read More »

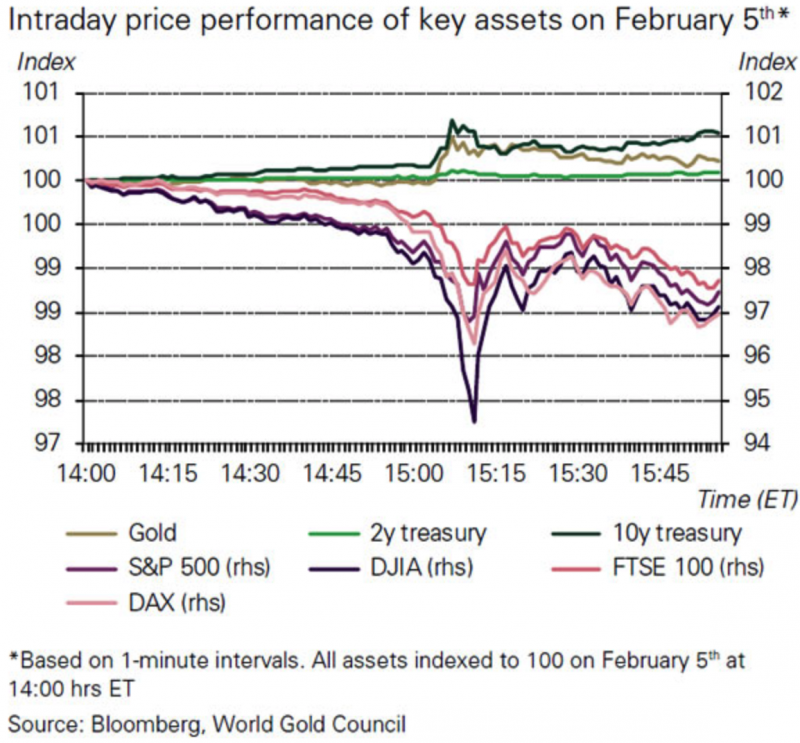

Stock Market Selloff Showed Gold Can Reduce Portfolio Risk

Stock Market Selloff Showed Gold Can Reduce Portfolio Risk. Recent stock market selloff showed gold can deliver returns and reduce portfolio risk. Gold’s performance during stock market selloff was consistent with historical behaviour. Gold up nearly 10% in last year but performance during recent selloff was short-lived. The stronger the market pullback, the stronger gold’s rally. WGC: ‘a good time for investors to consider including or adding gold...

Read More »

Read More »

Women’s Pension Crisis Highlights Dangers To Savers

Women’s Pension Crisis Highlights Dangers To Savers.

– International Women’s Day highlights the underreported UK Women’s pension crisis.

– 2.66 million affected by UK government’s change to state pension act.

– Women’s pension crisis is one of many in the UK, where there is a £710bn deficit for prospective retirees.

– Changes by government highlights the counterparty risks pensions are exposed to.

– Global problem as pensions gap of developed...

Read More »

Read More »

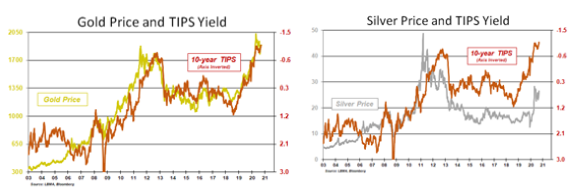

Gold Does Not Fear Interest Rate Hikes

Gold Does Not Fear Interest Rate Hikes. Gold no longer fears or pays attention to Fed announcements regarding interest rates. Renewed interest in gold due to inflation fears and concern Fed won’t do enough to control it. Higher interest rates on horizon will make debt levels unsustainable. New Fed Chair warns “the US is not on a sustainable fiscal path” and could lead to an “unsustainable” debt load. Higher interest rates are good for gold as seen...

Read More »

Read More »

London Property Sees Brave Bet By Norway As Foxtons Profits Plunge

London Property Sees Brave Bet By Norway As Foxtons Profits Plunge. Sales in London property market at ‘historic lows’. 65% fall in pre-tax profits in 2017 to £6.5m reported by London estate agents Foxtons. Foxtons warns 2018 will ‘remain challenging’ for London property. Norway’s sovereign wealth fund is backing London’s property market. RICS: UK property stock hits record low as buyer demand falls. Own physical gold to hedge falls in physical...

Read More »

Read More »

Silver bullion will likely outperform gold bullion going forward

Normally the action in the gold and silver futures markets tends to be pretty similar, since the same general forces affect both precious metals. When inflation or some other source of anxiety is ascendant, both metals rise, and vice versa. But lately – perhaps in a sign of how confused the world is becoming – gold and silver traders have diverged.

Read More »

Read More »