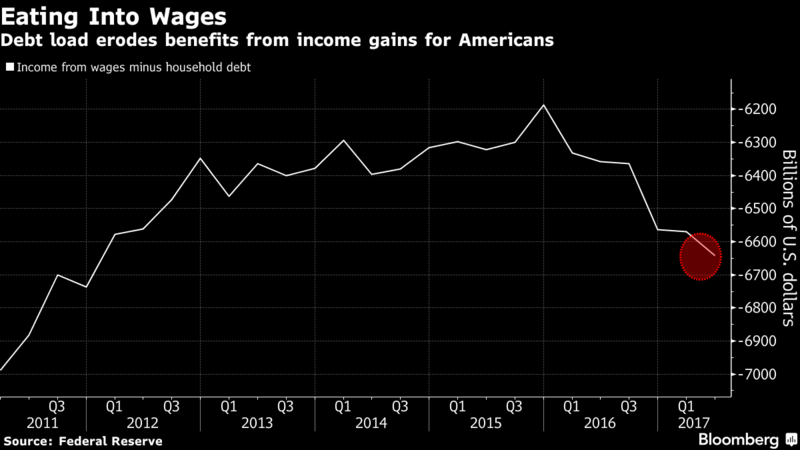

– Rising and record U.S. debt load may cause financial stress, weaken dollar and see gold go higher

– Massive government and consumer debt eroding benefits of wage growth (see chart)

Rising U.S. interest rates, usually bad news for gold, are instead feeding signs of financial stress among debt-laden consumers and helping drive demand for the metal as a haven.

That’s the argument of Sprott Inc., a precious-metals-focused fund manager that oversees $8.8 billion in assets. The following four charts lay out the case for why gold could be poised to rise even as the Federal Reserve tightens monetary policy.

| Gold futures have managed to hold on to gains this year, staying above $1,300 an ounce even as the Fed raised borrowing costs in December for a fifth time since 2015 and is expected to do so again next week.

The increases followed years of rates near zero that began in 2008. Low rates coupled with the Fed’s bond-buying spree contributed to the precious metal’s advance to a record in 2011. Higher rates typically hurt the appeal of gold because it doesn’t pay interest. |

Gold's Resilience, Mar 2015 - 2018 |

Paper LossesThe U.S. posted a $215 billion budget deficit in February, the biggest in six years, as revenue declined, Treasury Department data show. That’s boosting the government debt load, fueling forecasts for higher yields and raising the specter of paper losses for international investors who own $6.3 trillion of U.S. debt. Slowing demand for Treasuries from overseas buyers is contributing to dollar weakness against the currency’s major peers, helping support gold prices, according to Trey Reik, a senior portfolio manager at Sprott’s U.S. unit. |

Foreign Ownership of US Debt, 2001 - 2018 |

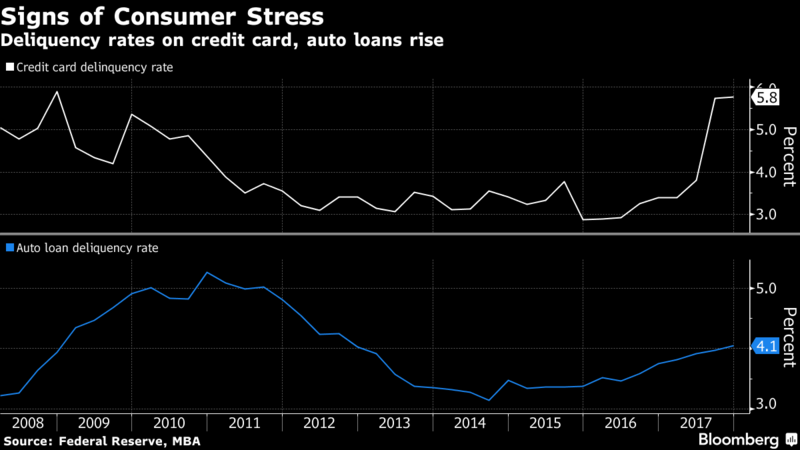

Debt-Laden ShoppersThe yield on the 10-year U.S. Treasury, which has been in decline for more than three decades, has risen over 40 basis points this year as the Fed raised rates and U.S. debt ballooned to more than $20 trillion. That has ramifications for American households already struggling to pay down their credit cards and auto loans, dimming the outlook for consumer spending that helped fuel U.S. growth. Those concerns have been widely overlooked by investors but will spur demand for haven assets like gold, Reik said. |

Credit Card and Auto Loan Deliquency Rates, 2008 - 2018 |

| “With as much debt as there is in the system, if you have a backup in rates, you’re going to see a default wave pretty quickly,” Reik said in an interview at Bloomberg’s headquarters in New York. “You’re going to have personal bankruptcies flare up. Gold really does well when financial stress starts to take hold in the system.”

In December, Fed officials signaled they may boost interest rates three times this year amid improving U.S. economic growth and a tightening labor market that could spur wage growth and push inflation toward the central bank’s target of 2 percent. Even with a synchronized global expansion, though, consumer debt is likely to erode the benefits of rising wages, undercutting the argument from gold bears that an improving world economy will damp haven demand for gold, Reik said. |

US Income Gains from Wages, Q3 2011 - Q1 2017 |

Tags: Daily Market Update,newslettersent