From Bloomberg: Gold’s breakneck rally eased this week, but tailwinds in both physical and paper markets suggest it’s got room to run. Chinese New Year buying and option prices suggest the stars are aligning for the metal to extend its 6 percent gain over the past month. “I’m always a bit nervous when gold prices rise this much, this fast,” said Mark O’Byrne, director of bullion dealer GoldCore Ltd. “But there certainly is healthy demand from China and the futures market — I think we should break highs above $1,400 later in the year.” |

Gold Spot, Oct 2017 - Jan 2018 |

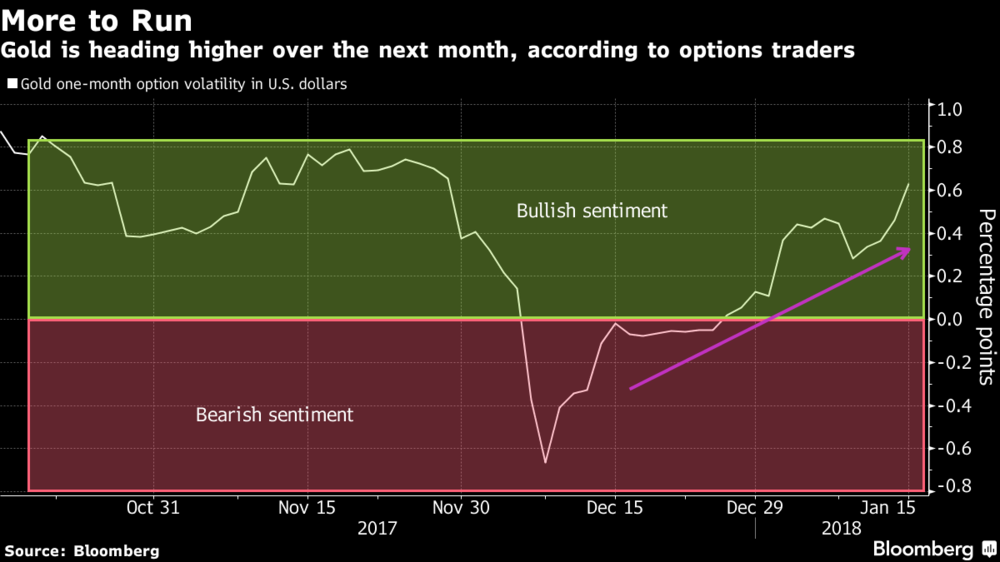

| Options traders are betting on at least another month of rising prices. They’re charging more for benchmark call contracts than for similar puts, and by the biggest premium since November. The bias, measured in implied volatility, has increased to about 0.6 percentage points. |

Gold One-month Option Volatility in U.S. Dollars, Oct 2017 - Jan 2018 |

| Gold tends to do well in January and February. That’s when demand spikes in the biggest consuming nation, China. Over the past decade, the metal advanced by about 6 percent on average in the first two months combined. The Lunar New Year, which is often celebrated with gifts of gold in much of Asia, falls on Feb. 16 in 2018.

January has historically been gold’s strongest |

Average Monthly Price Change, Jan - Dec 2017 |

| Still, a technical indicator points to a rally that may have grown tired.

The metal, which reached a four-month high this week, crossed into 2018 with an eight-day rally, the longest string of increases since 2011. Now, it’s considered overbought, according to the relative-strength index, a gauge of momentum. As gold futures are quoted in the U.S. currency, its upswing somewhat depends on whether the greenback’s losing streak continues. Option prices signal that traders foresee the dollar falling over the next month against the euro, yen and pound. That’s good news for bullion: The 120-day price pattern is close to its strongest negative correlation since late 2012. |

Correlation, 2012 - 2018 |

| GoldCore Note

Gold is due a correction after its $100 rally since the Fed raised rates. A near 8% gain in a month is quite a move up in a short period of time and ordinarily one would expect a correction. Frequently a 50% retracement of the gains takes place. This could take us back to the $1,300 level which acted as resistance before. Previous resistance frequently becomes support. We are always a bit nervous when gold prices rise this much, this fast. At the same time the sharp fall in bitcoin and crypto-currencies is leading to an increase in demand for physical gold and there is robust demand from China ahead of the Chinese New Year. We are a little cautious in the very short term but very positive in the medium term and see gold over $1,500 in 2018. |

iShares Gold Trust, 2013 - 2018 |

Full story here Are you the author? Previous post See more for Next post

Tags: Daily Market Update,newslettersent