Tag Archive: Credit Suisse

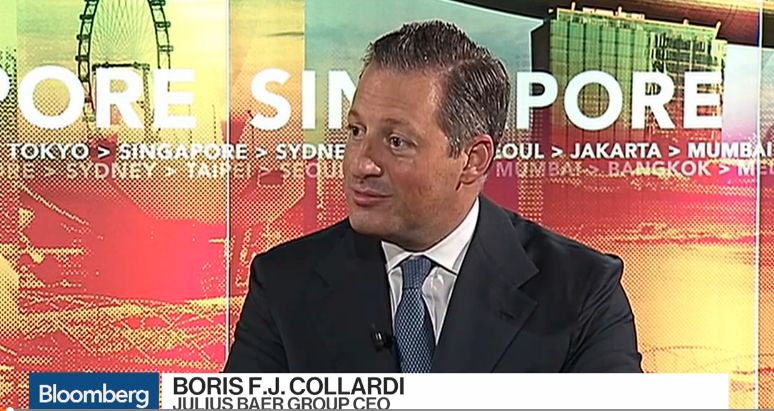

Julius Baer CEO says Asia revenue may excede Europe’s in 5 years

Julius Baer Group Ltd. said Asia may overtake Europe as its biggest revenue-generating region, as the Swiss wealth manager steps up hiring in Hong Kong and Singapore. “In the next five years, Asia could be the biggest region for us if we grow at double-digit” rates, Chief Executive Officer Boris Collardi said Wednesday in an interview in Singapore. More than half of about 200 new bankers that Julius Baer plans to hire this year will be based in...

Read More »

Read More »

Swiss stocks drop on volatility spike

The Swiss Market Index is set to finish the week notably weaker along with global equity markets as fears around global monetary policy hit sentiment ahead of key meetings by the Bank of Japan and US Federal Reserve next week. The SMI did manage to outperform its European peers thanks to its heavy weighting towards more defensive pharmaceuticals and consumer staples sectors.

Read More »

Read More »

Negative and the War On Cash, Part 2: “Closing The Escape Routes”

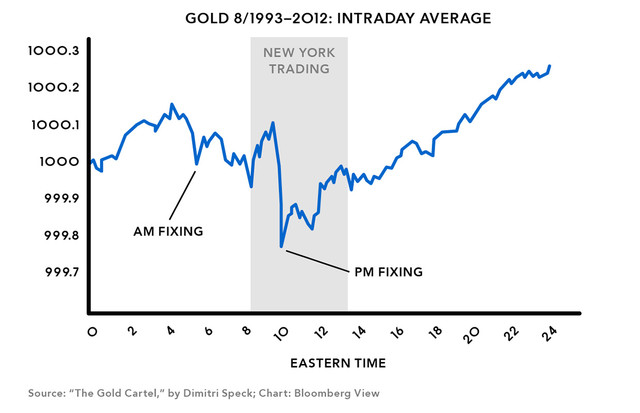

History teaches us that central authorities dislike escape routes, at least for the majority, and are therefore prone to closing them, so that control of a limited money supply can remain in the hands of the very few. In the 1930s, gold was the escape route, so gold was confiscated. As Alan Greenspan wrote in 1966:

Read More »

Read More »

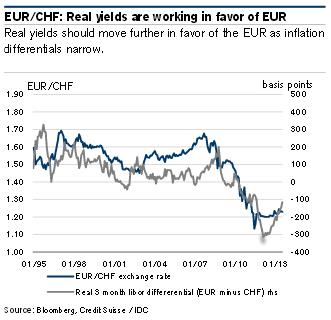

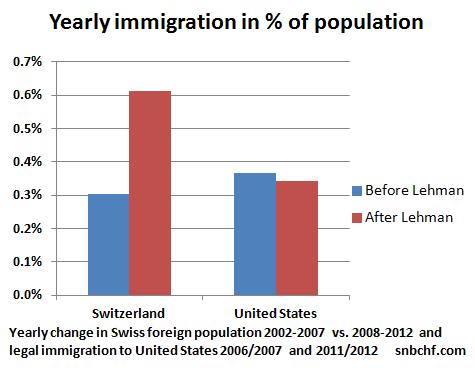

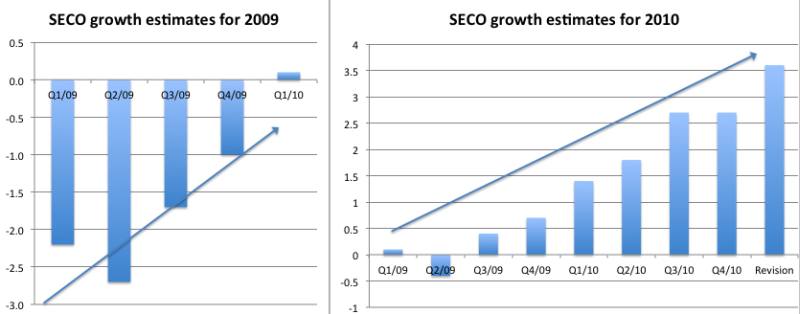

Why Switzerland’s franc is still strong in four charts

Swiss National Bank President Thomas Jordan keeps saying the franc is “significantly overvalued.” And that’s despite the central bank’s record-low deposit rate and occasional currency market interventions.

Read More »

Read More »

Negative Consumer Financing Rates in Germany, Soon More Negative in Switzerland?

Things are increasingly upside down in the brave new centrally planned world: thanks to negative deposit rates central banks have put an explicit cost on saving, while in various instances, such as taking out a mortgage in Denmark and the Netherlands, the bank actually pays the borrower, thus rewarding living beyond one's means.

Read More »

Read More »

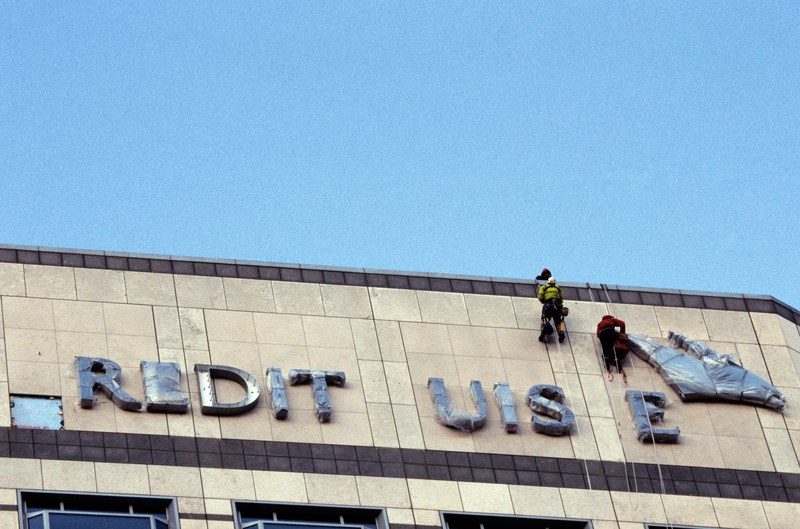

Credit Suisse’s turnaround is working, but vulnerable

Brought to you by Investec Switzerland. Just a month ago, Credit Suisse CEO Tidjane Thiam and Deutsche Bank CEO John Cryan risked, as one hedge fund manager put it, becoming the dead men walking of European banking as they struggled to shore up their...

Read More »

Read More »

Return of the Repressed: Europe’s Unresolved Banking Crisis

The IMF identified three banks that posted the most significant systemic risks. It has been overshadowed by new pressure on Italy's banks, and Three UK commercial real estate funds have been frozen to prevent redemptions.

Read More »

Read More »

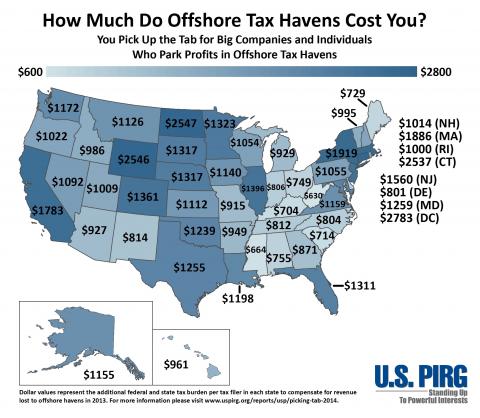

Panama Tax Haven Scandal: The Bigger Picture

The “Panama Papers” tax haven leak is big … After all, the Prime Minister of Iceland resigned over the leak, and investigations are taking place worldwide over the leak. But the Panama Papers reporting mainly focuses on friends of Russia’s Putin, Ass...

Read More »

Read More »

British Discontent About The EU: Only A Precursor To Unrest On The Continent

Britain leaves the EU and if the reaction to Brexit causes years of uncertainty, the EU will reap what it has sowed. British discontent is only a precursor to unrest on the Continent, where populists from across the political spectrum feel they have lost control over their fate, and are gaining popularity

Read More »

Read More »

Why An Ex-Credit Suisse Banker In Brazil Made More Money Than The CEO

Ever had to testify in a trial involving your father's dealings in corrupt activities, and as a result had your tax records leaked for all of the public to see? Sergio Machado, the ex-head of Credit Suisse's Brazil fixed-income business has, and now ...

Read More »

Read More »

Negative Rates: Jim Bianco Warns “The Risk Of An ‘Accident’ Is Very High”

In an interesting interview with Finanz und Wirtschaft, Bianco Research president Jim Bianco discusses a variety of topics such as negative interest rates turning the entire credit process upside down, bank balance sheets being even more complex and ...

Read More »

Read More »

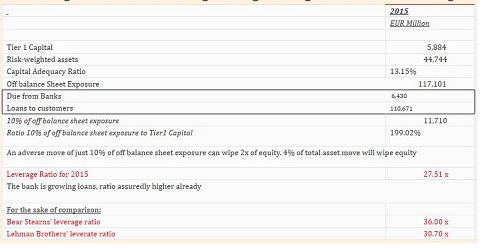

ZIRP, NIRP, QE, Bank Collapse and Helicopters Coming Too Late – The Lehman Effect Hits Europe – Hard!

It's official, I'm calling a banking crisis in Europe. Things didn't go well the last time I did this. Of course, many will say, "But the rating agencies have learned their collective lessons. They would most assuredely warn us if the European banks...

Read More »

Read More »

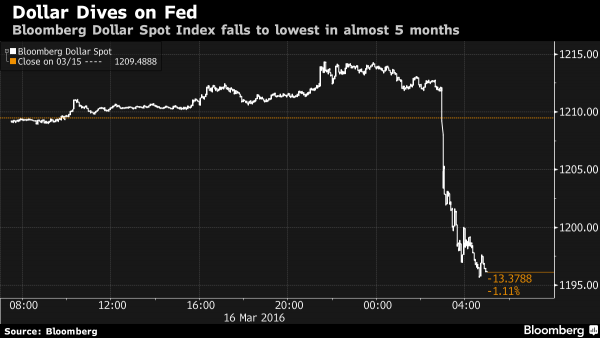

Another Fed “Policy Error”? Dollar And Yields Tumble, Stocks Slide, Gold Jumps

Yesterday when summarizing the Fed's action we said that in its latest dovish announcement which has sent the USD to a five month low, the Fed clearly sided with China which desperately wants a weaker dollar to which it is pegged (reflected promptly ...

Read More »

Read More »