In an interesting interview with Finanz und Wirtschaft, Bianco Research president Jim Bianco discusses a variety of topics such as negative interest rates turning the entire credit process upside down, bank balance sheets being even more complex and concentrated than before the financial crisis, energy loans being an accident waiting to happen, the markets having veto power over the Fed, and gold having more room to run.

* * *

Mr. Bianco, negative interest are causing a lot of stir at the financial markets. It looks like even the Bank of Japan is having some doubts now, since it didn’t launch more monetary stimulus this week. What’s your take on negative interest rates?

Even if you go back to the Egyptian pharaohs and the Fertile Crescent in Mesopotamia we have never consistently seen negative interest rates in the reported human history until two years ago. That’s why investors are worried that negative rates are going to create distortions and what you see out of Japan are some of those distortions. The Bank of Japan is not getting the market reaction that it expected. So if negative yields are not a mistake then central bankers have to do a better job in explaining to the world why this is going to work out just fine.

Why are many investors so skeptical about negative interest rates?

People are still staring at negative interest rates and still not comprehending them. When the ECB introduced negative interest rates two years ago the world viewed it just as a temporary gimmick. But then, on January 29th, the Bank of Japan comes in and they go negative as well. After the Bank of Japan decided to go negative, the number of outstanding bonds with a negative yield suddenly doubled in about two days. If you exclude the US market, around 45% of sovereign bonds in the world are now yielding negative.

Why is it so hard to understand negative interest rates?

The problem with negative rates is two-fold. Firstly, it’s a procedure problem. Even though we at the financial markets look at our screens and see negative numbers, negative interest rates don’t exist at the consumer level. The banks in Europe are not offering negative mortgages, they’re not offering negative deposits and they’re not issuing bonds with negative coupons yet. If a country like Switzerland was to issue a negative coupon sovereign bond that means that every owner of that bond has to pay the issuer. But how do you collect that money? Nobody’s got a system in place that can reach out to bondholders and get all those checks. Or how does a negative mortgage work? With a negative mortgage, instead of you paying the bank, the bank pays you. But how does the bank pay you? They don’t have a system in place to mail out all those checks.

And secondly?

Negative interest rates turn the whole credit process upside down. Let’s say we have a system in place and a company has thousand and thousands of bondholders that own its bond with a negative coupon. What’s the credit rating of that security? It’s not the credit rating of the company. It has to be some kind of total of the people that own this bond and that’s probably a junk rating. So how does the company get the money from everybody? What happens if some bond holders don’t pay? And what are the collection procedures for people that are in arrears? That’s the problem with such kind of securities and that’s why people thought it was just a gimmick.

So what are the consequences of negative interest rates?

In a negative interest rate world currencies yield zero and that’s actually a high yield. As a matter of fact, according to former Fed-chief Ben Bernanke the Federal Reserve did a very interesting study that looked at the volume of all of the vault space at the major banks in the US and they calculated a break-even. They calculated that if the Fed Funds Rate ever got below -35 basis points, the banks would be better off by stacking in the volume of their vault space with $100 bills yielding zero as opposed to taking a Funds Rate at -35. There is no such study for European banks. But Bernanke believes that their break-even would be even closer to zero, something like -20 or -15 basis points because they have a 500 Euro note which is six times the monetary value of a $100 bill and roughly the same size. Yet, we’re seeing no movement out of the European banks to stack 500 Euro notes in their vaults. That means they’re acting irrationally. They’re not acting that way because they don’t believe it or they don’t understand it. So we’re still all trying to feel around in the dark as to what this means. And that means that the chance of an accident is very high.

Also, when you look at the poor performance of European bank stocks, negative interest rates seem to cause severe concerns among investors in the financial sector.

Deutsche Bank’s share price is under its 2009 low. That was the level at which we thought the world was ending. So what does it mean that Deutsche Bank’s share price is lower than that? Does it mean the world is ending for the largest European bank by assets? And by the way, Credit Suisse is not far behind. Of course, Deutsche Bank’s on the hook for a lot of other things, too. They’ve missed on regulation, they’ve missed on capital, they’re in the wrong line of business and they have significant risk. Deutsche Bank is the largest holder of Euro denominated derivatives. So what happens if it comes to a Brexit or if it comes to a Grexit? The problems in Greece never went away. We’ve just decided that we got bored to talk about it.

And what about the big banks in the United States. The performance of US bank stocks is pretty disappointing as well.

Coming out of the financial crisis, the five largest financial institutions in the United States now have a higher concentration of financial assets. Not only do they have a higher concentration of assets than they did before the financial crisis but it’s the largest concentration ever. So we’ve made the too-big-to-fail-problem worse because we have bigger, more systemically important financial institutions now than we did in 2007 – and nobody seems to know what to do about it.

But regulators claim that the financial system has become much safer since the financial crisis.

At our offices, we laugh about a running joke: Every time when somebody talks about large financial institutions there are only two answers to any question: Either you respond: »I don’t understand it because it’s too complicated» or you’re lying. Therein lies the problem. When people start picking through JP Morgan’s balance sheet nobody understands it. I don’t know if even Jamie Dimon understands it. The complexity of these institutions is beyond the comprehension of the human mind. So am I concerned about the financial system? Yes, with respect to more concentrated and more complicated banks. Am I concerned that there’s an imminent accident coming? In one additional respect: Energy.

Why?

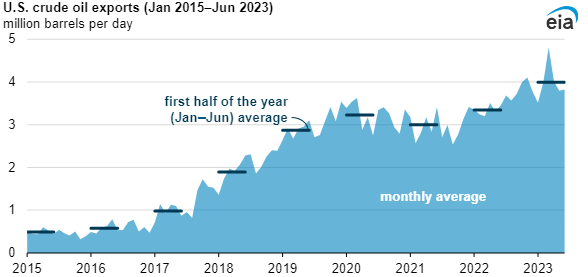

Energy could be the tripwire because low oil prices heighten the likelihood of a credit event. It looks a lot like the housing problem in 2007. At that time people said: «Housing never goes down, and if it goes down it’s a buying opportunity. Don’t worry about this stuff, it’s all going to work itself out.» Today, crude oil prices are very important for financial markets. If we get a plunge in crude oil prices then that’s bad, as it means the bankruptcies come, the write downs come, investors run away and losses pile up. And then we’re back looking at financial institutions and asking ourselves: How much of those energy loans do they have? The banks will tell you that they’re not exposed and there’s no problem – just like in 2007, when they claimed that they had no exposure to subprime lending. But that wasn’t quite the way it worked out. So maybe we have to do the whole exercise again that we had to do during the financial crisis and listing out all the write downs of the banks.

How bad could it get?

It’s not going to be the level of the housing market, it’s not going to produce another great recession. But it is going to hurt. There are going to be some real problems as we move forward from here. The Bank for International Settlements estimates that there are about 3 trillion dollars worth of energy lending world wide. So we’ve got a market of 3 trillion dollars worth of loans and the primary pricing of that market has fallen apart: the world wide price of oil. And the price doesn’t even need to go down much lower. It just needs to go back down to around $35 and we’re going to start looking at those 3 trillion dollars worth of lending and all of the investments in oil. And if investors see how much it really is, it’s going to be bad.

Then again, oil has rallied strongly since February.

I don’t see any skepticism or fear. The reason investors haven’t hit the panic button yet is because they still believe that the price is going to be $60 in a year and $75 to $80 at the end of 2017. So oil is »not a problem». But what I would like to have seen on a large scale is energy companies on the verge of failure going bankrupt and production falling of a cliff, a changing of investor behaviour which is setting up the mood for the next move up in the price of oil. But we’re getting the opposite of that. If you’re an energy company that’s losing astronomical sums of money and you go to Wall Street you will get more money to burn. You’ll get it because there is a fundamental belief in energy. Money is pouring into the energy sector. Investors think they’re buying a lottery ticket that is going to pay off big time when the oil price goes back to $100. That encourages energy companies to keep their foot on the gas, to keep overproducing and that could give us $25 to $30 oil again. And when we go back down again than we’re going to dust off the whole credit issue all over again.

So is there no way out?

The only thing that could save us from this oil glut is a strong comeback in demand. That’s the only way we could get rid of all those bloated inventories. We need somebody using this oil, we need demand. That’s a nice way of saying that we need strong growth for energy out of China. But we’re not getting anything near strong growth out of China or out of Europe or out of the United States.

The lack of growth seems also to be a concern for the Federal Reserve as the FOMC statement for the April meeting showed. What does that mean for the Fed’s plans to raise interest rates?

The Fed is raising rates in a very generic view of the world. It’s their signal to the markets that things are getting better, everything is returning to normal: »mission accomplished» to use an old line from George W. Bush. But right after the Fed raised interest rates on the 16th of December the gold price took off, treasury yields plunged and stock and oil prices dropped. That’s not the reaction the Fed wanted. I think the Fed was surprised by this reaction, especially by what happened in the gold market. Gold literally turned around on the day of the Fed move and it had its best quarter in 30 years in the first quarter. It’s almost like the gold market initially said: »Oh boy, I think the Fed made a mistake by raising rates.»

Nevertheless, the rally in gold seems to have lost some of its steam recently. What’s your outlook for gold?

Gold turned higher when the Fed raised rates and it turned even higher when Japan went negative. Some say gold is a barbaric relic that for 5000 years never paid interest. That’s true, but in a negative interest rate environment the barbaric relic that does not pay an interest is actually a high yielding investment. So if you want to put your money in a high yielding investment, put it in zero yielding gold. That’s what’s got the world so upside down right now. What was coincident with gold taking off since the Fed move is that all the measures of speculation in gold with respect to futures traders and ETF buyers took off, as well. Enormous sums of money came flying into the gold market. Gold has not seen a speculative frenzy for four years. Now, it’s starting to get some speculative interest but it’s still far from overbought. That’s why I’m not thinking the rally in gold is over. Gold has room to go.

And what about the next step of the Federal Reserve?

The markets have a veto over the Fed policy. The Fed suggests a policy, the markets bless it. If the markets don’t bless it, eventually the Fed will engage in some kind of push-pull-strategy. But at the end of the day, the markets have the final say and if they’re not ready for another rate hike, they throw a fit and the Fed refrains from upsetting them. This is not new. The markets have been driving Fed policy for a long time. It’s just that our awareness is higher about recently. The FOMC statement was invented in 1994. Since then, the Fed has never raised rates without a move being at last 60% priced in the markets the day of the Fed meeting. So if a rate hike is not priced in the Fed is not going to do it.

So when do you expect another hike?

The Fed seems to be very dovish. They’re afraid to upset the financial markets at this point. We’ve started the year with everybody confident that we are going to get four rate hikes. But we could very well get out of 2016 with zero or just one rate hike.

Obviously, the financial markets love this dovish tone. In the US, stocks are even close to the record high of May 2015.

Full story here Are you the author? Previous post See more for Next postIf the markets are understanding that they got a veto over the Fed then they can do what they want. This runs the risk that stocks take off to overvalued range, go to immense multiples, go bubble because investors don’t believe that this Fed would ever step on the breaks. That is the concern that I have because I am still not a believer that the economy is doing well. Of course, Wall Street’s job is to torture the data to find something positive out of it. But I see negative year-over-year earnings, I see the forecast for the next couple of earnings seasons with negative year-over-year earnings growth, I see sub 1% growth in the US economy and I see low expected inflation. Except for the payroll reports, there is no consistency that things look robust.

Tags: Bank of Japan,Ben Bernanke,Bond yield,China,Credit Suisse,Crude Oil,Deutsche Bank,Federal Reserve,Greece,Housing market,Jamie Dimon,Japan,newslettersent,recession