Tag Archive: Credit Suisse

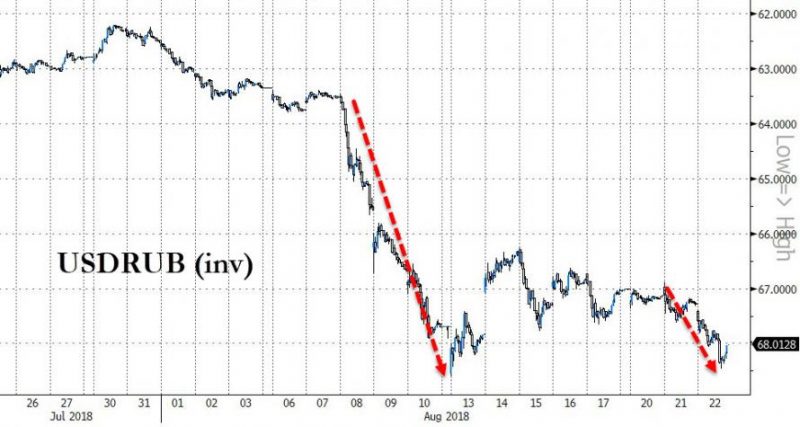

Swiss Bank Freezes $5 Billion In Russian Money

For years, Russian oligarchs and robber barons seeking to park their "unsourced" capital offshore and away from the sticky fingers of the Kremlin, treated Swiss bank accounts (preferably anonymous) with their "no questions asked" customer policies as, well, Swiss bank accounts.

Read More »

Read More »

Credit Suisse freezes $5 billion in US-Russia sanctions move

The Swiss Credit Suisse bank froze some CHF5 billion ($5 billion) of assets linked to Russia earlier this year in an effort to toe the line with US sanctions levied against Moscow. The bank froze the funds in the second quarter of 2018, according to Reuters, in response to sanctions introduced by Washington in April.

Read More »

Read More »

Swiss bank settles US tax evasion probe

The Zurich-based Neue Privat Bank (NPB) has paid $5 million (CHF5 million) fine to settle a criminal tax evasion investigation in the United States. NPB is one of a handful of so-called ‘category 1’ Swiss or Swiss-based bank branches that were still facing sanctions at the start of this year.

Read More »

Read More »

Credit Suisse: “Our Risk Appetite Index Is Near Panic”

Sure, it's been a bad year for investors, with the S&P posting the smallest of gains in the first half (all of which thanks to tech stocks) after several hair-raising, monthly incidents including February's vol-spike, April's real yield scare, May's Emerging Market massacre and June's trade war fears as shown in the following Citi chart...

Read More »

Read More »

Credit Suisse boss earned less last year

Credit Suisse Chief Executive Tidjane Thiam earned slightly less in 2017 during his third year on the job, the bank said on Friday. The news comes at a time of scrutiny over executive pay and bonuses. Thiam earned CHF9.7 million ($10.26 million) last year, a 5.3% drop on 2016, Switzerland’s second-biggest bank said.

Read More »

Read More »

UBS chief’s pay rises to over CHF14 million

The chief executive of Switzerland’s largest bank UBS received CHF14.2 million ($14.92 million) in compensation for 2017, up from CHF13.7 million in 2016, UBS said on Friday. The announcement comes at a time when executive pay and bonuses are under increased scrutiny in Switzerland.

Read More »

Read More »

Rosier economy should boost Swiss housing market

The economic upturn should drive demand for Swiss property after a period of record construction and lower rental prices, a survey claims. The improved economic situation should “revive demand in all segments” of the Swiss housing market, according to Credit Suisse’s Swiss Real Estate Market 2018 reportexternal link, published on Tuesday.

Read More »

Read More »

Swiss Retailers Suffered Lacklustre Sales growth in 2017

Switzerland’s retail sector failed to profit from a weaker franc and improving economy last year and business remains sluggish, according to a Credit Suisse report. Retail sales increased by 0.1% in 2017 after two years’ decline, Credit Suisse noted in its annual industry surveyexternal link published on Tuesday.

Read More »

Read More »

“Gnomes Of Zurich” In Panic As Saudi Corruption Crackdown Sparks Flood Of Money Laundering Inquiries

There are two divergent views on the crackdown on corruption by Saudi Arabia’s crown prince, Mohammed bin Salman (MBS), which led to the arrest and detention of 200 princes, ministers and former ministers. On one hand, it was a masterstroke which will earn political capital with the Saudi people and catalyse an Arab Spring in which MBS is a modernizing reformer who will liberalise Islam.

Read More »

Read More »

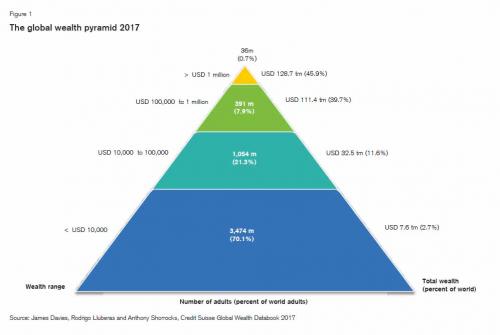

For The First Time Ever, The “1 percent” Own More Than Half The World’s Wealth: The Stunning Chart

Today Credit Suisse released its latest annual global wealth report, which traditionally lays out what has become the single biggest reason for the recent "anti-establishment" revulsion: an unprecedented concentration of wealth among a handful of people, as shown in Swiss bank's infamous global wealth pyramid, an arrangement which as observed by the "shocking" political backlash of the past year, suggests that the lower 'levels' of the pyramid are...

Read More »

Read More »

Saudi Billionaires Scramble To Move Cash Offshore, Escape Asset Freeze

Over the weekend, Saudi King Salman shocked the world by abruptly announcing the arrests of 11 senior princes and some 38 ministers, including Prince Al-Waleed bin Talal, the world’s sixty-first richest man and the largest shareholder in Citi, News Corp. and Twitter.

Read More »

Read More »

Credit Suisse Fined $135 million for Malpractices

Credit Suisse bank has been ordered to pay a fine of $135 million (CHF134.5 million) to the US authorities after an enquiry into the Swiss bank’s practices in setting foreign exchange rates. The figure was reached in a consultation between both parties.

Read More »

Read More »

Each Bitcoin Transaction Uses As Much Energy As Your House In A Week

While Bitcoin bulls will probably never have it so good as they have in 2017, we wonder whether many of them have stopped to think about the environmental downside of this roaring bull market. After all, back in the dot.com boom, people had ideas about potential internet businesses, issued pieces of paper representing ownership and watched their prices go parabolic parabolic.

Read More »

Read More »

Credit Suisse targeted for break-up by activist hedge fund

A Swiss hedge fund is poised to launch an activist campaign to break up Credit Suisse, tapping into investor impatience with the progress of the bank’s turnround under chief executive Tidjane Thiam. RBR Capital Advisors, supported by Gaël de Boissard, a former Credit Suisse investment bank co-head, is set to unveil the plan later this week at the JPMorgan Robin Hood investor conference in New York, according to people briefed on it.

Read More »

Read More »

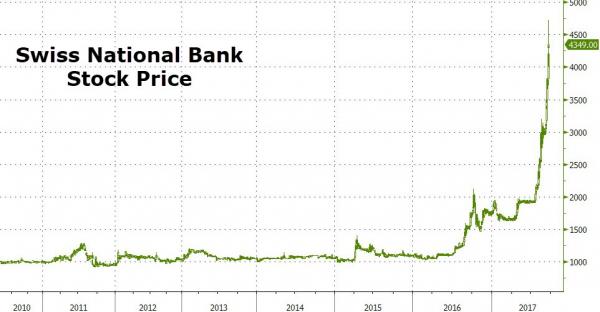

Is The Swiss National Bank A Fraud?

The price of shares in The Swiss National Bank is up 11 days in a row, soaring 150% in the last two months. That sounds like a 'tulip' bubble-like 'fraud'... The SNB is up over 120% in Q3 so far - more than double 'bubble' Bitcoin...

Read More »

Read More »

Hard times continue for Swiss private banks

Over half of private banks in Switzerland analysed by KPMG last year experienced net outflows of client cash. In a difficult period for finance, many could be forced to shut down or be bought out. “Implement truly radical change, or continue to see performance deteriorate.” This was the message of a study released Thursday by audit group KPMG with the University of St. Gallen, evaluating the performance of 85 Swiss private banks.

Read More »

Read More »

Finding a place to rent getting easier in Switzerland

A recent Credit Suisse report, entitled: Tenants Wanted, says capital continues to flow into Swiss real estate, boosting the supply of rental properties. Against a backdrop of negative interest rates at Switzerland’s central bank, investors continue to plough money into constructing new residential properties. At the same time, declining immigration has hit the demand for rental apartments.

Read More »

Read More »

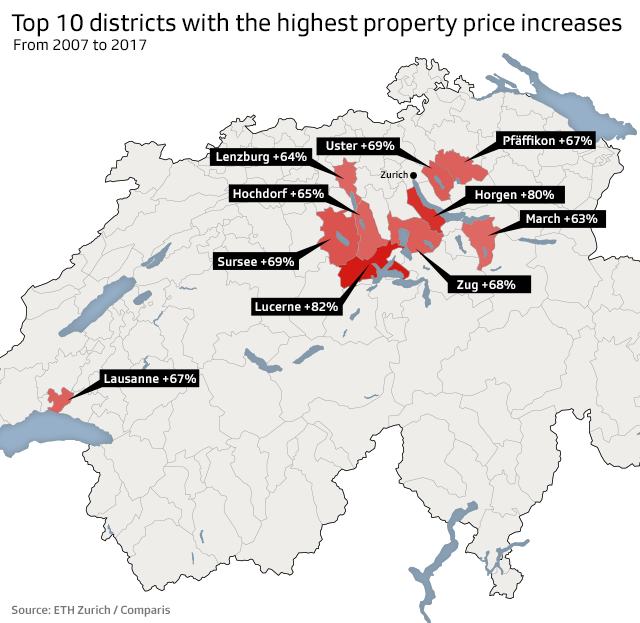

Highest Swiss Property Prices Recorded in Zurich

Zurich remains the dearest location for Swiss property at CHF12,250 ($13,000) per square metre. However, houses in Lucerne have gained the most in value over the past decade, with one square metre costing CHF8,500, up 82% on 2007.

Read More »

Read More »