Or how to talk down an economy with wrong forecasts

Read the introductory post here, if you haven’t yet.

Details of SECO forecasts

In the following we give the details about the SECO, the Swiss government economic agency’s, forecasts.

Forecast Q1/2009

Sharp recession in 2009, gradual stabilization in 2010

Bern, 17.03.2009 – Economic trends and forecasts of the Expert Group on Economic Forecasts of the Federal – Spring 2009 *. Due to increased and all regions of the world economic downturn concerned the economic outlook for Switzerland have darkened since December 2008. The recession is likely to be much sharper than previously thought. For 2009, the Group of Experts predicts a drop in new economic output of -2.2%. Under the assumption of a gradual stabilization of the international financial crisis in the coming months and a slow onset of the global economic recovery should the Swiss economy again in 2010 to reach a weak positive growth (+0.1%). In the labor market must be expected also for 2010 show a further deterioration.

source SECO

Reality: After a -2.2% dip in Q4/2008, the Swiss economy slowed by -1.1% in Q1/2009. By the end of the year 2009 it rose by 0.1% against end of 2008. The average GDP for 2009, however, fell by 1.9% against the average value of 2008, the GDP in 2010 rose by 3.0%, in 2011 by 1.9%.

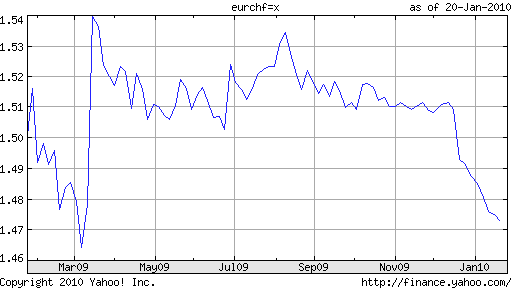

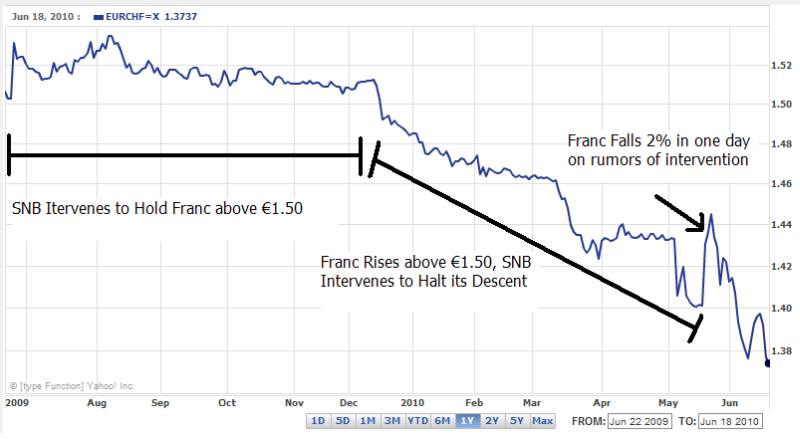

After the EUR/CHF had fallen from over 1.60 to 1.46 in March 2009, SNB interventions moved it to 1.54, over the 1.50 “line in the sand”.

Evaluation: Good guess for Q1, for 2009 a miss of 0.3%.

Forecast Q2/2009

Thanks to QE1, the U.S. economy has improved gradually since February/March 2009, especially visible is the improvement in the purchasing manager indices (PMI). The Swiss economists, however, did not get impressed and remained pessimistic, probably because they relied on past data to predict the future.

Further deterioration in economic outlook

Bern, 17.06.2009 – Economic trends and forecasts of the Expert Group on Economic Forecasts of the Federal – Summer 2009 *. Compared to March, the global economic outlook for 2009 has deteriorated further. The expert group expects 2009 with a decline in gross domestic product (GDP) in Switzerland by 2.7%. In 2010, the economy is expected to shrink despite slow onset of recovery is still slightly by 0.4%. Against this backdrop, unemployment will strongly rise in 2010.

source SECO

Reality: The Q2/2009 growth was 0.0%, the year +1.9%. Unemployment – a lagging indicator – rose to 3.8% in Q2 from 3.3% in Q1.

Evaluation: The SECO forecast missed the 2009 reality by 0.8%. The miss for 2010 was 3.4%.

Forecast Q3/2009

After the Swiss economy effectively stabilized in Q2/2009, it was time again for the SECO to copy/paste real data from the past into the future forecast – (for that we do not need an expert group, we can employ an intern).

Swiss Economy Stabilizing But Recovery in 2010 Remains Sluggish And Unemployment High

Bern, 22.09.2009 – Economic Tendencies and Forecasts by Expert Group on Economic Forecasts of the Federal Government – Autumn 2009*. The global economy is currently recovering faster than anticipated from the previous strong economic slump. In Switzerland, too, the recession has slowed down in the second quarter, and for the second half of the year, a positive change is underway. For this reason, the expert group of the Federal Government is expecting a weaker decline of the Swiss gross domestic product (GDP) than in June (-1.7% instead of -2.7%). However, it is assumed that the international economy, after its first strong recovery, will run out of steam again in the course of 2010 which will also limit further economic recovery in Switzerland. For 2010, the expert group expects a weak GDP growth (+0.4% instead of -0.4%) and rising unemployment.

Source SECO

Reality: The Swiss economy improved by 1% in Q3/2009. Unemployment rate rose to 4.1% in Q3. But some market participants seemed to believe in the SECO. The

Evaluation: The 2010 miss, was reduced from -3.4% to 2.6%.

Forecast Q4/2009

After the strong economic improvement in Q3, once again typical Swiss understatement, especially in the headline. An American would have shouted: “The recovery is here!” and would have revised forecasts strongly upwards – like the Fed actually did. But the Swiss revised growth only from 0.4% to 0.7% for 2010.

Meaningful Economic Recovery and Turnaround on the Labour Market only in 2011

Bern, 15.12.2009 – Economic Outlook and Forecasts of the Federal Government’s Expert Group on Economic Forecasts – Winter 2009*. In a brightened-up global economic environment, the Swiss economy, as well, had been able to overcome the recession in Q3 of 2009. According to the Federal Government’s Expert Group on Economic Forecasts, the economic recovery will continue next year, however, in the wake of temporarily fading positive impulses from the international economic environment, it will remain moderate (GDP growth of +0.7% in 2010). It will probably not be before 2011 that the economy will gain momentum (GDP growth of +2.0%). Against the background of a sluggish economic recovery, labour market forecasts remain bleak for 2010. A decline in unemployment is not expected before 2011.

Source SECO

Reality: During nearly the whole of 2009 the line in the sand for the EUR/CHF of 1.50 was valid. The economy improved by 0.9% in Q4/2009 and after a slight change of SNB language, the line in the sand collapsed.

Evaluation: The 2010 miss was 2.3% – forecast +0.7%, reality +3.0%. Only one month later, the seasonal adjusted unemployment rate topped 4.2%. Then it started to decline and not as the SECO predicted, only in 2011.

Forecast Q1/2010

In March 2010, the SECO upgraded its forecast for 2010 from 0.7% to 1.4%. For the SECO, this revision was certainly only “slight”.

Economic Perspectives Slightly Brightening Up in 2010

Bern, 16.03.2010 – Tendencies and Forecasts for Economic Development As Given By Expert Group on Economic Forecasts of the Federal Government – Spring 2010*.

Economic recovery in Switzerland has stabilized, and the short-term outlook reveals to be friendlier than a few months ago. In the course of this year, how-ever, the upswing is expected to lose some of its impetus again in the face of not more than moderate global economic impulses and a declining domestic demand. For 2010, the Expert Group of the Federal Government now expects the Swiss economy to grow by 1.4%, a growth rate which is higher than anticipated so far (+0.7%). For 2011, the forecast of a recovery slowly picking up momentum remains unchanged (GDP growth rate around 2%). Nevertheless, relief – i.e. rising employment and a decline in the unemployment rate – is not expected before next year. Source SECO

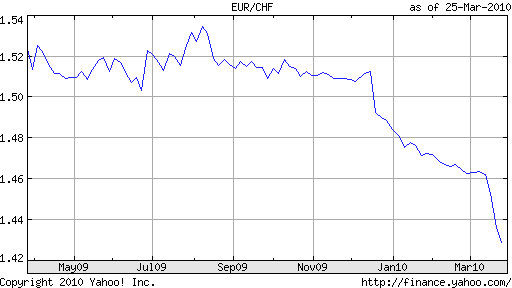

Reality: The growth in Q1/2010 was 1% in one single quarter. After Greek vows became stronger and EUR/CHF fell to 1.42, markets were asking “where was the SNB?”.

Evaluation: The SECO 2010 GDP miss was reduced to 1.6% – but against the forecast, unemployment had already started to fall in 2010.

Forecast Q2/2010

Once again the title of the forecast is negative, partially due to theunfolding Greek crisis. The SECO increased the 2010 GDP growth and reduced the 2011 rate.

Gradual Economic Recovery – Increased Risks for 2011

Bern, 08.06.2010 – Economic Outlook and Forecasts of the Federal Government’s Expert Group on Economic Forecasts – Summer 2010*. In principle, the expert group adheres to the present forecast scenario of a slowly advancing recovery of the Swiss economy. While the growth prospects for 2010 are even slightly better than anticipated until now (1.8% instead of 1.4%), the GDP forecast for 2011 in light of increased external trade risks in connection with the euro crisis will be lowered slightly (1.6% instead of 2.0%). The outlook for the job market has brightened even though the decrease in unemployment is likely to continue slowly. Source SECO

Reality: The growth in Q2/2010 was 0.9% in one single quarter. The SNB abandoned the interventions for EUR/CHF 1.40.

Evaluation: The 2010 miss is still 1.2%, even if half the year has already passed – forecast: +1.8%, +3.0% growth reality.

Forecast Q3/2010

Once again the title of the forecast is negative, the Swissmem and other exporters image campaign at the SECO and the SNB had started.

Higher Growth Forecast for 2010 – Bleak Export Prospects Lower Forecast for 2011

Bern, 16.09.2010 – Higher Growth Forecast for 2010 – Bleak Export Prospects Lower Forecast for 2011 Economic Outlook and Forecasts of the Federal Government’s Expert Group on Economic Forecasts – Fall 2010*. As a consequence of the lively economic revival up to the middle of the year in Switzerland, the expert group has increased the federal government’s growth forecast for 2010 to 2,7% (previously 1.8%). The prospects for 2011 are less positive than recently assumed, due to modest world economic prospects as well as higher valuation of the Swiss franc producing significant drag and having a negative influence on Swiss export growth. Based on estimates from the expert group, the economic recovery in Switzerland will not completely cease in 2011 but with forecast GDP growth of 1,2% it will be significantly slower than in 2010. Source SECO

Reality: The growth in Q3/2010 was 0.7% in one single quarter. The growth is driven by internal growth, the trade balance in August 2010 fell to 0.5 bil. CHF from levels of 2 bil. CHF. No wonder: The USD/CHF nears parity, the EUR/CHF 1.30.

Evaluation: The SECO needed to upgrade the 2010 forecast, still a miss of 0.3%. Effectively the SECOM maintained that Q4 growth would be flat, but it was actually +1%. The 2011 forecast of 1.2% was far lower than reality, 1.9%.

Forecast Q4/2010

Once again the title of the forecast is negative.

The Swiss Economy Faces Economic Slowdown

Bern, 14.12.2010 – The Expert Group’s Assessment of Economic Trends and Forecasts – Economic Forecasts for Switzerland – Winter 2010/2011*. In spite of the to date brisk growth dynamics of the Swiss economy, there are mounting indications that the export development will worsen next year, resulting in an economic slowdown. However, thanks to the relative resilience of the domestic market so far, the expected slowdown should remain limited. The federal government’s expert group forecasts a slowdown of GDP growth from 2.7% in 2010 to 1.5% in 2011. Given a gradual improvement of the international trade conditions, the Swiss economy should gain some momentum again in 2012 (+1.9%). The unsure global economic situation, the continued tense situation on the financial markets and the yet unsolved debt problems of many industrialized nations make up considerable risks for the economic situation in 2011 and 2012. Source SECO

Reality:

The trade surplus improved again, GDP grew by 1% in one single quarter mainly thanks to internal demand and housing.

Evaluation:

Two weeks before the end of the year the SECO estimate for 2010 was still wrong by 0.3%. Estimate for 2010: 2.7%, reality 3.0%. This wrong estimate could not stop the euro falling: at the end of the year the EUR/CHF fell to 1.24.

In the picture gallery, the reader can see the estimates by different Swiss economic institutes. The actual GDP growth for 2010 was 3.0%, the seasonally adjusted unemployment 3.6%. The 2011 growth rate 1.9%.

The UBS has been clearly the best in predicting, Créa the worst.

- 2009 Konjunkturprognosen Forecasts

- 2010 03 Konjunkturprognose Schweiz March 2010 März

- 2010 04 Konjunkturprognose Schweiz April 2010

- 2010 05 Konjunkturprognose Schweiz May 2010 Mai

- 2010 07 Konjunkturprognose Schweiz July 2010 Juli

- 2010 08 Konjunkturprognose Schweiz August 2010

- 2010 09 Konjunkturprognose Schweiz September 2010

- 2010 10 Konjunkturprognose Schweiz October 2010 Oktober

- 2010 11 Konjunkturprognose Schweiz November 2010

- 2011 05 Konjunkturprognose Schweiz May 2011 Mai

- 2011 03 Konjunkturprognose Schweiz March 2011 März

- 2012 03 Konjunkturprognose Schweiz March 2012 März

- 2010 06 Konjunkturprognose Schweiz June 2010 Juni

- 2012 07 Konjunkturprognose Schweiz July 2012 Juli

- 2010 12 Konjunkturprognose Schweiz December 2010 Dezember

- 2011 01 Konjunkturprognose Schweiz January 2011 Januar

- 2011 02 Konjunkturprognose Schweiz February 2011 Februar

- 2011 04 Konjunkturprognose Schweiz April 2011

- 2011 12 Konjunkturprognose Schweiz December 2011 Dezember

- 2012 09 Konjunkturprognose Schweiz September 2012

- 2012 11 Konjunkturprognose Schweiz November 2012

Forthcoming: Why were Swiss and the Fed’s economists so wrong? Have they ever heard about credit cycles and balance sheet recessions?

Are you the author? Previous post See more for Next postTags: Credit Suisse,Federal Reserve,GDP growth,SECO,Swissmem,Switzerland KOF Economic Barometer,Switzerland Trade Balance,UBS,Unemployment