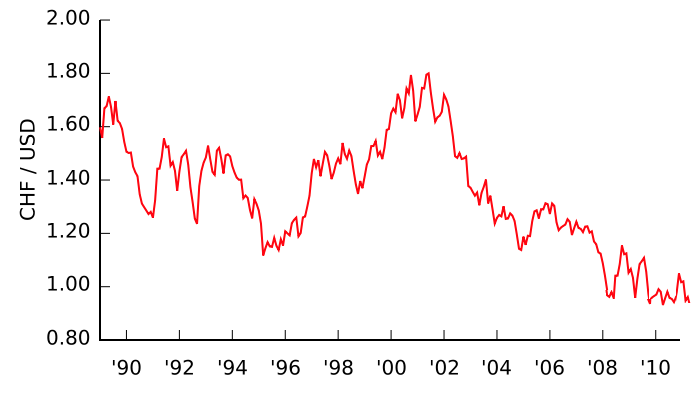

Extracts from the history of the Swiss franc (September 2010)

In the year-to-date, the Swiss Franc has risen 3% against the Dollar, 15% against the Euro, and more than 5% on a trade-weighted basis. It recently touched a record low against the Euro, and is closing in on parity with the USD. Since the beginning of the summer, the Franc has rallied by an unbelievable 15% against the Greenback. I don’t think I’m alone in scratching my head in bewilderment wondering, What could possibly be behind the Franc’s rise?

By this point, everyone is familiar with the safe-haven phenomenon. Basically, concerns of a double-dip recession have ignited a flare-up in risk aversion and spurred investors to shift capital into locales and investment vehicles that are perceived as less risky. Switzerland and by extension the Swiss Franc, have both benefited from this phenomenon: “Anxious investors searching for a haven from fears about the health of Europe’s banks, which knocked equities and sent peripheral eurozone government bond spreads higher, dumped the single currency. The Swiss franc benefited.” Enough said.

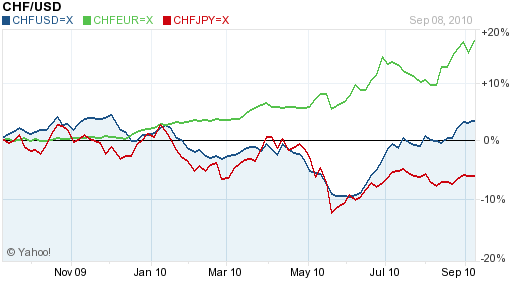

At the same time, the Dollar and Japanese Yen are also considered safe-haven currencies, and as you can see from the chart below, the three have hardly traded in lockstep. In other words, there must be something distinguishing the Franc. Economists point to a strong economy: “Gross domestic product rose 0.9 percent from the first quarter, when it increased 1 percent. ‘The underlying economics of Switzerland are very, very healthy. Concerns about deflation have subsided.’ ” The consensus is that the Swiss economy will expand by close to 2% on the year. However, this is hardly impressive, especially compared to other industrialized countries. In addition, Swiss interest rates remain low, which means the opportunity cost of holding the Franc is high. There must be something else going on.

In fact, it looks like the Swiss Franc’s rise is kind of self-fulfilling. For most of 2009, the Swiss National Bank (SNB) spent nearly $200 Billion to artificially hold down the value of the Franc. During this period, the Franc remained stable against the Euro and depreciated against the Dollar and Yen. Having finally broken through the “line in the sand” of €1.50, however, the Franc is now appreciating rapidly. Why? Because the SNB no longer has any credibility. It lost $15 Billion (due to the Euro depreciation) trying to defend the Franc, and in hindsight, the mission was a complete waste of time. As a result, a fresh round of intervention is out of the question. The currency markets have also dismissed the possibility of new intervention, and it seems they are punishing the SNB (via the Franc) for even trying.

According to analysts, the markets have also come to see the Franc as a reincarnation of the Deutschmark, due to its “strong economy, massive foreign reserves, traditional haven status and close links with the German economy.” Those that fear a Eurozone collapse and/or want to make exclusive bets on Germany are now using the Franc as a proxy. I don’t personally understand the logic behind this strategy, but where perception is reality, it’s more important to understand that other investors see the connection rather than seeing the connection for oneself.

Going forward, there is mixed sentiment surrounding the Franc. One analyst warned clients, “I would be cautious about chasing it too far in the short term. There’s still a huge number of headwinds out there.” According to another analyst, “We expect the franc to remain strong throughout the decade.” Personally, I’m inclined to side with the former point of view. From a fundamental standpoint, there isn’t a whole lot to keep the Franc moving up and its recent surge is probably running on fumes. At the very least, I would expect a correction in the near-term.

Posted thanks to Forexblog.org.

Tags: Japanese yen,Swiss National Bank,Switzerland