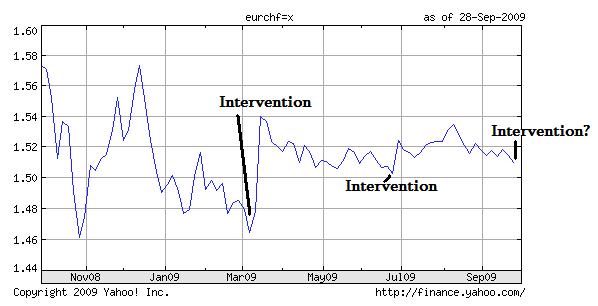

Extracts from the history of the Swiss Franc (September 2009)

After a brief “hiatus,” the Swiss Franc is once again rising, and is now dangerously close to the $1.50 CHF/EUR “line in the sand” that spurred the last two rounds of Central Bank Intervention.Both from the standpoint of the Swiss National Bank (SNB) the Franc’s appreciation is vexing, while from where ordinary investors are sitting, it’s downright perplexing. That’s because based on the standard litany of factors, the Franc should be falling.

The Swiss economy remains mired in its worst recession in 17 years, and is projected to shrink by at least 2% this year. In addition, deflation has already set in, with prices falling at an annualized rate of .8%. To be fair, signs of recovery are emerging, and a plurality of economists believe that growth will return in 2010, as will inflation.

But downside economic risks remain, namely the worsening labor market. There is also the fact that the Swiss economy remains heavily weighted towards exports, the demand for which remains slack. From a comparative standpoint, though, projections of recovery are not unique to Switzerland. Financial markets have long since stabilized in most industrialized countries, which many have interpreted as a harbinger for better things to come.

On the monetary front, Swiss interest rates remain among the lowest in the world, as the SNB has gradually guided its benchmark lending rate to .25%. It is also in the process of expanding its quantitative easing program, by pumping liquidity directly into the credit markets, in order to mitigate against deflation. In this sense, the SNB is arguably behind the curve. In the US and EU, for example, speculation is already mounting that interest rate hikes will take place as soon as 2010. Economists are less concerned about a shortage of liquidity in those economies, and more nervous about how the potential excess of liquidity can be withdrawn from the financial system before it turns into a problem. Economists in Switzlerland aren’t even close to beginning to have that conversation.

According to the SNB, the problem lies in the Swiss Franc, which has remained oddly buoyant. While capital has flowed out of the US, for example, it actually seems to flowing into Switzerland. Members of the SNB have attributed this to the “safe haven,” notion, whereby investors still view the country as a safe haven from the financial turmoil. Perhaps slightly irrational, but real nonetheless.

Despite strong rhetoric and equally strong action, the Franc has slowly edge back to the 1.50 mark. Policymakers have pledged to defend the currency vigorously, and it now appears as though another intervention is looming. Given that the SNB has intervened to depress the Franc twice in the last six months, you would think that it would have some credibility with some investors. It seems the lesson is that Central Banks are no match for the markets, and investors realize that ultimately, the SNB is no exception.

Tags: Swiss National Bank,Switzerland