Tag Archive: consumption

Position Squaring Ahead of US Data Helps the Dollar Recoup Some Recent Losses

Overview: Position-squaring ahead of today's US

personal consumption data and perhaps tomorrow's jobs report is giving the

dollar a firmer profile against most G10 and emerging market currencies. The

Scandis have been the hit hardest and are off 0.75%-0.85%. The euro and

sterling about 0.35%-0.45% lower. The yen is the only G10 currency that is

slightly firmer. The dollar-bloc is nursing small losses (0.10%-0.15%). Despite

the firmer than expected...

Read More »

Read More »

Dollar Recovers from Yesterday’s Stunning Reversal, but has Sentiment Turned in North America?

There has been little follow-through dollar selling so far today after yesterday’s dramatic downside reversal after the initial flurry of buying in response to the stronger than expected US CPI.

Read More »

Read More »

Market Pulse: Mid-Year Update

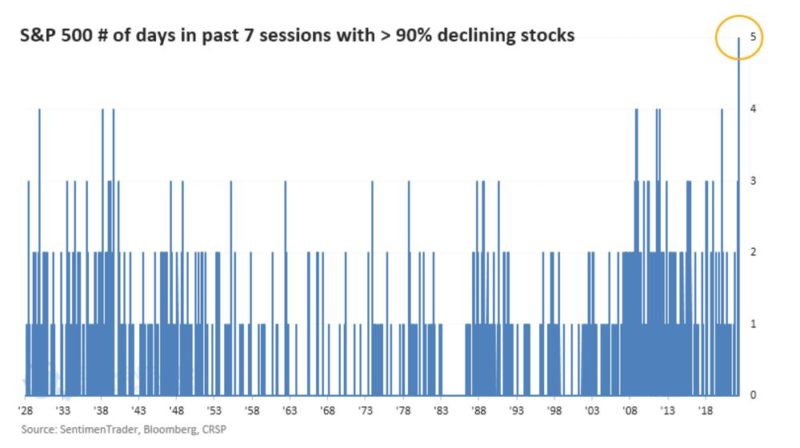

Note: This update is longer than usual but I felt a comprehensive review was necessary. The Federal Reserve panicked last week and spooked investors into the worst week for stocks since the onset of COVID in March 2020. The S&P 500 is now firmly in bear market territory but that is a fraction of the pain in stocks and other risky assets.

Read More »

Read More »

Reserve Bank of Australia Surprises, but Aussie Struggles

Overview: The jump in US interest rates helped lift the greenback to new 20-year highs against the Japanese yen and pushed the euro back below $1.07. US equities saw initially strong gains pared and this set the tone for today’s activity.

Read More »

Read More »

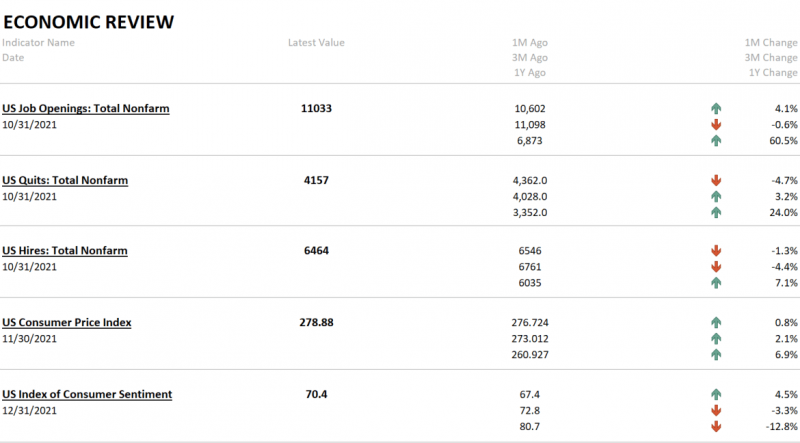

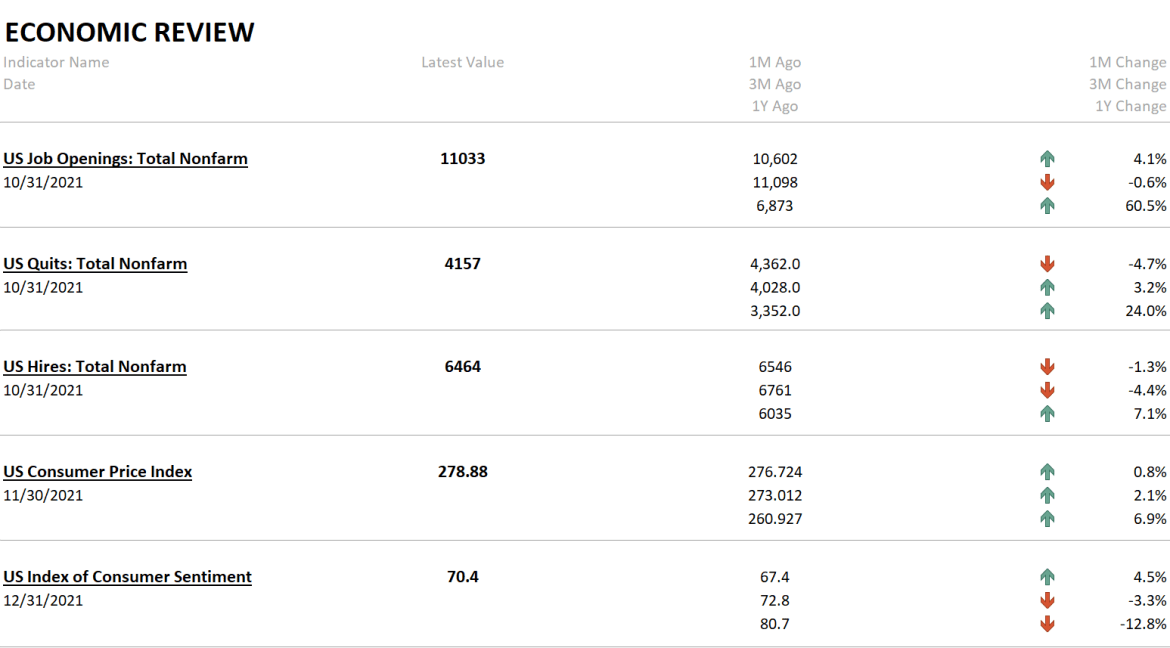

Weekly Market Pulse: Has Inflation Peaked?

The headlines last Friday were ominous: Inflation Hits Highest Level in Nearly 40 Years. Inflation is Painfully High… Groceries and Christmas Presents Are Going To Cost More. Inflation is Soaring..

Read More »

Read More »

Monthly Macro Monitor: Doom & Gloom, Good Grief

When I first got in this business oh so many years ago, my mentor told me that I shouldn’t waste my time worrying about the things everyone else was worrying about. As I’ve related in these missives before, he called those things “well worried”. His point was that once everyone was aware of something it was priced into the market and not worth your time.

Read More »

Read More »

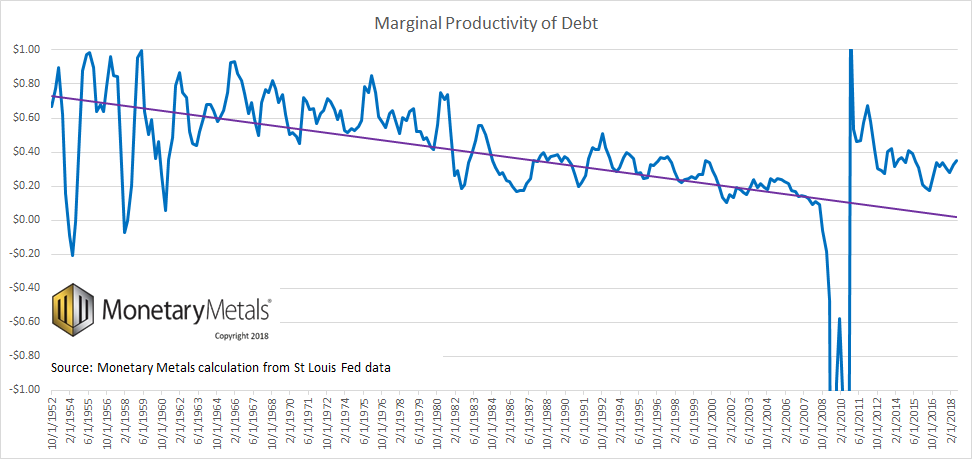

Monthly Macro Monitor: We’re Not There Yet

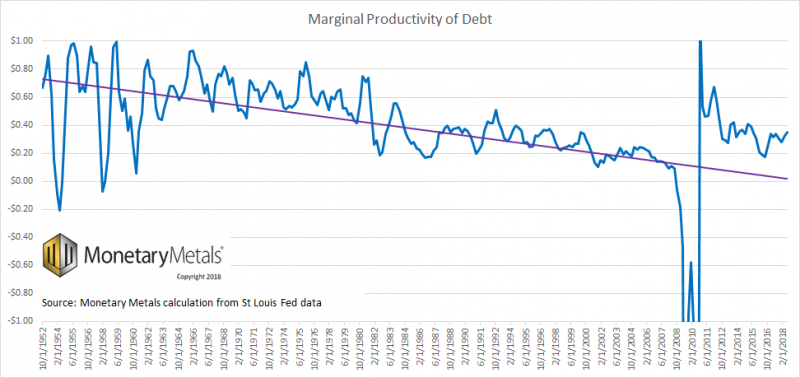

I first wrote about the current economic slowdown a year ago and Jeff Snider actually started seeing signs of slowdown in the Eurodollar market as early as May 2018. So, the slowdown we’re in now certainly isn’t a surprise here at Alhambra. I think though that we often forget how long these things take to develop.

Read More »

Read More »

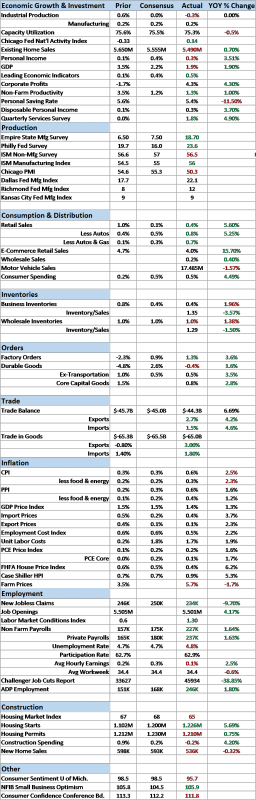

Monthly Macro Chart Review: April 2019

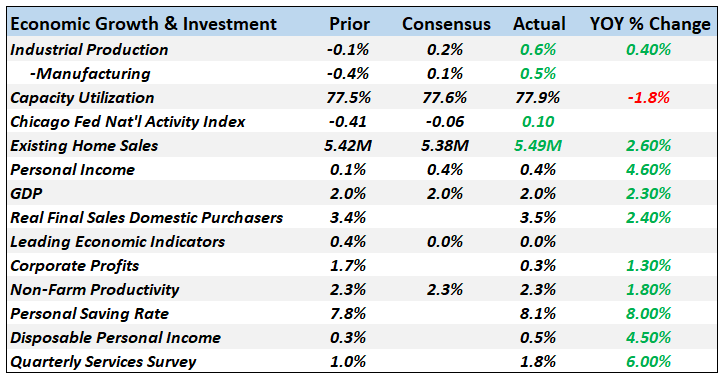

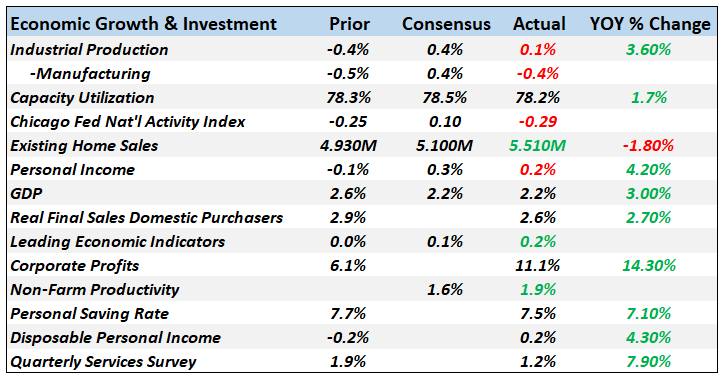

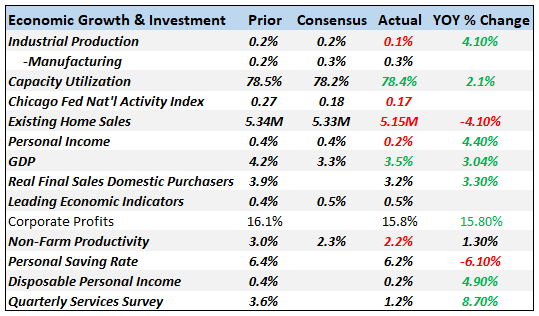

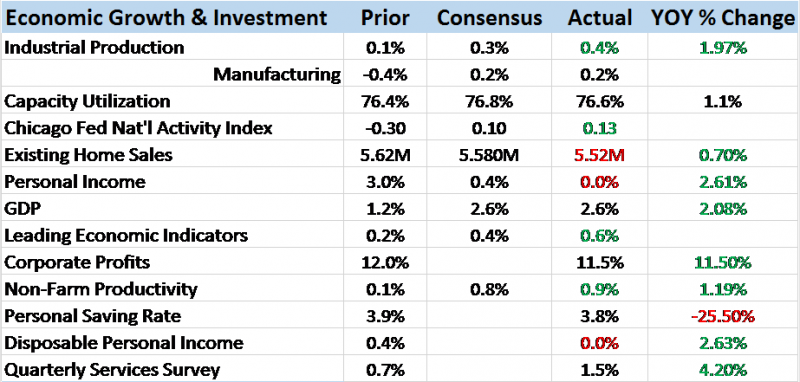

The economic data reported over the last month managed to confirm both that the economy is slowing and that there seems little reason to fear recession at this point. The slowdown is mostly a manufacturing affair – and some of that is actually a fracking slowdown – but consumption has also slowed.

Read More »

Read More »

Monthly Macro Monitor – November 2018

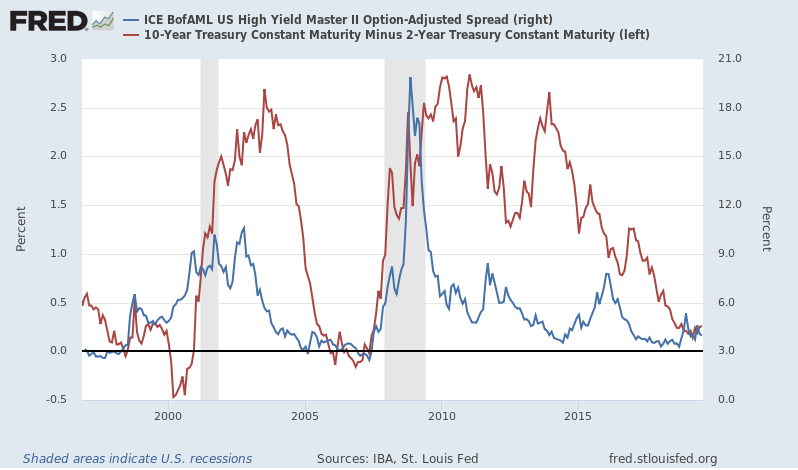

Is the Fed’s monetary tightening about over? Maybe, maybe not but there does seem to be some disagreement between Jerome Powell and his Vice Chair, Richard Clarida. Powell said just a little over a month ago that the Fed Funds rate was still “a long way from neutral” and that the Fed may ultimately need to go past neutral.

Read More »

Read More »

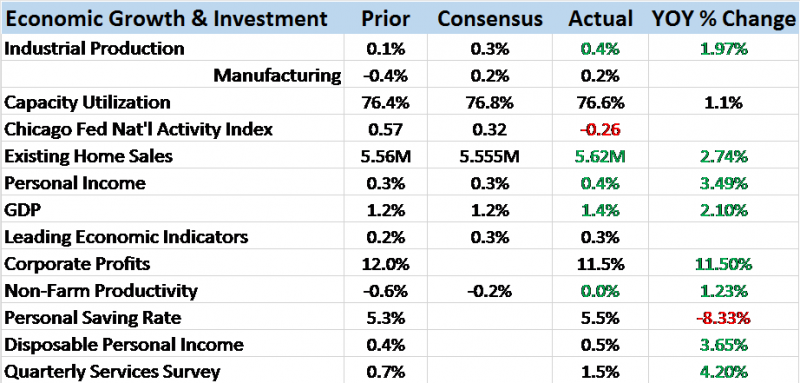

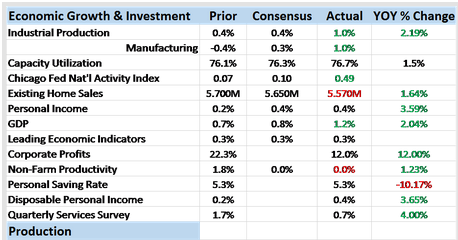

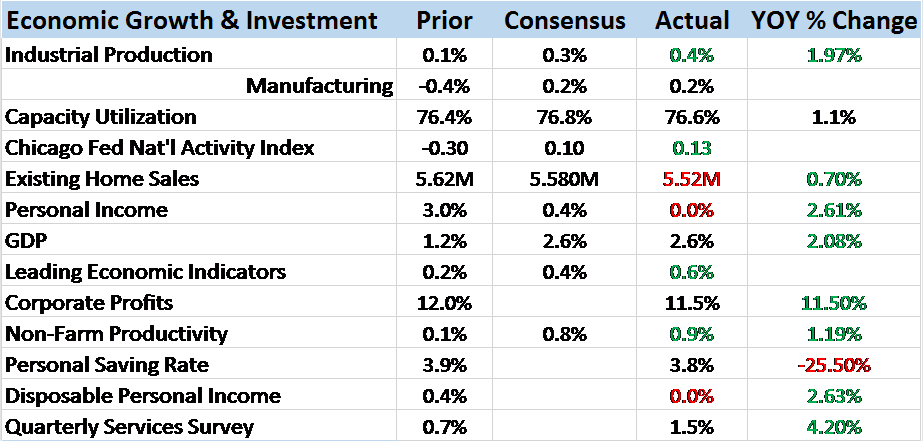

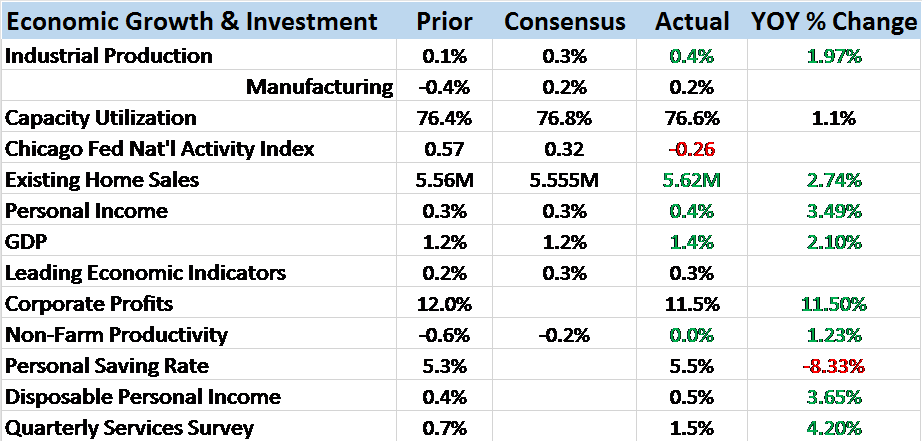

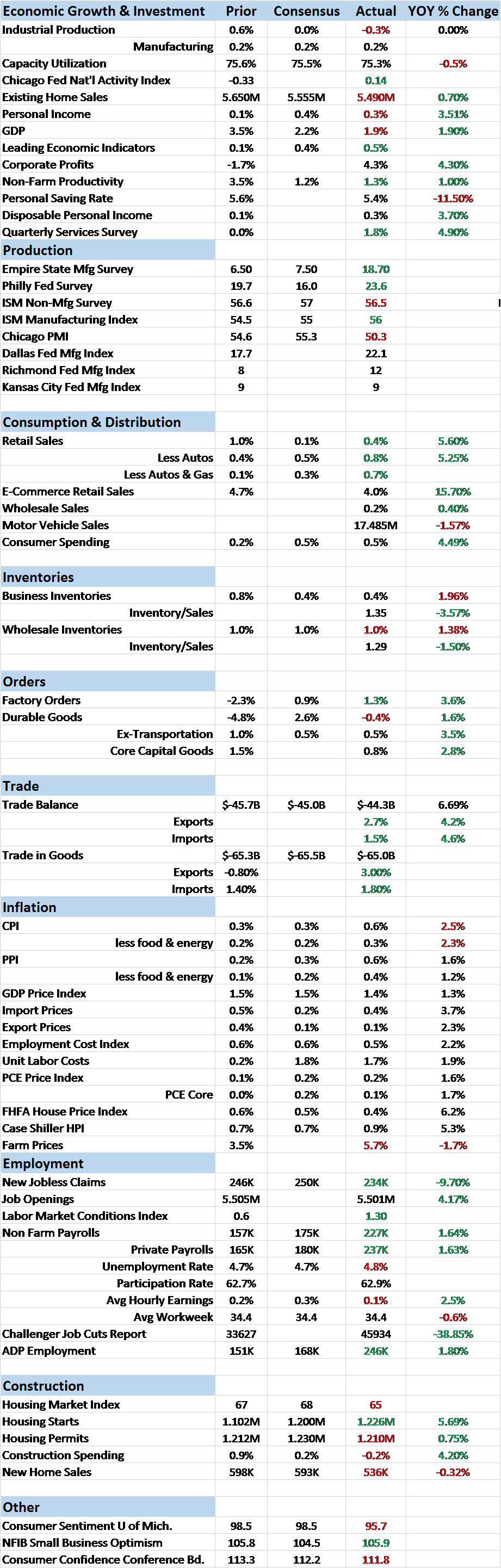

Bi-Weekly Economic Review: Ignore The Idiot

Of the economic releases of the past two weeks the one that got the most attention was the employment report. That report is seen by many market analysts as one of the most important and of course the Fed puts a lot of emphasis on it so the press spends an inordinate amount of time dissecting it.

Read More »

Read More »

Bi-Weekly Economic Review: Attention Shoppers

The majority of the economic reports over the last two weeks have been disappointing, less than the consensus expectations. The minor rebound in activity we’ve been tracking since last summer appears to have stalled. Retail sales continue to disappoint and inventory/sales ratios are once again rising – from already elevated levels.

Read More »

Read More »

Bi-Weekly Economic Review: The Return of Economic Ennui

The economic reports released since the last of these updates was generally not all that bad but the reports considered more important were disappointing. And it should be noted that economic reports lately have generally been worse than expected which, if you believe the market to be fairly efficient, is what really matters.

Read More »

Read More »

Bi-Weekly Economic Review

The economic data since my last update has improved somewhat. It isn’t across the board and it isn’t huge but it must be acknowledged. As usual though there are positives and negatives, just with a slight emphasis on positive right now. Interestingly, the bond market has not responded to these slightly more positive readings with nominal and real yields almost exactly where they were in the last update 3 weeks ago. In other words, there’s no reason...

Read More »

Read More »

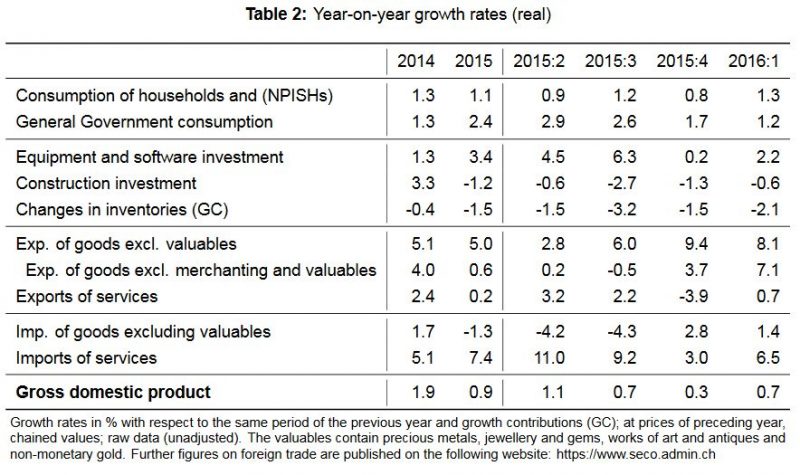

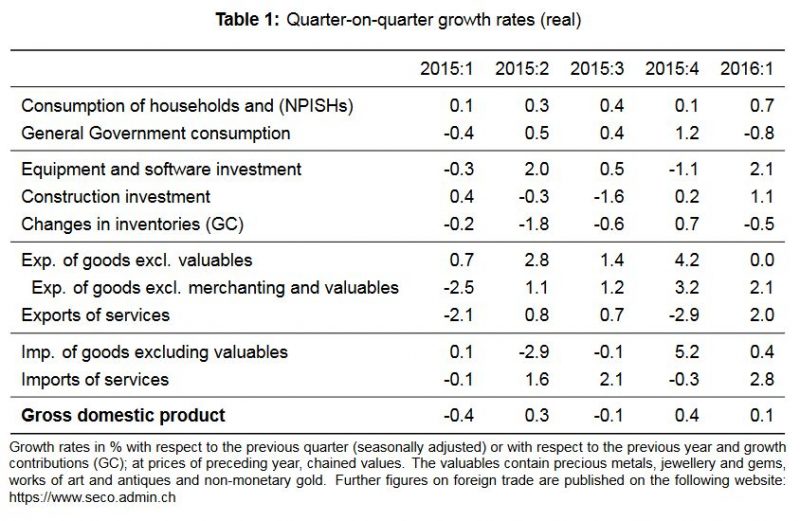

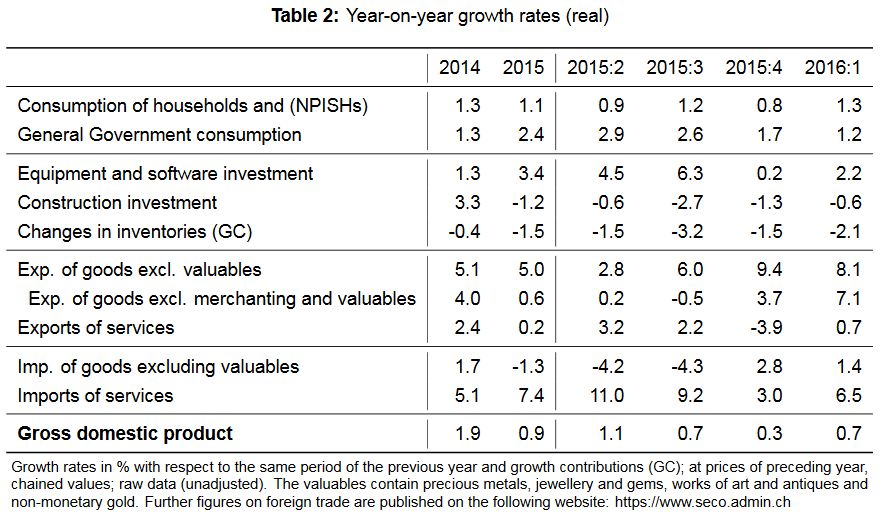

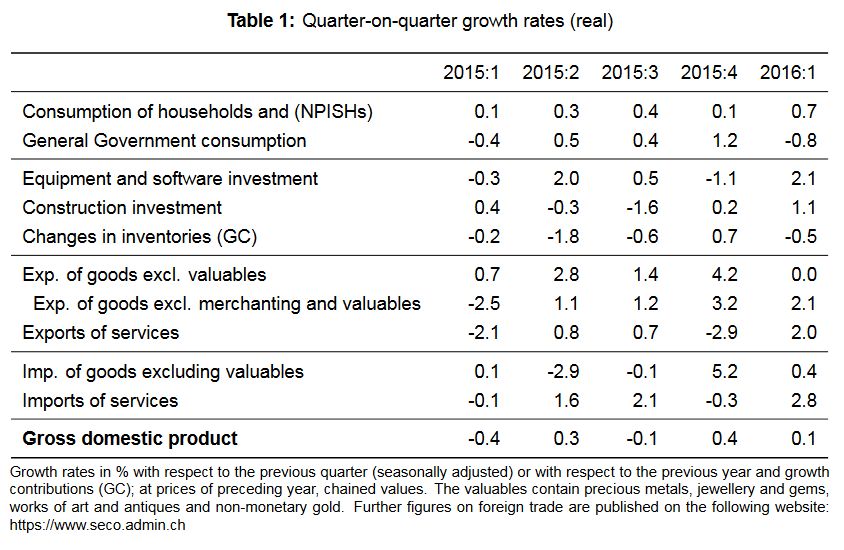

Switzerland GDP Q1 2016: +0.1 percent QoQ, +0.7 percent YoY

Q/Q GDP growth: +0.1%, YoY GDP growth: +0.7%.

Until 2014, Swiss GDP was driven by net exports: Exports were rising more quickly than imports, which improved GDP.

Positive change in the trade balance in goods: +8.1% YoY exports, +1.4% YoY imports in Q1/2016.

Negative change in the trade balance for services: export +2.0%, import +6.7% YoY

In 2015 and in Q1/2016 the main GDP drivers were consumption (+1.3% YoY in Q1/2016) and investment...

Read More »

Read More »

Gross domestic product in the 1st quarter 2016

Switzerland’s real gross domestic product (GDP) grew by 0.1% in the 1st quarter of 2016.* GDP was underpinned by consumption expenditure from private households and investments in construction and equipment but curbed slightly by government consumption. On the production side, the picture was mixed: whilst financial services and the hotel and catering industry saw a decline, value added in manufacturing,

Read More »

Read More »